Summary:

- Nike has suffered missteps and there are real issues it has to address. These are not reasons to abandon the company.

- Nike has many levers to pull to bring it back to growth, including accelerating the roll-out of new products, share repurchases, and intensifying its marketing efforts.

- Nike has a deep vault of valuable brands to tap into to excite its fans.

- Globally, there is an increasing consciousness toward healthier living, providing a long-term secular growth trend that will increase the total addressable market. Even if competitors come in and grow, everyone gets a bigger slice of a bigger pie, including Nike.

- The negative reaction to its reduced guidance for FY 2025 has been intense, and that has afforded a buying opportunity for value-focused investors willing to give the company a little more time to get its mojo back. Barring a recession, I see a potential upside of 26% from the current level.

Robert Way

Preamble

A little history of my thoughts around this company.

I first considered NKE as an investment possibility in May 2022 when it was trading sideways at around $110. I was skeptical that NKE could justify that premium price given the headwinds it faced then, so I passed.

As a firm believer of “price is what you pay, value is what you get“, I waited till September 2023 to start my first position in NKE at a cost basis of $92. The positive commentary from CFO Matthew Friend at Q1 2024’s conference call was reassuring,

Now let me turn to our financial outlook. As we look forward, we are confident in NIKE’s new product innovation pipeline, brand strength, deep consumer connections and the health and shape of our marketplace. Our Q1 results reaffirm our expectation for healthy profitable growth this fiscal year. For the full year, we continue to expect reported revenue to grow mid-single digits.

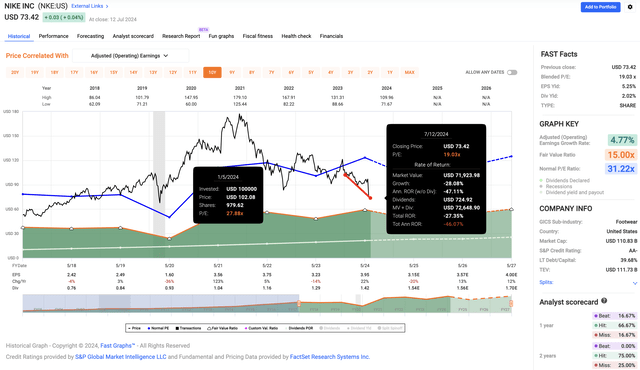

Fast-forward to July 2024. By now, everyone would know of Nike’s (NYSE:NKE) 28% year-to-date crash in 2024.

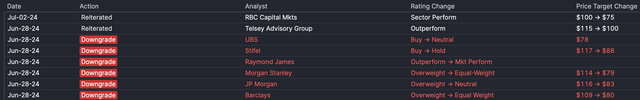

A day after the disastrous Q4 2024 earnings call, analysts did their worst. Analysts revised their price targets, bringing the average price target fell to $82, down 27% from the previous average price target of $111.

Seeking Alpha analysts have shared their thoughts on NKE with an overwhelming majority in July giving it a HOLD rating.

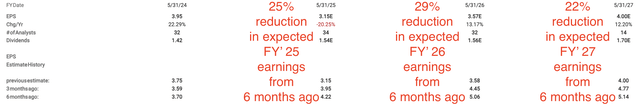

FactSet analysts cut their adjusted operating earnings forecasts for FY 2025, 2026, and 2027.

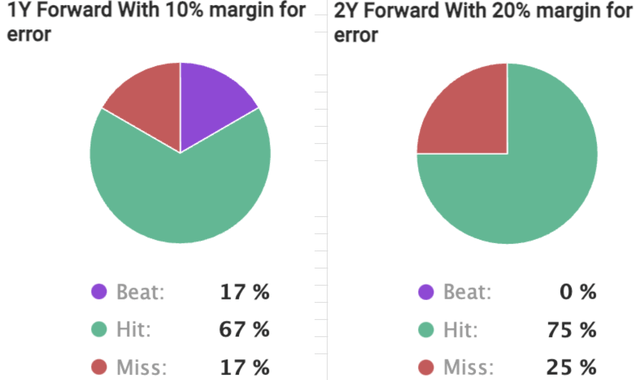

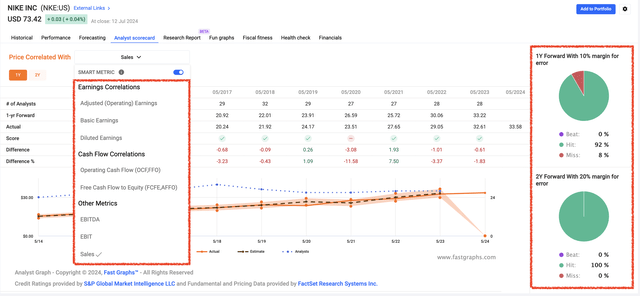

FactSet analysts have a solid track record of forecasting Nike’s adjusted operating earnings, being right 67% and 75% of the time on their 1-year and 2-year forecasts respectively.

