Summary:

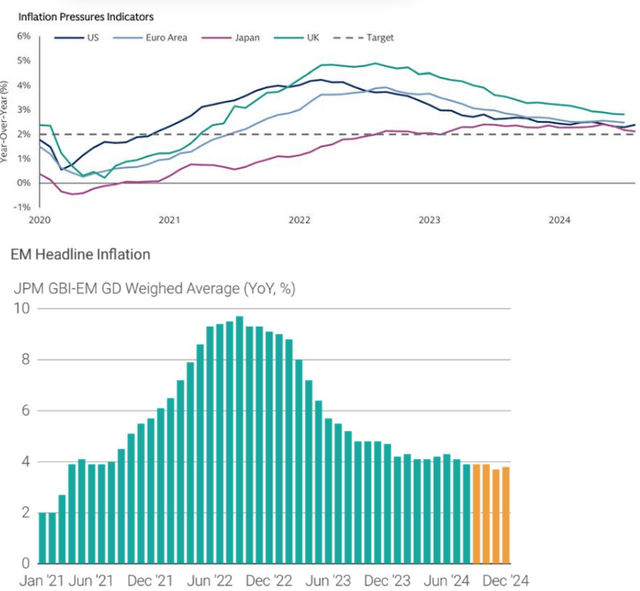

- Inflation is under control in developed economies and emerging countries, a combination that is difficult to achieve and that benefits the consumer sector.

- Nike has the best financial fundamentals among its competitors, and the most attractive valuation in the last 3 years.

- The combination of the above factors with the change of CEO, which will bring a new route for sales growth, could be a great opportunity for the investor.

hapabapa

Investment Thesis

I recommend buying Nike (NYSE:NKE) stock. The global macroeconomic environment seems very susceptible to consumer spending, given that inflation is well controlled in developed economies and emerging markets, a combination that is difficult to achieve.

In addition, Nike has the best fundamentals among its competitors. The company’s valuation is at its most attractive level in the last 3 years, and the change of CEO could bring a great potential return to investors.

Sectoral Scenario

Before we talk about the company’s profile, its business model, financial position and valuation, it is interesting to note that Nike is a global company that produces durable and discretionary consumer goods.

Therefore, the ideal scenario for the company is that there is controlled inflation. Controlled inflation contributes to a safe environment, which encourages consumers to spend on items such as sports shoes.

Inflation in developed and emerging markets (FactSet, Lazard, GS)

The fact is that we have a positive outlook in many markets. As we can see below, except for Japan, there is a strong trend towards disinflation in developed markets, and when we look at emerging markets, inflation is also well controlled. This corroborates an initial positive view of consumption.

History and Business Model

Nike was founded in 1964 by Phil Knight and Bill Bowerman. The company currently operates in 170 countries with more than 79,000 employees. Nike has 123 athletic footwear factories in 12 countries and more than 1,000 stores worldwide. Now, let’s talk more about the market.

Nike is a global leader in sports apparel and footwear. The company has a diverse audience, from athletes, elite and casual consumers, due to the prestige that the brand has built over time.

The company’s strategy is multichannel, with sales through e-commerce, physical stores and partnerships. Geographic diversification also mitigates the specific risks of each economy, bringing resilience to results.

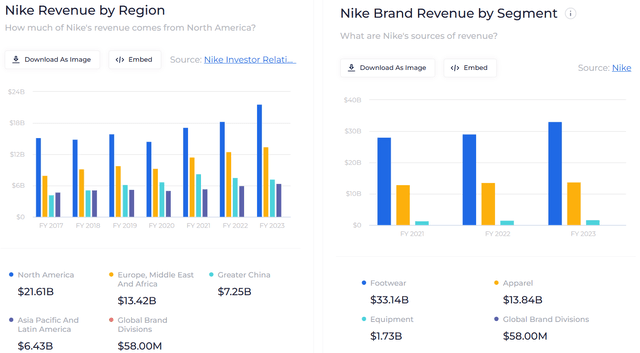

Revenue by Region and Segment (wallstreetzen)

All these competitive advantages corroborate a positive view of the company, but there is nothing better than comparing Nike’s numbers with its competitors around the world to draw more accurate conclusions. Let’s analyze.

Nike Fundamentals

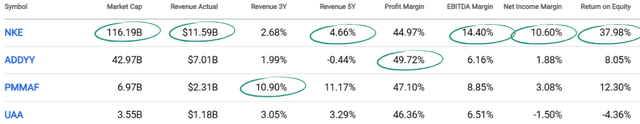

Next, we’ll look at the fundamentals of Nike and its competitors Adidas (OTCQX:ADDYY), Puma SE (OTCPK:PMMAF), and Under Armour (NYSE:UA)(NYSE:UAA). We’ll do this by looking at revenue, growth, margins, and ROE.

