Summary:

- Nike remains a symbol of victory, the most valuable brand in the world, and a successful American business.

- Nike possesses a strong moat around its business that will help navigate through challenges.

- Nike’s current valuation offers an investment opportunity to buy a wonderful business at a fair price.

code6d

Investment Thesis

NIKE (NYSE:NKE), the ancient Greek goddess of victory, remains as a symbol of victory to this day: one of the most valuable brands in the world, with shoes worn by Olympic medalists, and a hallmark of American business success. Given its established brand image and ongoing innovation, Nike represents a solid investment with potential for long-term growth. The recent dip in Nike’s stock has brought its valuation to a fair price for this wonderful company.

Introduction

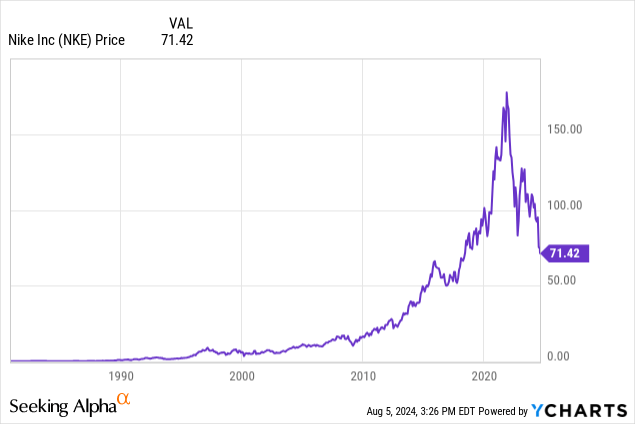

On June 28th, 2024, Nike had a bad day, wiping out nearly $28 billion in market capitalization. At the time of writing this article, Nike’s stock price stands at $71.42, which is nearly a 60% drop from its all-time high. The decline was mainly due to the headwinds Nike is facing and the company’s adjusted fiscal 2025 financial outlook. Matthew Friend, CFO of Nike, said in the most recent earnings call:

Taking all of this into consideration, we now expect fiscal 2025 reported revenue to be down mid-single digits, with the first half down high single digits. Foreign exchange headwinds have also worsened and will now have a one-point translational impact on revenue in fiscal 2025.

Nevertheless, I believe Nike possesses a strong moat that will enable the company to overcome its current challenges.

Headwinds

China

China is a very important market for Nike. It always has been and always will be. We’re committed to investing in China. – John Donahoe

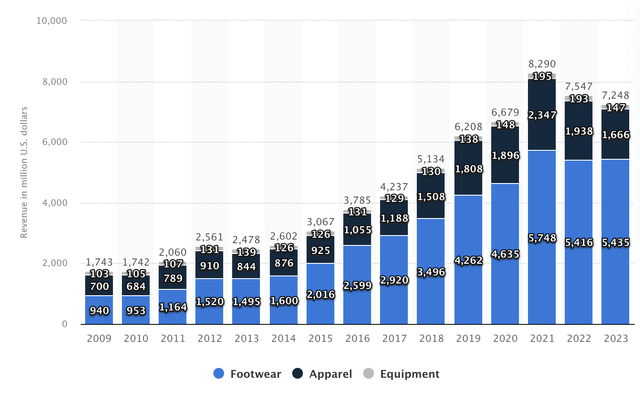

China, without a doubt, is a very important market for Nike. The revenue growth of Nike in China during the COVID recovery contributed significantly to the company’s gain in revenue and stock price in 2021. However, due to increased competition and declining consumer spending, Chinese market’s revenue has declined from approximately $8.3 billion to $7.2 billion.

