Summary:

- Nike has declined more than 50% since its peak in 2021 and is now trading at historically low multiple valuations, but the risk/reward is still not compelling enough.

- Nike’s brand power remains strong, but its decline in the “cool” factor and changing consumer preferences pose a challenge to regaining market dominance.

- Despite declining revenues, Nike remains profitable, with an A+ profitability rating, strong margins, and manageable debt levels.

- Nike’s total yield of 5.5% is attractive but not enough to offset valuation concerns and competitive risks.

- Nike is a hold due to its high valuation, uncertain growth prospects, and competitive challenges, but it remains a strong brand with potential for a turnaround.

ozgurdonmaz

Introduction

NIKE, Inc. (NYSE:NKE) has really crashed the past few years and now has a valuation significantly below historical multiples. Nike has had a significant premium on its underlying values, but for a good reason: Market leader, good growth, and brand power. This premium has fallen significantly because of several factors. The ones I believe had the most impact are harder competition because of lower barriers of entry, losing its “cool” factor, and rising interest and inflation, which is reducing disposable income. While disposable income is a cyclical factor beyond their control, competition is something they can address, and they have a great brand name that will help them going forward. Trends can change rapidly, so Nike has the potential to regain its ‘cool’ factor and that will help them to get back to stronger growth. However, I believe some of Nike’s current risks outweigh their possible potential. Therefore, I believe NIKE, Inc. is a HOLD and I will tell you why.

Business model

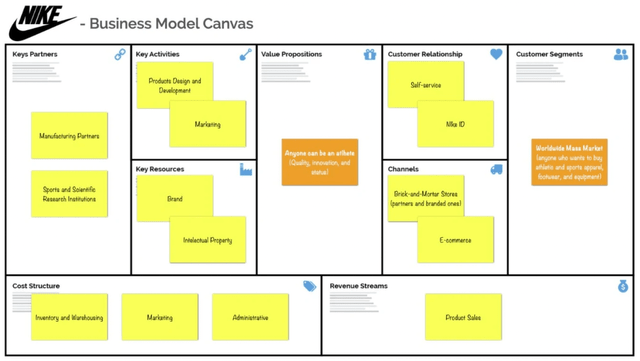

Nike is one of the world’s biggest brands, and their business model is not something I will go into too much detail about. Below is a depiction of Nike’s business model.

Nike’s business model (The Business Model Analyst)

Nike’s biggest market by revenue is North America, Europe & the Middle East and Africa, Greater China, and Asia Pacific. I can see a relationship where their biggest markets are where they have higher disposable income.

Nike revenue per region (Statista)

What’s happened?

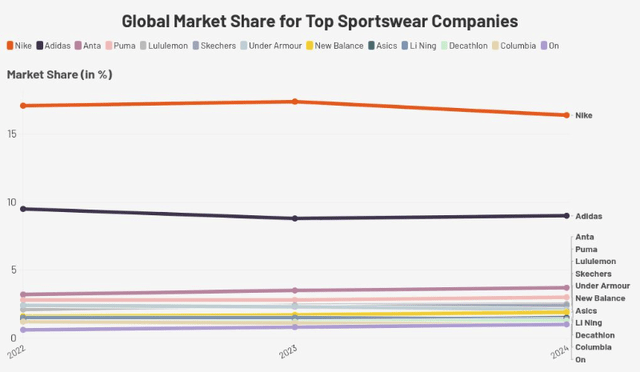

Nike has declined more than 50% since its peak in 2021. What has happened? Nike fell during 2022, like most companies did, but they didn’t manage to recover in 2023. Their growth has paused and lost approximately 1% in market share since 2023, but they are still by far the world leader in sportswear.

Nike market share versus competitors (FrontOfficeSports)

I believe there are several reasons why Nike has fallen so much, but I believe one of the main reasons is that Nike has lost some of its “cool” factor, and consumers are looking for different brands. And new competition is not hard to find these days. One of the reasons is that 3D printers have become more advanced and much cheaper, which makes it easier for new brands to start producing. The shoes can have a rather complex structure without having to cost significantly more. Portugal’s new “Shoe Valley” is also attracting luxury brands to make shoes and has made it easier for new brands. TikTok’s advanced algorithms also make it easier for consumers to find new brands and discover different companies, and with the internet, this is easier as they can sell directly to consumers without having to use traditional retail channels.

Both this year and last year, there have been stories about retailers selling Nike at discount due to lower demand. Since Nike is struggling, this could arguably be the ideal time for competitors to capitalize on Nike’s vulnerable position, which is what I believe we are currently seeing.

Additionally, Asia has had a quick rise in disposable income in the past years, which has been good for Nike, but as disposable income rises, more competition comes in to try to get a piece of the pie. A relatively new trend is called Guocha in China.

A term that translates to ‘national wave,’. It refers to a movement in China where consumers, particularly Millennials and Generation Z, show a strong preference for domestic brands and products that incorporate traditional Chinese culture and style”.

As people earn more money, I believe people seek different styles and different identities and try to become more individualistic, and with a quick rise in new brands around the world, this has made it a lot easier, and as Nike has lost some of its “cool factors,” it’s not helping them either, but I don’t believe all hope is lost for Nike. They have a lot of brand power; fashion and trends can change quickly, and Nike has managed to create unique brands and partnerships that have helped them. So they definitely have opportunities to come back stronger. In the past quarter, Nike appointed a new CEO, Elliott Hill, who has spent nearly his entire career at Nike, previously serving as President of Consumer & Marketplace as well as Sales & Geographies. His deep understanding of the company positions him to drive meaningful change, and with the right management decisions, I believe Nike can turn things around quickly.

