Summary:

- Lower-income households are feeling pressure while the high-end market appears to be doing well, evidenced by reports from Ross Stores and Foot Locker.

- Nike’s Q3 results last March showed a mixed performance, with a beat in earnings but a decline in digital sales. China remains a challenge for the company.

- I am upgrading Nike from a hold to a buy valuation given its attractive valuation and solid free cash flow yield.

- Technical risks are still very apparent, though, and I highlight key price levels to monitor.

Thank you for your assistant

It’s hard to paint the American consumer with a broad brush. There’s growing evidence that lower-income households are increasingly pressured while the high-end is fairing OK. A trade-down effect appears in full swing, at least that’s a reasonable conjecture following a strong report from Ross Stores (ROST) earlier this month. Foot Locker (FL) had decent results, too, saying that consumers are willing to pay full price, while firms like LVMH Moët Hennessy – Louis Vuitton, Société Européenne (OTCPK:LVMHF) voiced concerns about the luxury market. Finally, DICK’S Sporting Goods (DKS) shares soared after its Q1 report earlier this week.

I am upgrading shares of Nike (NYSE:NKE). With the stock now trading near a 10-year low in its price-to-earnings ratio and with stabilizing earnings, the stock could stand out if its management executes well in the quarters ahead. Shares must, however, hold critical support that I will detail later in the article.

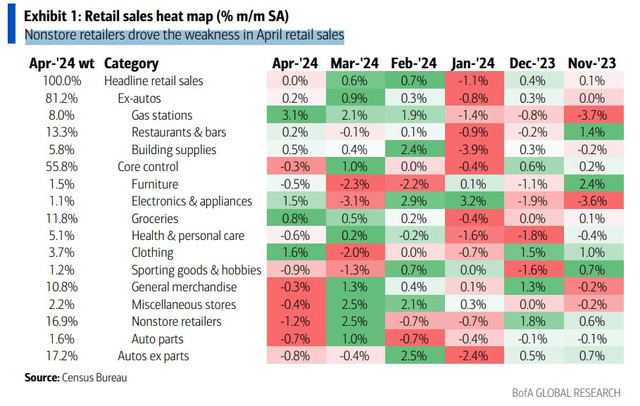

A Soft April Retail Sales Report

BofA Global Research

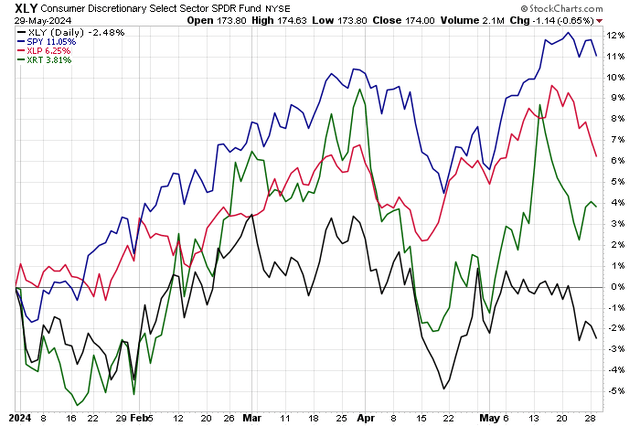

Consumer Stocks Sagging in 2024, S&P 500 +11%

Stockcharts.com

Nike is the premier global athletic footwear and apparel company with roughly 40% global athletic footwear market share. It also sells brand Jordan, Converse, and Nike golf shoes and athletic apparel. It produces through independent contracts and sourcing abroad.

Nike posted a mixed set of Q3 2024 results back in March. Non-GAAP EPS of $0.98 topped the Wall Street consensus forecast of $0.65 while $12.43 billion of quarterly revenue, up just 0.3% from year-ago levels, beat by $130 million. NIKE Direct reported revenue of $5.4 billion, a bit better than estimates on a constant-currency basis while NIKE Brand Digital’s sales fell 4% on an FX-adjusted basis. The Wholesale segment saw $6.6 billion of sales, up 3% YoY. Direct-to-Consumer (DTC) revenue dropped in the quarter, however, with digital sales falling significantly. The bright spot was a 200-basis-point improvement in its gross margin, driven by full-price selling and reduced product costs. China remains a sore spot.

