Summary:

- NKE looks attractive ahead of its Q1 earnings report following a sharp selloff in recent months.

- Expectations for Nike’s earnings are low, but we see potential for the company to beat estimates.

- NKE appears over-sold and undervalued setting up a potential rally going forward.

Thank you for your assistant

Nike, Inc. (NYSE:NKE) is set to release its fiscal 2024 Q1 earnings on Thursday, September 28. This will be a good opportunity for the company to kickstart a rebound in the stock, considering NKE is down nearly 30% just since May.

The story over the past year has been inflationary cost pressures and an inventory overhang, both working to hit margins and earnings. Soft guidance last quarter amid volatile macro conditions has added to the somber mood.

That being said, we view this backdrop of low expectations heading into this upcoming report as the perfect setup to turn bullish on the stock. Growth remains positive and we see room for the company to beat top and bottom line estimates. We like NKE at the current level as shares appear undervalued, while technically well-positioned to rebound higher.

Nike Earnings Expectations Are Low

Nike is expected to report Q1 EPS of $0.76, representing an -18% decline from Q1 fiscal 2023. The revenue estimate at $13.0 billion, if confirmed, would be up just 2.6% from the period last year.

The way to think about these numbers is simply that overall costs have climbed faster than the pace of sales. Everything from higher freight, logistics, and S&A expenses over the past year have added up. The last few quarters have been defined by Nike’s attempt to rebalance the operation.

Normally, the first step most companies take to address cost pressures is to hike prices. On this point, Nike has been forced to take the opposite route through markdowns to deal first with some excess inventory that accumulated since the pandemic boom.

For context, the Q4 gross margin at 43.6% was down from 45% in the year prior, and well off the peak levels near 47% in 2021. This metric helps explain much of the earnings and stock price weakness and is a key monitoring point for Q1.

Seeking Alpha

The good news here is a sense that this quarter will mark the beginning of a turnaround, with an understanding that Nike has already made progress in recalibrating the firm-wide inventory levels.

So while margins and earnings may still be down on a year-over-year basis, we’ll be looking for some evidence of a sequential improvement supporting a more positive outlook.

Even with the weaker earnings trend, there have been some strong points. In fiscal 2023, NIKE Direct sales climbed by 20% on a currency-neutral basis, including both company-owned stores and digital channels. While wholesale still represents the bulk of the business, this ongoing shift towards direct-to-consumer channels is an important structural theme that can support higher margins long term.

By region, growth in China re-accelerated in the last quarter with total sales between footwear, apparel, and equipment up 16% y/y. This has balanced softer trends in North America and other parts of the world.

So while the overall momentum with sales climbing by 10% in fiscal 2023, and slowing to 5% in the last quarter has not been particularly robust, the bigger point here is that the top-line direction remains positive.

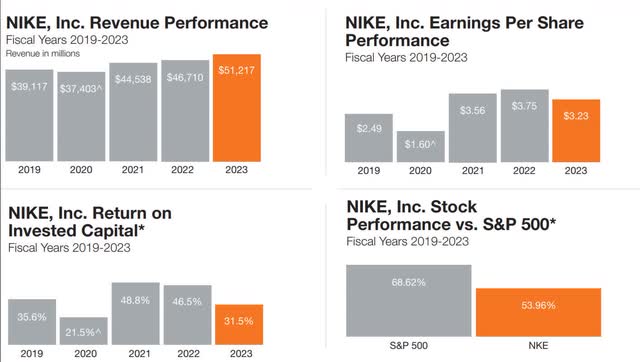

source: company IR

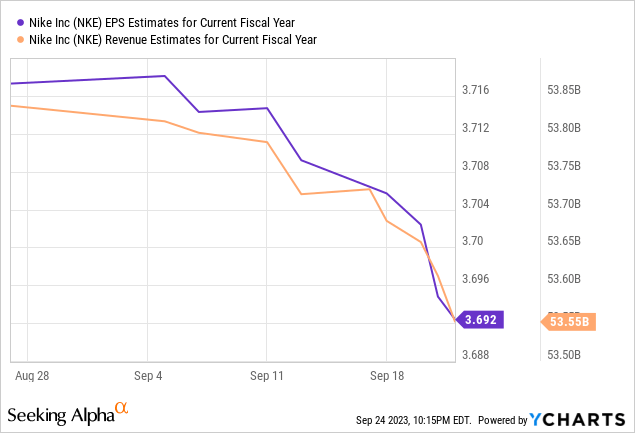

For the full year ahead, the consensus revenue estimate of $54 billion, marks a 5% increase from 2023. Similarly, the EPS forecast at $3.69 is 14% higher than last year. Again, the data suggests Nike is on track to turn around its operating and financial results, although we can point out that the estimates have been pushing lower.

As with the upcoming Q1 quarterly, the market has been pushing full-year estimates lower, particularly over the past three months, which implies some underlying pessimism.