Although Nike is the largest company in terms of market cap and revenue, it also has the highest growth in the last 5 years, the highest EBITDA margin, the highest net margin, and the highest ROE.

It is worth noting that even in the indicators where Nike is not in first place, it is well positioned, such as revenue growth in the last 3 years and profit margin. This definitely supports my buy recommendation. But we need to go further and investigate the company’s valuation.

Valuation

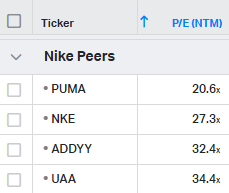

Following this reasoning, as the companies have stable results and are well diversified geographically, I will evaluate them based on a comparative analysis of the P/E multiple.

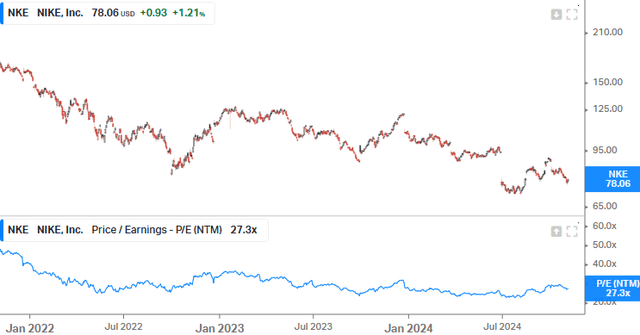

P/E (Koyfin)

It is interesting to note that although Nike has the best fundamentals, its valuation is discounted compared to its competitors. If we calculated the average multiple of its peers, we arrived at 28.7x, which implies a potential appreciation of 5% if Nike trades at the average of its peers.

Another method is to analyze Nike against its own historical P/E. Over the past three years, Nike has traded at 47.5x earnings at its highs and 22.3x earnings at its lows, for an average of 34.9x earnings, which implies an upside of 28%.

We can be conservative and average the upside using both methods, and we arrive at a 16.5% upside for Nike stock, which seems attractive to me given the company’s competitive advantages and fundamentals. This supports my buy recommendation, with a target price of $90.94.

Latest Earning Results

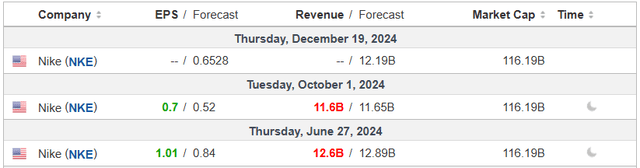

As we can see, Nike has had difficulty exceeding market expectations in its results. This has been especially true in terms of revenues, and has had direct implications for the company’s executive team.

Nike had been experiencing reduced sales growth (as we saw in Nike’s fundamental analysis) and questions about direct-to-consumer sales, which led to complex relationships with retailers.

In this sense, the company replaced CEO John Donahoe with Elliott Hill, who had started working at Nike in 1988 and was retired. Shares rose 7% on the day on confidence in the company’s change of direction.

Potential Threats To The Bullish Thesis

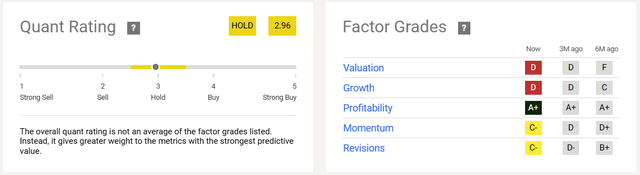

As risks to my bullish thesis, it is important to highlight that it is not a consensus. Seeking Alpha’s Quant tool indicates that investors should hold on to their shares due to a stretched valuation and other indicators.

Quant Rating and Factor Grades (Seeking Alpha)

Additionally, it is important to highlight that turnaround processes take time to take effect. Therefore, the next results to be released should not yet contain drastic management changes; we will probably only see this in 2025.

The thesis is complex due to the size of the company’s operations, geographic diversification, and competition. In my view, investors should exercise caution and conduct their own investment analysis.

The Bottom Line

The consumer market for durable and discretionary goods is expected to gain momentum at the end of 2024 and in 2025 due to controlled inflation, both in developed countries (except Japan) and emerging countries.

Nike has the largest market share and the best fundamentals compared to its biggest competitors. Furthermore, the change of direction with the new CEO could bring new perspectives to the company.

Based on this analysis, I recommend buying Nike shares. In my view, the new outlook combined with the lowest valuation in three years could bring great gains to the investor. The risk/return ratio seems very attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.