NKE does not have a good track record of beating those forecasts, only exceeding their 1-year forecasts 17% of the time and none for the 2-year forecasts. NKE missed the forecasts more often than it beat them.

What do all these mean for Nike investors?

Investment Risks

For those who hold negative views about the company’s future, I do agree with much of the criticism leveled at the management: delay in product innovation, uninspiring marketing, rising competition from brands outside China and within China, and an over-reliance on legacy brands like Jordan.

During the Q4 2024 earnings call, CEO John Donahoe said,

For full year fiscal 2024, revenue grew approximately 1% on a currency neutral basis and earnings per share grew 15%. Q4 revenue was flat. For the quarter, we saw strong gains within Performance product. However, this was more than offset by declines in lifestyle. These declines had a pronounced impact on our digital results. These factors, when combined with increased macro uncertainty and worsening foreign exchange, have caused us to reduce our guidance for fiscal 2025… While fiscal 2025 will be a transition year for our business, we continue to make real progress on our comeback.

For a CEO to describe his company as going through a transition year in the next twelve months is akin to admitting that the company is no longer in growth mode.

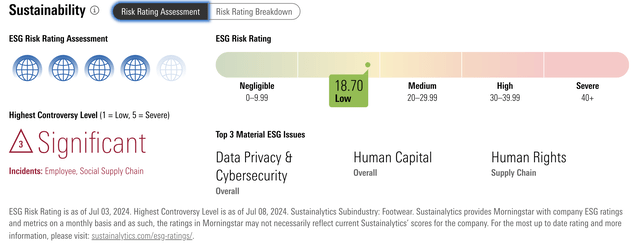

On top of these are ESG concerns. Morningstar assigned NKE a “Significant” controversy level. While its ESG Risk Rating is “Low” at 18.7, it is certainly not “negligible”, especially when NKE has often courted controversy as part of its marketing efforts. There is ongoing scrutiny of NKE’s labor practices. For instance, it is accused of not paying more than 4000 garment workers for three years.

All these cause unnecessary distraction for the management and negative publicity for a company that takes pride in its environmental commitments.

The final risk lies in a worsening macroeconomic situation or prolonging of the current environment. I will cover a recession scenario in a later section.

Investment Thesis

Despite all these, I believe that Nike (NKE) is investable now from a value investor point of view, though it may not be for the same reasons as expounded by some analysts.

I do not believe that sports-related products like shoes and apparel can have moats based on elusive factors like “quality” (products from different companies are made in factories from similar countries like China and Vietnam) and performance (can a layman accurately determine that Peg 41’s all-new ReactX foam midsole is 13% more responsive than previous React technology?). I am not a runner. I prefer to exercise barefoot in my home gym. I own three pairs of shoes – a pair of leather shoes for work, a pair of Crocs walking shoes for leisure, and a pair of Nike shoes for the occasional jog. I do not play basketball and cannot understand the appeal of pumping air into the soles of my soles.

However, I do not need to be a die-hard Nike fan to appreciate the investment opportunity this sports shoes and apparel behemoth can offer at the right price.

My understanding of Nike’s instability can be narrowed down to the following five premises.

Long-Term Secular Growth Trend = Expanding Market Share for Everybody

According to this New York Post article, 70% of Americans feel they have a better opportunity to focus on their health in the coming year, and 42% plan on making health their top priority.

