Summary:

- Nike reported FQ3’23 results beat analyst targets, but the company reported an EPS decline.

- The athletic apparel company now faces a period of slow revenue growth due to reduced orders.

- The stock continues to trade at a stretched valuation, trading at 31x FY24 EPS targets.

LPETTET/iStock Unreleased via Getty Images

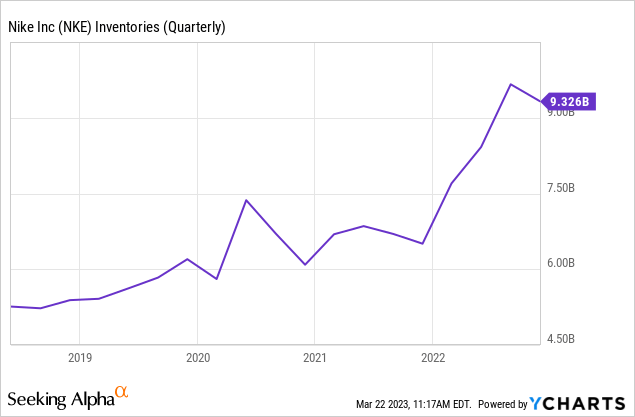

The current investment story on Nike (NYSE:NKE) starts and stops with the inventory levels. The athletic footwear company continues strong growth, especially for the retail environment and economic issues, but the profit pictured has been hampered by a promotional environment. My investment thesis remains Bearish on the stock due to the inability to manage inventories and the premium valuation awarded to Nike currently.

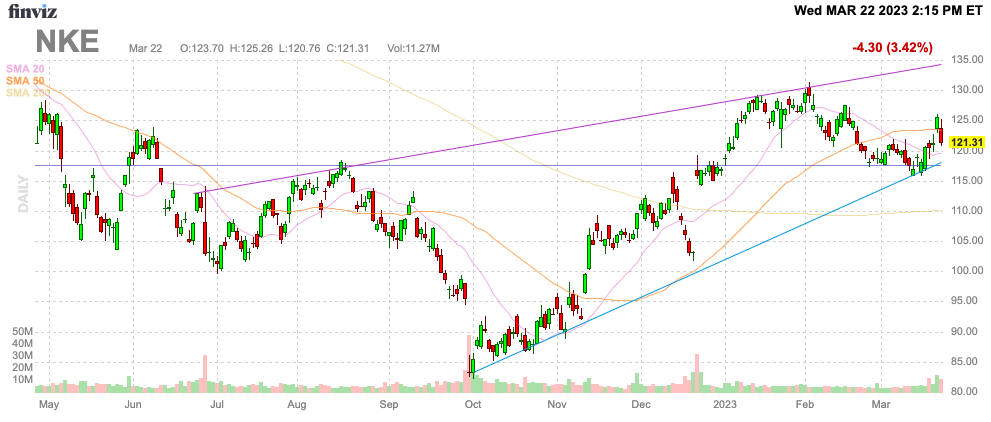

Finviz

Inventory Control

Nike reported really strong sales for FQ3’23. The concern is that a lot of the sales boost came from promotional offerings and markdowns to reduce inventory levels, not wholeheartedly from higher consumer demand.

The athletic apparel company saw gross margins dip 300 basis points to 43.3%. The gross margin bumped up from 42.9% in the prior quarter and was regularly in the 45% to 46% range prior to the current inventory correction and higher costs from the supply chain.

Naturally, a company with sales growing 14% in the quarter to reach $12.4 billion would normally see gross margins booming. A big question exists on what real demand is for full-priced Nike items.

The company smashed EPS targets, reporting $0.79 for the quarter vs. estimates at $0.55. As in the past, investors have been cautioned that Nike tends to provide conservative earnings guidance and easily top the numbers while reporting weak YoY numbers. In FQ3’23, EPS indeed fell $0.08 from FQ3’22 levels and the company beat FQ2’23 EPS estimates by a similar $0.20 to reinforce the pattern.

While the sales numbers were impressive and the EPS was a big beat, the investment story is all about the inventory levels. Nike headed into the quarter with inventories up 50% from prior normal levels, and the company was again able to reduce total inventories by ~$420 million to $8.9 billion.

Management has reduced inventory buys for the spring and summer seasons in order to further drive inventory levels back to normal levels. Of course, when Nike was at ~$6 billion in inventory heading into covid, the company only had annual sales of closer to $40 billion versus $50+ billion targets now.

The company should be able to handle far higher levels of inventory going forward. With the supply chain mostly in line with pre-covid shipping times, Nike should have the inventory issue resolved in the current quarter, leading to smooth inventory levels starting FY24.

Priced For Perfection

Nike solving the inventory issue doesn’t necessarily make the stock a buy. The company guided to flat to low-single-digit revenue growth for FQ4.

As competitor Under Armour (UA, UAA) has faced in the last few quarters, Nike is taking fewer shipments in the spring and summer and this will reduce sales levels for a short period. The company wants to move away from markdowns going into FY24.

For years now, Nike was priced for perfection, yet the company has gone through struggles such as this inventory issue. The company is now guiding to slow sales for a few quarters, questioning the reason to pay for a stock trading at stretched valuations.

Remember, Nike earned $0.78 back in FQ3’20 prior to covid. The company is now reporting earnings back where the business was prior to covid.

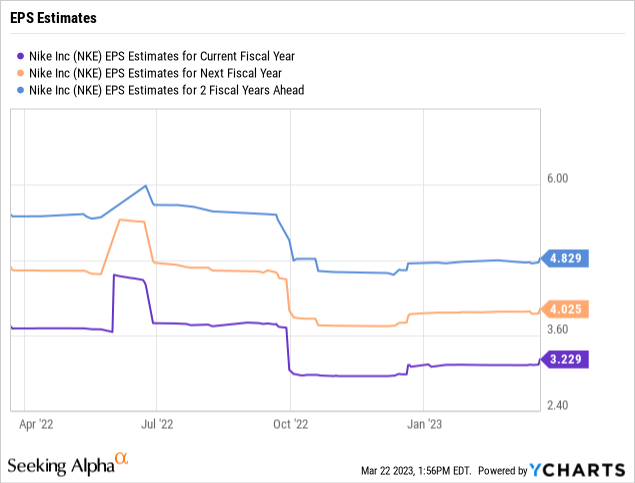

Analysts now forecast an EPS of only $3.23 in FY23. The forecast is for Nike to generate a strong EPS boost in FY24 and FY25 as gross margins return to the more normalized levels closer to 46% similar to FY19.

The stock trades at 31x the FY24 numbers that require 25% growth while revenues will only rise 7%. These numbers should be achievable, but the upside appears limited while the risk exists that margins don’t snap back to prior levels.

With the stock trading at $122, investors need to see more signs the athletic apparel company can produce the FY25 EPS targets above $4.80 before the stock ever becomes appealing. Nike faces some interesting risks with On Holding (ONON) becoming a very successful running and tennis shoe manufacturer in Europe with 2023 sales targets to rise 39% to reach $1.84 billion.

Takeaway

The key investor takeaway is that Nike will enter FY24 in a more normal inventory situation, setting up the company for growth. The problem is that the market continues to value the stock based on these profits already occurring, and investors shouldn’t spend the next year assuming this risk with limited stock upside.

Disclosure: I/we have a beneficial long position in the shares of UA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.