Summary:

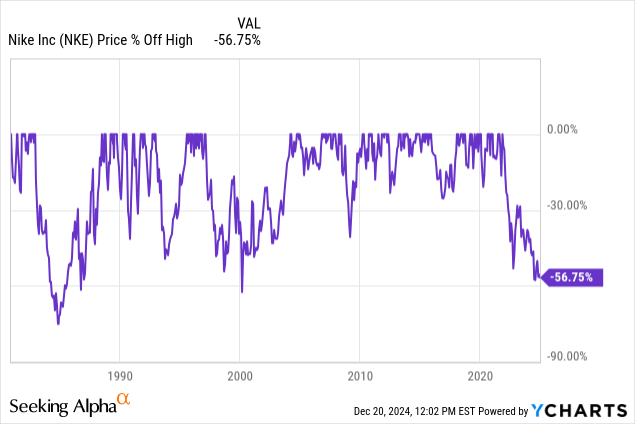

- NIKE stock is down 30% YTD and 56.75% off its all-time high, presenting a buying opportunity for patient investors believing in mean reversion.

- New CEO Elliott Hill emphasizes a pivot back to sports focus, reinvesting in brand storytelling, and rebuilding trust with wholesale partners.

- Despite recent underperformance, Nike’s solid balance sheet, 10-year high dividend yield, and low P/E ratio make it a strong buy for long-term investors.

- Risks include potential execution delays and higher-than-expected CAPEX, but the balance sheet strength and brand name support a positive outlook for NKE stock.

ozgurdonmaz

This is one for the patient

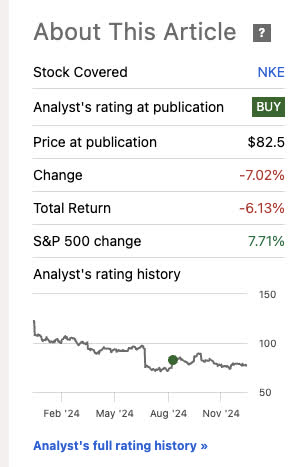

The last time I wrote about NIKE, Inc. (NYSE: NKE), the company had just gone through a massive drop and was about to transition to a new CEO, who later became Nike veteran Elliott Hill. The stock popped for a bit, Bill Ackman bought in [he just increased his stake, by the way], and all seemed hunky-dory.

Well, the “Street” ain’t happy yet, and luckily, I get a chance to buy in even cheaper than my original cost basis. This is for the patient and those that believe in mean reversion. I was patient with Disney (DIS), buying it in the $90s which, I believed, was the bottom. Nike’s bottom seems to be right around this $70/share point in my opinion. I believe Nike is another 2-3 year turnaround story worthy of a “strong buy.”

Last article

Seeking Alpha

Since my last article, this has performed worse than the S&P 500 (SP500), which has been on a tear. It’s nice to find some Dow 30 components that are not up this year and see which ones are worthy of purchasing as the year ends. Nike is near the top of my list.

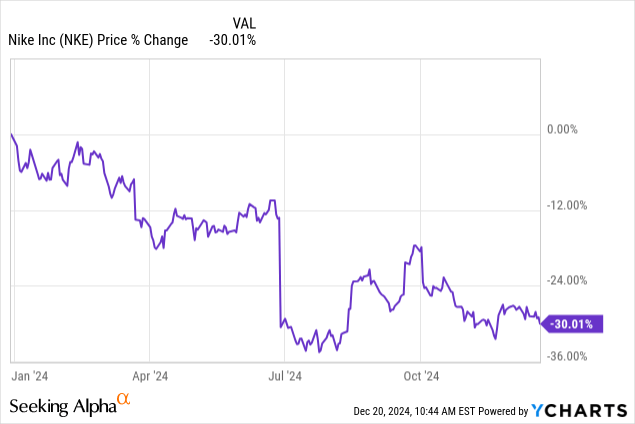

Nike stock year to date performance

Down -30% for the year, this stock has basically done the opposite of the broad US stock market. These are the charts I seek.

Off all-time high

-56.75% off the all-time high, we are now getting more than half off. Are investors really that right to be worried about On cloud and Hoka? In my last article, I noted my childhood experience where Fila, British Knights, Reebok pumps, and even Cross Colors gave the company a run for the money.

All were hybrid athletic sneakers trying to market as semi-luxury products, except for the Reebok pump of course [something Nike had been edging towards]. The further they got away from sports the more they seemed to fade. Nike is smart to pivot back to a sports focus.