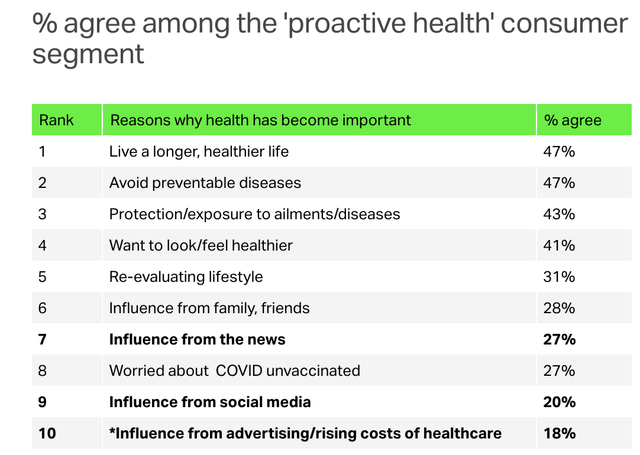

A similar trend is observed globally. Based on a report by NielsenIQ, 48% of global consumers say they make proactive health and wellness choices regularly, while 29% say they are triggered to prioritize health when it’s necessary.

The following are the top ten reasons why health has become a priority.

These strong desires will boost the sales of health-related products including running shoes, apparel, and equipment, and expand the total addressable market.

According to a report by MordorIntelligence, the athletic footwear market is expected to grow at a CAGR of 6.86% from $173.89 billion in 2024 to $242.33 billion by 2029.

Yes, there will always be new entrants, with diehard believers claiming nothing comes close to their beloved brand of shoes which let them feel like they are walking on air.

Yes, existing competitors will also be fighting tooth and nail to win market share.

Yes, earnings may fluctuate from time to time.

However, if the total addressable market is expanding, a bigger pie means there is more to go around, and everyone gets a bigger piece of that pie.

NIKE’s Dominant Position Is Not Easily Displaced

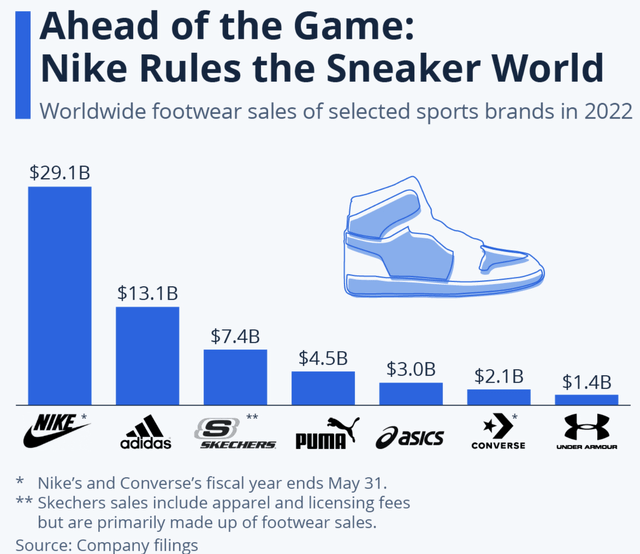

It is helpful to remember that Nike is the largest footwear seller in the world, with sales of more than 100% of second-placed Adidas.

There are legitimate concerns that NKE has fallen behind the innovation curve and competitors like On Holding (ONON) and Hoka are taking market share from NKE. This is not to say NKE does not invest in research and development. The company plowed in $353 million in FY 2022 and increased that to $548 million in FY 2023. Putting that in context, NKE spent more on R&D in FY 2023 than the combined net income of Asics (OTCPK:ASCCF) and Under Armour (UA).

We know a much better product can displace a former titan in the technology industry. Think Nokia (NOK) and Apple (AAPL). A revolutionary business model can crush a dominant rival. Think Netflix (NFLX) and Blockbuster. None of these is the case for a business selling athletic footwear, apparel, equipment, and accessories. NKE is still churning out new products like the Pegasus 41 and Zoom Fly.

On top of a well-made product, it is about advertising and marketing. And Nike excels at that. Nike’s marketing goes beyond traditional and digital advertisements. Its endorsements of top athletics in major sports like basketball (Michael Jordan, LeBron James, Kevin Durant), tennis (Serena Williams, Rafael Nadal), football (Christiano Ronaldo), golf, and gymnastics (Simone Biles) guarantee eyeballs from a global audience and their association of the brand with top performance. Nike’s sponsorship of teams (NBA, NFL, English Premier League, and numerous Olympic committee) and events (Olympics, FIFA, marathons) keeps the brand visible to a worldwide audience.

Beyond these efforts, Nike markets to youths through sponsoring college athletic programs and through these efforts, builds brand recognition and loyalty from the young.

All these mean that Nike’s already dominant position will grow stronger.

An accelerated share buyback program will boost earnings per share.

