Summary:

- Ailing zero-emission transportation start-up Nikola Corporation reported another set of disappointing quarterly results.

- Painfully weak FCEV truck gross margins resulted in average cash losses of more than $450,000 for each truck sold during the quarter.

- Adding insult to injury, forward guidance was also well below consensus expectations.

- Based on the company’s projections, 2024 cash usage would be above $400 million thus consuming most of Nikola’s reported liquidity at year-end.

- Given the disappointing trajectory of the business and very high likelihood of further, material dilution, investors should consider selling existing positions and moving on.

Tramino

Note:

I have covered Nikola Corporation (NASDAQ:NKLA) previously, so investors should view this as an update to my earlier articles on the company.

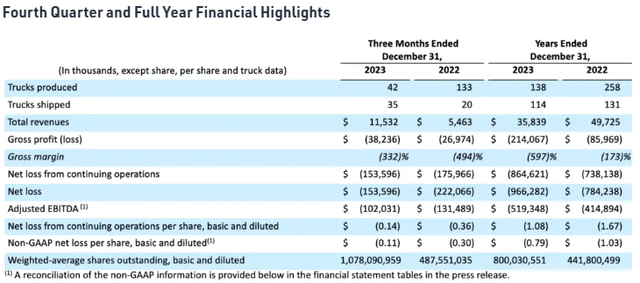

Last week, ailing zero-emission transportation start-up Nikola Corporation (“Nikola”) reported another set of disappointing quarterly results:

Company Press Release

While FCEV truck deliveries came in within the projected range of 30 to 50 trucks, gross margin of (332%) was a far cry from the (115%) to (135%) range anticipated by management on the Q3 conference call.

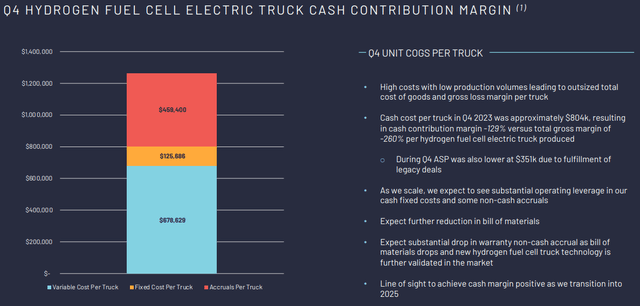

Company Presentation

However, on a cash basis, FCEV truck gross margin of (129%) would have met the company’s projections.

During the quarter, the average selling price per FCEV truck was just $351,000 as compared to stated expectations of $400,000 to $425,000 due to the fulfillment of poorly priced legacy deals.

As a result, the company suffered a cash loss of more than $450,000 on each FCEV truck delivered during the fourth quarter.

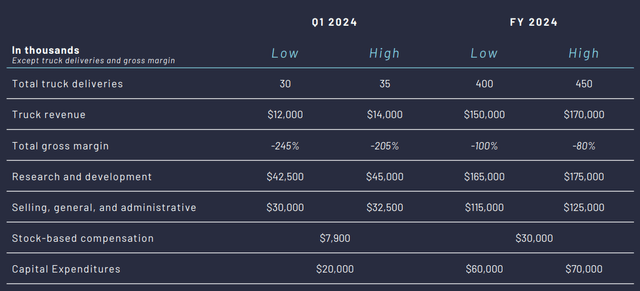

Adding insult to injury, forward guidance was also well below consensus expectations:

Company Presentation

While analysts have reset their models over the past week, projected 2024 truck revenue of between $150 million and $170 million was approximately 50% below consensus expectations going into the Q4 earnings release.

On the conference call, management outlined expectations for truck cash contribution margin to turn positive going into 2025 which at least in my opinion appears to be an overly aggressive target given Nikola’s ongoing challenges.

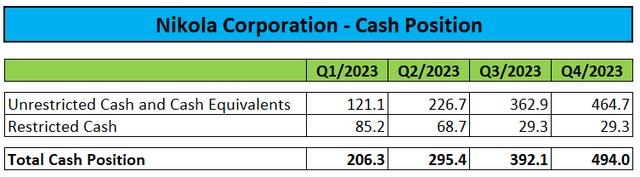

Based on the company’s guidance and generously assuming a full-year truck cash contribution margin of (50%), 2024 cash usage would be above $400 million thus consuming most of Nikola’s liquidity at the end of Q4:

Regulatory Filings

During the questions-and-answers session, CEO Steve Girsky got poked by an analyst on the issue and responded rather indignantly, in my opinion:

Jeff Kauffman

(…) So if I walk through the guidance that you gave and then my math might be a little fuzzy here because I’m kind of in a pay phone booth with my cell phone here. But it looks like somewhere in the low $400 million cash burn ex depreciation, ex stock-based comp, does that mean you’re going to have to raise capital again before the end of the year or do I have the…

Steve Girsky

Yes. So listen, we have the highest cash, unrestricted cash we’ve had in two years. We actually have more cash than that burn, okay. Second half is going to be materially lower than first half and we have assets we could sell that we could monetize. So we’ll figure out what we need to do when we need to do it, but we don’t need to do it right now that’s for sure.

Quite frankly, considering projected cash usage I wouldn’t be surprised to see Nikola raising a substantial amount of capital in the second half of the year to avoid running out of funds in early 2025.

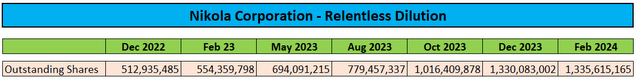

However, this would likely require another substantial increase in the company’s authorized shares as Nikola is not far from bumping against the just recently doubled 1,600 million ceiling. As of December 31, the company had 1,330 million shares outstanding with another 130 million reserved for issuance.

Regulatory Filings

At prevailing share prices, Nikola would be able to raise approximately $100 million, insufficient to fund the business in 2025.

Consequently, I would expect the company to ask shareholders for approval to raise the number of authorized shares even further.

But with Nikola’s sales efforts currently limited to California and Canada, the company will likely be challenged to scale truck manufacturing operations to economically viable levels in the near- to medium-term.

At this point, there’s simply not sufficient demand to achieve a quarterly run rate of 300 trucks allegedly required to reach gross margin breakeven levels. But even if Nikola would somehow manage to cross this mark next year, the company would still be far from generating free cash flow.

Given this issue, shareholders better prepare for substantial further dilution in the second half of this year and 2025 in order for Nikola to keep the lights on.

Bottom Line

Nikola Corporation reported less-than-stellar fourth quarter results with dismal FCEV truck margins. In addition, the company provided underwhelming guidance for both the first quarter and full year 2024 as truck sales are expected to remain well below break-even levels.

Considering the company’s unrestricted cash balances and anticipated 2024 cash burn, I would expect Nikola to raise more capital in the second half of this year at the latest point.

Please note also that the company is not in compliance with the Nasdaq’s $1 minimum bid price requirement. However, Nasdaq has provided the company a 180-day grace period until July 17.

Given the disappointing trajectory of the business and very high likelihood of further, material dilution, investors should consider selling existing positions and moving on.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.