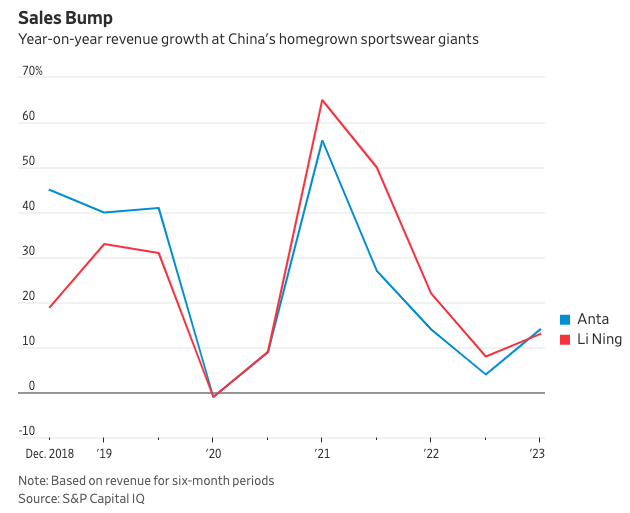

One of the contributing factors in China’s declining sale is increased competition. China’s competitors, Anta (HKSE:2020.HK) and Li Ning (HKSE:2331.HK) continued to grow their market share in China. Both companies saw surges in sales in 2021 after many Chinese citizens began boycotting Nike due to Nike’s decision to cut ties with suppliers from China’s Xinjiang region. Benefiting from this situation, Anta and Li Ning had a huge boost in their sales in 2021. However, this growth did not last long. By 2022, the growth had slowed to mid-single digits, and both companies’ stocks have declined, underperforming the market. It is worth nothing that even during the boycott, Nike continued to thrive in the wealthier coastal cities, while Anta and Li Ning remained more popular in the second and third-tier cities.

Anta and Li Ning Sales Growth (S&P Capital IQ)

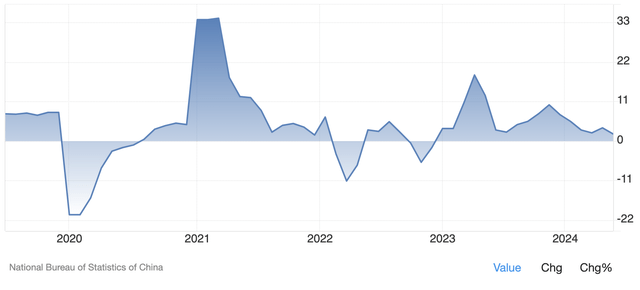

Another contributing factor to the decline in Chinese market is the low spending of Chinese consumers in retail sale. This appears to have a greater impact on the decline on Nike’s China sales and overall athletic apparel market. The following chart shows the data of China’s retail sale from the National Bureau of Statistics of China. Compared to nearly 33% YoY growth in 2021, recent China’s retail sale growth has been very sluggish. While I cannot predict when the consumer spending will rise, it’s seems like the overall market has been stagnant influencing the decline in Nike’s revenue.

China Retail Sales (National Bureau of Statistics of China)

DTC vs Retailers

Back in 2020, Nike planned to increase DTC sale up to 50% of the total revenue. After the plan was announced, Nike slashed a significant number of its retail partners to focus on DTC sale. This strategy was almost prophetic as the world was locked down due to COVID-19 in 2020, with offline shopping declining. However, as everything normalized, consumers began returning to the stores but Nike products were not. Realizing the company’s mistake, Nike has resumed its wholesale partnership with Foot Locker, DSW, and Macy’s in 2022. Additionally, Nike recently created a CIO role, filled by Cheryan Jacob, to focus on online sales. They also brought back Tom Peddie, a veteran of nearly 30 years, who may recover the relationship with the wholesale retailers. John Donahoe acknowledged these challenges in Q3 2024 Earnings Call mentioning,

And while Nike Direct will continue to play a critical role, we must lean in with our wholesale partners to elevate our brand and grow the total marketplace.

Nike is adapting back to the original consumer behavior and taking necessary steps to recover.

