Summary:

- Nike is a global giant in the sports industry with a diverse product range and strong brand recognition.

- Lululemon, on the other hand, has carved a niche for itself in yoga and athleisure wear.

- Lululemon is undervalued compared to its historical multiples, while Nike is slightly undervalued, making both companies attractive buys.

- Choosing between them will depend on factors like valuation and the sustainability of their competitive advantages.

LeoPatrizi/E+ via Getty Images

My Thesis

The two companies I will analyze today are both high-quality, growing companies. Both sell high-quality products in the sports products category. While Nike (NYSE:NKE) sells a wide range of products, Lululemon (NASDAQ:LULU) mainly focuses on niche categories such as yoga but is also expanding.

I believe that at the right price, I would love to own both companies. However, for now, I will choose one as my preferred buy.

A Few Words About Nike

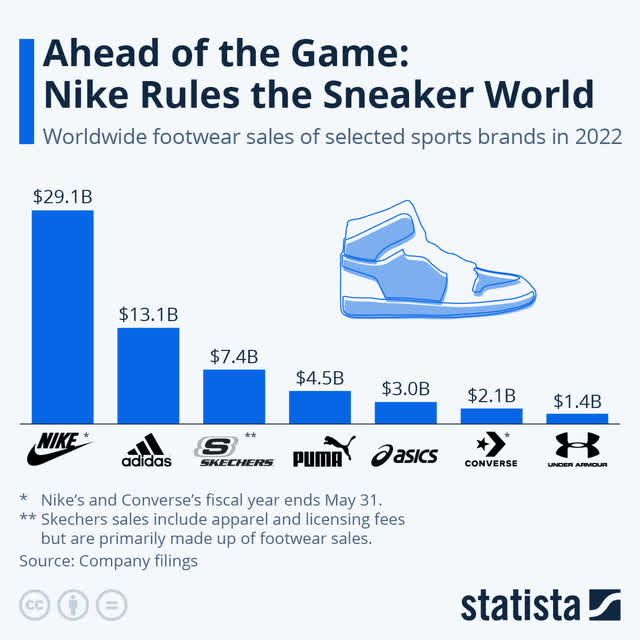

Nike, as the largest sports firm in the world, boasts a diverse product range, with the majority (68%) of its revenue coming from footwear. It possesses one of the world’s strongest brand names, including invaluable assets like the Jordan brand. I want to emphasize the significance of this brand name. Nike’s enduring dominance in the sports industry over decades sets it apart from other brands. Unlike younger brands that may fade in popularity, Nike is highly unlikely to go out of fashion.

To illustrate this point, let’s make a quick comparison with a company that garners strong attention in the investment community, Crocs (CROX). Crocs has impressive financials, substantial growth, and a robust marketing team. However, the main concerns I see for Crocs revolve around its brand’s ability to stay relevant. Will it remain relevant five years from now, or is it merely riding a strong trend? I believe that with Crocs, the answer is unclear. But with Nike, the answer is unequivocally yes.

If we peer into the future, we’d like to know which brand is the favorite among teenagers. The clear answer is Nike, which holds a commanding 33% share, followed by American Eagle (7% share) and Lululemon (6%) in the apparel business. In the footwear industry, the picture is even more astounding, with Nike enjoying a robust 61% share, followed by Converse (10%, owned by Nike) and Adidas (6%). Vans (5%) and New Balance (2%) round out the top five.

These data points are crucial in my view, as teenagers often set the tone in the media. Nike is the king of marketing, featuring the best athletes with long-term contracts and dominating in basketball while leading the European football world.

Overall, these factors establish a wide moat around the company. This moat, in my opinion, is unique to Nike in the industry, which is also what gives me pause when considering Lululemon.

A Few Words About Lululemon

Lululemon is a prestigious sports brand that primarily focuses on women’s products, particularly in the yoga segment. The company is credited with essentially inventing this niche and is best known for its high-quality yoga pants, which can carry price tags of up to $100. While Lululemon does not have the lengthy and rich history of Nike, it is not a newcomer to the industry. Lululemon operates in a growing niche market, primarily within the highly competitive women’s apparel segment, and is also expanding into the men’s industry.

