Summary:

- The improving macroeconomic environment is likely to have a positive impact on the demand for Nike’s products. The reopening of China could be also a major contributor to increasing demand.

- We believe that the firm’s valuation is still not justified. We would like to see inventory levels and the growth in accounts receivable normalising.

- FX headwinds are likely to be less significant in 2023 than they were in 2022.

- We reiterate our neutral rating.

hapabapa

NIKE, Inc., (NYSE:NKE) together with its subsidiaries, designs, develops, markets, and sells men’s, women’s, and kids athletic footwear, apparel, equipment, and accessories worldwide.

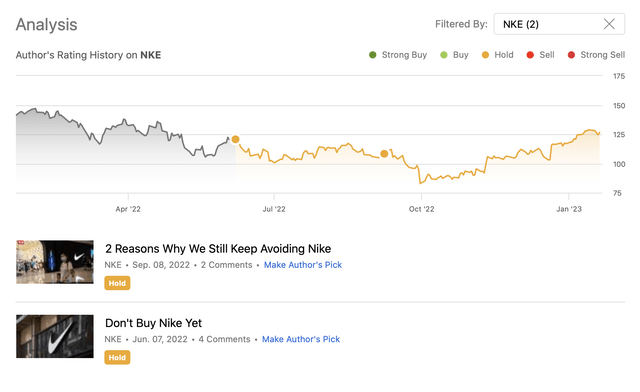

In 2022, we have published two articles on the company titled:

Analysis history (Seeking Alpha)

Both of these times we have assigned a neutral rating to the stock for the following reasons:

- Macroeconomic uncertainty, including consumer confidence, energy security, inflation and Covid lockdowns, continuously creating headwinds for Nike’s business.

- The strong USD is unfavourable for the company’s financial performance as more than half of NKE’s revenue is being generated outside of the United States.

- Price multiples are indicating a significant premium compared to the sector median.

In today’s article we are going to take a look at these factors again and see how their changes may impact our previously established rating and outlook for the stock.

Macroeconomic environment

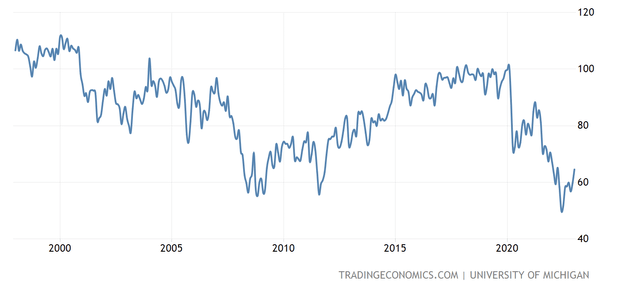

Consumer confidence

U.S. Consumer confidence (Tradingeconomics.com)

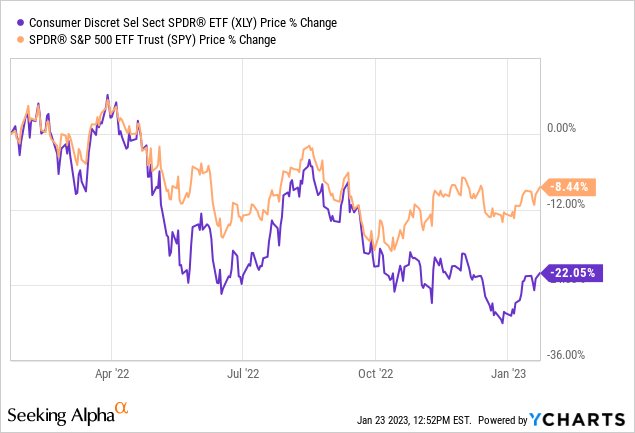

The consumer sentiment has been gradually improving since summer 2022. While the consumer confidence reading remains at historically low levels, its improvement definitely appears promising. It means that consumers are starting to have a more optimistic outlook on their financial future and on the economy as a whole. In our opinion, one of the main reasons why the consumer discretionary segment as a whole has underperformed the broader market in the past 12 months, has been the poor consumer sentiment throughout 2022.

While the rapid improvement of the sentiment may not continue, we believe that a gradual improvement throughout 2023 is more likely than not. This in turn could fuel consumer spending an increased demand for discretionary goods, including Nike’s products. For this reason, our outlook on Nike’s financial performance in 2023 is more bullish now.

Reopening of China

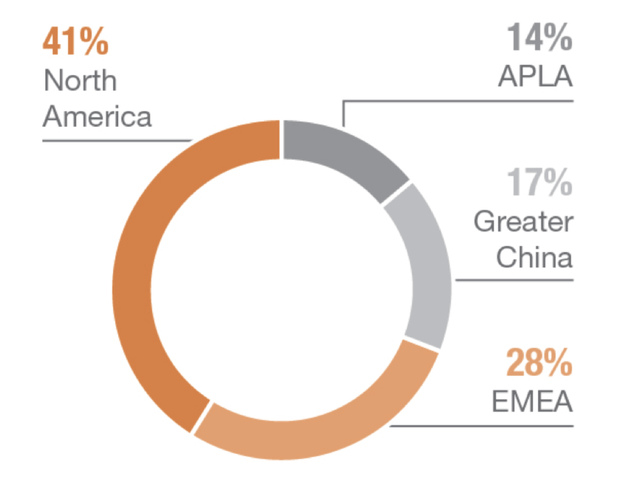

According to Nike’s 2022 annual report, as much as 17% of the company’s revenue has been generated in the Greater China area.

For this reason, the development in the demand can have significant impacts on the overall performance of the firm.

