Summary:

- Nike reported Q4 FY24 earnings, with revenue growing 1% to $51.4B, driven by strength Performance products while profitability and cash flows improved.

- However, Lifestyle revenues declined in Q4, along with shrinking digital sales and uneven performance across geographies as macroeconomic uncertainty remains.

- The management has outlined that FY25 will be a year of transition as they refocus their innovation efforts on Performance products, while it optimizes its product portfolio and reignites brand momentum.

- While sales are expected to decline in the mid-single digits in FY25, I believe that its valuation multiple is still extended and will remain under pressure, making it a “sell”.

Robert Way

Introduction & Investment Thesis

Nike (NYSE:NYSE:NKE) reported its Q4 FY24 earnings on June 27, and the shares plunged over 10% as the retailer cut its full-year guidance and expects sales to decline in the mid-single digits in FY25. So far, the company has severely underperformed the S&P 500 and Nasdaq 100 YTD. During the earnings call, the management outlined that FY25 will be a year of transition, especially as the company tries to reposition itself with a renewed focus on innovation in Performance, while managing global macro uncertainty and uneven consumer trends.

In FY24, the company grew its revenues by just 1% on a currency-adjusted basis, and the management attributed the weakness to its Lifestyle business, which declined during the quarter, along with shrinking digital sales and uneven geographic performance. Even though the management has taken initiatives to improve its overall profitability, I believe that the stock will remain under downward pressure after assessing the “good” and the “bad” in the earnings report.

As a result, I will rate the stock a “sell” at its current levels.

The Good: Renewed focus on Performance Sport, profitability.

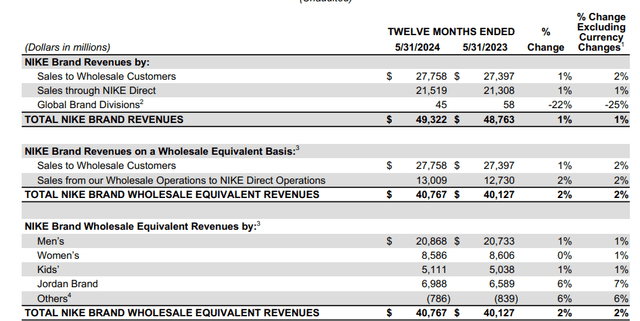

Nike reported its Q4 FY24 earnings, where full-year revenue grew 1% on a currency-neutral basis to $51.4B, with Nike Brand contributing 96% of Total Revenue, and Converse accounting for the remaining 4%, with YoY growth declining 15%. Within the Nike Brand, Nike Direct Revenues contributed 43.6% to revenue, which grew 1% led by growth in Nike-owned stores, while Wholesale Revenue contributed the remaining 56.4%, growing 2% YoY on a currency neutral basis.

Q4 FY24 earnings report: Revenue breakdown by sales channels

During the earnings call, John Donahoe, CEO of Nike outlined that Nike saw strong gains within their Performance products during the quarter, which grew in double digits in many of their key sports, while demand for Lifestyle products declined.

As the company continues to make strategic shifts to better position themselves in an uncertain macroeconomic and highly competitive environment, they are sharpening their focus on performance sports by accelerating the pace of innovation and speed to the consumer. For example, Nike saw double-digit growth in basketball in Q4 driven by innovations in Kobe’s new footwear and apparel and Sabrina 1, while they announced the signing of Caitlin Clark to the roster of athletes to fuel the growth of women’s basketball business.

At the same time, the company is also seeing double-digit growth in fitness apparel with new innovations, while women’s fitness footwear also had a strong quarter driven by Motiva and the latest version of Free Metcon. Plus, the company continues to amplify their game in road running with new releases in Vomero, Invincible, Infinity, and Structure that grew in high double digits during the quarter, while launching Pegasus 41 a few weeks ago, which had a better than expected start with strong sales in both wholesale and Nike Direct.

Shifting gears to profitability, gross margins increased 110 basis points to 44.6% in FY24, which was driven by strategic pricing and favorable ocean freight and logistics costs. Meanwhile, FY24 diluted earnings per share grew 15% YoY to $3.73 as the company continued to streamline expenses through product cycle transition as they consolidated suppliers and optimized technology spend, among other initiatives to maximize customer impact and fuel the next phase of their growth.

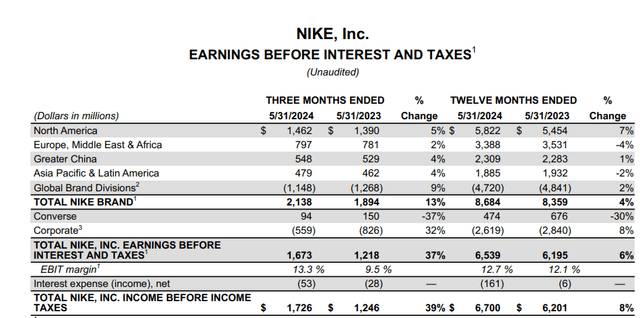

In fact, in Q4, the company reduced their SG&A expenses by 7% YoY to 32.4% of Total Revenue, thus unlocking operating margin in the fourth quarter. In terms of geographic breakdown, North America contributed close to 88% of total Earnings before Income Taxes on a GAAP basis, growing 7% YoY.