Lululemon has undoubtedly built a strong brand value, which I believe serves as its primary moat, although it may not be as extensive and deep as Nike’s. My main concern, and the question that I continually ponder, is whether Lululemon can sustain its brand strength into the future. Will it face a fate similar to Under Armour (UAA)? What can we expect from Lululemon’s future – will it be as unpredictable as Crocs or as clear and foreseeable as Nike? These are the critical questions that every investor should contemplate.

It’s important to note that, unlike Crocs in the past, Lululemon has achieved a secular growth trajectory. If you believe that Lululemon’s brand is sustainable and won’t be overshadowed by competitors like Gymshark or Alo Yoga, then its financials are indeed impressive, surpassing those of Nike. In that case, it might be an excellent buy opportunity right now.

Comparing The Numbers

When conducting research on a business, there are several key factors I focus on:

1. Revenue growth2. Free cash flow growth3. Return to shareholders4. High returns on capital

Let’s delve into these aspects for both companies:

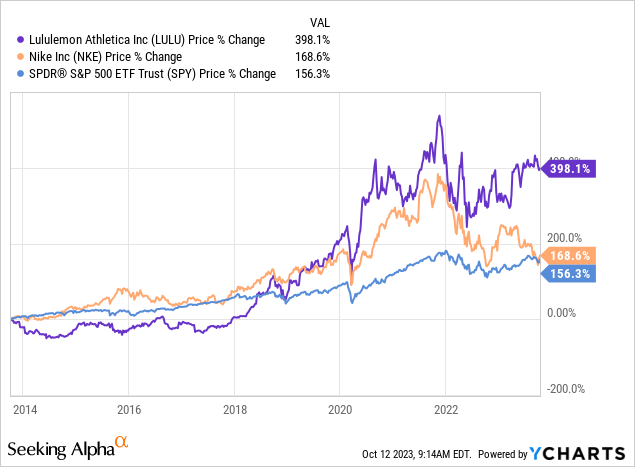

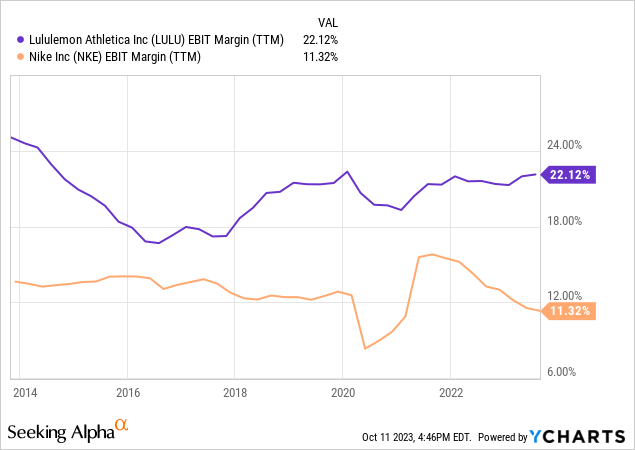

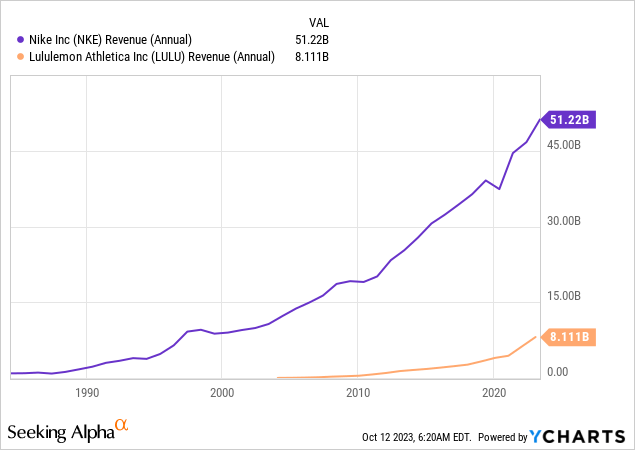

Both Nike and Lululemon have showcased significant top-line growth in the past, and this growth trajectory is expected to continue into the future, even amidst economic uncertainties. It’s worth noting that Lululemon, being a smaller company, has demonstrated a higher CAGR, which is a logical outcome. Additionally, both companies have demonstrated considerable operating leverage, indicating their ability to expand their top line without a corresponding increase in costs. This operational efficiency, coupled with higher CAGR, is one of the reasons behind Lululemon’s outperformance.

