Summary:

- Nikola’s stock has fallen 57% since July, with ongoing challenges and leadership changes.

- The company has produced a hydrogen fuel cell Class 8 vehicle, which could prove to be a positive development.

- Dilution is a concern, with the potential for an additional $200 million in shares and a declining stock price.

Electric truck Nikola on a street Tramino

A Rocky Ride

It’s been a tough year for Nikola (NASDAQ:NKLA), the maker of electric semi-trucks. We last wrote about the company in July of this year (you can read that article here) when the stock surged from roughly $0.60 per share to the $2.50 range (it eventually climbed to almost $3.50). At that time, we were negative on the stock, and it has fallen 57% since then.

NKLA Performance (Seeking Alpha Analyst Page)

In this article we’ll take stock of what could be In store for Nikola, and whether or not the current price, in our view, warrants optimism. Let’s dive in!

The Story Today

A lot has transpired since we last covered Nikola, notably:

- The company upped its capacity to offer equity in the open market from an aggregate of $400 million to $600 million

- CEO Michael Lohscheller departed the company effective August 4th, with Stephen Girsky appointed as his replacement (Lohscheller had been CEO since January 1st, 2023)

- The departure of company Carey Mendes, who was the President of Nikola’s energy segment, and the appointment of Joseph Capello to the position

- The appointment of John Vesco to the Board of Directors

- The appointment of Mary Chan to serve as the company’s Chief Operating Officer

- A recall of 209 of the company’s BEV trucks due to two fire-related incidents was announced on August 11th

Whew. That’s a lot of ground to cover for only three months of time.

Investors have been understandably sour on the stock with all of the goings-on, but we are always on the lookout for rays of hope in a possible turnaround story.

To that end, Stephen Girsky hosted a special call for investors on September 13th, where he addressed the state of the recall. Importantly, he noted that while the recall affected the company’s battery-powered electric trucks, it did not affect the production and sales of the company’s hydrogen fuel cell trucks.

He stated:

We began production of the hydrogen fuel cell electric truck on July 31, and the first production vehicle came off the line in Coolidge approximately 2 weeks ago. We plan to begin delivering the trucks to dealers in late September and early October, and we’ll have a launch celebration in Coolidge on September 28, where we will have our customers, dealers and other partners in attendance.

Following that event, we will ship the first production fuel cell trucks to dealers and shortly after they will be delivered to customers for operation in their fleets. To date, our dealers have received more than 210 nonbinding orders for the fuel cell truck.

Some of those customers include large fleet operators like J.B. Hunt, Biagi Bros. and TTSI. We want you all to be aware that the battery electric truck recall does not affect the production or deliveries of the fuel cell electric vehicle since it uses a different battery pack from a different supplier.

This is notable, if only for the fact that the company has actually produced a hydrogen fuel cell Class 8 vehicle. Unlike smaller Class C vehicles, the sheer weight of Class 8 poses a special challenge–to generate any significant amount of range, an enormous battery is needed. Hydrogen, while often cited as a pipe dream of green-tech enthusiasts, at least is theoretically proven to bypass the weight problem.

Girsky also stated in the call that one of the company’s hydrogen trucks had recently covered 900 miles in one day – a serious feat.

We wouldn’t venture out onto any limbs here and state that Nikola is on the verge of achieving the future, but rather we believe that – if properly developed – these green shoots could turn into something meaningful for the company.

It should go without saying, however (we’ll say it anyway), that we want to see cold hard results from the company on the business front before becoming any more optimistic.

The Specter of Dilution

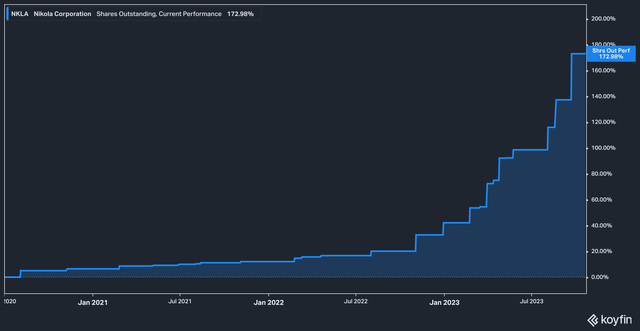

Returning to the first bullet point on our list of notable events in recent months, Nikola is nothing if not a prolific issuer of shares. Since July 2020, the outstanding share count has grown by 172%.

The prospect of adding an additional $200 million of dilution out there, waiting in the wings, does not inspire good feelings, especially when you consider that the current market capitalization of the company is only $945 million.

So, yeah, it would seem as though shares bought today are risking a 20% haircut in terms of dilution right off the bat. Oh, and that isn’t counting the $40 million of senior convertible notes that were issued on September 22nd, 2023.

There is, however, a counter-argument to be made that the dilution has already been accounted for:

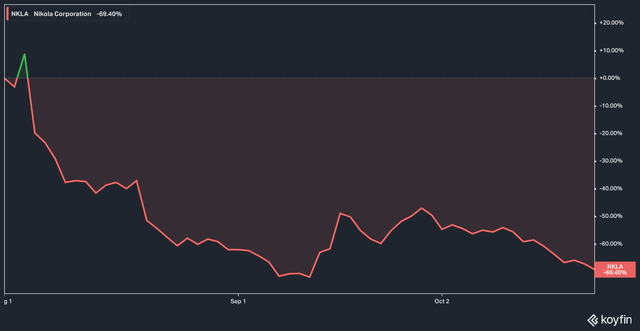

NKLA Stock Performance From August 2023 to Present (Koyfin)

Since the start of August, shares have been on a downward tear, declining by almost 70% in that time.

While we would not say that we believe Nikola to be a deal after this price decline, it would seem as though the market has more than taken into account the potential for current and future dilution prospects.

The Bottom Line

Nikola still has a long, long way to go in order to rebuild investor confidence. We must note, however, that the messaging from the new executive leadership team does seem to be quite upbeat. However, given the chaotic past three months that the company has endured, we think that extreme caution is warranted and that the company will need to generate a solid track record of sales and proven product development before optimism is warranted. At the end of the day, talk is cheap–Nikola will need to deliver.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist, and while they will be corrected if identified the author is under no obligation to do so. Author Is also under to obligation to update changes of view. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.