Summary:

- Nikola reported mixed Q2/2024 results, with higher sales more than offset by increased cash usage.

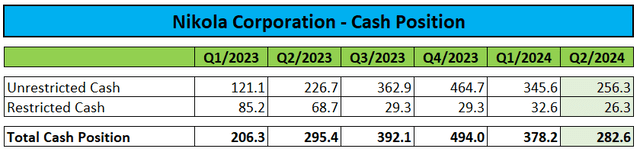

- As a result, unrestricted cash was down by more than 25% sequentially to $256.3 million.

- At the current rate of cash usage, the company will have to raise additional capital by Q4/2024 at the latest point.

- With the market for FCEV trucks still in its infancy, NKLA won’t be able to scale production in the way required to materially reduce cash consumption anytime soon.

- Considering the lack of a viable business model in combination with elevated capital needs, I am reiterating my “Strong Sell” rating on the shares.

VanderWolf-Images/iStock Editorial via Getty Images

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

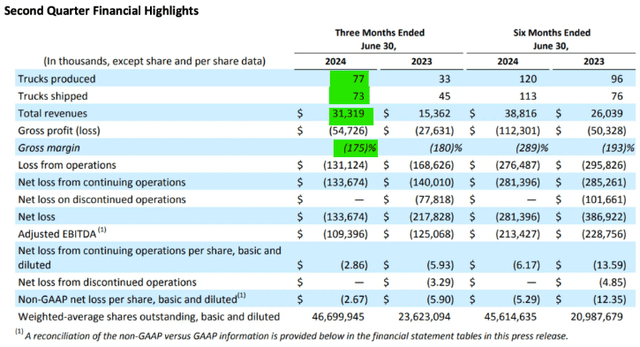

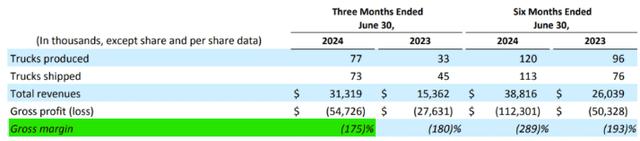

Last week, zero-emission transportation start-up Nikola Corporation (“Nikola”) reported mixed Q2/2024 results:

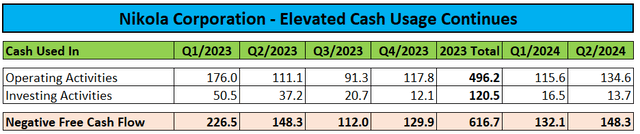

While better-than-expected FCEV truck sales to dealerships resulted in revenues coming in ahead of consensus expectations, cash usage increased by more than 12% sequentially to $148.3 million.

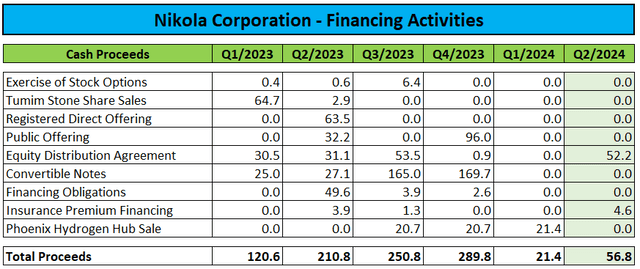

Persistent cash outflows were somewhat offset by $52.2 million in net proceeds from the sale of additional shares into the open market and $4.6 million generated from insurance premium financing:

As a result, Nikola’s unrestricted cash was down by more than 25% sequentially to $256.3 million:

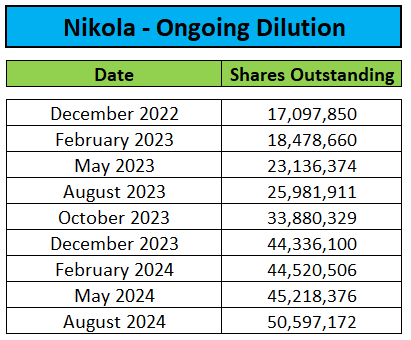

Ongoing open market sales resulted in outstanding shares almost doubling on a year-over-year basis:

Regulatory Filings

On a more positive note, the gross margin of (175)% was vastly improved from the abysmal (768)% reported in Q1/2024.

While margins benefited from higher sales volumes and an increase in average selling prices, it is important to note that Q1 revenues were reduced by more than 50% as a result of a return reserve related to the cancellation of dealer agreements.

Total debt and finance lease liabilities amounted to $278.2 million at the end of the quarter.

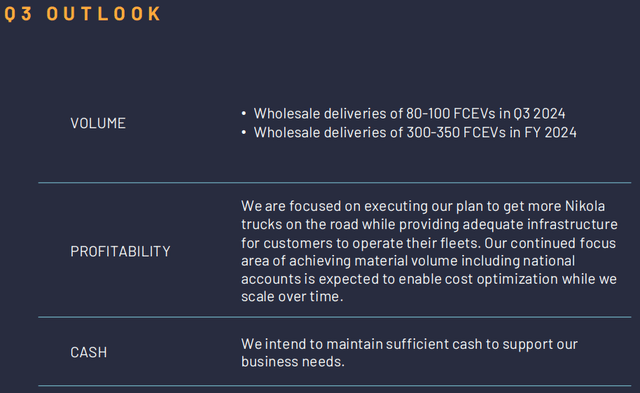

On the conference call, management projected 80-100 FCEV truck deliveries for Q3 and reiterated full-year expectations for 300-350 FCEV truck deliveries:

However, with the market for FCEV trucks still in its infancy, Nikola won’t be able to scale production in a way required to materially reduce cash consumption anytime soon.

As a result, investors will likely have to prepare for further dilution from persistent open market sales or potential follow-on offerings, particularly after the company convinced shareholders to increase the number of authorized shares by almost 2,000% to a whopping 1 billion as of late.

At the current rate of cash usage, the company will have to raise additional capital by Q4/2024 at the latest point.

Bottom Line

Nikola Corporation reported better-than-expected Q2 results, but cash usage increased to almost $150 million, with persistent cash outflows only partially offset by proceeds from additional open market sales.

With demand for FCEV trucks nowhere near the levels required for Nikola to achieve meaningful economies of scale, I would expect dilution for common shareholders to continue unabatedly.

Considering the lack of a viable business model in combination with elevated capital needs, I am reiterating my “Strong Sell” rating on the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.