The way we see it playing out is that Nike should be benefiting from what has been a resilient global economy in recent months, considering metrics like the firm U.S. labor market statistics and even tracking Q3 GDP data. While macro uncertainties remain a topic of discussion, the reality here is that consumers are still spending which is a good read on Nike’s operating environment.

By this measure, we see a good chance that Nike can beat both the top and bottom line with a potential narrative by management citing an early margin recovery amid easing supply chain inflationary pressures.

Valuation Looks Attractive

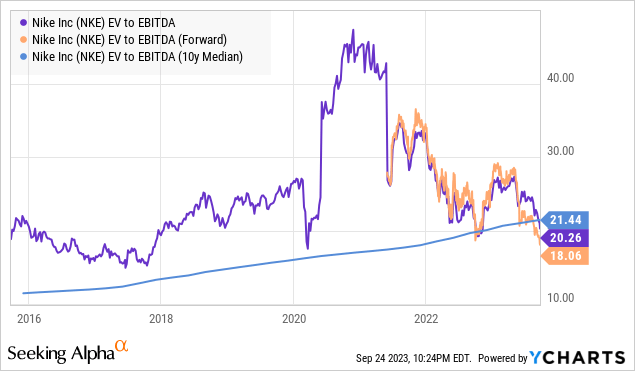

An important dynamic from the big selloff in shares of NKE from highs in 2021 has been the reset in valuation. Here we can point to the stock now trading at a discount to various earnings multiples relative to long-term averages.

Shares trading at 18% of the EV to forward EBITDA multiple represent a 17% spread to the 10-year average for the multiple closer to 21.5x. On a forward P/E basis, NKE is trading at a 25x multiple which is also well below the 10-year average of around 31x.

Beyond some of the weaker short-term trends, let’s not forget the quality aspect of Nike as a global leader in the footwear and sporting apparel segment. The brand recognition, underlying pricing power, and history of innovation mean to us that shares warrant a premium.

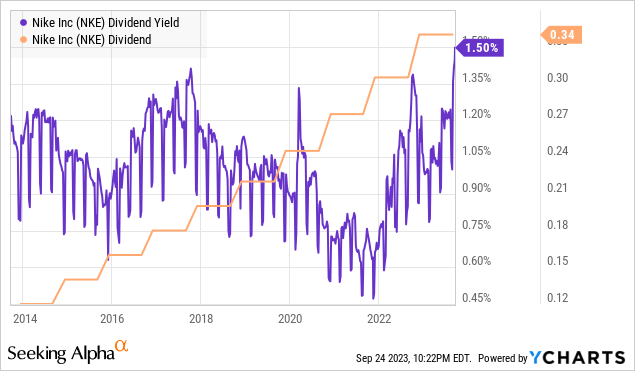

The other metric that stands out is Nike’s dividend yield which is currently at 1.5% and at its highest level in a decade. While NKE has never necessarily been an “income stock”, the company is a dividend growth leader with the last dividend hike of 9% coming in late 2022.

We see room for the 22-year streak of consecutive annual rate hikes to continue with another increase likely in November following the pattern of announcements in recent years.

Making the assumption that Nike can reclaim its long-term growth trajectory and has room to re-accelerate earnings higher, we make the case that shares are undervalued.

Technically Oversold

Finally, we can point out that NKE appears technically oversold heading into the Q1 earnings report. From the chart below, there has been relentless selling pressure over the last four months since NKE was trading at $130 per share.

The latest leg lower took the stock down to $91 and has driven the relative strength index (RSI) to a 20.61 reading. The indicator measures the average price change over a 14-day moving period to quantify the momentum in price. In this case, NKE is extremely weak. Curiously, a reading under 30 at various points in the past year has marked the start of a rally.

The potential that NKE delivers a “good” earnings report with encouraging guidance, brushing aside fears the company is facing a deeper deterioration in its operating environment could be enough for shares to reprice higher. Simply put, our take is that NKE bears have gone too far, opening the door for bulls to take control.

Seeking Alpha

Final Thoughts

Putting it all together, the call here is that “the bottom” in NKE is in. The first point here is that a bullish outlook matches an optimistic view of the global economy. The way we see it playing out is that favorable inflation trends over the coming months, coupled with stabilizing interest rates should be enough to avert any scenario of a deep recession.

We rate shares as a buy with a price target for the year ahead at $110 representing a 30x multiple on the current consensus fiscal 2024 EPS at $3.69. Stronger-than-expected sales while margins firm, should support more positive sentiment as earnings estimates get revised higher, ultimately narrowing the earnings premium.

In terms of risks, evidence of a sharp slowdown in consumer spending globally or a surge of unemployment in the U.S. would undermine current forecasts. Weaker-than-expected results would open the door for the stock to reprice lower. The gross margin and cash flow trends are key monitoring points over the next few quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.