Summary:

- Nike shares remain a BUY due to attractive entry points from recent price declines and expected steady growth as the product range is refreshed.

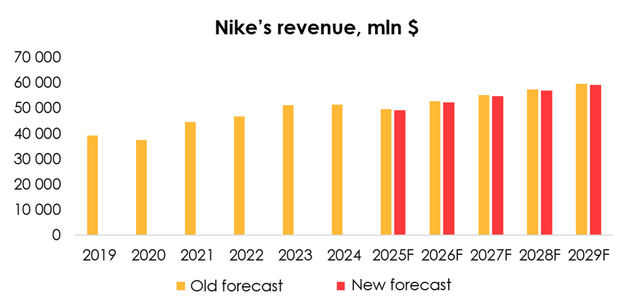

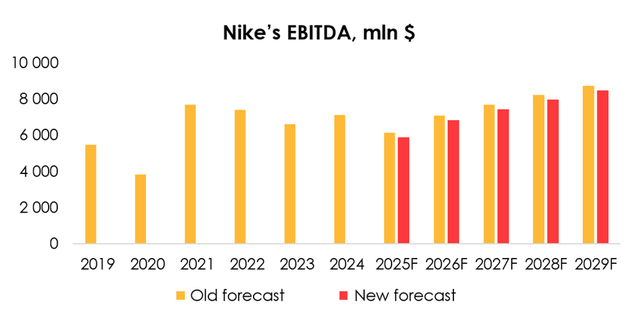

- NKE’s financial outlook slightly lowered due to weaker-than-expected sales and foot traffic, with revenue forecasts adjusted for 2025 and 2026.

- Gross margin expected to decline by 90 bps y/y, reflecting conservative assumptions and uncertainty about the new CEO’s strategy.

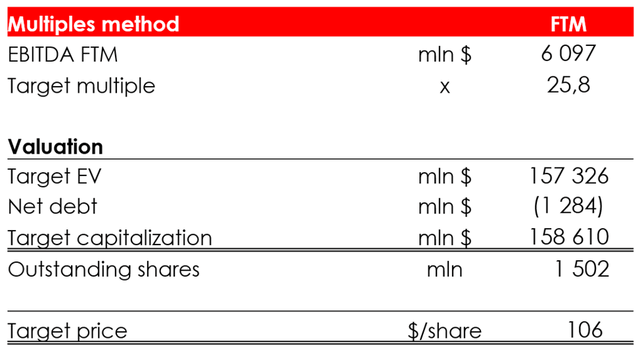

- Target price adjusted to $106, maintaining BUY rating despite reduced EBITDA forecasts and a shift in the valuation period.

Justin Sullivan/Getty Images News

Investment thesis

It has been our view for some time that Nike (NYSE:NKE) shares should be added to the portfolio while the opportunity is there. Since our previous article on Nike, the company’s shares have risen by more than 10% while the S&P500 has risen by 5%. Our view remains essentially unchanged and NKE is still a BUY.

The decline in share price as a result of slowing growth and increased competition in the international market creates an attractive entry point: Nike’s enterprise value is now below 2018-2019 levels, even though the volume of the business has expanded substantially since then. We view the medium-term decline in financial performance as a cyclical shift in trends in the volatile apparel and footwear market, and believe Nike will return to a steady growth in financial results as it refreshes its product range and thanks to regular shifts in consumer preferences.

Financial results outlook

Revenue totaled $11.6 bln (-10.4% y/y) slightly down from our forecast of $11.8 bln. Nike noted that sales fell short of expectations and that foot traffic to Nike’s brick-and-mortar stores also underperformed. The lower traffic and sales were partially offset by a higher average selling price than the company had expected.

Nike has embarked on a trajectory of complete assortment renewal. Nike is reducing the offering of its classic Air Force, Air Jordan and Dunk franchises, but ramping up the offering of its sports franchises: Mercurial and Global Football. Sales of legacy brands are down 10%-20% y/y, being partially offset by a doubling of revenue from the new initiatives that were launched recently.

On the whole, Nike’s current trajectory is in line with our expectations with the exception of a stronger headwind in China, where weak economic activity continues to weigh on Nike’s sales.

As a result, we are slightly lowering the forecast for Nike’s revenue from $49.6 bln (-3% y/y) to $49.1 bln (-4% y/y) for 2025, and from $52.7 bln (+6% y/y) to $52.2 bln (+6% y/y) for 2026.

Company data, Invest Heroes calculations

The key point in the company’s guidance for the next quarter is a 150 bps decline in gross margin, although in 1Q and throughout the last 4 quarters, the company has been increasing gross margin despite stagnant revenue.

This variation in the margin of a major business can only happen if there is an intense selloff of inventories of older collections at a 20%-30% discount, which translates into sales volume rising by 10%-20% and prompts total revenue to slump by 8%-10% and profitability to fall.

But this would be a rather drastic move, which the management did not comment on. The management even stated that the current inventory buildup is not of too much concern. Nike had a good campaign during the Paris Olympics, where 60% of all medalists used Nike gear, which led to an increase in orders from wholesalers to last year’s levels.

Given that Nike’s new CEO is intent on higher investment in brand advertising, but the company’s general trend is toward cost optimization, we are projecting a gross margin decline of 90 bps y/y, with negative momentum through the end of FY 2025, as we seek to reflect more conservative assumptions, which imply uncertainty about the new CEO’s strategy. Nike postponed Investor Day indefinitely, pending strategy approval by the incoming CEO.

As a result, we are lowering the EBITDA forecast from $6.1 bln (-14% y/y) to $5.9 bln (-37% y/y) for 2025 and from $7.1 bln (+16% y/y) to $6.8 bln (+52% y/y) for 2026.

Company data, Invest Heroes calculations

Valuation

We are lowering the target price of the shares from $107 to $106 due to:

- the reduced EBITDA forecasts for 2025 and 2026;

- the reduction of outstanding diluted shares from 1517 mln to 1502 mln;

- the shift of the FTM valuation period.

Based on the new assumptions, we are maintaining the rating for the company at BUY.

Invest Heroes

Conclusion

We believe that Nike will return to a stable growth rate in financial results as the product range is updated and consumer preferences regularly shift. The target price is $106, the rating is BUY.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.