Summary:

- Nike’s Q4 earnings are highly anticipated as investors analyze discretionary spending trends.

- Bulls believe in Nike’s strong brand, financial performance, and market share consolidation.

- Bears question Nike’s enduring moat and believe its valuation is excessive, leading to a hold rating.

Robert Way

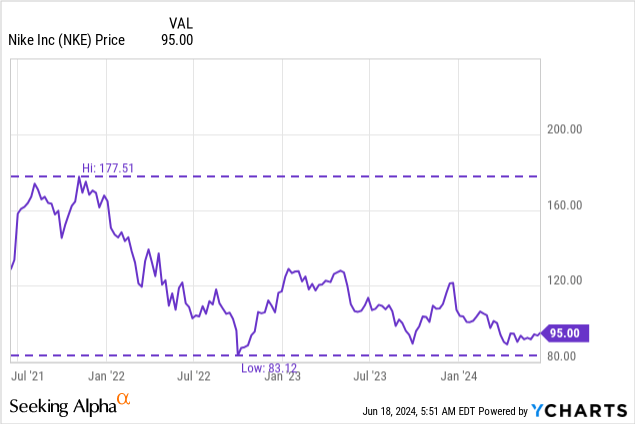

Nike’s Q4 earnings represent one of the last events of every Q2 earnings season, with investors ready to read through the report and feel the pulse of discretionary spending as a new quarter approaches. In fact, Nike (NYSE:NKE) closes its fiscal year in May and will thus release its annual report in a few days, making the report even more valuable now that we are halfway through this year. Needless to say, Nike shares were among the pandemic winners, but, after reaching an ATH of $177.51 in late 2021, Nike’s stock has underperformed the market and its shares have bottomed just above $80 in late 2022. Since then, the stock has traded mostly flat, never moving above $130. Currently, the technical setup is not encouraging, because we see the stock making lower highs, although support seems to have formed around the $85-$90 range. Bulls hope for a new catalyst, bears wait for the stock to break its support and plunge below $70.

As we approach Nike’s earnings, I would like to present the two main theses around the stock, both of which I am seriously pondering. In fact, I own a little stake in Nike and have to make up my mind whether I want to exit the position or increase it.

Nike’s bull case

Before even looking at Nike’s financials, the first and strongest argument every bull stresses is the brand’s strength. According to Brand Finance, Nike remains the most valuable apparel brand and is worth around $31.3 billion. Louis Vuitton comes in second place, with a total value of $26.3. Adidas (OTCQX:ADDYY), Nike’s largest peer, is fifth with a value of $15.7 billion. Nike also leads the race in teens’ preferences for footwear and clothing. We have often heard sporting goods retailer Academy Sports & Outdoors (ASO) report strong Nike sales even during times of softening consumer spending.

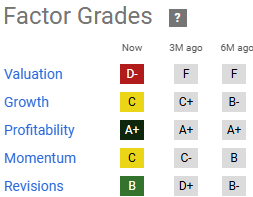

Secondly, thanks to its huge appeal, Nike’s profitability is incredible and rightly earns an A+ as its Quant Grade. In fact, we have a company whose gross profit margin is usually above 44%. Net income margins are usually above 10%. Returns are also great: ROCE is above 36% and Nike’s ROTC is 14%. Adidas, for example, reports a higher gross profit margin of 49%, but its net income margin is barely above 0% and its ROCE is just 1.75% while its ROTC is 3%.

Third, Nike controls over 43% of the market and has been able to consolidate its market share by strong endorsement contracts with famous athletes. For example, back in 2022, Nike was able to sign a €150 million deal with the tennis player Jannik Sinner, who has just become the new No. 1 in the ATP rankings. For ten years, he will wear Nike shoes and apparel. We all know Nike partnered with legends such as Michael Jordan and Tiger Woods, and still partners with Cristiano Ronaldo and Kylian Mbappé. With the Olympics about to take place in Paris, Nike will gain further global exposure thanks to its partnerships. Storytelling, after all, is at the heart of the brand and requires strong testimonials.

