Summary:

- Due to the suspension of sports as a containment measure for Covid 19, NKE shares declined.

- The Chinese full reopening will serve as a significant tailwind for NKE, considering it enjoys the biggest market share in China.

- The recent collapse of the Chinese Yuan against the US dollar may impact the strong momentum in China.

ISAAC LAWRENCE/AFP via Getty Images

Investment Thesis

Nike, Inc. (NYSE:NKE) creates, develops, markets, and sells men’s, women’s, and children’s athletic footwear, clothes, equipment, and accessories in conjunction with its subsidiaries. Sports have suffered significantly since the onset of COVID-19, with most sports being stopped as a containment measure. Additionally, some people lost their jobs, and the lockout caused a global economic downturn that reduced consumer confidence.

These factors had a big impact on NKE and the overall sportswear industry. Due to challenges associated with Covid and the current precarious economic environment, NKE shares lost around 12% over the past year. Nevertheless, with China again reopening, the corporation is exhibiting indications of recovery, with share prices rising by about 18% over the previous six months. The CEO believes that momentum in China will be a major tailwind for its growth.

In light of this, I fully concur with the CEO because, besides Chinese consumers’ higher spending power, NKE also enjoys a significant market share in China as the top sportswear brand. As a result, I am bullish on this stock.

A vast Market Share in China

Nike, the global industry leader in sports apparel, dominates the Chinese market as well. With a market share of 25.2%, Nike dominates the Chinese sportswear market, outperforming the local manufacturer Anta, which enjoys a market share of 16.2%.

By 2021, the Chinese sportswear market was worth about US$59.2 billion. In the years following, the market was predicted to expand at a CAGR of 5.23 percent, ultimately reaching about 79.5 billion US dollars in 2027. Assuming NKE maintains its position, which I think it will or can even improve upon, by 2027, the firm will be generating roughly $20B in China, which will majorly boost the revenues and profits.

China Rows NKE Comeback

I believe the resumption of sports after a long time of suspension and lockdowns in most nations due to Covid 19 will significantly boost NKE recovery. Even if the global economy is picking up steam again, NKE may find a particularly fertile market in the reopened Chinese market, thanks to the country’s more prosperous consumers and conciliatory government.

1. Consumer Capacity

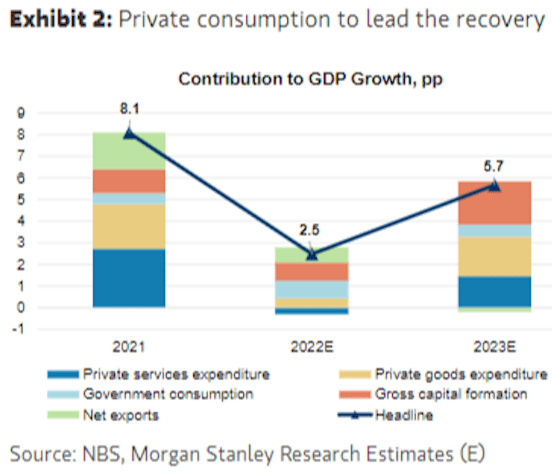

For almost all of 2022, China enforced stringent Covid lockdowns long after the rest of the globe had lifted them. This profoundly impacted the country’s economy, but it’s now fully reopened. After the lockdowns are lifted, the government is banking on a sprightly increase in consumer spending to spark a significant economic recovery. To achieve its target growth rate of approximately 5.5% this year with that spending and a respectable contribution from government investments, China wouldn’t even need to export more than it imports.

NBS

One cannot state this. As a result of the harm done to household finances and confidence by last year’s steep collapse in housing values, Chinese consumers may be more wary than American consumers were in 2021. Despite this, Chinese consumers accumulated large surpluses of savings throughout the pandemic, and their pent-up desire is now ready to be released. Furthermore, since the global economy is weakening and supply chains are operating smoothly, China’s reopening is less likely to be met by a spike in inflation.

I believe NKE will gain greatly from the increased purchasing power of Chinese consumers, as it has a sizable part of the Chinese market.

2. Government Policy Influence

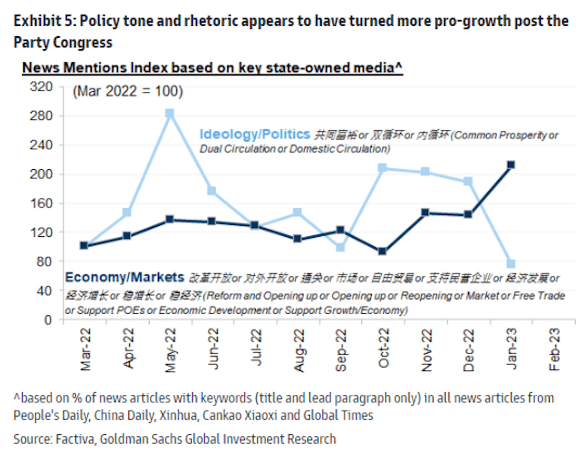

The administration has reversed its growth-stifling Covid-19 policies and is doing so on numerous fronts. By relaxing the previously imposed constraints and adopting growth-friendly policies, the government has adopted a more market-friendly position, mitigating a significant risk factor and opening the door to a gradual return of hesitant investors. The expansion of the economy will benefit NKE and other businesses in the country.

Factiva

Dividend

Despite the economic downturns, which hit most companies financially, prompting roughly 190 US-listed companies to discontinue paying dividends in 2020, NKE has been a consistent dividend payer. The firm has a track record of increasing its dividend payment yearly for the past decade, with a compound annual growth rate (CAGR) of 11.14% during the past 5 years. In my opinion, a payout ratio of 34.42% is quite sustainable and frees up a lot of capital for growth. I anticipate the company will continue its dividend growth trend in future quarters as it reaps the rewards of China’s economic openness.

Risks: The Inferior Yuan

In offshore trading, the Chinese Yuan hit a record low against the US dollar, joining a long list of other currencies that have seen significant drops against the dollar. According to the Bloomberg news agency, the offshore Yuan, traded outside of mainland China, dropped to 7.2386 versus the dollar in September, marking its lowest level since Beijing loosened restrictions on trading the currency in Hong Kong in 2010.

The onshore yuan (the version of the yuan used in mainland China and subject to tighter government supervision) dropped to its lowest level against the dollar since the 2008 financial crisis, at 7.2302 per dollar.

Revenues generated in China, which is now a major tailwind to NKE, could be high in Yuan but less by a factor of about 7x when converted to USD due to the depreciation of the Yuan relative to the US dollar. This is a significant risk associated with buying stock in the corporation.

Conclusion

Sportswear industry gets a huge boost now that sports activities have recovered after suffering heavy losses during Covid 19. Especially for NKE, which has the lion’s market share, the easing of restrictions in China following the Covid 19 scare has been a boon to the company’s expansion. The purchasing power of Chinese consumers is very high, which is good news for businesses in the country. I am bullish on the stock and give it a buy rating to investors looking for a consistent dividend payer even during economic downturns, even though the company faces FX risk.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This essay is not intended to provide financial advice but rather to share my honest assessment of the firm.