Summary:

- I rate Nike stock as a Hold due to its fair valuation amid ongoing challenges that are balanced by some positives.

- Positives include a new CEO, Chinese stimulus measures, growth in the running footwear business, and lowered market expectations.

- NKE’s negatives include strong competition, falling earnings and revenue, consistent downward revisions from analysts, and a weak Fiscal Q2 revenue forecast.

- A turnaround may take quite some time, so I prefer to wait a few more quarters to see the new CEO’s impact.

code6d

Nike (NYSE:NKE)(NEOE:NKE:CA) stock has been in the doldrums in recent years, more than 50% off its all-time high. The stock fell by about 6% in after-hours trading at reporting its Fiscal Q1-2025 earnings, but I don’t see a major buy-the-dip opportunity here.

What I see is a fairly valued company, more or less, that has a lot of work to do to make a comeback. But there are still a lot of unknowns. Positives include a new incoming CEO with useful experience, Chinese stimulus, growth in its running footwear sales, an improved gross margin, and lowered expectations overall.

Meanwhile, negatives include strong competition that is gaining market share, falling earnings and revenue, consistent downward revisions, a delay in the company’s investor day presentation, and the decision to not provide guidance for the full year. Nike is also dealing with elevated inventory, which has led to more promotional activity, and its Fiscal Q2 revenue forecast came in below analysts’ expectations.

Overall, due to the many unknowns, Nike looks like a show-me or wait-and-see story for now. Combined with just a fair valuation, I rate the stock as a Hold.

Nike Q1 Earnings and Q2 Guidance Recap

Let’s quickly go over Nike’s results — both the good and the bad. First, its revenues fell by 9% on a constant-currency basis to $11.6 billion (10% on a reported basis). This just slightly missed the $11.65 billion estimate. Next, its diluted EPS fell by 26% year-over-year, but this figure easily beat the $0.52 estimate.

Since its effective tax rate in the quarter was 19.6% compared to 12% last year due to a one-time benefit in the prior year, I think EBIT paints a better picture of its operations. Still, its EBIT fell by a whopping 22% year-over-year to $1.264 billion — not good.

Its gross margin grew by 120 basis points to 45.4%, but its gross margin is expected to be 150 basis points lower YoY in Q2 due to higher promotional activities as a result of elevated inventory of $8.3 billion. So, those two facts basically offset each other.

Speaking of Q2, management expects an 8-10% decline in revenues, whereas analysts expected a 6.75% decline. This can cause some analysts to cut their price targets.

The Running Footwear Business Saw Growth

On a more positive note, Nike’s CFO, Matthew Friend, stated that its running footwear business grew in Q1 for the first time in several quarters. Specifically, in the Q1 earnings call, he said:

This quarter, men’s and women’s running footwear was up and it was the first time we’ve got positive growth in several quarters. When we look at the order book for spring footwear, men’s and women’s running footwear is growing double-digits.

That’s positive news, but there’s one thing to consider. Recently, Nike has been focusing on expanding its presence through partners rather than relying heavily on DTC or digital sales. In the Q1 earnings call, Matthew Friend stated the following:

Digital is still and Direct is still an important part of our overall marketplace strategy. Having direct connections with consumers is strategically important. But our consumers want to connect directly with NIKE, whether it’s in our own channel or with a partner.

This includes partners like DICK’S Sporting Goods (DKS) and Foot Locker (FL). What I’m getting at here is that it’s not a 100% certainty that the growth in running footwear was due to demand from consumers or because of its partners restocking its items. I believe it likely was due to higher demand, but it’s still something worth thinking about. Nonetheless, it’s good to see that Nike is working with partners to increase its exposure.

Less Reliance On Classic Products, Trying To Achieve More Balance

Nike’s CFO stated that the company has purposely reduced how much of its business comes from its classic footwear franchises, such as Air Force 1 and Air Jordan 1. As a result, revenue from these franchises fell more than the overall business, and this is expected to have a negative effect on revenue “over the coming seasons.”

However, the point of this is to achieve balance and be less reliant on certain products. Nike intends to release new products and draw more attention to those. Therefore, this could be a case of short-term pain, long-term gain, but here’s another consideration. Nike expects more promotional activity, and my guess is that more promotional activity will happen with its older products, which would make it harder to sell the new products.