Competition

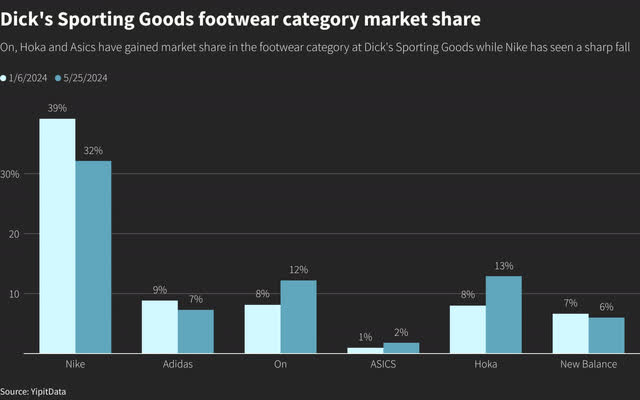

Currently, Nike faces challenges from both new and existing competition. HOKA (NYSE:DECK) and On (NYSE:ONON) have been mentioned as the up-and-coming brand and it is true that both products are increasingly prevalent. Additionally, Nike faces challenges with existing competition like Adidas, which has seen a recent boost in sales of its Samba model compared to Nike’s Air Force 1. As the saying goes, “fashion is a fickle business”, and consumer preferences change frequently. A key contributing factor to these challenges was Nike oversupplying its most popular models, which drove down the resale value and diminished the appeal for customers who value the scarcity of these products. As supplies of their trendy shoes increase, people often seek out new options.

Dick’s Sporting Goods Market Share (Reuters)

However, I do not see this as a long-term threat. Nike is indeed losing its market share, but it is still the market leader. As Nike reestablishes its relationships with wholesale retailers and continue to innovate in running shoe technology, it’s likely to increase its availability in key locations and develop a more competitive model. Furthermore, Nike has cultivated a strong running culture through its apps, such as Nike Run Club and Nike Training Club, as well as its collaborations with the Apple Watch series – advantage that its competitors lack.

Most importantly, Nike has established a style around its products. Today, Nike products are worn not only for their function but as a fashion style. We’ve observed shifts in consumer demands from New Balance running shoes to Asics to Reebok and then to Adidas and this is not the first time we’ve seen such a cycle. Just like Mr. Market, consumer’s interest tends to fluctuate, creating opportunities for investors to buy the dip. Ultimately, the cycle is likely to repeat, with the demand for Jordans and Air Forces to rise again. Nike established a style that lasts, evident in the continued desire for shoes made many years ago.

“Fashion comes and goes, but style lasts forever.” – Coco Chanel

Moat

Brand and Sponsorship

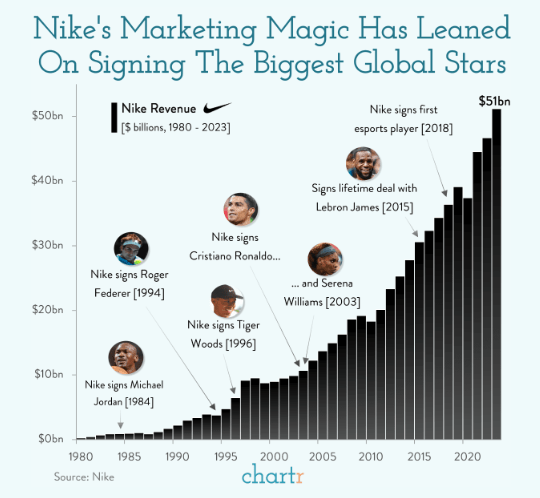

Following its name after the ancient Greek goddess of victory, Nike has established itself as a symbol of victory. Nike has successfully engraved its brand image in the world through its sponsorship of winning athletes. Of course, Michael Jordan’s story is one of Nike’s most successful victory.

Almost 40 years ago in 1985, Air Jordan 1 BRED (Chicago Bulls) was first released at a retail price of $65 (Interesting fact: $65 invested in Nike stock in 1985 would be $60,979 today. Michael Jordan autographed game-worn Jordan 1 was sold at $672,000, making it the ultimate winner). By the end of its first year on the market, the Air Jordan brand brought in total revenue of $126 million. Nearly four decades later, the Jordan brand boosts a revenue of $7.1 billion.