After a third-straight EPS beat, shares rose initially, but then fell nearly 8% after the March earnings update, and options traders have priced in a 5.6% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the June 27 reporting date. Nike issued a cautious outlook after the Q3 report which reflected broad consumer challenges ongoing, particularly at the low end. I see much of the consumer and China challenges now priced into this strong brand, but the upcoming Q4 report will be key. Risks include ongoing weakness in consumer spending, poor FX trends (a stronger dollar), and further softness in China.

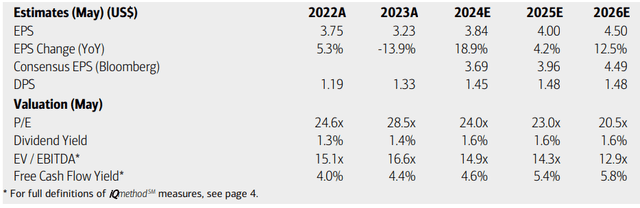

On valuation, analysts at BofA see earnings having risen 19% this year with out-year EPS reaching $4. A bottom-line acceleration is expected by 2026. The current Seeking Alpha consensus numbers show a stronger FY 2024 operating EPS number, but then slightly softer figures in the out years. Nike’s top line is seen inching up at a 1-2% clip this year and next, with strong sales increases in 2026.

Dividends, meanwhile, are forecast to hold at the current $1.48 annualized run rate, so the 1.6% yield, slightly above the S&P 500’s, is unlikely to attract income investors. But with an earnings multiple now significantly below its 5-year average and an EV/EBITDA ratio that is close to that of the broader market, there is a decent value case emerging. Finally, the free cash flow yield is solidly above 4%.

Nike: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

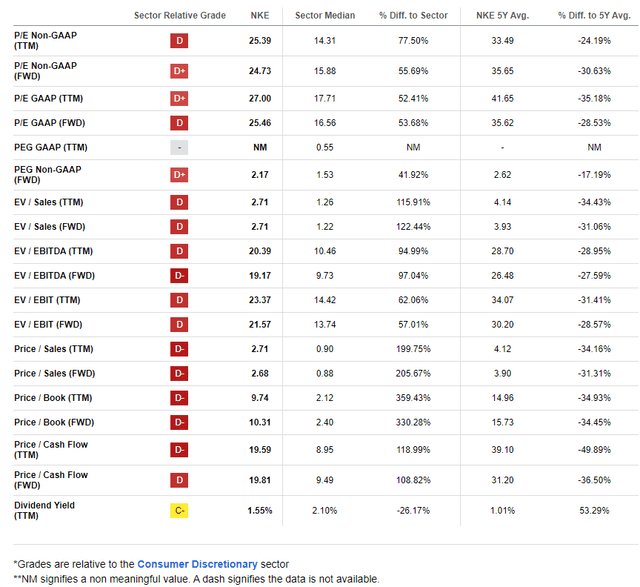

If we assume $3.90 of non-GAAP EPS over the next 12 months and apply a 28 multiple, nearly eight turns cheaper than its long-term average, then shares should trade near $109, making the stock close to 20% undervalued today. Just about every valuation metric suggests the stock is cheap compared to history, though I do not expect a mid-30s multiple to be in play any time soon given growth estimates.

Nike: The P/E Has Fallen Four More Handles From Late 2023

Seeking Alpha

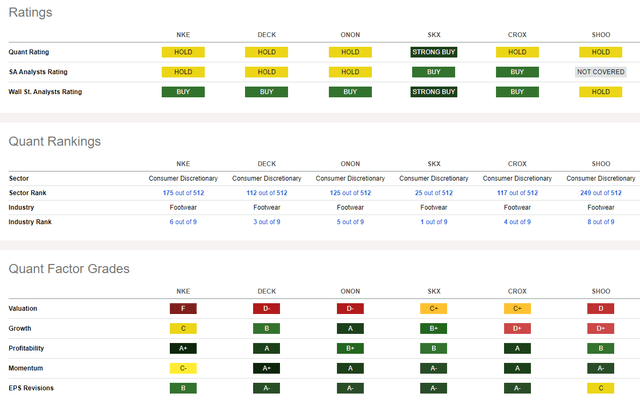

Compared to its peers, NKE features a weak valuation grade, but relative to its long-term trend, the valuation is appealing in my view. The Footwear industry company’s growth trajectory has been lackluster, and a key risk remains its tepid EPS growth forecast over the next handful of quarters.