However, unlike most of the other companies I’ve analyzed on this platform, both companies don’t demonstrate margin expansion. In my opinion, margin expansion is critical to enhance the return on capital, which, in turn, drives value and share appreciation. The reason for this lack of margin expansion is probably the super high competition in the industry.

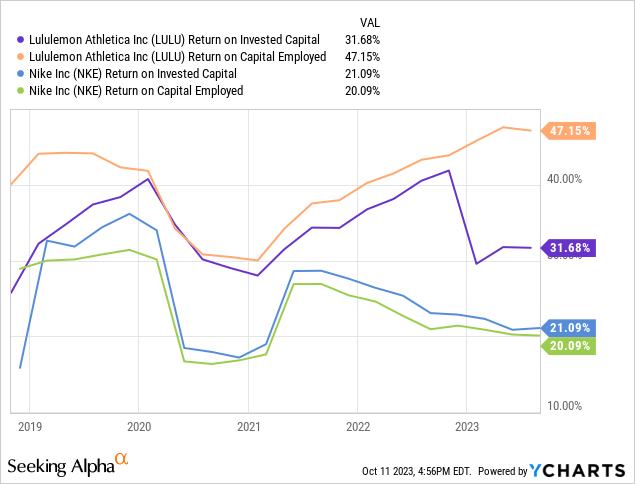

Besides higher revenue growth in the past, one of the main reasons for Lululemon outperforming Nike is its returns on capital. High returns on capital, coupled with solid revenue growth, create market-beating results. Therefore, this may be one of the most important factors to consider.

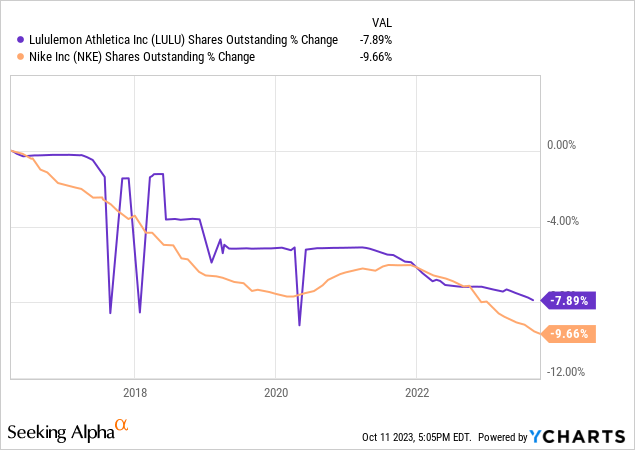

Companies that are good capital allocators need to balance between providing solid returns to shareholders, timing those returns in the form of stock buybacks, and distributing cash for reinvestment, which, in turn, enhances the return on capital. Both companies have conducted buybacks, although you can see in the chart that they do not engage in share repurchases as aggressively as some other quality companies. This is more understandable with Lululemon, as it is a growing firm, which explains its lack of dividend payments. However, Nike’s buyback program is somewhat limited, and I would prefer to see them be more active, especially now that the stock is trading at a lower valuation. Nike does provide a solid dividend, currently yielding 1.4%, which is a suitable approach for a mature firm.

By now, it is quite clear that the financial indicators favor Lululemon. However, the central question I will repeatedly ask is, “Is the moat wide enough?” A conservative investor would choose Nike any day of the week. Yet, if you believe that Lululemon has a wide moat, there is a massive opportunity, as we will explore in more detail later.

Just before diving into the valuation, I will provide a quick solvency overview. Both companies are in excellent financial positions. Lululemon has zero debt and is perfectly fine from a liquidity perspective, boasting a current ratio above 2. Nike can effectively pay off all of its debt right now, as it holds nearly as much cash on hand as long-term debt. It is also in good short-term shape, with a current ratio above 2.

Another aspect I like to assess is the linearity of revenue, as it indicates how predictable and secular or cyclical the business is. Well, both of these firms exhibit a perfectly linear revenue, which, in my opinion, is a highly positive aspect.

Lulu with a Moat, Massive Opportunity

I prefer to analyze the valuation of companies through a three-step process: historical multiple averages, a conservative discounted cash flow model, and a basic technical analysis.

