Summary:

- Nike’s dividend has almost tripled in the past 10 years and is projected to continue growing, potentially reaching $3.38 per share in 10 years.

- Nike’s dividend coverage is strong, with a low debt-to-equity ratio and sufficient free cash flow to maintain and increase dividends.

- Upcoming events like the Women’s Soccer World Cup should spur sales.

- The stock looks fairly valued here, and I suggest buying in step-ladder fashion.

Drew Angerer

As I’ve written in the past, one of my favorite things about writing on Seeking Alpha is how easy it is to look up your past recommendations and evaluate how they did against the market. I last evaluated Nike, Inc. (NYSE:NKE) 10 years ago, highlighting NKE’s potential as a dividend growth stock. As part of that article, I had predicted what NKE’s dividend would look like in 2023. We will evaluate the results and future dividend prospects in detail below but let’s just say Nike outdid my predictions handily.

Since my 2013 review, Nike has handily outperformed the market by 205% (including dividends) to 148%. Clearly, while dividend growth has helped, capital gains have contributed a bulk to this outperformance. That is all in the rearview mirror though. How strong does Nike’s dividend look now and where will it be in 2033? Can the company afford another dividend increase in December 2023? What about the stock’s outlook in general? Let’s find out and before that, a little history about the company that just does it.

Company History

Since I haven’t written about Nike in almost a decade, let me start off with some (well-known) basics about the company. Nike was founded in 1959 and is the world’s largest supplier of athletic shoes and apparel. Nike reported a revenue of $46 billion in 2022 and has presence in 46 countries. In my 2013 article, I had noted that Nike was the 24th most powerful brand in the World. To get a sense of how quickly things change in the business world in 101 years, consider the following:

- Robinhood (HOOD) was 6 months old as a company.

- NVIDIA Corporation (NVDA) stock was trading at < $4.

- Apple Inc.’s (AAPL) market cap was at “just” $500 billion.

- Forget about AI, even the terms “AWS” and “Azure” would have elicited a “what?” from 99% of the World.

But Nike has remained one of the top brands through all these technological changes, with a brand value of $31.3 billion in 2023. While its rank has fallen a little in the overall brand value list, Nike remains the World’s most valuable apparel brand. In short, in many parts of the World, the word “Nike” is still synonymous with a running shoe.

2023 Review

Nike is currently operating in its Fiscal Q1 2024 as the company reported its FY 2023 Q4 and full-year earnings about a month ago. The full-year report had many highlights, including:

- Revenue being up 10% to $51.2 billion.

- Inventories remained flat at $8.5 billion, suggesting continuing operational excellence.

- A cash balance of $10.7 billion more than offsets long-term debt of $8.9 billion.

- Returning $7.5 billion to shareholders, with $5.5 billion on buybacks and $2.0 billion on dividend, which sets us up nicely for the section below.

However, not everything was bright in the 2023 financials. For example:

- EPS for FY 2023 was down nearly 14% YoY at $3.23.

- Cost of sales increased 15% YoY to nearly $29 billion. In particular, demand creation expense increased 12% in FY 2023 to about $12.4 billion, suggesting that even a brand as strong as Nike cannot rely primarily on its brand recognition to fuel sales.

Overall, 2023 showed that Nike still has it to generate substantial sales but is also vulnerable to inflation and margin pressures.

Dividend History

With that rich company history and 2023 review out of the way, let us now look at the company’s dividend history.

- According to Seeking Alpha’s data, Nike has been paying dividends since at least 1989.

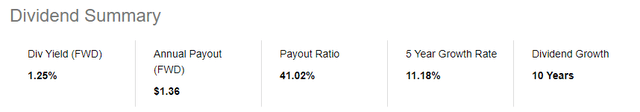

NKE Dividend Summary (Seekingalpha.com)

- Since 2002, Nike has generally been announcing a dividend increase in the 4th quarter of the calendar year, with the new dividend being in effect in December of each year.

- Although Seeking Alpha’s summary page lists the dividend growth streak as 10, I believe Nike has been paying increasing dividends for 21 years at this point when the splits are accounted for properly. That means, the upcoming dividend increase will be the 22nd consecutive and Nike is marching slowly but surely to become a dividend aristocrat in 2026.

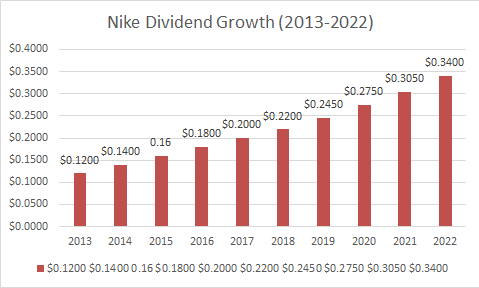

- Since my last review in 2013, Nike’s dividend has almost tripled in 10 years with a little more likely to come in December. Please note the numbers below are adjusted for Nike’s 2:1 stock-split that was announced in 2015.

