Summary:

- Nike reigns as the world’s most valuable apparel brand at $31.3 billion.

- Early Black Friday data indicates a 7.5% YoY surge in discretionary spending, signaling recovery for this blue-chip.

- I think Nike’s forecast for FY24 is conservative; I am anticipating a 7.5% sales growth and expecting improved profit margins.

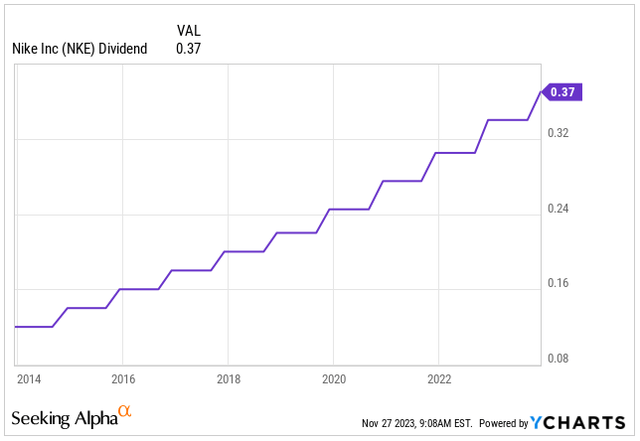

- Despite a modest 1.07% dividend yield, Nike has shown consistent growth in its dividends. I anticipate this trend of 10%+ increases to persist over the next decade.

- According to my model, the projected annualized total returns average between 12.5% to 13%.

code6d

Which brands initially come to mind when people think of sports?

Well, when it comes to sportswear that ticks all the boxes-whether in terms of technical excellence or style – Nike, Inc. (NYSE:NKE) shines as one of the top choices. Nike isn’t just a big player in the sports world; it’s a globally recognized name, extending far beyond athletics.

It’s the reigning champion in the realm of apparel brands, valued at around $31.3 billion, outshining even luxury heavyweight Louis Vuitton under LVMH (OTCPK:LVMHF). To put it in perspective, adidas (OTCQX:ADDYY), a long-standing contender from Germany, takes the fifth spot with a brand value roughly half of Nike’s.

Brands are one thing, and while many of us love slipping into Nike shoes and sweatpants for a cozy day, the reason I’m discussing Nike is because, in my opinion, it’s one of the best discretionary stocks out there.

With a market cap of $163 billion and FY22 sales reaching $51.2 billion, Nike is a juggernaut, having delivered a 202% total return over the past decade, similar to that of the market (SPY). Despite this, uncertainties surrounding the economy with the Fed fund rate peaking over 5% and a pullback in consumer spending have led the stock to stall, showing minimal growth since pre-pandemic 2020.

What draws me to Nike, above all, is its dividend growth profile. While the company currently offers only a 1.07% dividend yield, which might seem modest to many, their ability to compound the dividend at a 13.4% CAGR over the last two decades is admirable.

Let me explain why I like Nike, as I anticipate they’ll continue to deliver market beating performance while growing their dividends by a low double-digit percentage annually over the next decade.

Blue Chip At Its Finest

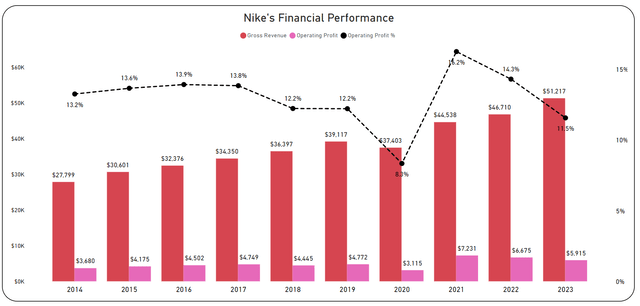

Nike has been a consistent performer; it’s a good example of what I’d call a blue-chip company. If we exclude the COVID-19 year of 2020, the company has managed to grow its top-line every single year over the past decade.

While this growth hasn’t been the fastest, it’s been a reasonable 6.3% CAGR in revenue and 4.9% CAGR in operating profit.

