Summary:

- Nike’s strong brand, innovation, and market leadership drive long-term growth despite recent negative sentiment and competition.

- Valuation is attractive, with Nike trading below its 5- and 10-year P/E ratios, presenting a potential buy opportunity despite short-term volatility.

- Future growth driven by digital transformation, athleisure, and international expansion, with potential for a $160B market cap by 2027.

Flavio Vallenari/E+ via Getty Images

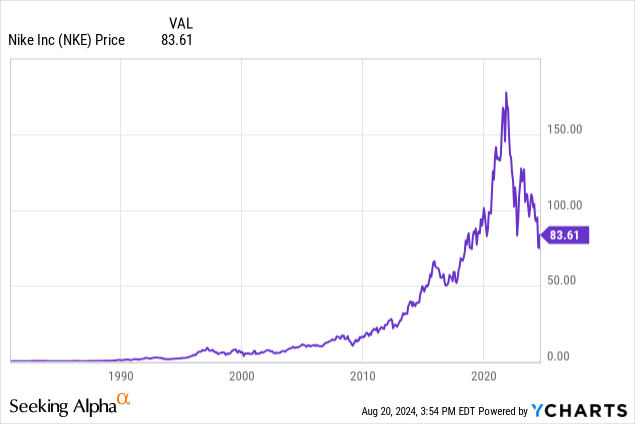

At the moment, I consider Nike (NYSE:NKE) to be a long-term buy, as its valuation is currently very attractive. I believe the stock and company are at an inflection point, but I have confidence in management that it will continue to position the company competitively. As a result of this, I think current negative sentiment can be capitalized on for long-term alpha; although realistically, this may not be substantial over a long timeframe, the current valuation does indicate medium-term returns, which are competitive against the S&P 500 (SP500), in my opinion.

Innovation Strengths, Brand/Market Leadership, & Trend Adaptation

Nike is introducing the Air Max Dn product range, featuring Dynamic Air technology, a system featuring a dual-chamber, four-tube air unit designed to enhance the functional quality of the shoe. This has been brought to the market quickly through Nike’s fast innovation cycle, leveraging computational design and advanced manufacturing techniques with rapid prototyping and testing. Nike crucially focuses on enhancing athlete performance, and it has developed a strong brand and reputation here, which has created lasting demand and should help it sustain growth in the future. This brand is further supported by storytelling and brand experiences; for example, the launch of the Air Max Dn during Air Max Day 2024 celebrates Nike’s heritage while showcasing its latest innovations.

Nike’s global brand has helped to support it to have market penetration internationally, with 58% of its revenue coming from non-US markets in FY24. Over the years, Nike has benefited from collaborations with high-profile athletes and celebrities, including LeBron James, Serena Williams, and Cristiano Ronaldo, to promote its products. This status of world-class athletes has created a timeless and enduring brand for Nike. However, the company also strategically partners with micro-influencers, which are currently rising in number, to build meaningful connections with niche audiences. I believe that this brand power is likely to continue to be accretive to shareholders over the long term, especially as the company continues to focus on innovation to drive growth and remain relevant.

The company’s ability to capitalize on growing trends is critical for its future growth, and it has a proven track record of this. For example, Nike has capitalized on the growing trend of athleisure, focusing on lifestyle apparel and opening up broad new revenue opportunities. In addition, management has invested heavily in its digital transformation and e-commerce, and I expect this part of its business to grow over the coming decade. Despite a recent decline in digital sales in Q4’24, the company has grown its digital sales at a compound annual growth rate of 26% since 2019. It also plans to establish a technology center in Atlanta, which will focus on AI, machine learning, cybersecurity, and logistics.

Furthermore, Nike is redesigning its digital ecosystem in China, including updates to the Nike app, SNKRS app, and other digital platforms. It has also entered the metaverse through initiatives like Nikeland on Roblox (RBLX) and the acquisition of digital sneaker firm RTFKT. This forward-looking attitude to innovation and trend adoption makes me bullish on Nike stock, especially as I currently consider it to be significantly undervalued at the moment.

