Summary:

- Market leaders in trouble are what we like seeing when trying to shop on Blue-chip-Wall-Street.

- My valuation approaches indicate that Nike now trades around fair value. The market appears to be pricing it efficiently this time.

- Not wanting to wait for steep discounts on market leaders, I am satisfied with a fair valuation to rate Nike Buy.

Thank you for your assistant

A Counter-Cyclical Value Idea

Nike (NYSE:NKE) was part of my recent coverage for a German investment community just over two months ago. In the course of the analysis, I calculated a reasonable P/E ratio for Nike of under 20 based on purely quantitative CAPM assumptions. Yet due to Nike’s 20-year average P/E of 29, I would have been willing to tolerate P/E ratios of up to 25, thus still significantly below their long-time average, to account for the traditionally observed brand premium. However, since Nike has now actually reached the P/E ratios of under 20 that I calculated, it seems that the brand premium has been priced out. This might be justified given the refreshing and strong competition, such as On, which I recently covered. Nonetheless, this leads me to increasingly view Nike as an absolutely fairly valued market leader. During this phase of uncertainty, disappointments, and short- to mid-term growth slowdowns, Nike finds itself out of favor with investors. This situation appears ideal for the long-term, counter-cyclical establishment of a value position.

Other recent sport-related coverages of mine, fitting the summer of 2024 with its mega sporting events, include the game data provider Sportradar and the former FIFA soccer games publisher Electronic Arts. I’d be happy if you looked at those as well.

No Reason To Write Off Nike

Nike’s share price is currently at levels seen six years ago in 2018. Notably, however, revenue and net income levels are very roughly around 40% higher than back then. Clearly, this does not necessarily indicate an undervaluation, as it might simply point to a reduced overvaluation. Nevertheless, in light of these factors, value appears to be the name of the game. This is more about the fair valuation of a market leader rather than a growth rocket, obviously.

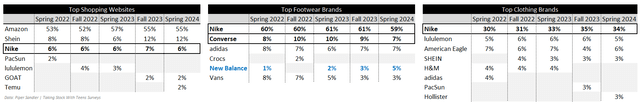

As long-term value investor, I am initially interested in the broader perspective of brand sentiment towards Nike. Given Nike’s longstanding presence, I consider the opinion of the younger generation particularly valuable in this context. After all, they will be crucial for the sustainable longevity of a brand. See the below data gathered from 5 of Piper Sandler’s semi-annual Taking Stock With Teens surveys. In the perception of the average 16-year-old US teenagers, Nike has consistently ranked 3rd among the most popular shopping websites for over 2 years. This indicates that Nike’s direct-to-consumer strategy might not have been all that wrong.

While there has been a slight decline in Nike’s approval as a top footwear brand recently, Nike remains still relatively stable at around 60% over the long term, holding the top spot, followed by Converse, also owned by Nike. It’s worth noting the emerging brand awareness of New Balance, albeit starting from a low level. What I find most intriguing, however, is that Nike is perceived as a top clothing brand by a third of respondents, with a rising trend. Therefore, writing off Nike seems clearly premature. Being challenged at this market position is common business and quite normal. It should have been clear that Nike couldn’t be a growth rocket at these levels by nature. As a market leader, Nike is interesting from other perspectives: value and future income.

Data: Piper Sandler | Gathered by Author

Valued To The Point

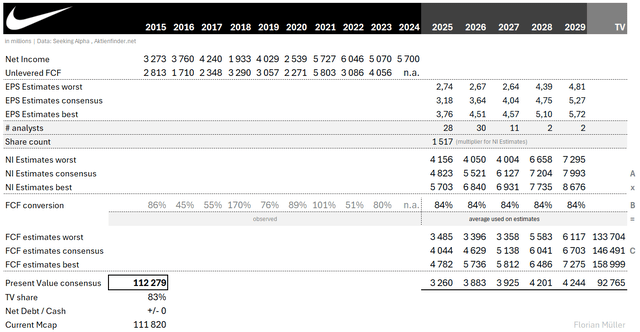

Let’s briefly dive into the first of these points: value. For this, I conducted a simplified DCF analysis based on analyst estimates. In the first step, I calculated the free cash flow conversion from net income over 10 years, averaging at 84%. Applying this FCF conversion to the net income estimates (EPS estimates x current share count x FCF conversion), I derived simplified FCF estimates. The data is primarily sourced from Seeking Alpha.

My WACC stands at just under 10%, mainly influenced by slightly elevated country risks in Asia, Africa, and Latin America. For the long-term growth rate, I assume around 5% post the current sluggish phase, based on a 50% retention rate applied to WACC, being more conservative than current return on assets as per Seeking Alpha.

Liquid assets and interest-bearing debt are balanced, resulting in the present value of future cash flows based on consensus estimates aligning closely with the current market capitalization, suggesting a fair valuation. For comparison: results for worst and best estimates vary by approximately +/-10% around this present value of consensus estimates.