As in the recent weeks China has been gradually loosening and lifting its Covid-19 restrictions, the development of demand in the region is likely to be positive for Nike. While uncertainty still exists that the restrictions may be reintroduced in the near future, we believe that the likelihood of such an action is relatively low. Recently, Goldman Sachs has published a list of companies, which could benefit most from the reopening of China. Nike was on their list. Furthermore, Nike CEO has been also talking optimistically about the developments in the Chinese market:

We’re still the number one cool and favorite brand in Shanghai and in Beijing. We’re really focused on the Gen Z consumer in China, we saw a very good response from the Gen Z consumer who wants the most innovative products and wants brands that are globally relevant, […]

As a result, our view is once again turning more bullish on the company.

FX headwinds

As the above chart indicates, more than 50% of Nike’s revenue is coming from outside of the United States. For this reason, exchange rates have an impact on the company’s reported financial figures. In 2022, the relative strength of the USD compared to other currencies has been having a negative impact on the sales figures.

Dollar index (Tradingeconomics.com)

However, since Q3 2022, the strength of the dollar has been gradually declining compared to other currencies. In 2023, we do not expect the USD to return to its 2022 highs. Looking forward, we believe that this improvement is also going to have a positive impact on Nike’s financial performance and therefore our view is once again turning more bullish.

Does it mean that we are upgrading our rating to “buy”? To answer this question we have to take a look at the valuation once again as well.

Valuation

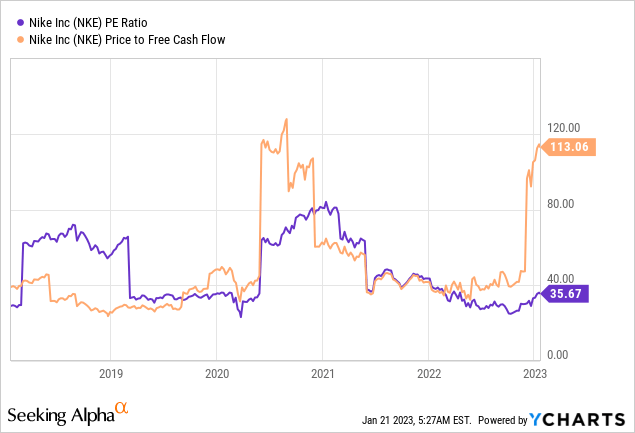

At this point, we believe that the stock’s high valuation based on the traditional price multiples is one of the biggest risks. While the P/E ratio is high, at least it is comparable to the historic levels. On the other hand, P/FCF has skyrocketed late 2022, rising well-above historic levels.

Why do we believe that these multiples are not justified?

- The reopening of China is definitely a good sign and we expect that it will have a positive impact on the firm’s sales. However, if for any reason, these expectations are not met, the price ratios are likely to start contracting, which could have a significant effect on the stock price.

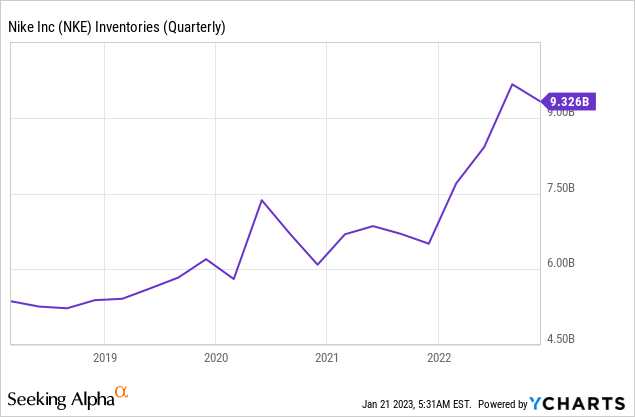

- Inventory levels have been increasing in 2022. While inventory has seen a slight reduction during the last reporting period, we would like to see inventory levels normalising to make sure that inventory management issues (e.g. products becoming obsolete) do not lead to the need for substantial discounting and therefore contracting margins.

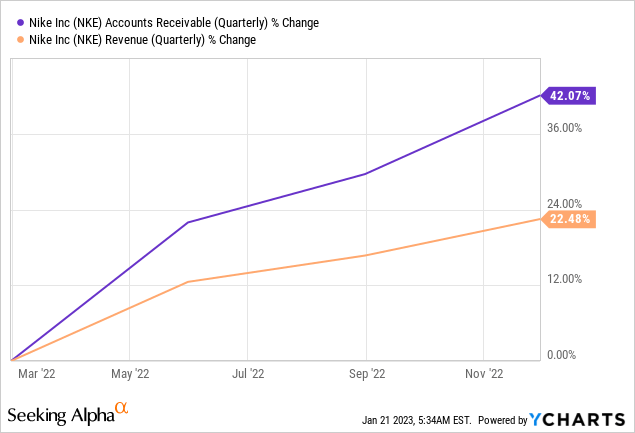

3. When accounts receivable are increasing at a faster rate than the revenue, it is often a warning sign that the firm is trying to “pull sales forward”. They may have loosened their credit policies in order to accelerate sales. When the demand is accelerated, it can often have a negative impact for the coming periods.

All the three issues presented here are material risk factors for Nike’s business.

With these three issues in mind, we do not believe that the current valuation is justified and for these reasons we cannot upgrade our rating. We reiterate our “hold” rating.

Conclusion

The macroeconomic environment has been gradually improving in the past months. Consumer confidence has been trending upwards, while the dollar index has been gradually declining from its peak reached in Q3 2022. The reopening of China is also likely to benefit Nike’s business in the near term as demand is likely to be positively impacted by the lifting of the Covid related restrictions.

On the other hand, we are reluctant to upgrade our rating on Nike’s stock to buy, as the valuation remains elevated, which we believe is not justified primarily due to the rapid increase in inventory levels, coupled with the high growth of accounts receivable (compared to revenue growth).

For these reasons, we maintain our “hold” rating.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.