Summary:

- Last week, ailing zero-emission transportation start-up Nikola Corporation reported another set of disappointing quarterly results.

- Reported gross margin of (768)% reached a new all-time low, mostly due to higher inventory reserves and increased warranty accruals.

- Unrestricted cash was down by approximately $120 million quarter-over-quarter to $345.6 million as the company abstained from raising additional funds during Q1.

- Going forward, Nikola will be focusing on winning large national accounts in order to scale the business in a way sufficient to achieve profitability.

- Given the ongoing lack of a viable business model in combination with the proposed reverse stock split and a very high likelihood of additional near-term dilution, I am downgrading the stock from “Sell” to “Strong Sell”.

Tramino

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

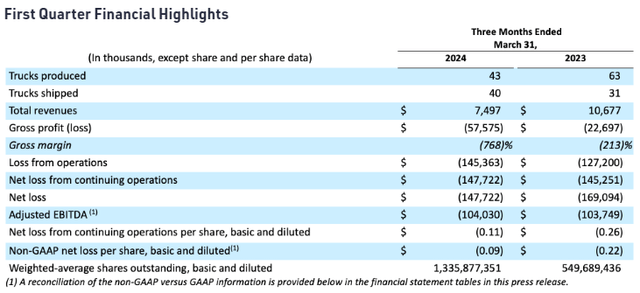

Last week, ailing zero-emission transportation start-up Nikola Corporation (“Nikola”) reported another set of painfully weak quarterly results:

While the company sold 40 FCEV trucks in Q1, revenues were impacted by a $8.0 million return reserve related to the cancellation of dealer agreements.

Reported gross margin of (768)% reached a new all-time low mostly due to higher inventory reserves and increased warranty accruals.

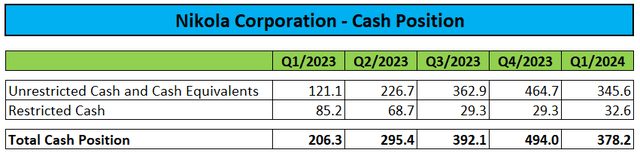

Unrestricted cash was down by approximately $120 million quarter-over-quarter to $345.6 million as the company abstained from raising additional funds during Q1:

Total debt and finance lease liabilities amounted to $274.6 million at the end of the quarter.

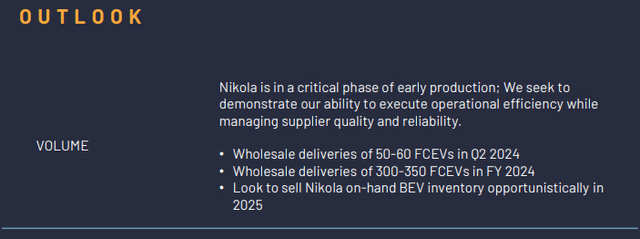

On the conference call, management projected 50-60 FCEV truck deliveries for Q2 and reiterated full-year expectations for 300-350 FCEV truck deliveries.

However, the company does no longer expect to sell down its existing inventory of BEV trucks this year, allegedly due to battery supply constraints.

In addition, management abstained from providing detailed second quarter financial guidance and updating full-year expectations, as the latest change in the company’s go-to-market approach is likely to result in Nikola falling well short of previous financial targets:

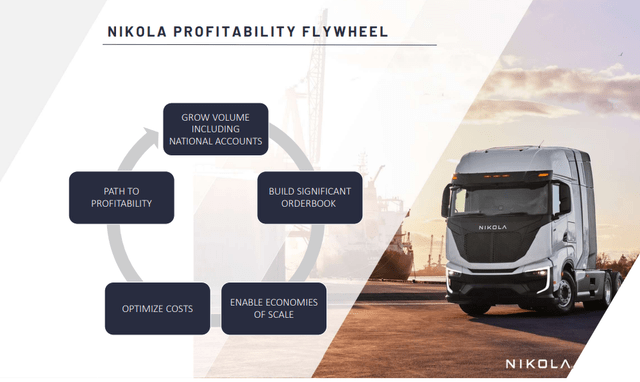

As outlined by the company’s new CFO Thomas Okray on the call, Nikola will be focusing on winning large national accounts in order to scale the business in a way sufficient to achieve profitability at some point going forward (emphasis added by author):

There is a market for our trucks and we’ve begun to demonstrate that. That said, profitability will not be where we want it to be until we can build scale. Simply put, it is not practical to optimize our cost structure without a meaningful level of volume. (…)

First, we are putting a greater focus on selling to national accounts, which we define as fleets greater than a thousand trucks. Second, we are being more forgiving on the economics of the initial deal to build confidence with our end fleet users. We are confident once end fleet users drive our trucks, they will be delighted and want more.

Finally, we are expanding our geographical focus beyond California and Canada. In short, we will leverage partnerships to build volume across North America. With meaningful volume, we will be able to provide our supplier partners with a consistent order book. The order book will enable suppliers to be able to provide their suppliers to optimize their cost structure by enabling economies of scale to reduce our bill of material.

While getting the company up to scale remains an imperative, the new focus on large customers is likely to become an uphill battle due to a number of key issues:

- Extensive testing is likely to be required.

- Decision making for potential large orders usually takes a considerable amount of time, particularly when it comes to new technologies.

- Ongoing lack of hydrogen infrastructure.

- Customer concerns regarding Nikola’s financial viability.

In addition, “being more forgiving on the economics of the initial deal” is likely to translate into even higher near-term losses and cash outflows.

At least in my opinion, there’s basically no way for the company to secure the number of firm orders needed to negotiate better terms with suppliers in the short- to medium-term as the markets for FCEV trucks remains in its infancy with required fueling infrastructure basically non-existent.

Adding insult to injury, the company is seeking shareholder approval for a reverse stock split at a ratio ranging from 1 share-for-10 shares up to a ratio of 1 share-for-30 shares and reduce the number of authorized shares from 1.6 billion to 1.0 billion.

However, adjusted for the proposed reverse stock split, the new number of authorized shares would calculate to between 10 billion and 30 billion. Effectively, the company is asking shareholders to increase authorized shares from 1.6 billion to up to 30 billion.

The issue was also raised in the questions-and-answers session of the conference call:

Second question why is the strategy being referred to as a reduction in authorized shares when it effectively increases the potential dilution for current shareholders?

Thomas Okray

It’s important for a growing company like Nikola to have access to capital. Therefore, having the flexibility to best position Nicola to raise capital efficiently and effectively is of critical importance. If not for reverse split, we would have had to request shareholder approval for authorization of additional shares to support the business. We analyzed both options, the reverse split or authorizing more shares, and the impact on shareholders in depth. We concluded that the reverse split provided the most financial flexibility we needed, discussed in the prior question, to achieve our objectives.

Even at the current rate of cash usage, the company will have to raise additional capital by Q4/2024 at the latest point, but for my part, I would expect dilution to resume soon after the company’s annual meeting on June 5 (assuming approval of the respective proposals).

Bottom Line

Nikola Corporation reported another set of disappointing quarterly results and essentially scrapped all previously stated financial expectations following another change to the company’s go-to-market approach.

However, at least in my opinion, the new focus on large national accounts is not likely to yield any tangible near-term results as customers remain wary of the company’s financial condition and requirements for hydrogen fueling infrastructure.

Considering the ongoing lack of a viable business model in combination with the proposed reverse stock split and a very high likelihood of additional near-term dilution, I am downgrading the stock from “Sell” to “Strong Sell“.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.