What this tells us is that historically, Nike has maintained pretty stable margins, except for the blip in 2020 due to the pandemic. However, with current inflationary pressures, while SG&A expenses remain steady, the increase in COGS is squeezing profit margins, and I anticipate this might persist for two to three more quarters. But once these inflationary pressures ease, I would expect this to happen sometime in H2 2024, Nike is positioned to push its operating margin back up to its historical average of 12.9%, ultimately unlocking value to shareholders.

Financial Performance (Author’s Graph (Data SA))

Nike released its Q1 FY24 earnings on September 28 amidst heavy pressure on its stock price, reaching a 52-week low of $88.66 per share.

Sentiment toward discretionary stocks was notably impacted by data indicating customers cutting back on non-essential spending. Surprisingly, the earnings outperformed my expectations, resulting in a 20.8% surge in the stock price since then.

I have to admit, I was expecting a tougher quarter for Nike, especially since they were controlling marketplace inventory and being conservative about new inventory purchases for the first half of the year. I was planning on buying the stock around $85, especially with the prevailing overly negative sentiment. But, as it turned out, I was taken by surprise and missed the chance. Sometimes it’s better not to try to time the market and instead gradually build up a position.

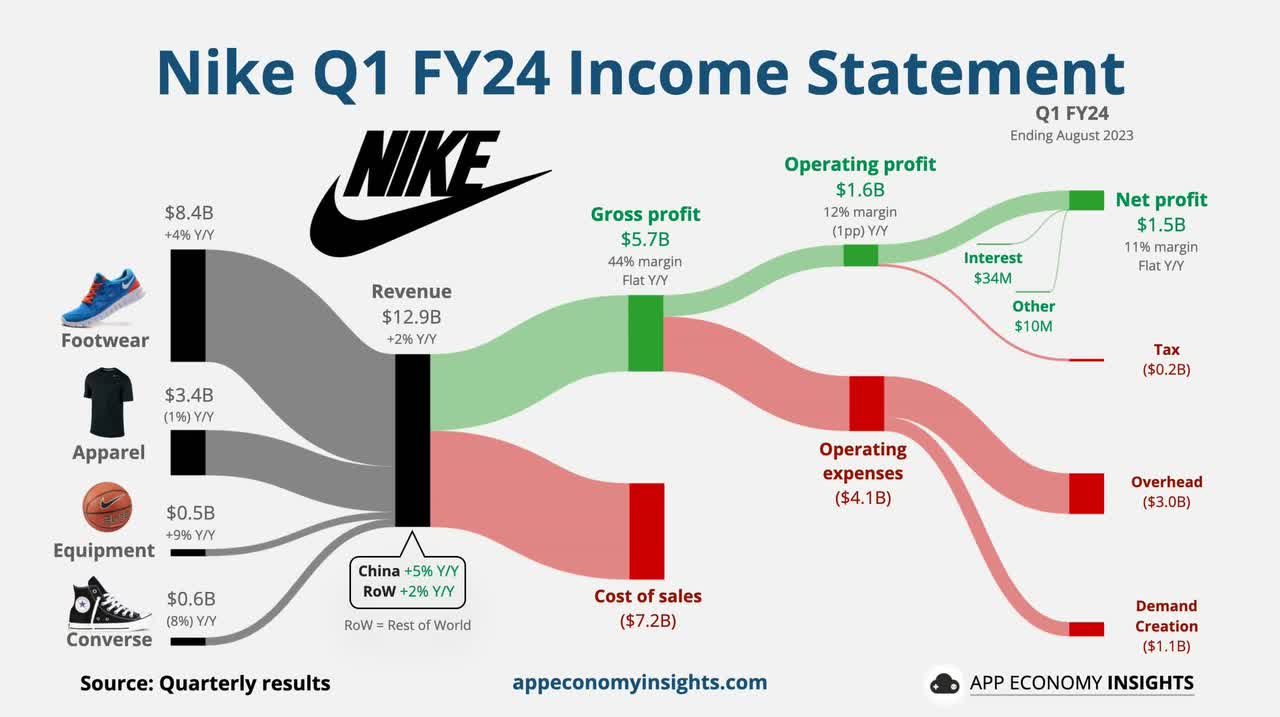

In Q1 FY24, Nike reported an EPS of $0.98, surpassing analysts’ expectations by a significant $0.18. Despite some headwinds, revenue stood at $12.94 billion on a currency-neutral basis, slightly missing analysts’ projections by $60 million but still reflecting a 2% YoY growth.

