Summary:

- Nikola Corporation and Hyzon Motors Inc. kickstarted 2023 with uncertainty over their respective futures.

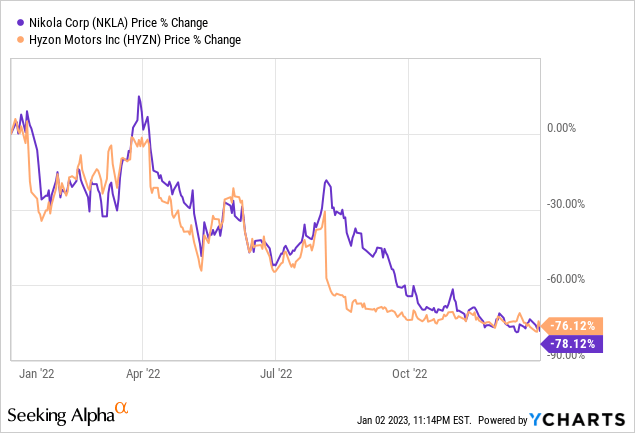

- Both FCEV truck companies have suffered huge drawdowns over the last 12 months and are trading closer to Nasdaq’s $1 minimum listing requirement.

- Whilst they both stand to benefit from significant government support, their respective liquidity positions are fast falling.

Aranga87/iStock via Getty Images

Nikola Corporation (NASDAQ:NKLA) slipped 10% last week Friday following its disclosure of a securities purchase agreement to sell up to $125 million in senior convertible notes. The Form 8-K provides more information on what looks to be an aggressive move by the Phoenix, Arizona-based FCEV (fuel cell electric vehicles) company to shore up its balance sheet and stave off the specter of a liquidity crisis. The notes will accrue interest at 5% per annum but come with a voluntary conversion clause that provides the noteholders with the option to convert all or any portion of their principal into common shares at the volume-weighted average price on or after January 9, 2023.

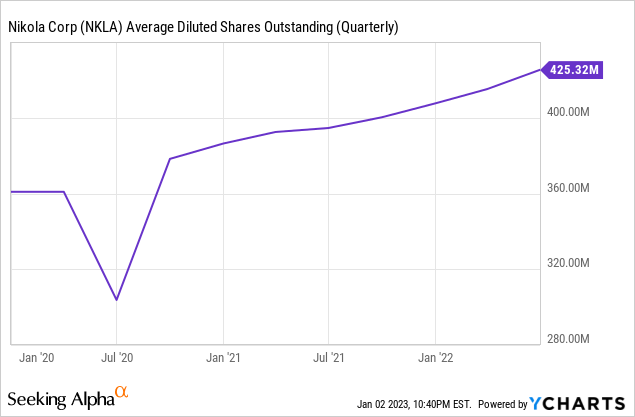

Nikola has essentially kickstarted its new year with dilution that amounts to 12% of its market cap to reignite angst over its future. The company’s cash and equivalents as of the end of its last reported fiscal 2022 third quarter was $320 million, but that was against capex of $51.1 million and negative operating flow of $157.6 million. The combined total of $208.7 million was a material increase from outflows of $118.3 million in the year-ago comp and highlighted how critical the situation is for Nikola.

Liquidity Gaps And Uncertainty To Kick Off 2023

Mirroring this uncertainty is Hyzon Motors Inc. (NASDAQ:HYZN), which faces February 13, 2023, as a deadline to file its long-delayed fiscal 2022 second-quarter earnings report. The Rochester, New York-based FCEV truck developer held cash and equivalents of $407.3 million as of the end of its last reported quarter, but this has likely been reduced to around $300 million following three consecutive quarters of total cash outflows running in parallel to their first quarter figure of $34 million. There is no indication that the company will file on time as shareholders stare at the very real prospect of their investment being delisted from the Nasdaq.

The company has continued to make operational progress, recently fully acquiring the remaining 1.485 million shares, around a 49.5% stake, in Hyzon Europe that it did not own for a total consideration of $5.84 million. Hyzon Europe was flagged by management for operational inefficiencies that were material enough to have an adverse effect on the company’s ability to produce and sell vehicles on the continent. Whilst it’s not quite clear if the investigation launched by its board of Directors into revenue recognition timing issues in China was extended to Europe, it’s odd for the new management, after the exit of ex-CEO Craig Knight, to push through with the acquisition of a unit without fully disclosing what the identified inefficiencies are and what remedies are being implemented.

