Summary:

- NKE stock price is less than half of its all-time high, with a dividend yield of 2.00%.

- Dividend yield analysis suggests that NKE rarely yields more than 2%, making the current level a potential buying opportunity.

- Despite concerns about dividend safety, NKE’s earnings per share comfortably cover the dividend, with potential for a dividend increase in the future.

dynasoar/iStock Unreleased via Getty Images

Scanning through charts over the weekend, I came across NIKE, Inc. (NYSE:NKE) (NEOE:NKE:CA) the global athletic footwear and apparel company out of Beaverton, Oregon. Most people know NKE to be a well-known brand that sells a product that everyone needs, footwear, and I was surprised to see that the stock was selling for less than half of its all-time high of $173.32, which was reached in November 2021. Then I wondered what the dividend yield was and saw that it is at 2.00%. In this article, I will outline what happened in the past when NKE’s dividend exceeded 2%, and I will discuss some metrics from the most recent earnings report that indicate to me that the dividend is not in jeopardy.

I realized that a 2% dividend yield is nothing to get excited about, and I know that NKE isn’t a traditional dividend stock, but I’ve had success in the past using dividend yield as a buy signal to start a position in a stock.

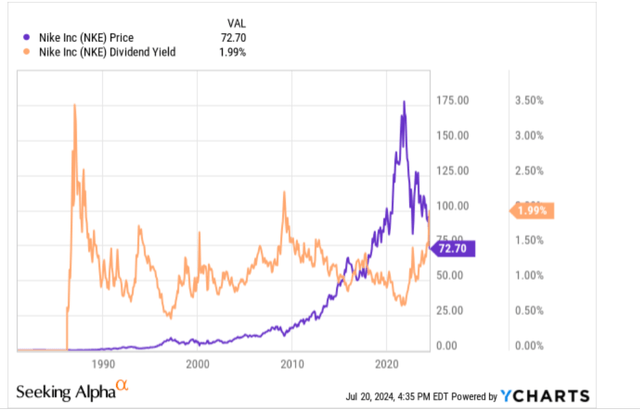

Chart 1 – Nike Stock Price with Dividend Yield Overlay

Source: Fundamental Chart Creator (ycharts.com)

Chart 1 shows the price of NKE stock in purple, overlayed with its dividend yield in orange. This chart covers NKE ever since they began to pay a dividend. Using a chart such as this one, an investor can note what has happened in the past when the dividend yield spiked or dropped to levels rarely seen over the years. NKE is still considered a growth company, not a stodgy dividend company. It’s not a high yielder. Even so, investors can use its dividend yield to determine price anomalies in the stock.

Chart 1 shows that NKE rarely yields more than 2%. Apart from its initial dividend paying years back in the 1980s, NKE has only yielded more than 2% one other time and that was during the lows of the financial crisis bear market, late 2008 to early 2009. That proved to be an excellent time to buy NKE. Looking at Chart 1, you can see that the most recent selloff of NKE has caused the dividend yield to spike to 2.00%. Consequently, now may be another great time to accumulate shares of NKE. I realize that this is a small data sample, but that is what the chart is telling me. This dividend yield buy signal is not an exact timing tool. However, it could be useful to indicate that it is time to start a small position in NKE.

How safe is the dividend?

Seeking Alpha says that the dividend safety rating of NKE is a D- which indicates that a dividend rate cut isn’t out of the question, maybe even likely. I was shocked when I read that rating. I was immediately skeptical. After doing some fundamental research using some simple metrics, I find that D- rating hard to believe. NKE still sells plenty of products. I understand that their revenues fell short of the mark on their recent quarterly earnings report and more importantly, future revenue guidance was reduced. Yet, after reading the earnings call transcript, NKE mentioned their plans for increasing revenues in the future even though they say that 2025 will be a transition year.

Also, there was nothing mentioned in the transcript about cutting the dividend or the dividend being in jeopardy. For the most recent quarter, NKE earned $0.99 per share. This more than covers its current dividend of $0.37 per share. Consensus earnings per share estimates for the next quarter do sink to $0.52, but I doubt that one quarter causes NKE to cut their dividend. Consensus earnings per share after next quarter exceed the $0.99, they earned this quarter.

I couldn’t find free cash flow per share for the most recent quarter. However, in the previous quarter NKE had $1.27 of free cash flow per share, which more than covers the $0.37 quarterly dividend. My guess is that free cash flow in the latest quarter will also comfortably cover the $0.37 quarterly dividend. In the press release for the most recent earnings call, NKE mentioned that they have raised their dividend for 22 consecutive years. And if things go as they have in the recent past, NKE investors should receive a dividend increase in November. NKE also is in the middle of an $18 Billion share repurchase program authorized in 2022 which has about $9 Billion remaining. Now would be a great time for NKE to repurchase some of its shares.

My contention is that NKE has rarely yielded more than 2% in its history as a company. The last time it did so was during the financial crisis bear market in late 2008, early 2009. That proved to be an excellent time to buy NKE. I realize that the yield was higher than 2% at that time. I also understand that this dividend yield buying signal is not an exact science. NKE could easily continue to decline from this level, especially if the overall market goes into a 5-10% correction. Consequently, I’m not advocating buying a full position at this level. However, this might be the time to initiate a small position in NKE if you consider yourself to be a long-term shareholder.

I believe NKE management will figure out a way to increase revenues moving forward, based on what I read in the earnings transcript. I don’t think the dividend is in jeopardy of being cut as their earnings per share are still well above their quarterly dividend per share and I think the dividend will be raised later this year. Lastly, NKE will continue to be a buyer of their shares, as they still have two years and approximately $9 Billion remaining on their most recent share repurchase program.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.