Summary:

- Nike is the most valuable apparel brand, with a brand value of over $30 billion and a market share of 38.23%.

- Nike faced inventory challenges during the pandemic, leading to delayed shipments and excess inventory, impacting margins in the short term.

- These problems are expected to be short-lived, and a turnaround should happen soon to the benefit of shareholders.

Justin Sullivan

Investment Thesis

Nike (NYSE:NKE) has experienced a significant decline in share price in recent years. In my opinion, most of the reasons that contributed to this decline are short-lived, presenting a great opportunity for long-term investors.

The reported poor financial results from other peer companies appear to be wrongly priced into Nike’s share price. In my opinion, the underperformance of Foot Locker (FL) and DICK’S Sporting Goods (DKS) is not related to Nike in any material way.

Nike does have its own supply chain problems largely due to the disruptions brought about by the Chinese lockdown 2 years ago. Since then, the company has been taking steps to rectify its problems with excess inventory. Looking at the financial numbers, these efforts have paid off and a turnaround might be happening soon.

In spite of its supply chain issues over the last 2 years, Nike still maintains a commanding lead in market share which its closest competitors are unlikely to overtake in the near future.

Company Profile

According to a report by Statista, Nike is the world’s largest supplier and manufacturer of athletic shoes and apparel, and is regarded as the most valuable apparel brand:

Nike is the most valuable apparel brand, boasting a brand value of over 30 billion U.S. dollars. In other words, Nike is not just the world’s leading sports clothing brand, it is also the single most valuable apparel brand on the planet overall

As per another report by Investing.com, Nike has a total market share of 38.23%.

In contrast, Adidas is the second-largest player in the global sports apparel market, according to MarketSplash:

- “Adidas takes the top spot as the largest sportswear manufacturer in Europe, while globally, it holds the second position, following behind Nike in the lead”

- “Nike made almost twice as much revenue as Adidas”.

Therefore, we can estimate Adidas’s global market share to be approximately 19%.

According to Shoe Effect, PUMA is the third-largest player in the global sports apparel market, with a market share of 5-8%.

According to Investopedia, Nike’s main business segment is footwear, which accounts for approximately 66% of its revenue. The remaining revenue comes from apparel (30%) and equipment (4%).

Lululemon, on the other hand, specializes in yoga-inspired athletic wear and has a smaller presence in the footwear market. Therefore, it can only be considered an indirect competitor to Nike.

Overall, we can understand that Nike has an overwhelming lead in the global sports apparel market. The other closest competitors are nowhere close to usurping its dominance.

Irrational Market Perception

According to recent reports, Footlocker’s earnings have been below expectations, with the management attributing it to the slowing demand for athletic and retail products. Similarly, Dick’s Sporting Goods also announced results that were below expectations. Footlocker and Dick’s woes create an impression that the athletic and retail industry is weakening, causing Nike’s stock to fall in sympathy for this perception.

For the last 6 months, we can observe that all 3 companies, Nike, Footlocker, and Dick’s Sporting Goods exhibit price actions that are almost in tandem with each other:

Investors must consider whether these perceived industry woes are expected to fundamentally affect Nike’s business.

Nike’s Supply Chain Problems

Over the last 2 years, Nike’s business operations have not been a bed of roses.

Nike faced inventory challenges during the COVID-19 pandemic in 2021. The company did not have enough inventory to meet excess demand in China, which led to lost sales and frustrated customers. According to a report by Forbes:

While vaccination rollouts and stimulus packages are still underway, consumer behavior has shifted, causing an upsurge in imports, driving up logistics costs, and disrupting lead times. As a result, Nike’s inventory flow has been delayed more than three weeks, impacting wholesale shipments.

After China’s factory opened, the reverse happened, with too much supply leading to excess inventory. This put pressure on Nike’s margins. According to a report by Axios:

The inventory stockpiles are one reason Nike’s shares have cratered this year, even as the overall stock market recovered.

In the last 2 years, Nike has been clearing its inventory by using promotions to induce demand and reduce the price of goods. This has increased marketing expenses and reduced bottom-line margins. However, this reduced margin is expected to be short-lived.

As Nike’s inventory levels decline, it will be able to cut back on sales and marketing expenses. With its unrivaled brand equity in the sports and apparel market, this should result in the company achieving its normalized margins comparable to pre-pandemic levels.