Bulls believe Nike’s moat is strong and what we have said is that its dominant position as the top footwear and sporting apparel brand won’t come into question. True, from time to time, an Under Armour a Lululemon, or a Hoka comes forward and seems to disrupt the industry and threatens to steal the leadership from Nike. But, so far, it has never happened and Nike has reigned over the industry for over four decades.

Finally, bulls show their enthusiasm about Nike’s financials. Nike’s top line keeps growing and has moved from $27.8 billion in FY 2014 to $51.2 billion in FY 2023. This is a CAGR of 4%.

In the same decade, its gross profit has grown at a 6.3% CAGR, from $12.4 billion to $22.8 billion, while its net income has compounded a bit more slowly at a CAGR of 5%, moving from $3.7 billion to $6 billion.

However, Nike’s free cash flow growth has been outstanding and it has compounded over 11% per year. In FY 2014, Nike generated $2.1 billion in FCF. At the end of its last fiscal year, Nike’s FCF was $6.2 billion.

At the same time, Nike’s balance sheet has been well managed. The company has doubled its cash from $5.1 billion in FY 2014 to $10.7 billion in FY 2023.

Long-term debt was below $3.5 billion until the pandemic hit. Then Nike took advantage of the low-rate environment and took on another $6 billion in LT debt, which is slowly (and rightly so, given the low rate) paying down. Currently, Nike carries $8.9 billion in LT debt. In any case, it has more cash on hand than LT debt, which makes it an unlevered business. Total debt amounts to $12.1 billion. In any case, this is below 2x Nike’s EBITDA of $6.8 billion.

With this strong of a business, supported by excellent financials, no wonder Nike has been a big dividend grower, with yearly increases always above 10% and a payout ratio usually below 40%. Coupled with buybacks, Nike has returned almost $7.5 billion to its shareholders in FY 2023 and seems on its way to breach this barrier as soon as it reports its FY2024 results.

Nike’s bear case

Before we discuss the bearish view, we have to make one big clarification. We are not talking about a bear case hinging on deteriorating fundamentals. Rather, most of the arguments against Nike rely on two core ideas: the moat is questionable and the valuation is extreme.

Regarding its moat, many believe Nike is not so enduring. In fact, Nike operates in the fashion industry, where, by definition, change easily happens. Nike’s sneakers may be among consumers’ favorites, but one is not bound to purchase them over and over in the same way an Apple customer is “forced” to remain within the ecosystem and purchase new Apple devices.

So, within the industry of fashion, it is hard to find enduring moats simply because of how fashion is structured. There might be strong and well-established brands that can become truly lucrative investments. But the argument here is on the word “moat” and Nike’s bears don’t believe Nike has a true one.

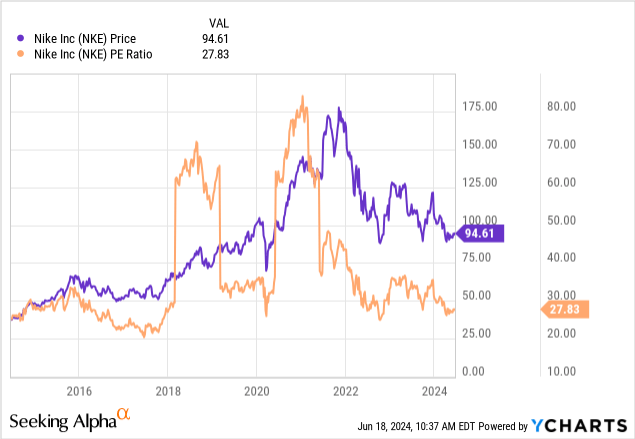

As a result, Nike’s premium changed. Currently, Nike trades at a 27 PE, which is at the low end of its 10-year valuation, which has always been above 25. Its fwd PE is actually 25.5, so it is even closer to the bottom.

According to the WSJ, the S&P 500 P/E ratio is currently 23.6, which makes Nike’s trade almost at par with the general market. To Nike’s bulls, this is outrageous because Nike deserves a premium. To its detractors, Nike is finally trading in line with the true nature of the business, which may deserve a little premium because of how well-established its brands are, but doesn’t deserve to trade way over the average multiple because it doesn’t have a true moat.