New CEO Is A Big Positive

CEOs can truly make a huge difference. Just look at how successful Brian Niccol was with Chipotle Mexican Grill (CMG). With Elliott Hill set to become the CEO of Nike on October 14, I’m optimistic that he will do a better job than former CEO John Donahoe. Elliott Hill quite literally “started from the bottom” at Nike, as he was an “intern, apparel sales representative” from 1988 to 1990, per his LinkedIn profile. He then slowly worked his way up throughout the years until retiring in 2020 as “President, Consumer & Marketplace.”

Now, he’s coming out of retirement, and the good thing is that he knows the business from the ground up, which will be a great advantage. I also believe that this will boost employee morale. Think about it. I’m sure that many people who work at retailers don’t truly care about the company they work for. They collect their paychecks, and that’s it. However, if they see that the current CEO was able to work his way up from the very bottom, that can give them hope that their hard work will actually be rewarded.

Apparently, employees are happy about Elliott’s re-arrival, per the earnings call:

Our Board believes that Elliott is the right leader to drive NIKE’s next stage of growth. Having had the opportunity to work closely with Elliott for many years, he leads with a passion that inspires the best from the team. Our employees’ response to this announcement has been tremendous. You can feel the energy and the enthusiasm walking around campus. And we’ve heard nothing, but excitement from our teammates around the world, including our alumni network, as well as our partners.

Nevertheless, I wouldn’t put all of my hope into a company because of a CEO change. Plus, changes take time to play out.

Chinese Stimulus Won’t Hurt

Of course, the recent stimulus news from China should benefit Nike. For example, China’s central bank cut its main policy rate from 1.7% to 1.5% and injected $142 billion into its banking system, among other things. With Greater China making up about 14.4% of Nike’s Q1 sales, the stimulus can somewhat move the needle for Nike.

Competition Is Fierce

Many people believe that Nike is losing its appeal, and the sales numbers suggest this as well when compared to the sales of Nike’s peers. For instance, HOKA, which sells running shoes and is owned by Deckers Outdoor Corporation (DECK) grew its net sales by 29.7% for the 3 months ended June 30, 2024. Similarly, On Holding AG’s (ONON) sales grew by 29.4% year-over-year during the same period. The new kids on the block are taking market share, and whether Nike can fight back remains to be seen.

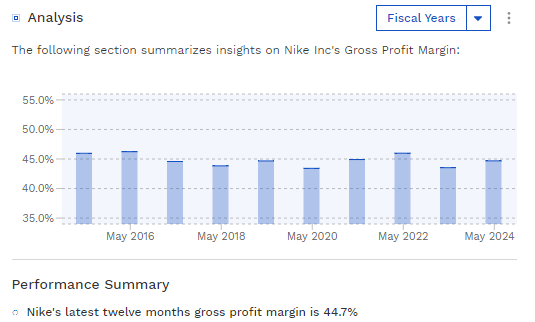

On the bright side, Nike’s gross profit margin has remained steady over the years, around 45%, which suggests that the competition hasn’t been able to impact its selling prices.

Nike’s Gross Profit Margin History (Finbox)

When Will The Downward Revisions Stop?

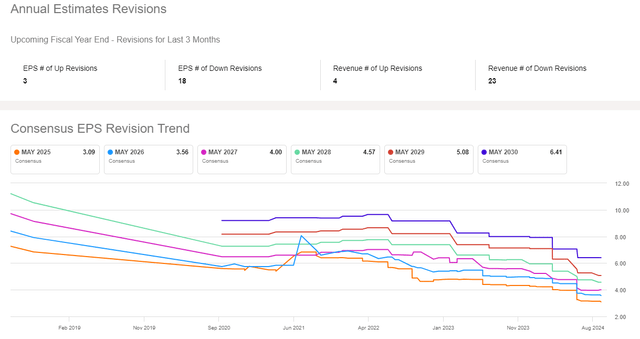

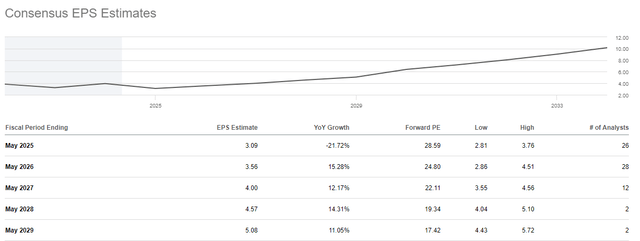

Due to several headwinds Nike has faced in recent years, it has also seen many downward revisions from analysts. At this time last year, EPS for Fiscal 2025 was forecast at $4.38, but now it’s at $3.09. It’s possible that another downward revision can come due to the soft revenue guidance provided for Q2. Perhaps these revisions can stop if the new CEO turns things around, but that’s a big “if” at the moment.