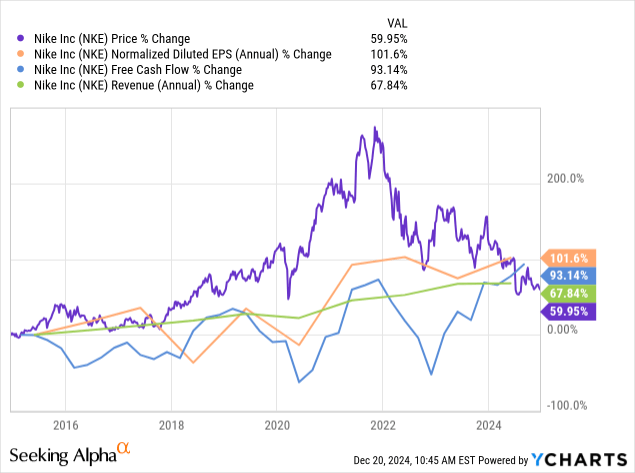

Reflexive patterns

This pattern has actually gotten even better than the last time I covered Nike. The price over the last 10 years is now a lower growth rate than all 10-year profitability metrics. This topic is covered in both The Alchemy of Finance and One Up On Wall St. This is the point where exuberance has now fallen below reality, we might call this the exuberance/reality ratio, EX/RE maybe? This alone for believers in mean reversion is a bullish buy signal.

Latest earnings call and presentation

Some highlights from the latest earnings call with comments from new CEO Elliott Hill:

-I’ll start with a high-level observation. We lost our obsession with sport. Moving forward, we will lead with sport and put the athlete at the center of every decision.

-I also see that we’ve shifted investments away from creating demand for our brand to capturing demand through performance marketing for our digital business. We will reinvest in our brands to create stories that inspire and emotionally connect with our consumers during important sports moments and critical product launches.

-We’re also going to continue to be aggressive in sports marketing. In just the last 60 days, we’ve announced the re-signing of the NBA and the WNBA, the Brazil Football Confederation, FC Barcelona and last week, the NFL.

-The final action we prioritize is building back and earning the trust of our key wholesale partners. Some partners and channels feel we’ve turned our back on them and we stopped engaging consistently. I’ve connected with many of them directly. Ed and Lauren at Dick’s, Regis and Mike at JD Sports, More Elliott, Foot Locker, Heinrich at the Deichmann Group, Michael at Sports Direct, Mr. Yu at Top Sports, Mr. Yu and Mr. Wang from Kaohsiung and Juan Carlos at Enova Sport.

Quick observations from the New Nike CEO Elliott Hill. Hill was a 32-year executive with Nike and has seen the company grow from its humble roots to where we are today. He emphasizes that he knows and loves this company and brand like no one else. Throughout the opening salvo, he’s very critical of Nike’s internalization [focusing heavily on Nike stores and not wholesale partners] and sole focus on digitization with marketing dollars.

He vows to make better, more sport focused products going forward which is what Nike was known for. They had recently gotten a bit off track trying to become more of a luxury brand than a sport brand making partnerships with musical artists and other non-sport celebrities. Elliott is focused on the pivot back to being squarely focused on sports.

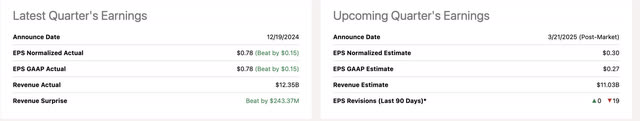

Nike did deliver a top and bottom beat, but the top-line is still lower year over year which was to be expected. The big problem here is what analysts took away from the earnings call and the re-organization of the company goals going forward. They believe it will hurt forward EPS estimates and many will start to be cut. While this may be true, this article will utilize existing data and estimates to draw up a valuation.

After all, we have over 70% of companies beating earnings estimates this year. Analyst estimates are basically “hope for the worst and expect the best” in many cases.

NKE stock valuation and future earnings expectations

In the case of slow growth established by Stalwarts, I like to use the Warren Buffett “Owner Earnings” discount model as a preference.

From Hagstrom’s books on Warren Buffett, net income is first adjusted to add back in depreciation and amortization, which is different from EBITDA, this still accounts for interest and taxes, two very real expenses to a business. Then you subtract capital expenditures. If capex is huge in comparison to D&A, the business will pencil out less valuable, if equal or close to it, then you have an efficiently run business.

The 10 year Treasury rate (US10Y), unless unreasonably low, is used as the discount rate. As of 12/20/2024, the current rate is 4.5%

2026 earnings expectations

- $.45 cent per share growth expected from 2025 to 2026.