Of course, we may also spend a few words considering that the current PE ratio of the index is rather high and this causes some optical distortion. However, more and more analysts believe the S&P 500 is correctly anticipating a few years of decent earnings growth. But let’s leave this discussion aside, for the moment, and focus once again on Nike’s earnings.

Nike Q4 Earnings Preview

Being aware of how bulls and bears think Nike is key to understanding how the stock may react after earnings.

However, before we make some educated guesses about Nike’s report, let’s consider the macroeconomic environment and see what some data suggest about Nike’s possible performance.

We have heard Dick’s Sporting Goods (DKS) and Academy’s earnings calls and they painted a mixed picture, with Dick’s sales increasing, while Academy’s were sluggish. But both reported Nike’s strength.

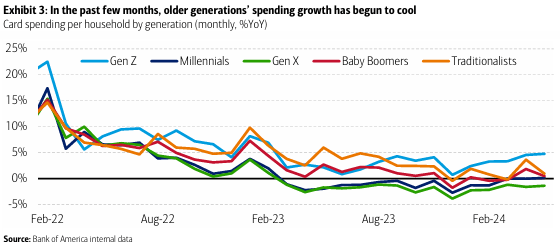

According to the Bank of America Institute, consumer spending continues to appear soft but stable, with total card spending per household up only 0.7% YoY in May. However, Gen X spending is the only one that saw negative spending growth because of its weaker wage growth. Gen Z, on the other hand, seems strong enough to offset the decrease in Gen X’s spending. These are two of the most important cohorts for Nike, together with millennials, whose spending growth is basically flat.

BoA Institute

The U.S. Census Bureau also announced U.S. retail sales in May to be up only 0.1% from the previous month and up 2.3% YoY. However, clothing & clothing accessories stores saw a 2.5% YoY growth for the first five months of the year, while sporting goods, hobby, and bookstores decreased by 2.5%.

The picture is mixed. Consumers are spending, but they are also a bit more picky on expensive items. However, spring sales are usually good for Nike as the outdoor season kicks in. As a result, I think Nike should report Q4 sales above $12.83 billion reported a year ago. For the FY, Nike is expected to grow revenues by 1%, which means Nike should report $13 billion for the quarter.

Nike said it expected its gross margins to expand 160 to 180 bpts in Q4. Since FY 2024 has so far been a good year for Nike’s profitability, we could expect Nike’s gross margins to come in close to 46%.

This would set the way for Nike’s earnings to be around $1.3 billion. This means Nike’s EPS could be around $0.86. Current consensus forecasts $0.85 per share, just a penny below my take. This would be close to a 30% increase YoY, which would be a great result. If Nike comes way above these numbers, then investors could celebrate and push the stock up. On the other hand, if the EPS comes in way below these estimates, I see the stock tumbling down.

Valuation

For Nike, top-line growth is key. In the past few years, we have seen slower growth and this upcoming report appears to be aligned with this trend. As a result, the stock is graded with a C under growth.

Seeing Alpha

Because of slow growth and weak momentum, the company is currently rated as a hold by Seeking Alpha’s Quant Ratings.

I keep considering Peter Lynch’s advice, when he writes in his famous book One Up On Wall Street:

The P/E ratio of any company that’s fairly priced will equal its growth rate. If the P/E of Coca-Cola is 15, you’d expect the company to be growing at about 15 percent a year. But if the P/E ratio is less than the growth rate, you may have found yourself a bargain. A company, say, with a growth rate of 12 percent a year […] and a P/E ratio of 6 is a very attractive prospect. On the other hand, a company with a growth rate of 6 percent a year and a P/E ratio of 12 is an unattractive prospect and headed for a comedown. […] In general, a P/E ratio that’s half the growth rate is very positive, and one that’s twice the growth rate is very negative.

In Nike’s case, we have a growth rate of 1% and a PE of 25. Even its earnings don’t grow at 25% but around half that pace. Moreover, although I am no Nike bear since I do have a little stake in the company, I am inclined to think Nike’s moat is not as strong as at first it may seem. Therefore, such a high premium before low-single-digits growth prospects appear to be still demanding.

As a result, although I expect Nike to come slightly above current earnings estimates, I still believe Nike is a hold and stick to my previous rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.