Valuation & Financial Analysis

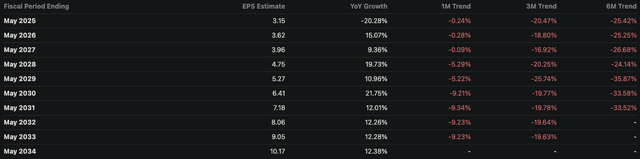

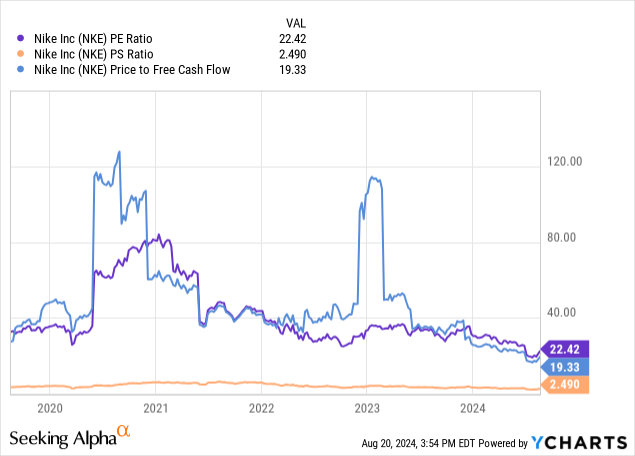

Nike is expensive relative to its sector average (forward PE GAAP ratio of 26.5 versus 17), but it is selling at a significant 24.75% discount from its own 5Y average. Nike is undoubtedly a premium stock for a reason, as it has delivered a 5Y average diluted EPS growth of 24.5% against a YoY sector median of 4.83%, among other sector-beating growth metrics. That being said, the concern at the moment is that Nike’s revenue growth could begin to slow. Its YoY and forward revenue growth are both around 0.3%, and its forward EPS GAAP growth of 4.27% is significantly lower than its YoY diluted EPS growth of 15.5%. However, over time, these growth rates are expected to improve, with the Wall Street consensus showing a -20.28% YoY decline in normalized EPS for the fiscal period ending May 2025 but 15% YoY growth for the fiscal period ending May 2026. Therefore, the current contraction is arguably a buying opportunity for value investors. From my research, the contraction has been caused by excess inventory after the pandemic supply chain disruptions, changing consumer preferences to leisurewear (which it is combatting with athleisure), and weak sales in one of its largest markets, China, among other catalysts. As a result, Nike implemented a $2B reduction through cost-cutting measures over three years and restructured its workforce.

In my opinion, this is one of the most attractive points to buy Nike stock that there has been in the last 5 years. Even beyond a 5-year horizon, Nike has a 10-year median PE GAAP ratio of 30.58, and with its current PE ratio at a much lower 22.39, this is undeniably Buy territory. To further support my thesis, we should take note that Wall Street is indicating that the stock is likely to continue to deliver normalized EPS growth beyond 2026, with 9.4% YoY growth estimated in the fiscal period ending May 2027 and two analysts suggesting growth upward of 15% in the fiscal year following this.

Although the valuation and medium-term growth estimates are strong, the stock has a 1-year price return of -18.75% at the moment and an F revisions grade from Seeking Alpha’s Quant. This is somewhat troubling, and I believe it indicates that Nike is still a falling knife. Therefore, this thesis is really aimed at long-term value investors who are willing to weather short-term downside for medium-term alpha.

In my opinion, it is reasonable to suggest that Nike will have a PS ratio of 3 in a couple of years if the ratio moves toward its 10-year median of 3.3 and 5-year average of 4 as its growth rates start to improve again. If it can achieve this and reach the Wall Street consensus revenue estimate of $54B by May 2027, the company’s market cap would be $162B at some point before May 2027, indicating 30% growth from the current market cap of $124.87B.

Competition, Innovation Concerns, & Shifting Consumer Preferences

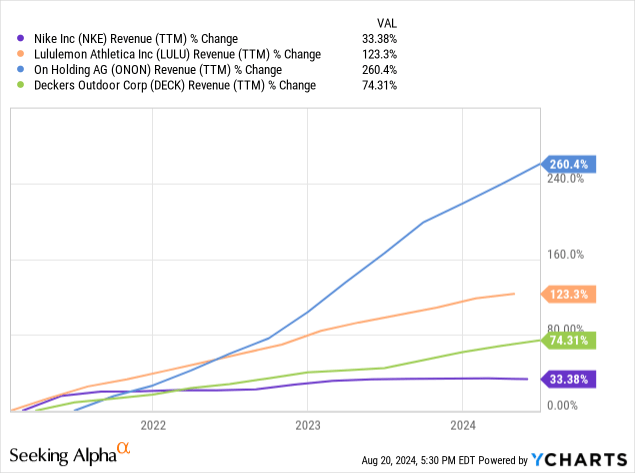

The competitive landscape of Nike is evolving quickly, and new brands like Lululemon (LULU), which is expanding into new categories such as footwear, are a significant threat. Lululemon’s revenue growth has surpassed Nike’s in North America, and emerging brands like On (ONON) Running and Hoka, owned by Deckers Outdoor Corporation (DECK), are also gaining traction.

The above chart shows why there is some rational skepticism surrounding Nike at the moment because newer, emerging competitors are offering faster growth prospects. This is certainly going to contribute to the negative momentum, but I believe it is also one of the primary factors that has opened up a strong value opportunity for Nike.

Also, while I mentioned Nike’s strengths in innovation in my operational analysis above, it is also facing criticism of its innovation pipeline, including the fact that it is relying heavily on its best-selling franchises like Air Jordans and Air Force 1s—arguably, this has allowed competitors to gain traction and capture market share. Nike’s CEO John Donahoe has attributed some of the innovation lag to remote work, which, I think, is probably true, as this can stifle collaboration and creativity that might be better fostered in a physical office and creative department.

Furthermore, with high levels of inflation in the United States at the moment, which is Nike’s largest market, there is a trend toward favoring casual and affordable apparel. This opens up a moment of weakness for Nike, but to combat this, it is adjusting its lineup to offer more affordable options.

I think Nike is at an inflection point, both operationally and in its valuation. Either management will attune the brand and offerings to favor high growth through meeting the new levels of spending capacity and preferences of its total addressable market, or it will fail to do so and continue to stress an elite quality, which could alienate a large number of its customers and stifle growth. Nike’s management has to ask itself whether it wants to be pseudo-luxury or affordable and accessible, the latter of which, I believe, will be higher revenue generating from now on, especially as its market saturation is already very high. If it attains higher growth rates, the valuation multiples are likely to expand again, and Nike would then be an excellent investment if bought at this time when the market is ascertaining its future growth potential.

Conclusion

Nike is currently a value opportunity, and I believe it is a Buy despite the potential downward momentum that still could be left before it begins to ascend in price again. I believe a market cap of around $160B is attainable in roughly 18 months in my bull-case prediction. I am bullish on Nike because I consider its brand to be incredibly well-situated and established, with management showing a history of adaptability and innovation that, I believe, will stifle present concerns around trend shifts and competition. As a result of my analysis, I rate Nike stock a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.