The company currently trades at a market cap of $384 million, down from $2.8 billion when it went public and against an annualized revenue as per its last reported quarter of $1.6 million. However, leaning on any financials would be a somewhat meaningless endeavor, as its historical revenue recognition is structurally flawed. These numbers formed the basis by which it went public and the length of time it has taken the company to rectify the issue perhaps highlights the intensity of the headwinds it faces to correcting it.

Further, whilst bears would be right to state there is a visceral oddity in the company’s lack of communications, we do know that Hyzon has sold all its $3.1 million equity interest in Hyzon Guangdong to the controlling shareholder of the unit. The company again looks to be making a major policy decision without disclosing the outcome of investigations. The full exit and wind down of commercial truck sales in China is a big decision that drastically reduces the overall total addressable market Hyzon serves despite the company maintaining a China-based R&D and procurement unit.

This comes as the commons for Nikola and Hyzon are down by 78% and 76%, respectively, far below their initial $10 SPAC reference price. They both now face the very real prospect of moving below Nasdaq’s $1 minimum listing requirement, which would create an additional layer of uncertainty and the broadly unattractive proposition of a reverse stock split.

Both companies went public via blank check firms, Nikola in June 2020 and Hyzon just over a year later in July 2021. That both FCEV truck companies have ended up in a position characterized by marked uncertainty over their respective futures has likely tainted the fledgling FCEV industry and fundamentally rendered it less of a serious contender for the enthusiasm and broader hype that’s been extended to pure EV companies. Sales of heavy-duty FCEVs look likely to start to bloom as a number of models move from development to production over the next few years. This includes FCEV trucks being developed by Daimler Truck (OTCPK:DTRUY), Hyundai Motor (OTCPK:HYMTF), and Volvo Trucks (OTCPK:VOLAF).

Demand will also likely be majorly driven by several national and state government incentives. Indeed, Nikola is chasing a base incentive award of $240k per Nikola Tre FCEV from California’s Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (“HVIP”). The HVIP award can also be layered on top of the $40k in clean commercial vehicle tax credits from the Inflation Reduction Act. Hence, the company could realize a healthy jump in sales on the back of these financial incentives. Hyzon is approved to sell its FCEV trucks in California as it received certification from the California Air Resources Board in June 2022. This certification is the primary requirement for HVIP eligibility, which is still pending for Hyzon.

The Hydrogen Part Of The Climate Economy Is Stumbling

Assuming Nikola’s fourth quarter free cash outflow is reflective of the third quarter, the company’s new funding would see its cash position at around $237 million. Shareholders should hope its quarterly burn rate has collapsed because the current trajectory is not sustainable and would see a runway that would likely not extend past the summer of 2023.

This comes as Nikola’s average diluted shares outstanding have been skyrocketing to continue to offer shareholders dilution. No longer being a going concern is a very real risk for Nikola, and its commons will continue to reflect this. However, the company did lay off 7% of its headcount in September, around 100 employees. This is unlikely to be deep enough. Hence, the key difference between both companies is their runways. At its current rate of burn, Nikola is set to run out of cash by the end of the year, whilst Hyzon has more time. Hyzon also has more time if it meets the February deadline to wait for a possible market recovery to issue more shares to fund a ramp of its FCEV truck.

Nikola’s Tre FCEV semi-truck is expected to begin production in the second half of 2023 and then start its ramp in early 2024, whilst the Hyzon Class 8 Freightliner is already being delivered to customers. This has around 500 miles of range, refuels in 15 minutes, and has a high voltage 110 kWh battery energy. The Tre FCEV also has 500 miles of range and refuels in around 20 minutes. Hyzon is pushing a more asset-light approach and intends to only manufacture fuel cell powertrains while sourcing and assembling various parts from other suppliers. Nikola is underway with developing its Coolidge, Arizona, manufacturing facility, which it plans to scale to a production capacity of 20,000 trucks.

Ultimately, I think the climate economy will come to form one of the most attractive industries for investors over the next decade. It describes the companies that are building the infrastructure to facilitate the shift towards a global low-carbon future and hydrogen uptake has been placed as a critical enabler of this. Essentially, if we are to reduce and ultimately eliminate anthropogenic climate change, companies building FCEV trucks will have to execute their roadmaps. The International Energy Agency spells out a future where FCEVs are needed now to enable substantial emission reductions in the 2020s and 2030s.

The underlying structural policy demand drivers for FCEV truck adoption will continue to be healthy as to reach ambitious net-zero targets we will need to decarbonize heavy-duty trucking. The industry’s green credentials are dire with 38 billion gallons of diesel fuel consumed each year in the United States to form one of the fastest-growing sources of carbon emissions. Whilst I think both stocks are to be avoided, Hyzon could rally if it finally files its missing results, and Nikola could, too, if announces a new partnership deal.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.