Author | Data: Seeking Alpha, Aktienfinder.net

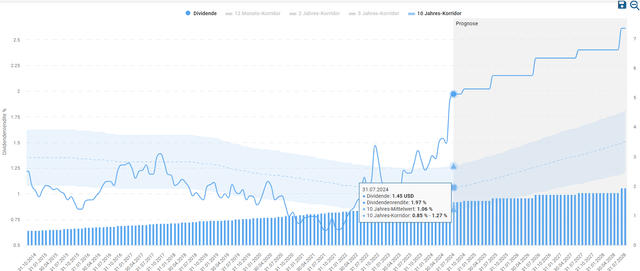

Nike Becomes A Steady-State Dividend Case

Nothing grows to the sky. Where growth has naturally approached its peaks, and companies fail to create additional value with excess earnings internally, they distribute more of them to shareholders. Nike’s payout ratio remains comfortably below 40%, although it can fluctuate due to the company’s cyclical nature. But recently, it has settled around this mark, up from an about 20% payout twenty years ago. Therefore, Nike’s attractive 10-year annual dividend growth rate of 12% wasn’t fully supported by equivalent earnings growth, but to a small extent also reflects a gradual shift towards increased shareholder participation over time by expanding the payout ratio. With current ratios below 40%, there appears to be ample room for continued dividend growth above earnings for quite some time, positioning Nike as a dividend growth investment despite recent operational challenges. While the dividend yield of 2% may seem low, it is actually the highest in 10 years, underscoring Nike’s transformed perception as a steady-state dividend investment. Moreover, the current payout ratios leave enough room for the easily manageable debt repayments if desired, growth investments, and not just dividends but also share buybacks. Since the turn of the millennium, outstanding shares have been reduced by a third.

Dividend yield over time and historical corridors (10y). (Aktienfinder.net)

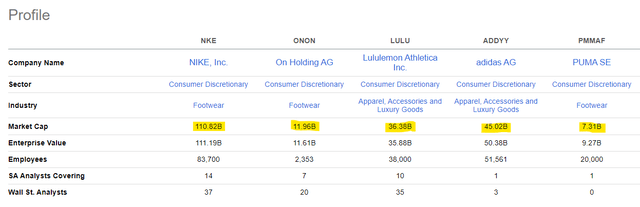

It’s Not About The Winner Takes It All

Keeping an eye on young, fresh, and potentially threatening competitors is certainly important. After all, in my recent analysis, On has been identified as a candidate that can truly challenge Nike, for example. Comparing aspiring companies like this from an investment perspective, however, makes little sense, especially since they satisfy completely different investor needs. Compared to German peers Adidas and Puma, the emerging Swiss brand On, as well as American peers Skechers and lululemon, Nike stands as the undisputed leader with a market capitalization of $111 billion, two to three times higher than the next largest, Adidas or lululemon. Moreover, after two decades of consistently increasing dividends, Nike is unquestionably the most relevant dividend payer in its peer group.

The starting point for all peers is thus very different. And all of them could have their justification. It’s not a winner-takes-it-all game. Nike simply should no longer be seen as a growth investment and appears to be currently priced accordingly.

Rounding It Off

Of course, I have not comprehensively covered Nike in its entirety in my article, and therefore it comes with potentially significant limitations. Hence, I would like to outline below some points I consider important for rounding it off in the form of bullet points:

- Nike appears to be re-shifting its focus towards wholesale and has brought a key executive back into the company to strengthen relationships with retailers. The “cut-the-middleman” strategy focusing on DTC, now accounting for 44% of Nike’s revenue, disappointed with a decline last quarter. Nevertheless, Nike remains one of the most popular shopping websites among youth as shown earlier, indicating that the strategy isn’t necessarily flawed. However, it is beneficial to refocus on the other pillar – wholesale – as both are necessary.

- While before the last quarterly report, growth for fiscal year 2025 was still expected despite weakness, Nike’s adjusted guidance of a mid-single-digit decline for fiscal year 2025 contributed to the widely noted stock market downturn.

- Long-term, Nike has announced that a new multi-year innovation and growth cycle will soon begin. This signals a renewed focus on a sharpened and targeted brand identity, strong customer relationships, and enhanced storytelling around the brand. Whether the plan succeeds remains uncertain, but Nike is certainly capable of achieving it.

- Nike has a healthy balance sheet with ample liquidity against manageable interest-bearing debt. Another advantage is its low goodwill, particularly since Nike is primarily a self-built brand.

I Don’t Wait For Discounts On Market Leaders

In conclusion, Nike finds itself at a compelling juncture where its market valuation closely mirrors its intrinsic value, reflecting efficient pricing by the market. Despite mid-term uncertainties and strategic evolutions ongoing, these daunting factors contribute to my willingness to buy the stock anti-cyclically. This confidence hinges on trusting in Nike’s resilience and adaptability in a competitive landscape beyond temporary setbacks. For example, Piper Sandler’s survey results support this. Nike’s evolution into a steady-state dividend investment might increasingly appeal to investors seeking income growth. Comparisons with younger yet aspiring competitors may fall short of harmonizing various investment strategies. While I haven’t invested yet, I may begin initiating a position very soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.