But enough about the past, let’s delve into what we can anticipate from Nike as we step into 2024.

Q1 FY24 Earnings (App Economy Insights)

Nike is gearing up for its Q2 FY24 earnings, slated to be reported on December 21.

In this quarter, Nike anticipates a slight uptick in revenue compared to the previous year, along with a projected 1% growth in gross margins from the preceding year.

On the backbone of the improving margins, I am expecting Nike to deliver $0.95 EPS, which would represent 11.7% growth YoY on a revenue of $13.45 billion.

During the latest earnings call, Nike stuck to its full-year guidance, projecting mid-single-digit revenue growth and a gross margin expansion of 1.4% to 1.6%. However, there’s a clear surge in discretionary spending, evident from Black Friday’s $9.8 billion in US online sales, marking a 7.5% increase YoY, as per Adobe Analytics. With this trend in mind and the holiday season around the corner, I expect Nike’s sales to bounce back more swiftly. I believe their initial growth projection is pretty conservative; hitting a 7% to 8% sales growth in FY24 wouldn’t surprise me at all.

Moreover, an aspect that I believe will positively impact Nike’s sales and EPS on a currency-adjusted basis is the potential FX improvement. With US rates likely reaching their peak, there might be reduced demand for USD. We’re already witnessing the EUR strengthening against the USD. While Nike still garners 44% of its sales from North America, a significant 29% comes from Europe, the Middle East, and Africa-regions that should benefit once the USD weakens.

| Region | Revenue | % of Total |

| North America | $ 5,423 | 44% |

| Europe, Middle East & Africa | $ 3,610 | 29% |

| Greater China | $ 1,735 | 14% |

| Asia Pacific & Latin America | $ 1,572 | 13% |

I think FY24 will signify a rebound in both top-line growth and profit margins, yet there are potential disruptions that could impact my investment view.

Reflecting on 2020, Nike faced a challenge dealing with high demand amidst supply chain disruptions. By 2022, these issues had cost the company a significant $2 billion in revenue. Once demand stabilized, Nike, along with other discretionary companies, grappled with excess inventory, leading to substantial discounts to make space for new stock. This had a noticeable impact on their EPS in 2022 and 2023.

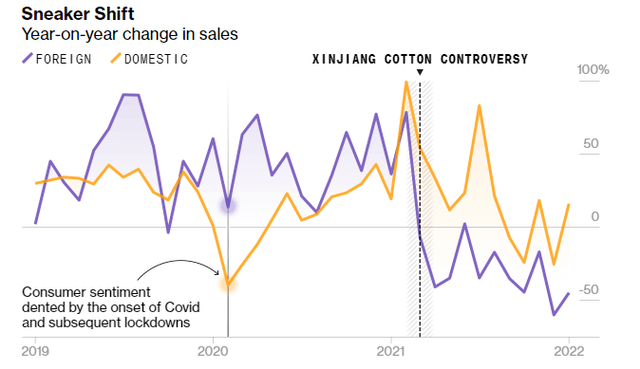

Although Greater China represents only 14% of current sales, it’s a pivotal market for Nike. Initially viewed as an untapped market for Western brands due to the rising incomes and consumer appetite, the situation changed swiftly. China’s geopolitical dynamics, particularly its disputes with the U.S. and others, have altered the landscape. Chinese consumers are increasingly aligned with the government’s political stance, posing a concern for global brands eyeing the $6 trillion market.