Its healthy balance sheet and high free cash flow make it possible. By the Q3 2024 10Q in February 2024, it had spent $8 billion on share repurchases, and together with the $1 billion it spent on share repurchases in Q4 of 2024, NKE had $9 billion left in its share repurchase program. At the closing price of $73.42 on 12 July 2024, that $9 billion can retire another 122.582 million shares, bringing the current share outstanding down from 1508 million shares to 1385 million shares.

Assuming FactSet analysts are right and NKE manages to make adjusted operating earnings of $3.15 per share in FY 2025, that translates to $4.5 billion in adjusted operating earnings on, 1508 million shares. If the share count drops to 1385 million shares, the adjusted operating earnings will increase by 8.8% to $3.43 per share.

NKE is finally priced right.

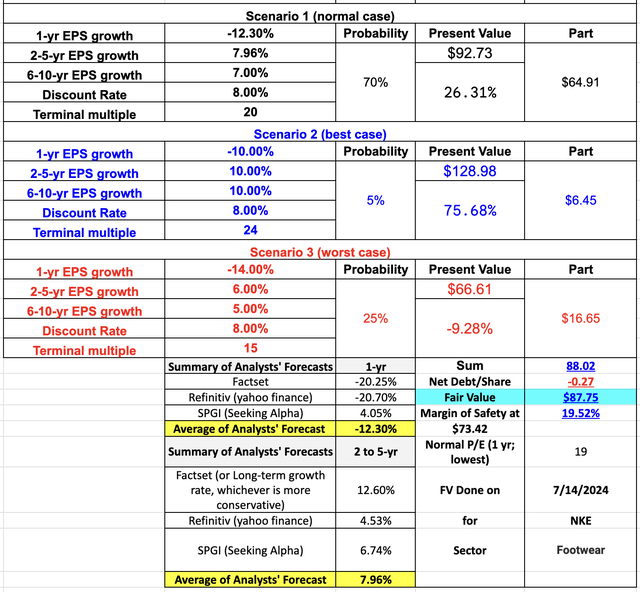

The table below shows my simulated range of possible fair value of NKE shares under different conditions. In my range of scenarios, NKE’s fair value can be worth between $66.61 and $128.98.

At the current price of $73.42, this range represents a possible downside of 9.3% and a potential upside of 26.3% in the normal case, and 75.7% in the bull case. The risk-and-reward argument seems favourable to consider an investment in NKE based on the entry price of $73.42.

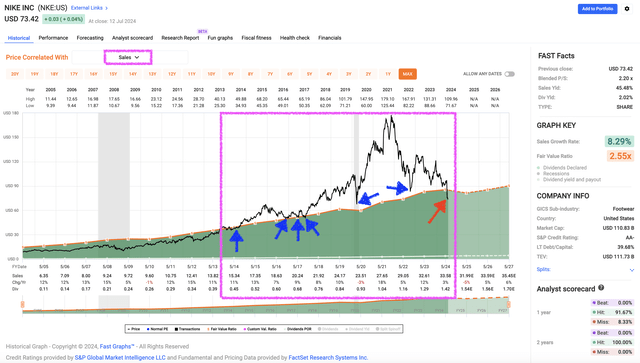

Another way to study NKE’s current valuation is to use price-to-sales. Based on the different metrics, analysts get NKE’s 1-year sales forecasts right 91.67%, and they get the 2-year sales forecasts right 100% of the time.

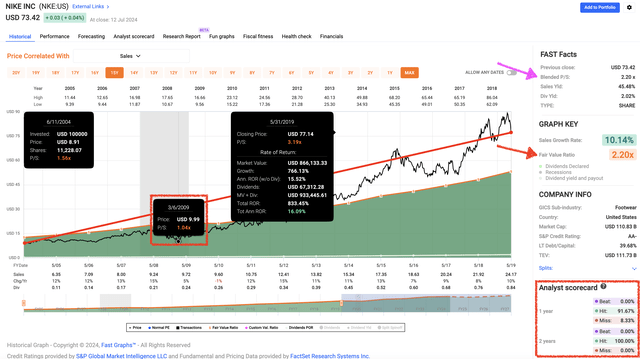

Some may argue that NKE’s P/S during the initial COVID-years were a little wonky. NKE shares were trading as high as 6 times sales in 2021. To factor in this distortion and recalibrate NKE’s normal P/S from 2003 to 2019 and cutting out 2020 to 2024 I arrive at 2.2 which is exactly where it is trading at now. From this P/S perspective, NKE seems to be trading at its fair value now.

