Summary:

- Nike’s position in the industry remains strong as the brand recognition remains high and DTC sales are nearing $30 billion a year.

- Nike’s profits have decreased due to heavy promotional activity and slower market growth.

- The company has made progress in reducing inventory surplus, but advertising activity remains high.

- The stock is considered overvalued and there are other non-valuation risks, limiting potential upside.

Gareth Cattermole/Getty Images Entertainment

Main thesis

Nike’s (NYSE:NKE) profits have shrunk this fiscal year due to heavy promotional activity needed to clear bloated inventory. At the same time, the company’s key markets’ growth has been rather slower than usual. And while Nike has made inventory surplus progress, advertising activity in the sporting goods segment remains elevated, which will continue to put pressure on the company’s profitability in fiscal 2024. The stock appears overvalued to me as it trades with 29x forward PE, which massively limits the potential upside.

The sneakers king

Nike’s wide range of products includes shoes, clothing, and accessories for various sports and active lifestyles. Products are developed with a focus on high quality, innovation, and design. Nike has long invested heavily in marketing to strengthen its brand and create demand. Annual demand creation spending, which includes promotions and sponsorship contracts and events, has exceeded $4 billion in FY2023 (8% of revenue). Nike’s revenue ($51.2 billion) is more than double that of its closest competitor, adidas (OTCQX:ADDYY) ($23.4 billion), and more than five times the third-largest player, Puma (OTCPK:PMMAF) ($9.1 billion).

The company also invests in research and development of new materials, technologies and design solutions to improve the performance and comfort of products, which allows it to attract and retain customers, to distinguish its products in a competitive market. Huge sponsorship of famous athletes and sporting events also contributes to brand awareness. This gives Nike’s trademark strength and credibility, especially with Gen Z. The company also, thanks to its size and brand recognition, can control huge specialized markets, like the basketball shoe market, where the Air Jordan brand reportedly holds 90% market share.

A screenshot from “Taking Stock with Teens” shows Gen Z’s top 10 apparel brands in the last four surveys. (Business Insider)

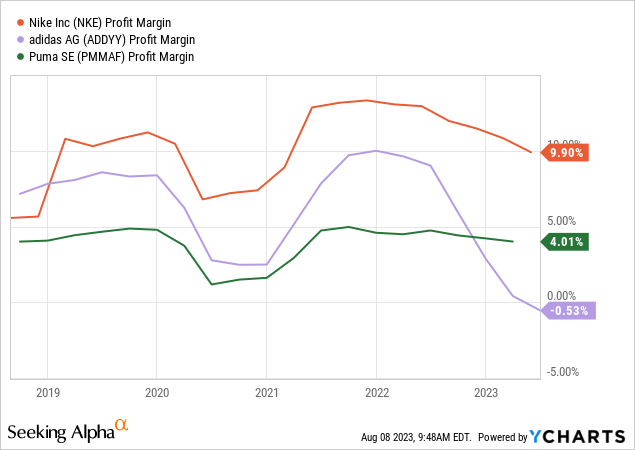

Key strengths, scale and branding entitle the company to higher prices for core products, resulting in higher profit margins compared to competitors.

DTC

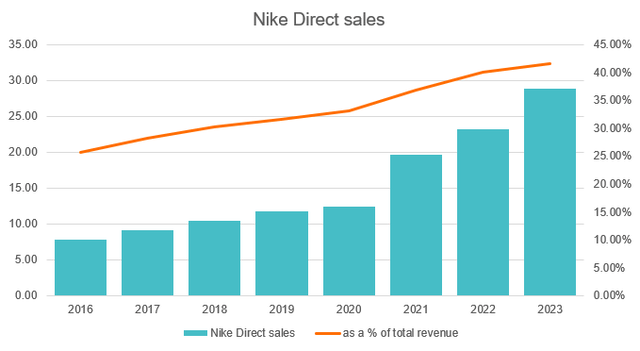

Historically, wholesale sales to distributors account for more than half of the company’s revenue, but the company is actively increasing the share of its own retail sales (target is 60% by 2025), which allows to unify and improve the shopping experience. By some estimates, Nike Direct’s margins are almost 30 percentage points higher than third-party distributors. DTC sales are up 2.3 times over the last 4 years, growing at a CAGR of 23.5%. As a % of total revenue, Nike’s channels account for 41.6%.

Since 2020, Nike has significantly reduced the number of distributors, focusing on large multi-brand partners like DICK’s Sporting Goods (DKS) and JD Sports as such retailers have the ability to invest in development and have far more brand power than, for example, Macy’s (M) and Urban Outfitters (URBN), which Nike preferred to cut ties with.

Financials

Nike’s fiscal year ends May 31, and the brand’s revenue is seasonal, with the largest revenue coming from the August and May quarters.