Let’s begin with the multiples. However, it’s essential to note that these multiples are calculated based on data from the ZIRP era (Zero Interest Rate Policy). With Quantitative Tightening (QT) becoming a factor, we can anticipate multiple contractions due to a higher equity risk premium.

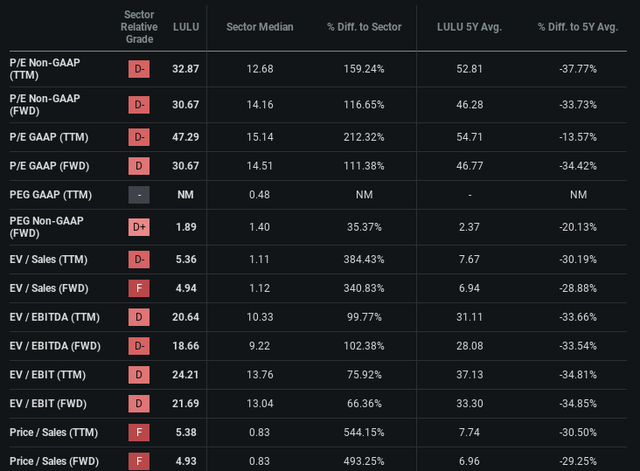

As for Lululemon, it’s currently trading significantly below its historical multiple averages, across every metric. Despite the growing competition, I’m struggling to identify reasons for such a valuation gap. These metrics suggest that, in addition to the business’s growth potential, there is ample room for multiple expansions, perhaps not back to the ZIRP-era averages, but certainly a bit below. What excites me is how challenging it is to find high-quality businesses undervalued to this extent by these metrics. In my other articles on Hermes (OTCPK:HESAY), LVMH (OTCPK:LVMHF), and ASML (ASML), you’ll see that they are only slightly below their historical multiples, however, having much wider moats.

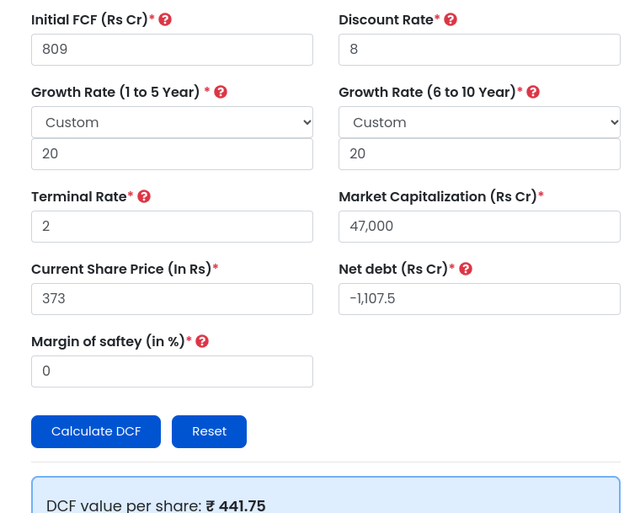

In terms of the DCF model, I utilized an 8% discount rate, derived from the Alpha Spread WACC calculation. I input a 20% growth rate, taking into account that the last 5 years average was a 17% CAGR, and the most recent three years saw a 30% CAGR. The terminal rate was set at 2%, which I consider neither overly optimistic nor overly conservative. The result of this calculation is an intrinsic value of $441, suggesting that the stock is undervalued by approximately 15%. It’s important to recognize that some companies, especially those of exceptional quality, may not fit neatly within the DCF model. This was exemplified in my previous article discussing Hermes and LVMH. Finding super-high-quality businesses with a 50% undervaluation is indeed quite rare. Notice that I do not consider any stock buybacks or dividends, which would contribute to the total return.

In the realm of technical analysis, I tend to favor buying when the stock price is in proximity to its 200-day moving average and exhibits a relatively low RSI (Relative Strength Index) reading. However, in the case of Lululemon, the current technical situation doesn’t align with my preferences. I would prefer to see the stock price at a lower level before considering it as a buy.

Based on the three-step valuation process, I find Lulu attractive, and I would suggest a STRONG BUY if I thought the moat was wide. However, in my opinion, it’s not the situation, and therefore, I think it’s a BUY. We will examine it versus Nike to consider which is preferable.