An example of this shift is evident in the sneaker market. Transactions over four years on Alibaba (BABA), a major business-to-consumer e-commerce platform in China, highlight a rapid and substantial turn towards nationalism. Despite substantial investments by Western brands to appeal to local shoppers, consumers are now veering away from these brands. Chinese consumer behavior seems closely correlated to political inclinations.

Additionally, the boycott of Western brands in 2021, following Nike and adidas’ declaration to refrain from using Xinjiang cotton, resulted in a downward trajectory in their sales. This incident shouldn’t be overlooked when considering the potential impact on these companies’ revenue streams.

Sneaker Sales in China (Bloomberg)

Following the controversy, domestic brands have continued to outpace Nike in sales. These local companies seized the surge in nationalism by catering to products specifically aimed at local consumers.

Additionally, while this issue might not be as prevalent in developed countries, in regions like Indonesia, Thailand, and other emerging economies in Asia, Nike is a prime target for counterfeiters who produce and market fake Nike products. This damages the company’s brand image and naturally leads to a decrease in revenue.

Soon To Be Dividend Aristocrat

Now, onto my favorite part about Nike, the return to shareholders.

Currently, Nike pays a dividend of $0.37 per share, which translates to a 1.07% dividend yield. It might not seem like much to most of us, but here’s the kicker: Nike has consistently increased its dividend for 22 years straight. If this trend continues, it’s set to become a dividend aristocrat in just three more years.

Let’s talk about the real rewards: If you had bought the stock a decade ago, you’d now be enjoying a 3.74% yield on your initial investment, along with a whopping 172% increase in the stock’s value. That’s definitely something to write home about.

In the latest move earlier this month, Nike increased its dividend by 8.8%. Looking ahead, as FY24 marks a recovery phase, I anticipate the next November to witness a dividend raise of more than 10%. And I foresee this trend continuing at a similar rate for the next decade.

Dividend per Share (Seeking Alpha)

The positive news is that the dividend seems very sustainable, with a payout ratio at 41.9%. It’s a tad higher than the 5-year average of 40.6%, but it falls well within the range that I find comfortable, offering ample flexibility to the company.

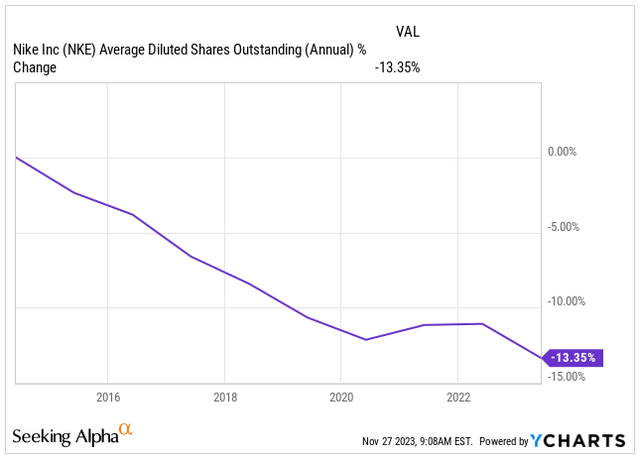

On the other front, Nike has actively pursued share buybacks, repurchasing 13.4% of its shares over the past nine years. Admittedly, this isn’t the quickest pace, but last year, Nike approved a substantial $18 billion share buyback program. They’ve already used $6 billion of that, leaving another $12 billion outstanding, which amounts to roughly 7.3% of outstanding shares. Given the current low valuation for buying back the stock, this move seems like a smart decision to me.