Nike has managed to maintain consistent margins over the past year, indicating that its costs closely align with its revenue. Nike is still a very profitable company with an A+ Quant rating from Seeking Alpha, and they have managed to keep their profitability regardless of declining revenue growth.

Nike’s profitability (Seeking Alpha)

Next week, Nike is set to release its latest quarterly report. The consensus estimate is an EPS of $0.64. The estimated EPS for 2025 is $2.75 and that is what I will use for my valuation later. It will be important to see if they manage to meet this estimate and what I will be looking for is any strategic plans for the future and what the newly appointed CEO will try to convey to the stakeholders about the current market or future plans. Will Nike try to be more efficient with new shoe developments? Are they going to invest more in R&D and try to take back their position as the most innovative player they once had? These are things some things I hope Nike will try to communicate going forward.

Outlook and growth opportunities

The global footwear market is expected to grow with a CAGR of 2.35% until 2029. Global sportswear demand, however, is expected to grow faster, with a CAGR of 4.68% between 2023 and 2030. So, I would assume that Nike’s growth rate could be anywhere between 3 and 4% over the next five years if these outlooks are right. I believe that the outlook is fair because GDP growth is expected to grow between 2.5% and 3% in the next couple of years, and there should be a positive correlation between the two.

Footwear – Worldwide & Forecast revenue of the global sports apparel market from 2023 to 2030 (Statista)

According to analysts, Nike is expected to have a revenue CAGR of 6% after 2025, that’s more than the market is expected to grow each year. What does this mean? It means two things: Nike will get some sort of competitive edge compared to their competition, or the market will grow so much that Nike and all competitors will benefit from it. What could give the market such a boost? I believe lower interest rates and lower inflation could increase spending because it will impact disposable income; if this does indeed happen, it could increase spending worldwide. But you have to ask yourself what the chances are that Nike will achieve this growth. I myself believe it is more unlikely.

Valuation

Now, over to Nike’s valuation. Nike, in the past century, had a high valuation multiple. Over the past five years, Nike’s average valuation multiples include a PE ratio of 35x, a PB ratio of 13x, and a PS ratio of 3.78x. This is quite a high valuation and a significant premium on underlying value, but it has been deserved regarding the fact that Nike is the market leader, has had strong growth, and is a very strong brand. Nike’s valuations have been tumbling in the past years, but according to my calculations, they still have a significant premium.

According to my discounted EPS valuation, Nike’s fair value is closer to $65 per share. The valuation is calculated using EPS, so the growth rate is what, I believe, will be Nike’s average EPS growth rate. My valuation is based on three different scenarios: Base case, worst case, and best case. The worst case is based on no more than 2% growth in the first five years and 1% after that, and the base case is based on 3% growth in the next five years and 2% after that. The best case is based on 5% growth in the first five years and 4% after that. The growth rates are based on either analyst projections or the anticipated market growth over the next few years. The EPS I am using is the estimated 2025 EPS of $2.75.

Three scenarios discounted EPS valuation (Author’s calculations)

Some might say I am pessimistic by using a 5% EPS growth rate for my best-case scenario in my valuation when the consensus projects over 10% growth rate for the next five years, but my preference for conservative valuations has proven effective so far.

Also, looking at the future P/E ratio using consensus earnings estimated, then Nike still looks expensive.

Future PE ratios using consensus estimates (Seeking Alpha)

Dividends and buybacks

On the positive side, Nike currently offers a combined dividend and buyback yield of 5.5%, which is compelling. They are finally buying back stock at a historically low price, and it seems way more logical compared to their buybacks in 2021.

Dividends and buybacks yield (Morningstar)

Financial health and risks

Nike has strong financial health, with a current debt of $9 billion and equity of almost $14 billion. Nike’s debt-to-equity ratio has risen in recent years, though it remains manageable. They currently have a negative net debt, with more cash and cash equivalents than debt.

In my view, Nike’s main risks going forward are tougher competition, premium valuation and a recession. A recession is generally not a good scenario for any company, but it will impact Nike significantly, as a recession will lower consumer spending.

A risk you have to take is the bet that they can make themselves “cool” again, and that management makes the right decisions, since they still have a significant premium compared to fair value according to my calculations, with a book/value 11x and forward PE ratio of 28x according to estimates.

Conclusion

So what is my final verdict? My view is that Nike is a hold. There are too many uncertainties regarding harder competition, lower barriers of entry and how Nike is viewed as less “cool”. According to my calculations, Nike still holds a significant premium compared to fair value and the risk/reward is still not good enough for me. I don’t believe you should buy a company because it is below historical averages unless it’s a cyclical company, and Nike is still expensive if they don’t manage to improve their sales and earnings.

Factor Grades (Seeking Alpha)

I also believe that brand power can erode fast, but on the positive side I believe Nike can turn things around rather quickly if they manage to make their brand “cooler” again, but there is a growing number of new competitors, and it will be a tough road ahead.

Looking at Seeking Alpha’s Factor Grades, we can clearly see that Nike’s grades are poor, but they still have strong profitability and I believe Nike could pull themselves back to the top. However, I believe the best thing is to HOLD and wait out the situation because the risk/reward is still not good enough.

This is just my view, let me hear yours.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.