Nike continues to receive endorsements from top athletes like Tiger Woods, Cristiano Ronaldo, and Lebron James. What truly stands out is the company’s innovative and agile marketing strategies. For example, esports has gained tremendous popularity, especially in the Asian market. One of the most prominent game is called the League of Legends, which is owned by Tencent Holdings (OTCPK:TCEHY). In 2019, Nike made its debut in esports sponsorship in China. The influence of esports has grown significantly that it was recently included as a medal event in the Hangzhou Asian Games 2023. In 2020, Nike signed a sponsorship with SKT T1, one of South Korea’s Leading League of Legends team. Surprisingly enough, SKT T1 won the gold medal in Hangzhou Asian Games 2023.

Nike Athletes (Nike)

Nike represents more than just individual top athletes; it’s deeply embedded in the global sports landscape. The top three sports leagues in the world by revenue – NFL, MLB, NBA are all sponsored by Nike. Nike has hundreds of sponsorships all around the globe, ranging from professional teams to even corporate polo shirts.

One particular sponsorship that I found most interesting is with the German national soccer team. After a 70-year partnership with Adidas (a German company), the German national soccer team signed a contract with Nike. These contracts does expire and there is no guarantee that Nike will continue extending them. However, these sponsorships and endorsements provide strong evidence of Nike’s successful brand image and its likelihood of continuing to do so.

Nike’s brand image is unique and cannot be replicated. Success wears Nike and the world watches success. As new generations watch athletes winning with the iconic swoosh, the brand image only strengthens.

Innovation

Nike’s story begins with two men, Phil Knight and Bill Bowerman, who innovated running shoes for college athletes in University of Oregon. Innovation is one of the key factors driving Nike’s success. However, recent news and market sentiment suggest that Nike is that Nike is losing innovation. Here is a story of a company that supposedly does not innovate.

In 2017, Nike released the Vaporfly. Named the Nike Vaporfly 4%, the shoe’s name reflects the lab test results showing an improvement in runners’ performance by 4%. It was secretly launched through some runners in 2016 Olympics, leading to controversy and accusation of “Technological Doping”. Forbes described the shoes,

The shoes that work like a drug are of course the Nike Vaporfly running shoes, which have evolved through several generations and now face the prospect of being banned or regulated by World Athletics for helping runners to run too fast.

When athletes from competing brands begins to wear the shoes while hiding the swoosh, it clearly has an innovation and technology behind it.

“I loved that company, but in terms of performance on race day, the Nike runners were driving a race car and we were driving a Mack truck” – Tommy Rivers Puzey (Altra and Craft Sponsored Athlete)

Nike’s innovation did not stop with the Vaporfly. Building on its success, Nike developed the new Alphafly. In 2019, Eliud Kipchoge ran a marathon in under two hours, a feat no other human had achieved. Of course, he was wearing Nike’s AlphaFly. Following his unofficial world record, World Athletics banned the shoes and introduced regulations stating that no shoes can have a midsole thicker than 40mm and must be available by any athlete on the open retail market for at least four months. As of December 3rd, 2023, the Alphafly 3 has been approved by the World Athletics. Despite the controversy, in 2023, Kelvin Kiptum breaks the world record in Chicago, running the race in 2 hour and 35 seconds. And of course, he was wearing the Alphafly 3.

Nike started with the founder’s ambition to improve the runners’ performance. 60 years later, Nike still achieves miracles, including breaking multiple world records. Innovation has been a major strength for Nike, something other companies struggle to keep up with. If a company fulfills its founders’ goals after 60 years, I believe it will continue to do so.

Risks

Despite my view on Nike’s strong competitive position, these are several company-specific risks that could affect its financial results extending into fiscal 2025 and beyond:

- Endorsement Challenges: Nike may face difficulties in maintaining endorsements from top athletes and major sports leagues, which could hurt its brand image and wasted capital on investments

- Innovation Risks: Failure to continuously innovate the “technological doping” and lead in world record breaking technology could result in wasted capital on investments and make Nike less appealing to customers who may turn to competitors offering more innovative products.

- Market Competition: Failing to dominate the emerging markets and continue losing market share in China, particularly to domestic competitors such as Anta and Li Ning.

- Geopolitical Risks: Given China’s significance as a major market, ongoing tension between the U.S. and China, could unpredictably impact Nike’s operations and financial outcomes.

While this summary highlights what I consider the most influential risks, the most recent 10-K filing includes other risk factors that are also relevant.