Nike Dividend Growth (Compiled by author, data from Seeking Alpha)

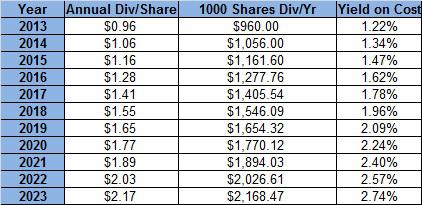

- In my 2013 article, I had projected conservatively that Nike’s annual dividend in 2023 could reach $2.17 per share by using a 10% dividend growth till 2018 and 7% dividend growth between 2018 and 2013. Adjusting for the 2:1 stock-split in 2015, that is $1.085/share. In reality, Nike’s current quarterly dividend of 34 cents/share annualizes to $1.36/share.

My Nike Dividend Projection in 2013 (Seekingalpha.com)

Dividend Coverage

- Based on total shares outstanding of 1.53 billion, Nike needs about $520 million in quarterly Free Cash Flow (“FCF”) to cover its dividend commitment to shareholders. This is based on the current quarterly dividend of 34 cents/share.

- Nike’s average quarterly FCF over the past 5 years stands at $1.07 billion. That gives the stock a FCF based payout ratio of 48.50%.

- Nike’s trailing twelve months [TTM] FCF stands at $5.70 billion. That means, on an annual basis, Nike’s payout ratio based on TTM FCF stands at 36.50%. That is, the annual dividend commitment of $2.08 billion divided by $5.70 billion in TTM FCF.

- Based on forward EPS of $3.72, Nike has an EPS based payout ratio of 36.50% again. That is, the current annual dividend of $1.36 divided by $3.72.

- Overall, Nike’s dividend coverage (based on FCF and EPS) seems strong enough to not only maintain the current dividend but to march towards the dividend aristocrat status in 2026.

- Nike’s debt of about $9 billion is more than offset by the company’s cash and short-term investments on hand. A very low debt-to-equity ratio of 0.64 also erases any doubts about the company’s ability to generate sufficient returns and being over-leveraged.

New Dividend Forecast

Now that we’ve established that the dividend is safe and sound, let’s predict what the new dividend is likely to be.

While the 5-year dividend growth average is impressive, what I like the most about the table below is the consistent, tight range with the lowest increase being 10% and highest increase being 12.24%. Based on that, I am predicting the new dividend to be 37.50 cents/share, a 10% to 11% increase. That should push the stock’s yield close to 1.40%.

| Year | New Quarterly Dividend | Dividend Growth % |

| 2017 | 0.2000 | |

| 2018 | 0.2200 | 10.00% |

| 2019 | 0.2450 | 11.36% |

| 2020 | 0.2750 | 12.24% |

| 2021 | 0.3050 | 10.91% |

| 2022 | 0.3400 | 11.48% |

| Five-year Average | 11.20% |

While 1.50% is definitely low in the current high-interest rate environment, do not underestimate the power of dividend growth, especially with a proven company like Nike and more so when it has plenty of room to afford future increases. As an example, anyone who bought the stock at $40 after my 2013 review is now sitting on a much higher yield on cost of 3.50%.

If we extrapolate the dividend growth at 10%/yr for the next 5 years and 7%/yr for five years after that, we arrive at an annual dividend of $3.38/share in 10 years’ time, which will once again push the yield on cost to > 3% for those buying here. In short, the allure of powerful dividend growth still exists with Nike.

Outlook, Risks, and Conclusion

Nike’s stock is trading at a fairly rich forward multiple of 29. But this looks a little better when you factor in the expected earnings growth rate of 15%. That gives the stock a Price-Earnings/Growth (“PEG”) of 1.93, which is respectable in the current market environment.

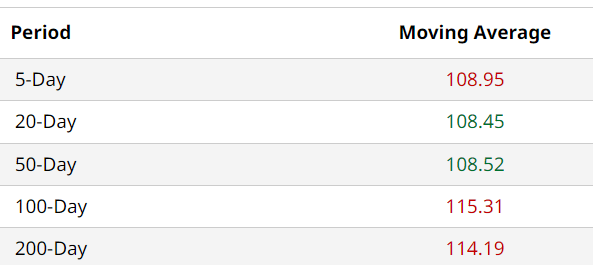

The fact that the stock has lost nearly 10% YTD in an up-year tell us momentum is not in favor of this stock, as confirmed by the fact that the stock is currently trading at or below all the commonly used moving averages. I won’t be surprised if the stock sells off a little if the market takes a breather from its YTD run.

NKE Moving Averages (barchart.com)

I rate the stock a “Buy” but suggest buying in step-ladder fashion by averaging in. In other words, initiate a position in the early $100s, nibble more in the $90s, and go all in if you get a chance to buy in the $80s. If you think $80s is too far off from here, please note the stock was in the $80s as recently as October 2022 and the stock has not had a favorable 2023 comparatively.

In terms of business outlook, the company has many exciting events to look forward to including the Women’s Soccer World Cup and continuing digital transformation.

Finally, my overall positive tone should not lead you to believe that there are no risks associated with the stock here. High inventory and slowing China sales are two high-risk factors against the stock. In addition, recessions risks have weighed on the stock for a while now.

To conclude, I believe the stock is a buy on valuation, its long-term prospects, and dividend growth. But investors need to be patient and cannot expect immediate results with this stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.