Summary:

- Nikola Corporation reported record revenue for Q2, while beating guidance. That resulted in a slight positive move in the stock price to end last week.

- NKLA’s economics are nowhere near viable at the moment. The higher production it achieves, the greater the net loss in a near-linear fashion.

- NKLA has two quarters of cash remaining. It will dilute more this year.

- At the current burn rate and market cap, investors can expect 100% dilution each year until the burn rate significantly improves.

Arthur Kaszuba/iStock via Getty Images

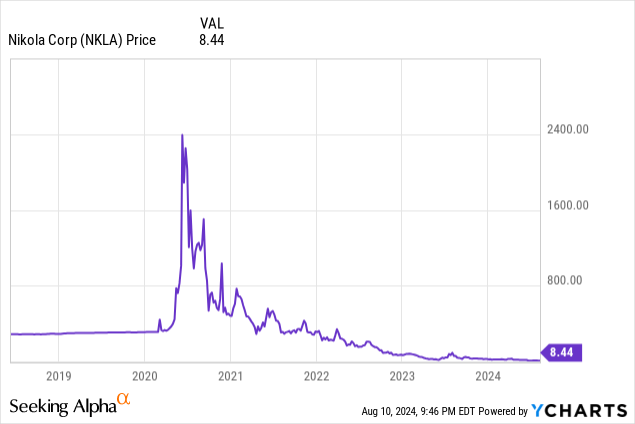

Nikola Corporation (NASDAQ:NKLA) announced its Q2 results last Friday. Investors were pleased with the results, sending the stock up 8%. My repeated strong sell calls at the peak of its hype in 2020 have been my most prolific articles on Seeking Alpha. After four years and an essential wipe out of greater than 99% of those investors at that time, I believe that the company is still nowhere near investible. Investors should take any temporary increase in price as an opportunity to get out of the stock in a slightly better position than the previous day. I see no path forward that doesn’t result in substantial losses for shareholders.

Q2 was a valiant effort, but not nearly enough to move the needle

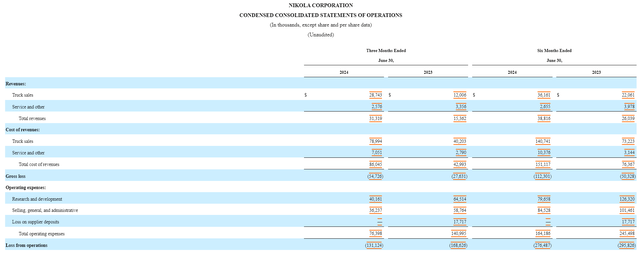

NKLA was up for good reason, as headlines of earnings beats and record revenue on the delivery of 72 hydrogen-powered vehicles made for a feel good turnaround story. However, when reviewing the company’s Q2 financials in greater detail, reality sets in:

Revenue may have more than doubled for the quarter from $15 million to $31 million, but so did the gross loss from $28 million to $55 million. Gross margin percentage barely moved in the right direction as it went from -180% in Q2 2023 to -175% in Q2 2024. With record deliveries and record revenues comes greater gross margin losses. The company is nowhere near the volume it needs to be before unit economics even at the gross profit level starts to make sense. At this stage of its growth, it’s just going to lose more money faster as the $351,000 average sticker price for its truck is barely half of what it costs to make.

The company has made progress in reducing its R&D and SG&A costs, but this still resulted in a $131 million operating loss for the quarter. While this is an improvement from the $169 million loss achieved in Q2 2023, it’s the equivalent of plugging one hole in a leaky boat when four more exist.

Dilution has wiped out legacy shareholders, and it looks like it’ll do the same to current ones

Tesla, Inc. (TSLA) once had losses far greater than this, and one could bring forth a fair argument that it is totally reasonable to expect a disruptive EV company like Tesla or Nikola to lose big money in the early stages. That’s all well and good, but Tesla always had at least $3 billion in cash on its balance sheet at any given time. It was also at the peak loss part of its growth stage back in 2017 when borrowing money was still cheap.

Nikola had only $256 million in cash on its balance sheet as of June 30th. Based on its current burn rate, it has maybe two more quarters worth of funds before it either raises cash or goes insolvent. In the going concern section of its Q2 filing, it made it clear that the company does not have enough funds to continue as a going concern for the next 12 months without raising more funds. It intends to use the equity distribution agreement it has with Citi, which was recently increased to an aggregate of $600 million.

While having already diluted its shares by over 300% from 12 million to 50 million since listing, NKLA needs to finance once again with no hopes of significantly improving the financials in the near term. Its annual burn rate is comparable to its market cap, which means it will have to dilute 100% every year at this pace.

NKLA’s fuel cell trucks remain a fun science project with limited ability to profitably scale. Investors are currently funding that science project, much like how the government might fund the military or NASA. However, when the government invests into these initiatives, there is reasonable expectation of an eventual return years down the road in the form of advanced technology or a proud achievement. By the time (or if) a FCEV truck business becomes financially viable, NKLA shareholders will either be completely wiped out or diluted to the point that they are essentially wiped out. Much like how buy and holders back in 2020 feel today. For investors who are adamant in holding stock in this company, thank you for funding the R&D required for the benefit of future generations. However, it’s very unlikely that your investment will pan out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.