Impact On The Financial Numbers

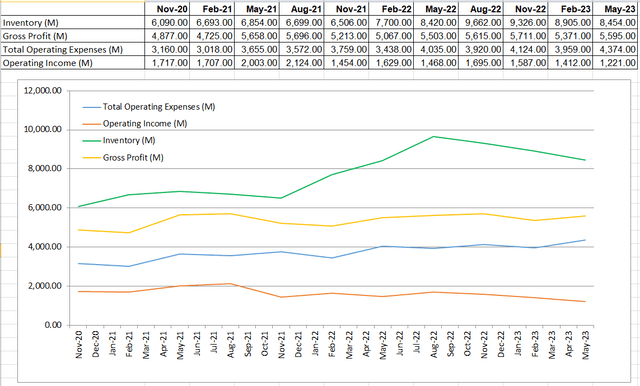

Using selected figures from the income statement and balance sheet, we can observe the effects of Nike’s marketing efforts:

Financial Numbers (Seeking Alpha)

- The company’s inventory levels reached a peak around August 2022 and have been on a steady decline.

- At the same time, when compared to historical levels, operating expenses have increased significantly to around $4B and above.

- With a gross profit that is largely flat, the overall effect is a visually consistent decline in operating income, to the ire of investors’ expectations.

In spite of the unfavorable bottom line in recent quarters, it can be observed that Nike’s elevated promotional expenses have been successful in clearing their excess inventories.

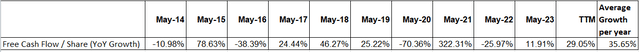

In the short term, the numbers may not look good, but long-term investors should consider whether this current woes are short-term. After all, from a long-term annual perspective, Nike has a proven track record of growing its Free Cash Flow (“FCF”) per share on an average of ~35% per year, to the benefit of long-term investors.

Projected Growth

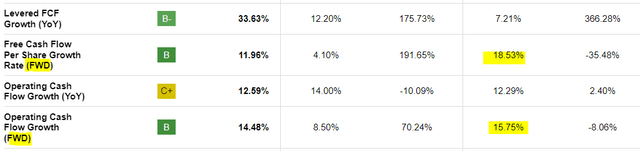

We infer from Seeking Alpha’s growth estimates to guide us on how Nike is expected to grow its free cash flow in the long run:

Projected Growth (Seeking Alpha)

Looking at the cash-related, forward-looking (“FWD”) growth figures, the “5Y Avg” ranges between 15-19%.

Nike is a fairly mature company. Although I still expect the company to grow significantly, a 19% growth might be overly optimistic. While Nike’s strong brand and competitive advantages give it pricing power over its peers, as a large matured company, it does not benefit from the small firm effect.

Nike has significant exposure to the Chinese market. According to FocusGuru, its operating revenue in greater China amounts to 14.2% The Chinese market has recently proven to be highly volatile and is expected to remain so in the near future.

Hence, considering all these factors together:

- Nike is a large mature company with a brand that is by far the most successful among its peers.

- In my opinion, being large and successful, Nike’s growth is likely to be assured in the long run but is not expected to compound as much as smaller firms.

- The macroeconomic outlook in the Chinese market, which Nike has significant exposure to, is expected to be less favorable.

Due to these considerations, I expected Nike’s growth to lean toward the lower end of the range of 15-19%.

According to this article from Seeking Alpha:

Over the past decade, through to March 31, 2022, the annualized performance of the S&P 500 was 14.5%.

We will use an arbitrary growth of just 15% in our valuation model. This growth rate is representative of the “lower end of the range of 15-19%”, and also on par with the average growth of the overall market.