However, the 2003 to 2019 period does not take into account its digital business, which has grown at a CAGR of 26% since its inception in FY 2019.

From another P/S perspective, NKE’s price-to-sales ratio have ranged from 2.55 to 3.84 from 2003 to 2023. Since its current blended P/S is just 2.2, that suggests NKE is trading below fair value now.

In the past 10 years, NKE’s investors have consistently awarded NKE’s shares a premium exceeding a P/S of 2.55, and the share price has respected that normal P/S of 2.55, trading above it most of the time, and on the few occasions when that were breached, the share price recovers soon after that.

However, a word of caution is necessary. If a recession were to hit, discretionary spending would definitely be hit hard, and NKE sells discretionary products. In the Great Financial Crisis, NKE’s P/S fell to 1.04, and if that were to happen it will be a 50% fall from current levels.

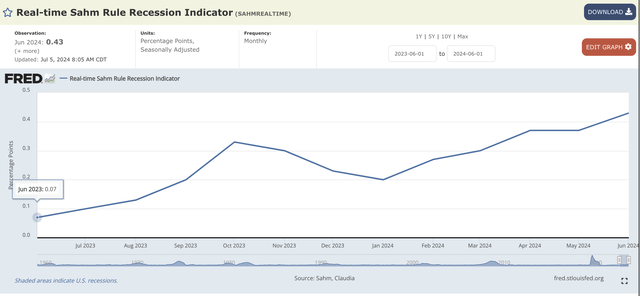

Based on the Sahm Rule Recession Indicator which “signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months”, it has already risen by 0.36 percentage points.

I am not calling for a recession, but as part of my risk-assessment, I have to be prepared for such an possibility, and therefore even in the favorable risk-and-reward entry of $73.42, NKE as a discretionary business is a BUY and not a STRONG BUY. If the economy hums along, I will miss some of the 26.3% upside with my BUY call, and if the economy were to tank, I will have room to add more later.

Nike is a dividend growth monster.

There are two things that provide returns to an equity investor. The first type of return is capital gain, which comes from a rerating upwards of a company due to positive business growth. The second type of return comes from the dividend.

NKE is no Nvidia (NVDA) but as a dividend growth company, NKE has rewarded its long-term shareholders richly.

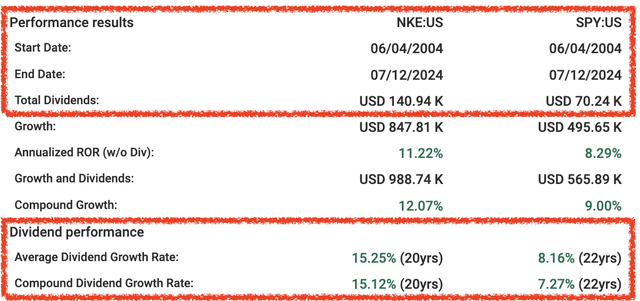

Investors who bought $10 000 worth of NKE shares since June 2004 and held would have collected more than $140 000 of dividends by July 2024.

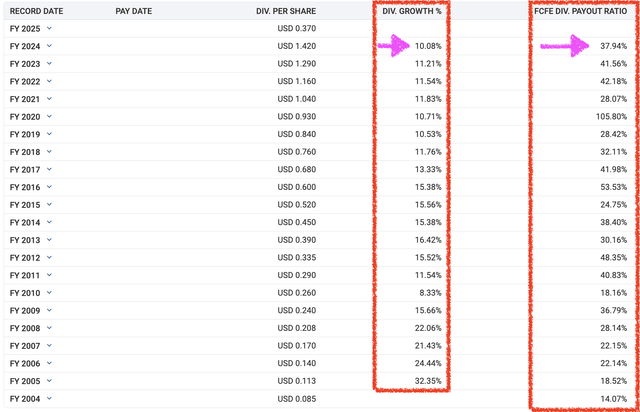

Besides FY 2010, when the world was still reeling after the Great Financial Crisis, the company has raised dividends at double-digit rates. At a free-cash-flow-to-equity payout ratio of under 40%, NKE’s dividend is not only safe, it has room to keep growing dividends at the current rate of 10%.