Finally, the company is successfully unlocking its working capital by improving its days in inventory as inventory levels declined 11% YoY for the full year FY24, allowing its cash from operations to grow 27% YoY to $7.4B during the same period.

Q4 FY24 Earnings Report: EBIT Breakdown by Geographies

The Bad: Decline in Lifestyle Revenues, Lumpy Geographic Performance.

Although the management has outlined that FY25 will be a year of transition as they kick-start a multi-year innovation cycle, I believe there are some glaring areas of concern in the current earnings report. One of them is the decline in their lifestyle businesses in Q4, despite the company innovating and launching new products.

During the earnings call, the management outlined the need for a diversified lifestyle portfolio, and as part of the initiative, they will be accelerating planned reductions for three franchises, which they expect to have a meaningful impact on their Lifestyle growth rate, while simultaneously scaling new footwear concepts in the second half of FY25.

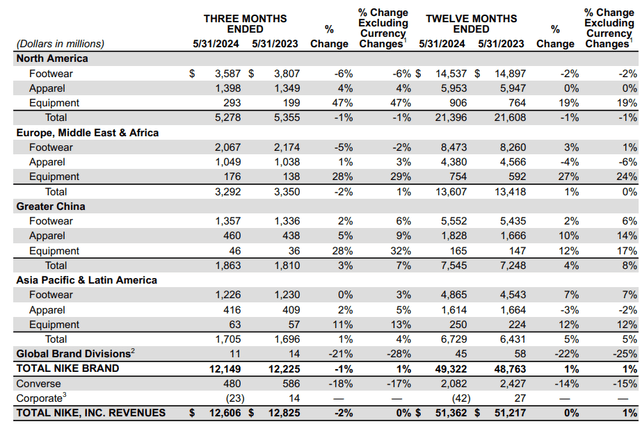

At the same time, the company continues to see uneven trends across operating geographies. For instance, for the full year, while North America revenue declined 1%, EMEA revenues were flat YoY, and Greater China and APAL grew 8% and 5% YoY, respectively. However, it is important to note that the China marketplace remains highly promotional, as brick-and-mortar traffic has declined and Nike continues to manage its inventory carefully.

Something that clearly stood out to me was that digital sales declined across all geographies with the exception of China in Q4, which weighed down on Nike Direct’s total revenue growth rate driven by softer traffic and lower sales of certain classic footwear franchises.

Q4 FY24 Earnings Report: Revenue breakdown by geographies

The management is aware of these headwinds that they are facing, and as a result, they have guided for softer revenue expectations of a mid-single-digit decline in FY25 as they manage the product cycle transition by shifting their channel mix dynamics. I believe global macroeconomic uncertainty is a considerable factor as retail sales in the US are declining with discretionary customer budgets squeezed amidst a high interest rate environment and weakening labor market conditions, while conditions in China and EMEA remain uncertain.

Tying it together: No sign of a bottom just yet

I mentioned earlier that FY25 will be a year of transition as management attempts to reposition Nike to be more competitive by balancing their product portfolio with sustainable and long-term profitable growth.

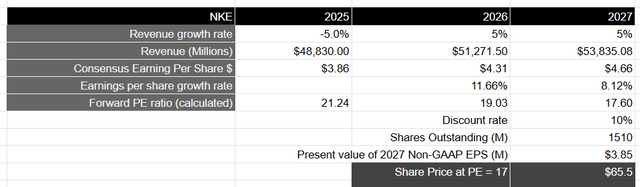

As the company refocuses its innovation efforts on Performance, it also has to manage macro uncertainty and uneven consumer trends as it reduces the amount of products in favor of new innovation. For the full year FY25, the company expects that revenue will decline in the mid-single digits. Assuming that the company gains its footing back and grows in line with the projected nominal GDP growth of the US, which is a reasonable proxy for retail sales in the US, it should generate close to $53.8B by FY27.

In terms of profitability, the company expects its gross margins to improve 10–30 basis points in FY25 as they benefit from strategic pricing and lower product input costs. Simultaneously, it expects its SG&A expenses to grow slightly YoY as it invests in demand creation, especially with the Paris Olympics next month, which is an opportunity to ignite brand momentum and maximize reach.

Therefore, assuming that diluted EPS remains flat YoY, followed by growth in the range of consensus estimates, we see that it will be growing at a slightly faster pace than projected revenue growth as it is able to improve its unit economics as the demand environment improves. This means that it will generate $4.66 in diluted EPS in FY27, which will be equivalent to a present value of $3.85 when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Nike should be trading at par with the S&P 500, given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 17, or a price target of $65, which represents a downside of 20% from its current levels.

Author’s Valuation Model

My Verdict and Conclusions

Although Nike has a long history of strong innovation and operation excellence, it has found itself in a rough patch, with revenue growth slowing while facing increasing competition from newer innovative brands in certain categories, such as HOKA. While it is managing its sales through a combination of Direct and Wholesale, the management has also been taking initiatives to boost profitability through cost-cutting efforts as well as improving its operating cash flow by reducing its inventory levels, especially as certain franchises have been performing poorly.

Although I am optimistic that Nike will get its footing back over the coming years, I still believe that its current valuation is elevated given the projected growth rate in revenue and earnings. As a result, I believe the stock will face downward pressure as investor sentiment remains dampened, at least until the management starts to demonstrate progress in accelerating its growth story.

Till then, I will rate it a “sell” at its current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.