But Nike’s profitability metrics are very strong and sell side EPS revisions have been to the good side, with 14 EPS upgrades and nine downgrades. Finally, share-price momentum continues to be tepid, and I will note important chart levels to monitor heading into earnings.

Competitor Analysis

Seeking Alpha

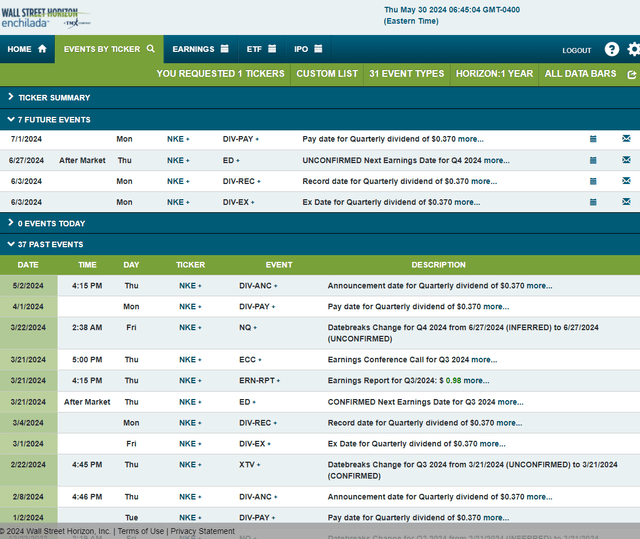

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2024 earnings date of Thursday, June 27. Before that, shares trade ex a $0.37 dividend on Monday, June 3.

Corporate Event Risk Calendar

Wall Street Horizon

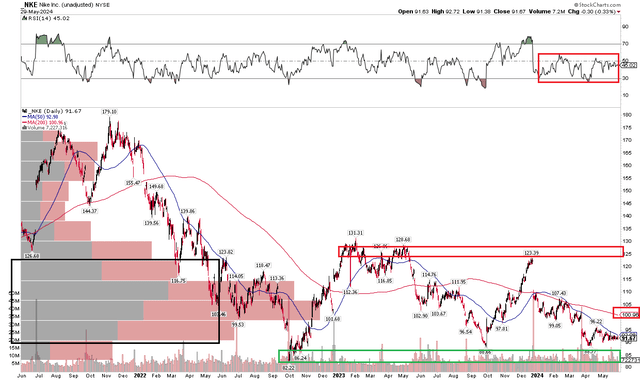

The Technical Take

Since I last reported on Nike, shares have fallen while the S&P 500 has increased significantly. Notice in the chart below that shares are now approaching key multi-year support in the low to mid-$80s. Since the stock continues to test this zone, I am growing increasingly concerned that we’ll see a bearish breakdown, but so long as the low from October 2022 holds, a long stake can make sense.

I see resistance in the $123 to $131 zone, but take a look at the RSI momentum gauge at the top of the graph – it is in the notorious bearish zone between 20 and 60. I would like to see a price increase that comes alongside a breakout in RSI to hopefully break the bears’ control of the primary trend. With a negatively sloped long-term 200-day moving average, buying here is admittedly fighting the tide. Finally, it’s possible that we could see NKE continue to trade between $85 and $100 based on a high amount of volume by price in the current area.

Overall, NKE’s chart is not strong. It sports absolute and relative weakness, but we have the October 2022 low to monitor for support.

Nike: Shares Near Critical Support, $130 Resistance

Stockcharts.com

The Bottom Line

I am upgrading Nike from a hold to a buy on valuation. While the technical situation is precarious ahead of earnings next month, the risk/reward setup appears reasonable in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.