Nike Is Attractive

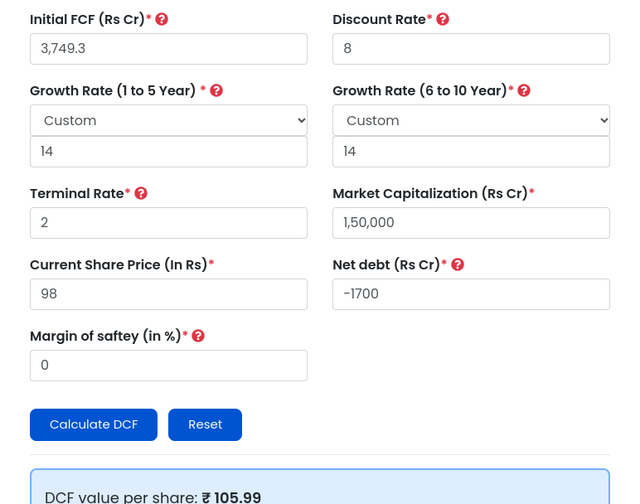

Using the same three-step approach, let’s begin:

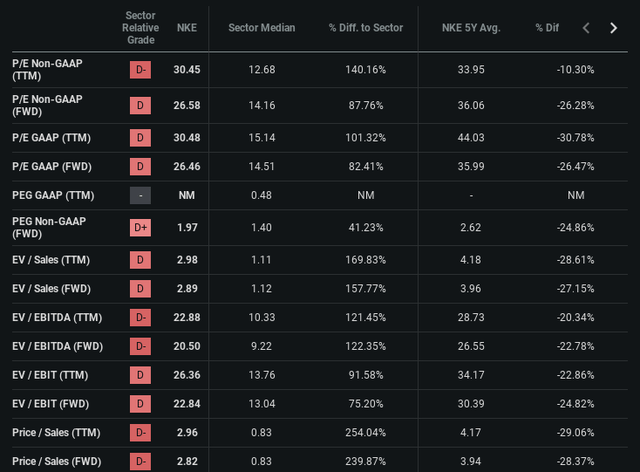

Nike is more than 20% above its historical average for free cash flow yield, which, in my opinion, is excellent. Furthermore, it is trading below its historical multiples, and when considering its wider moat, the potential for multiple expansion is evident.

In terms of the DCF analysis, I used the same discount rate and calculated the FCF CAGR over the last 10 years, which was approximately 14%, and used it as the growth rate. The terminal rate is the same as for Lululemon. Based on these inputs, the DCF model suggests a fair value of $106 for Nike. This implies that, by these parameters, Nike is slightly undervalued. It’s important to note that small changes in the inputs can lead to different results. As I mentioned earlier, the DCF model might not always fully capture the value of high-quality companies, especially those with rich valuations. In my opinion, Nike is one of these companies.

From a technical perspective, Nike recently experienced a dip and the technical indicators appear favorable. The stock is trading below its 200-day moving average, and its Relative Strength Index is relatively low. If you are content with the fundamental valuation, there might be a short-term opportunity to initiate a position.

Taking into account these three metrics, my conclusion is that Nike is a BUY. However, the price is not attractive enough to consider it a STRONG BUY. The wide moat of Nike is a significant factor in this assessment.

Conclusions

Based on this analysis, Lululemon clearly appears to be the more favorable buy at the moment. However, it’s crucial to emphasize that it’s only a buy if you believe it possesses a massive competitive advantage. On the other hand, Nike is undervalued, though not significantly so, but a company with such a competitive advantage that seems fairly priced is a rare occurrence.

Considering both opportunities, I’d prefer buying Nike right now, as finding such a favorable valuation for companies of this caliber isn’t common. However, I would say that whoever buys Lululemon right now will likely do well.

Currently, I do not hold any of the securities I mentioned above, as I find more favorable opportunities elsewhere.

I would like to hear your thoughts about these two compounders; please share your opinions in the comments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information provided in this article is for informational and educational purposes only. It should not be considered as financial, investment, or trading advice. The stock market is subject to various risks, and investing in stocks involves the potential loss of capital. Always conduct thorough research and consider your individual financial situation and risk tolerance before making any investment decisions. Past performance is not indicative of future results. Any investment decisions should be made based on your own judgment or in consultation with a qualified financial advisor. The author of this article and the platform where it is published are not responsible for any actions taken based on the information provided.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.