Valuation (Base case)

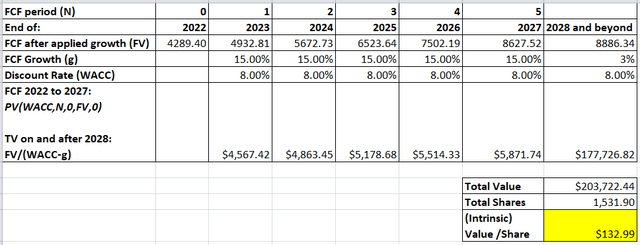

We will make the following assumptions/inputs into the calculation of Nike’s intrinsic value using the DCF model:

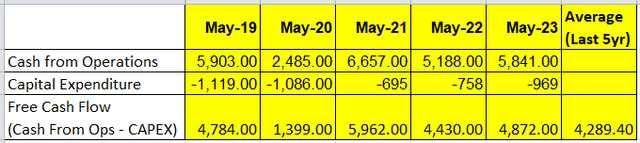

- Using Seeking Alpha’s Cash Flow statement, we calculated the average FCF of Nike over the last 5 years. We will use this average figure to represent the starting FCF from 2022.

Free Cash Flow (Seeking Alpha)

- We will assume the arbitrary growth of 15% in FCF will be maintained from 2023 to 2027 before the growth matures and tapers off to 3% from 2028 and beyond.

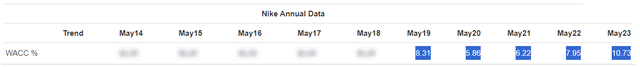

- From FocusGuru, the company’s WACC ranges from 5.86 to 10.73% over the last 5 years. We will use an estimated, rounded average of 8% in our calculation.

- We assumed the company’s “shares outstanding” would stay the same at 1531.9M indefinitely.

DCF model (Author’s Calculation)

Using the above-assumed figures, the intrinsic value is about $133.

Assuming a current market price of 102, the stock is:

(133 – 102) / 102 = 30% undervalued.

Valuation (Worst case)

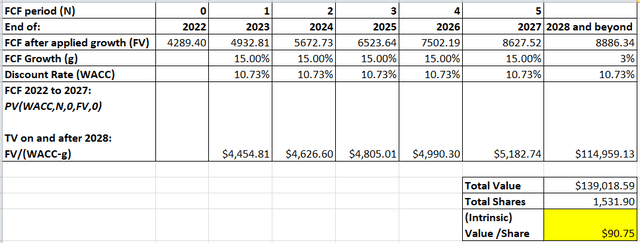

In our base case valuation, we have used a WACC of 8% which is roughly the average of the 5.86 to 10.73% range.

The WACC figure has been generally on an upward trend, especially over the last 3 years. The current figure is the highest at 10.73%. In my opinion, the worst-case scenario for Nike’s valuation is when the WACC value stays at this highest level. This is possible if the interest rate remains high in the near future.

Hence we will use a discount rate of 10.73% to calculate the intrinsic value for such a scenario:

Worst case DCF model (Author’s Calculation)

Assuming all other factors in our DCF model stay the same, the intrinsic value for this ‘worst case’ scenario is $90.75, implying that it is about 11% overvalued.

Overall, I consider the range between the worst and base case scenarios of $90.75 to $132.99 to be fairly valued.

At the current price, there is:

- More upside (30% undervalued based on the base-case scenario)

- Less downside (11% overvalued based on the worst-case scenario)

Investment Risks

We discussed earlier that Nike has an “unrivaled brand equity in the sports and apparel market” due to its “overwhelming lead in the global sports apparel market”.

Therefore, in the long run, Nike is unlikely to be fundamentally affected due to the recent short-lived problems as discussed earlier.

Still, the market is irrational and hence, it might take some time for the stock price to appreciate and price in the true value of the company. Investors should consider the opportunity costs that they might incur in the short term if Nike’s stock price takes longer than expected to recover.

Conclusion

In conclusion, I believe that Nike’s recent decline in share price is a buying opportunity for long-term investors. The stock is currently selling at fair value, with more upside than downside. The company’s underlying fundamentals remain strong, and the short-term headwinds that have weighed on the stock are likely to abate in the near future.

According to Grand View Research, the global athletic footwear market size is “expected to grow at a compound annual growth rate (“CAGR”) of 4.9% from 2022 to 2030″. As the undisputed leader of this market, Nike is expected to benefit more than its competitors in the long run.

As one of the most recognized and respected brands in the world, this brand reputation gives Nike a competitive advantage and allows the company to assert pricing power over its products. This is the main reason why I think the company’s expenses to induce demand and reduce price is expected to be short-lived.

Once the issue of excess inventory is resolved, Nike should be able to increase its prices to boost its bottom line, to the benefit of shareholders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.