In fiscal 2023, Nike saw a revenue jump of 10% YoY (not adjusted for currency exchange rates). Sales in North America, the largest and most mature market, grew 5% YoY in 4Q23 (+18% YoY in FY23), indicating brand strength and continued customer interest. Revenue growth in China, one of the brand’s most important regions, returned to double digits in the last quarter (+16% YoY in 4Q23, although -4% YoY in FY23).

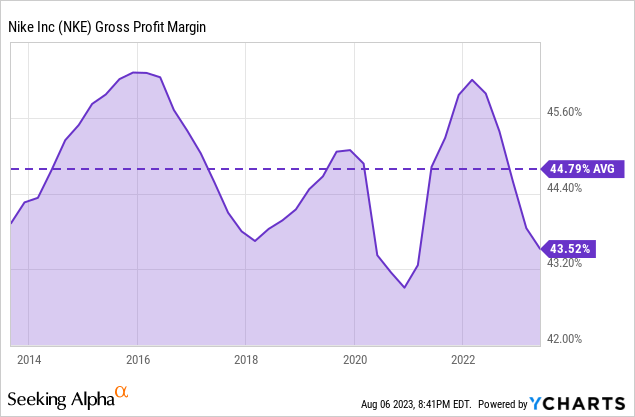

However, at the same time, Nike’s profitability began to suffer. Gross margin came down to 43.5% due to promotional activities to reduce inventory and higher COGS overall, as well as the negative impact of exchange rates. In addition, SG&A expenses increased (to 34.1% of revenue from 33% a year earlier) due to higher marketing and labor costs.

Thus, thanks to lower operating income and higher tax expenses, annual EPS fell 15% YoY (quarterly EPS -28% YoY) to $3.27 billion.

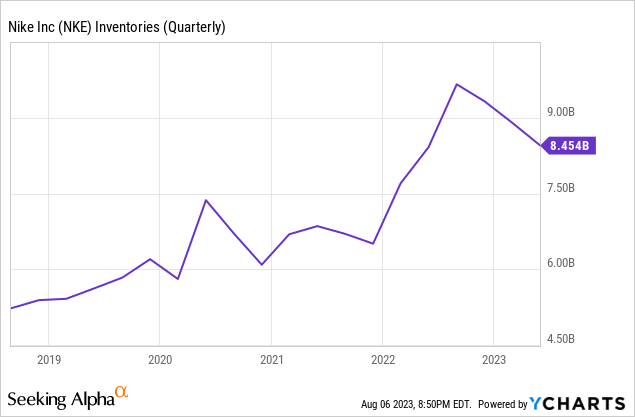

Inventories were unchanged from the same period a year earlier but were down 13% from their peak in Q1 2023.

In FY2024, management expects sales to grow by mid-single digits and gross margin to increase by 140-160 basis points and operating margin by 200 points due to better freight rates, a slight decrease in advertising activity, and continued acceleration in Direct. SG&As are expected to outpace revenue growth due to increased marketing spending.

Valuation & other risks

To estimate the fair value of Nike shares, I compared the forward multiples (P/E and EV/EBITDA) of the company with peers.

| Peers | Forward P/E | Forward EV/EBITDA |

|---|---|---|

| Nike |

29.2 |

21.8 |

| adidas |

NM |

31.3 |

| Puma |

21 |

12 |

| ASICS |

27 |

15 |

| Deckers Outdoor |

24.5 |

17.4 |

| Skechers |

15.8 |

11.4 |

| Lululemon |

31.7 |

19.3 |

| Under Armour |

15 |

9 |

| Median |

24.5 |

16.2 |

| Nike Vs Median |

+17% |

+25% |

And although Nike should deserve a higher valuation than competitors, having “the Apple (AAPL) of sneakers”-like positioning, it still looks rather overvalued at these levels as 29x forward earnings appear excessive, in my opinion.

On the other hand, Nike faces non-valuation risks. High inventory and promotions in the sportswear market are reported by big players, adidas and Puma. Both companies forecast that this trend will continue in the coming quarters, which will continue to put pressure on the company’s profits, especially in the first half of FY2024.

It is also worth mentioning that the actions of athletes or other ambassadors of the brand can damage the company’s reputation and image, which can lead to a decrease in sales, although Nike has been adept at avoiding negative headlines for many years. A prime example in the industry is the recent rift between adidas and Kanye West.

And finally, a deep recession economic scenario will negatively affect both wholesale and direct sales. Sneakers and sportswear are cyclical goods, the demand for which is sensitive to the financial condition of customers.

Conclusion

Nike’s position in the industry is still stronger than ever, with brand awareness close to all-time highs and DTC sales approaching $30 billion a year. However, as costs jumped, the profitability fell in the last year. In the next FY, the situation is expected to slightly improve, but excessive valuations and other risks do not make NKE a stock with little, if any, upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.