Shares Outstanding (Seeking Alpha)

Not Cheap, Yet Compelling Value

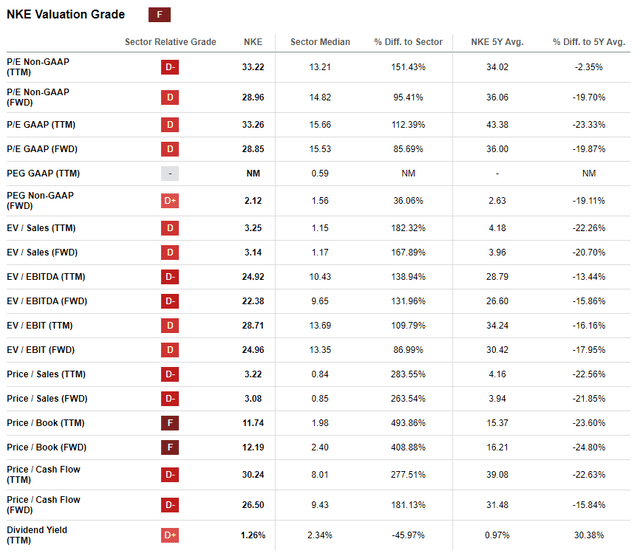

When it comes to valuation, Nike isn’t exactly a bargain. It’s a blue-chip company and its trading like one.

Its Forward PE ratio stands at 28.96x its FY24 earnings, a hefty 95% higher than the sector’s 14.82x forward earnings.

Yet, let’s consider the bigger picture. Despite being a high-quality business, Nike is actually trading at a discount compared to its own 5-year averages. The current Forward PE Ratio is 19.7% lower than its 5-year average, and the Forward EV/EBITDA of 22.38x is 15.86% lower than its 5-year average.

During the pandemic, Nike’s stock soared as people rushed to buy comfy sweatpants and new sports shoes amidst the lockdowns. However, I don’t anticipate Nike returning to those sky-high valuations again.

It seems to be trading at about a 17% undervaluation on average, but I reckon its fair value should be around 30x its forward earnings. That implies a price target of $112 for FY24. However, when you stack it up against Lululemon Atheltica (LULU), which offers higher growth prospects but trades at 35.47x its FY24 earnings, it kind of puts Nike’s seeming overvaluation into perspective.

Valuation Grade (Seeking Alpha)

Looking ahead at Nike’s performance over the next five years, I foresee a top-line growth of about 7% to 8%. Considering the substantial buyback and the anticipated recovery in profit margins, I expect the EPS growth to average around 13%. If the stock maintains a Forward PE ratio of 30x its earnings-which I consider a fair value for this stock-by the end of 2028, we could see an annual stock appreciation of approximately 11.8% from today’s price of $108. This, in my opinion, would outpace the market.

Factoring in the average dividend yield of 1%, the total annualized rate of return would land somewhere between 12.5% to 13%, which I view as very promising.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue (b) | $ 57.3 | $ 61.7 | $ 65.6 | $ 70.3 | $ 76.4 |

| Revenue Growth | 7.7% | 7.6% | 6.4% | 7.1% | 8.6% |

| EPS | $ 3.72 | $ 4.34 | $ 4.98 | $ 5.59 | $ 6.27 |

| EPS Growth | 15.1% | 16.7% | 14.7% | 12.2% | 12.2% |

| Forward PE | 30.0 | 32.0 | 31.0 | 30.0 | 30.0 |

| Stock Price | $ 112 | $ 139 | $ 154 | $ 168 | $ 188 |

Conclusion

Nike serves as a prime example of a solid blue-chip business: Consistent growth, fairly steady profit margins, and a strong outlook owing to its prominent brand presence and recognition.

While 2022 and 2023 posed challenges due to reduced discretionary spending caused by higher interest rates and recession fears, early Black Friday data indicates that we might have hit the bottom and the rebound in discretionary spending seems to have begun, especially with the holiday season approaching.

I anticipate Q2 FY24 earnings for Nike to surpass expectations. The full-year guidance for FY24 seems conservative to me, and I foresee the company achieving 7% to 8% growth this year, sustaining this momentum through to 2028.

With the expected recovery in profit margins and a robust approved buyback program, I foresee quicker EPS growth. My stock price target for FY24 stands at $112, while for FY28, it’s projected to reach $188. This represents an opportunity for roughly 12.5% to 13% total annualized returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LVMHF, LVMUY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.