Dividend and Buybacks

Dividends

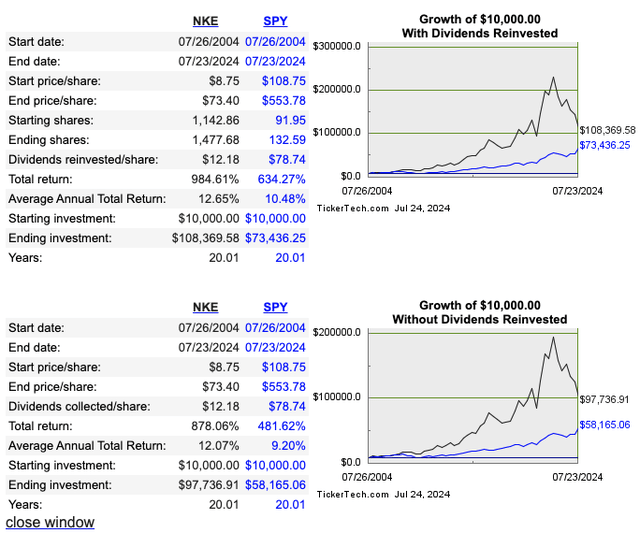

Nike’s dividend yield is currently at 2.07%. I do not consider dividends as a reason to purchase a stock as management can always cut dividend when needed. However, it is worth noting to see the effect of DRIP in the past 20 years compared to S&P 500 index. The CAGR differs only by 0.58% but the total return at the end of 20 year is 106.55%. If Nike continues to grow and pay out its dividend, DRIP would be very profitable for the next 20 years too.

DRIP 20 Years History (Dividend Channel)

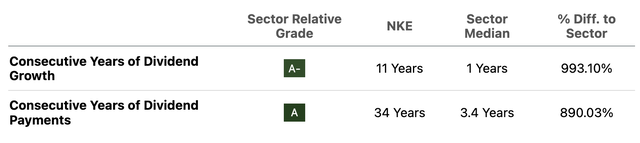

Nike stands out with its impressive dividend history. The company has been paying dividends for 34 consecutive years, growing its dividend for 11 consecutive years with the CAGR of 12.04% for the past 10 years. Compare to its peers in the consumer discretionary sector, this is an outstanding performance.

Nike Dividend History (Seeking Alpha)

With the new outlook for 2025, I wouldn’t be surprised if Nike lowered its dividend growth rate for the next year. However, I think is highly likely that Nike will continue paying out its dividend and continue growing it in the future. The following chart shows the dividend payout ratio of Nike for the past 10 years.

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| 27.47% | 27.18% | 26.72% | 64.30% | 33.06% | 57.19% | 28.60% | 30.38% | 39.68% |

Buybacks

In 2022, the Board of Directors approved a $18 billion stock repurchase program for the next 4 years. According to Nike’s most recent fiscal 2024 Full Year results, a total of 84.9 million shares have been repurchased under the current program for a total of approximately $9.1 billion. This leaves around $8.9 billion left in the current buyback program.

| Diluted Weighted Average Shares Outstanding | |||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | TTM |

| 1,768.8 | 1,742.5 | 1,692 | 1659.1 | 1618.4 | 1591.6 | 1609.4 | 1610.8 | 1569.8 | 1516.7 |

If Nike continues to aggressively buyback its own share at the current discounted price, it will be more beneficial for the shareholders. With the remaining $8.9 billion dollars, Nike can repurchase nearly 123.6 million shares, reducing the total share count by 8.15%. This is nearly 40 million more shares that Nike repurchased recently with the same amount of money spent in recent buyback.