Nike EPS Revisions (Seeking Alpha)

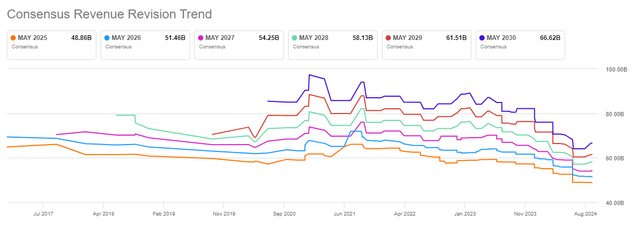

Nike Revenue Revisions (Seeking Alpha)

The Valuation Seems Fair

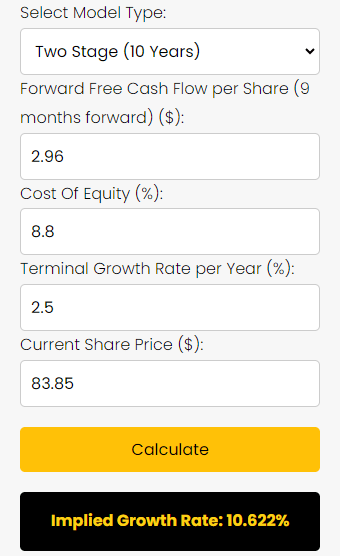

I’ll be valuing Nike using a reverse DCF calculator that I’ve created. Essentially, it calculates an implied growth rate that the market is expecting, and then you can decide if the stock can exceed that implied growth rate (which would make it undervalued) or not (which would make it overvalued).

I used a forward Fiscal 2025 FCF per share of $2.96 for this valuation, which I manually calculated using a share count of 1.5 billion and analysts’ Fiscal 2025 FCF estimate of $4.442 billion, per simplywall.st. However, I do recognize the chance that this FCF estimate can be revised lower.

Here are the valuation inputs:

- 9-months forward FCF per share: $2.96. The forward FCF is discounted back 9 months.

- Cost of equity (calculated using the CAPM model): 8.8%

- Terminal growth rate: 2.5%

- After-hours share price: $83.85

Here’s why I used 2.5% as the terminal growth rate (my terminal growth rates generally range between 2-3%). If we assume that the Fed’s 2% inflation rate goal is achieved over time, Nike’s pricing/brand power (which can be proven by its steady gross profit margin shown earlier) could allow it to potentially raise prices that slightly outpace inflation.

The Valuation Calculation

Looking at the screenshot below, we can see that the market is currently pricing in that Nike will see its FCF per share increase by 10.622% per year for the next 10 years after Fiscal 2025 and then grow 2.5% per year after that in perpetuity.

NKE Stock Reverse DCF Valuation (Author)

I think this is a fair growth rate to expect from Nike in the longer term, given that its 10-year levered FCF CAGR is 9.83% (which doesn’t include the positive effects of share buybacks). Plus, this is not too far off the EPS growth expected from analysts in the next few years.

Nike EPS Estimates (Seeking Alpha)

However, it is higher than the 6.37% increase in FCF analysts expect in 2026 and the 6.75% growth expected in 2027, which is a risk. Overall, I just don’t see a large margin of safety here.

The Takeaway

Nike reported a mixed quarter, with EPS that beat expectations but revenue and guidance that missed the mark. Nike has gotten several pieces of bad news out of the way, such as postponing its investor day and withholding its 2025 guidance, along with the weak Q2 guidance. This means that expectations have been lowered, making it easier for the company to positively surprise investors in the future.

Also, Nike will soon have a highly experienced CEO who knows the company very well and can possibly boost employee morale. Additionally, Nike saw growth in its running footwear business for the first time in a while, is trying to balance its business, and can benefit from Chinese stimulus measures. So, there are definitely some things going for the company.

However, at the current valuation, I just don’t see a wide enough margin of safety to make me want to invest in the stock. After all, Nike’s sales and earnings are on a downtrend at the moment (with downward revisions being the norm), and the competition is outgrowing the firm for now.

A turnaround won’t happen overnight. This could take over a year or perhaps longer to play out, and I’d rather wait a few more quarters to see where things go with the new CEO instead of taking a bet on the stock now. Consequently, I rate Nike as a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.