- 19% growth rate.

- Final valuation multiplied times forward average analyst expected growth rate [X1.199].

All numbers in millions of USD TTM.

| NI | 4886 |

| D&A | 844 |

| CAPEX | 812 |

| OE | 4918 |

| MARKET CAP | 109288.9 |

| PER SHARE | 73.54 |

| TIMES 2026 GROWTH RATE [19%] | 88.18 |

Again, this valuation does not consider anything about downward revisions to earnings estimates, and I do believe most companies in the S&P 500 will tend to beat. Therefore, if the Street was expecting 19% growth 2025-2026 and might shave -30% off estimates according to some recent analyst comments, then a beat to that would probably still leave us around this $73/ share number fair value if everything goes poorly.

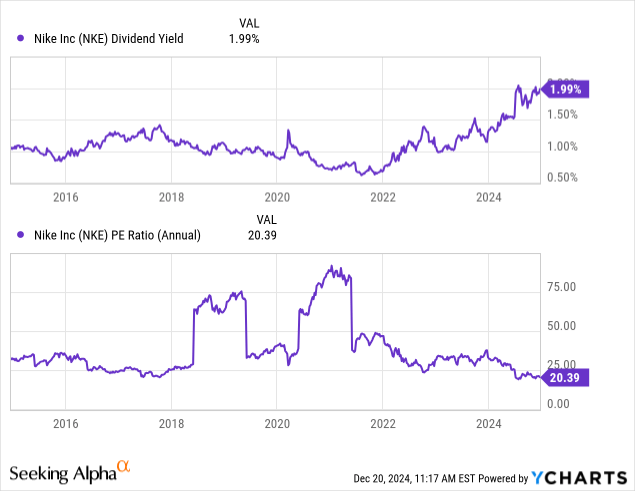

Being able to buy the bottom of a historical Stalwart like this and sit around while I collect a 10-year-high dividend and allow Nike to buy back shares is fine by me.

As you can see, my $88 estimate falls right at the current average of Wall St. Therefore, I believe this price target is pretty decent, and we have a FWD dividend yield now sitting at 2%. This could easily lead to a 15-16% total return next year in the face of what some investment banks think will be a flat year. This is if things go well, of course.

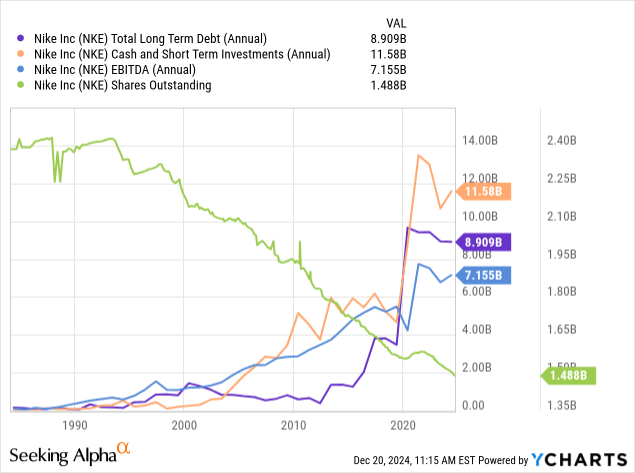

Balance sheet

The balance sheet for Nike is solid. It meets all the criteria I look for in a good balance sheet:

- Cash and short-term investments exceed long-term debt.

- Long-term debt is only 1.25 X EBITDA, a great leverage ratio.

- The share count is falling.

I have no bones to pick with Nike’s balance sheet. It does not blow your socks off strong, but it definitely hits all the right notes.

Historical dividend and P/E

Then we come to history and mean reversion theory. We can see first off that the 1.99% trailing and 2% forward dividend yield is a 10-year-high. The P/E ratio is also a 10-year low. Again, for the patient who believes in the Nike brand name, this is a great place to sit and collect a decent check while the turnaround happens.

Risks and summary

I believe the main risk in this is not competition, it’s execution. Similar to Disney, this thesis could take more time to turn around than expected. It could also take more CAPEX than expected, which could hurt owner earnings should CAPEX start to be greater than non-cash add backs.

I believe this is the deal in consumer discretionary right now. Analysts and the Street all dislike it, but the underlying fundamentals while not great on a growth basis, my opinion is that the balance sheet shows strength. I would argue that the balance sheet is much stronger from the point of where Bob Iger had to take back Disney to turn it around, so Elliott already has an advantage there. If you are conservative going into 2025, like myself, I think this is a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE, SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.