NKE began its streak of consecutive annual dividend increases in the year 2002. Since then, NKE has consistently raised its dividend every year, through every crash (GFC in 2008-2009, European Sovereign Debt Crisis in 2011, Trade Tensions in 2018, Covid Crash of 2020), marking 22 years of consecutive dividend growth as of 2024. In three years, NKE will join the ranks of the Dividend Aristocrats. It would be added to ETFs that track this special group of shares, increasing its visibility, and further diversifying its investor base to institutional and retail investors focused more on stability of income rather than growth, which would then add an element of stability of the share price.

Conclusion

Nike’s (NKE) recent lackluster performance is real. There is no sugarcoating it. Revenue was up just 1% year-on-year. Worst is FY 2025’s guidance of a 10% decrease in revenue for Q1 2025, a high-single-digit percentage fall in the first half of FY 2025, and a mid-single-digit decline for the entire FY 2025. Assuming a 5% decline in revenue in FY 2025, that would be an approximate $2.5 billion haircut in sales.

However, investors need to put that decline into context. Is all the bad news sounding a death knell for NKE, or is the company facing a temporary stumble that it can recover from? Is NKE’s growth on a permanent decline, or does the company have the means to turn this huge ship around?

I recall a time when analysts and investors thought that Microsoft (MSFT) was dead in the water, dependent on its dominant legacy Windows platform but lagging in innovation, that it was a dinosaur that missed the tablet wave, lost in the fight for handphone supremacy, and committed numerous self-inflected missteps that caused investors to cringe. MSFT was so poorly regarded that it did not trade at a premium for years. When a dollar retailer like Dollar General (DG) – no offense to DG fans – could trade at a price multiple much higher than MSFT for years, it goes to show how poorly regarded MSFT was for a long time. Eventually, the company did turn around and find its footing again, by being aggressive against its competitors and adopting a more start-up mindset.

Like MSFT, Nike (NKE) operates in a highly competitive industry, so even the mighty NKE is not immune to threats from more nimble competitors taking its market share. Like MSFT, it is not immune to management mishaps. And there have been missteps in the past four years under the current CEO, though I believe these self-inflicted wounds are insufficient to topple the footwear and sports apparel giant. Therefore, it is a positive sign that NKE has acknowledged its errant ways and is taking aggressive steps to address them headlong. For instance, NKE has always depended on thousands of retailers that it works with to handle the bulk of its distribution. The shift to achieve 50% of its sales through a digital strategy involved phasing out wholesale clients like Footlocker (FL) and Macy’s (M). That has not worked well and digital sales have fallen short of its target, while total sales are expected to decline in FY 2025. To repair relationships with its retailers, NKE brought back its 30-year veteran Tom Peddie to mend the fences. It has sought to streamline operations and reduce costs. Management promises to push new products out faster than its traditional 18-month period. CEO Donahoe just said in the Q4 FY 2024 conference call,

… we are very excited about this multi-year innovation pipeline and cycle. And it’s just — if you’ve seen some early examples of it in this past quarter with DN and Peg 41, and as we are saying, as we move into the end of this — second half of this fiscal year, which we talk about is spring 2025 and summer 2025 of this season, the amount and breadth and depth of the innovation is just accelerating significantly.

Management is also taking threats from upstarts like On and Hoka seriously. These brands have stood out in comfort and style, and NKE has taken note of consumers’ demand for products with these characteristics. CFO Matthew Friend acknowledged these,

The one thing that’s undoubtable is that the consumer wants more comfort. And you can see that across the marketplace. Our teams are absolutely focused on fit and comfort as we bring these new iterations to market. And I think that when you look at products like Peg Premium or even the Peg 41 or the Vomero 18, I think you’re going to start to see consumers carrying those over into lifestyle because they’re new, they’re fresh, they’ve got a particular look. And so, we’re balancing the fact that the consumer is voting for performance and innovation. And we need to make sure that we’ve got performance and innovation that they can wear every day, in addition to leveraging the vault, as I said before, leveraging the vault to bring classics back, because there will always be a classics business.

Indeed, management has lost some trust from investors. It is not often that I hear analysts questioning management’s ability to foresee their own sales projections.

NKE has plenty to prove in the short-term as it seeks to find its mojo again. With a deep vault of successful brands to draw inspiration from to excite consumers, with its deep pockets, and positive cash flows, I do not doubt NKE has the resources to help it find its way to growth again. And while I wait, I can trust NKE to reward my patience with a dividend that can safely grow around 10% a year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.