| Current Diluted Share Outstanding | 1,516,700,000 |

| Remaining Buyback | $8,900,000,000 |

| Estimated Buyback Price | $72 |

| Estimated Repurchase Shares Count | 123,611,111 |

| Estimated Total Shares Outstanding | 1,393,088,889 |

| % Change | -8.15% |

Valuation

PE Ratio

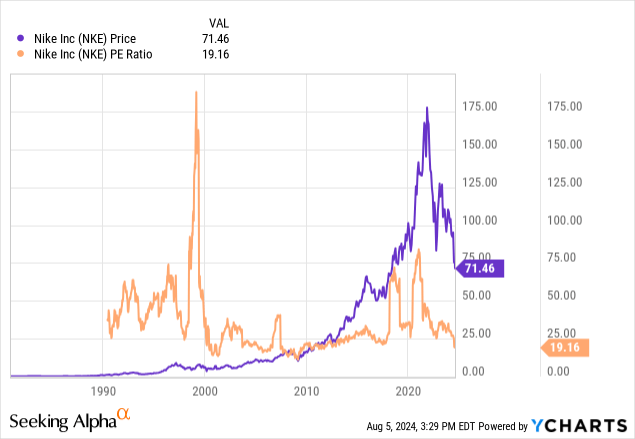

Nike’s current valuation is considerably cheaper than it has been recently. Although the PE ratio is only a historical metric doesn’t offer future insights, it does allow us observe how the market valued Nike in the past. A few years ago, Nike’s PE ratio exceeded as astonishing number of 75, but it now stands at 19.16. Looking back between the late 2000s to mid-2010s, Nike’s PE ratio typically ranged from the mid-teens to the 20s. While I do not think that the current valuation is a bargain, it appears to be closer to a reasonable price to invest.

DCF

The chart below presents Seeking Alpha’s data of 5-year average growth for various metrics. While historical growth doesn’t guarantee future performance, it helps me in estimating a conservative growth rate based on past trends.

| Revenue Growth | 6.45% |

| EBITDA Growth | 8.41% |

| EBIT Growth | 12.21% |

| Free Cash Flow Per Share Growth Rate | 16.84% |

Taking into account Nike’s strong brand moat, technological innovation, and its potential for continued expansion into emerging markets along with the recovery of the Chinese market, I consider a 10-year growth rate of 3% to 7% to offer a reasonable margin of safety. I anticipate that Nike will likely experience a faster growth rate in the future.

| Inputs | |

| Initial FCF | $4.5 Billion |

| Outstanding Shares | 1,516,700,000 |

| Discount Rate | 8% |

| Growth Rate | |

| Pessimistic | 3% |

| Normal | 5% |

| Optimistic | 7% |

| TV Growth Rate | 3% |

Based on these inputs, I calculated the intrinsic value of Nike using a weighted average for each scenario. This is strictly based on my own assumption and it provides a baseline that I feel comfortable using to initiate a position. I usually avoid purchasing when there is little margin of safety from its intrinsic value. However, I feel comfortable to initiate a position at this fair price for Nike.

| Probability | Stock Price | |

| Pessimistic | 0.3 | $64.09 |

| Normal | 0.4 | $74.58 |

| Optimistic | 0.3 | $86.86 |

| Intrinsic Value | $75.11 | |

| Current Price | $71.42 | |

Overall, I don’t expect Nike becoming a 2-3 bagger in the short term, but I view it as a solid long-term investment with the potential for satisfying returns through company growth and DRIP at the current price. There is a possibility for further decline in stock performance due to ongoing macroeconomic challenges and potential market disappointments in fiscal 2025. However, should the price decline further, I am prepared to increase my investment if the competitive advantage remains unchanged.

Conclusion

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price. – Warren Buffett

Nike dominates the athletic shoes, apparel, and equipment industry. It stands among the world’s most valuable brands, and I believe it will continue to remain as the symbol of victory. Olympic medalists, professional athletes, and champions will continue wearing Nike. Younger generations will continue to idolize the athletes and aspire to wear Nike. Emerging markets will grow in the next 20,30 years and their demand for Nike will only grow stronger. While the current price is not wonderful, I am willing to pay a fair price for a wonderful company and would consider increasing my investment if it were to decline further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content of this article represents the author's personal opinion and analysis of Nike, Inc. ("Nike") and is intended solely for informational and educational purposes. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The information provided herein does not constitute financial advice or a recommendation to buy or sell any securities. The author disclaims any liability for losses or damages arising from the use of this article or reliance on its content.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.