Summary:

- Nikola Corporation’s Q3 earnings report did little to change the long-run story of the stock.

- Production and deliveries became negligible in the quarter, and the company reported wider losses and negative revenue.

- Nikola lags behind competitors in terms of scale, technology, and brand reputation, and faces structural hurdles in becoming a viable electric vehicle manufacturer.

- While the pivot to the California Market appears promising at first, I am skeptical if this market is big enough to support Nikola’s overhead.

Geetarism

Introduction

Nikola Corporation (NASDAQ:NKLA) released its Q3 2023 earnings on Thursday, November 2nd before the bell. Revenue of -$1.73 million due to the firm having to buy back old trucks is a bad start. With negative revenue, a smaller total addressable market (“TAM”) focus of California market that may be too small, and unproven tech, I am doubting Nikola’s ability to meet long-term projections. If more people doubt their ability to scale, this will certainly impact their ability to raise more funds to operate. It’s a vicious cycle that I do not think will end well.

This most recent quarterly report highlights not only Nikola’s financial stance but also its struggles for long-term growth, which appear uncertain.

Company Background

Nikola Corporation was founded in 2014 by its now-disgraced (convicted of one count of fraud) founder Trevor Milton. The firm originally had success, claiming billions of dollars in preorders and lease agreements for the commercial BEV (battery electric vehicle) and hydrogen trucks it developed.

Milton was indicted for securities fraud related to Nikola. The stock has been largely declining since peaking after its IPO through a SPAC in 2020. Recently, there was a jump over the summer related to the firm getting approval to sell more shares, a meme stock frenzy, issuing a convertible note to raise $250 million in additional borrowings plus the initial excitement around the production of hydrogen trucks. The firm also just won an arbitration against Milton resulting in $165 million in damages being paid to the firm. While these are all positive developments for bulls looking for a turnaround, I believe the firm is still plagued with problems.

Since mid-summer the stock has been trending down, now trading just over a dollar per share, as recent battery electric truck fires have forced a recall of all of the firm’s BEV trucks it launched.

Q3 Earnings Recap & Bearish Investment Thesis

I believe Nikola’s stock continues to be at high risk post Q3 earnings release. I believe the set of multi-prong problems collectively poses an insurmountable challenge:

- Production and deliveries declined significantly in Q3 2023, indicating slowing momentum. Nikola produced 0 trucks in Q3 2023 and delivered just 3 trucks. With the closure of battery production facilities after acquiring Romeo Power, and the fallout of the battery fire recall, the company stalled production.

- Nikola reported a loss of 30 cents/share for Q3, missing by $0.16/share. Profits continue to be elusive with the firm losing $425.8 million in the 3rd quarter along.

- Revenue Completely collapsed to $-1.73 million in Q3, down from $24.2 million in Q3 2022.

- Management conveyed they need to raise $600 million to be EBITDA positive by the end of 2025 (Q3 Earnings Call). This is not even net income, but EBITDA income. This will result in massive dilution. The firm had $362.9 million in cash at the end of Q3, not including the Milton Settlement (Q3 Earnings Release). They will likely have to raise more soon.

- Deliveries looked weak for Q4 as well, with just 30-50 trucks projecting to be delivered.

- Much of the recall strategy appears to hinge (based on today’s conference call) on new battery technology, which from what it appears, comes from a now bankrupt supplier (Proterra Inc). Management refused to address it, saying “…we’re not talking about the BEV supplier yet, it’s premature to talk about that..” -(Q3 Conference Call).

Due to these hurdles (and more detail below), Nikola stock is definitely not one I’d recommend.

Q3 Execution Analysis

Nikola’s Q3 earnings showed the company still in the very early stages of development and commercialization but with multiple hurdles. The EPS loss, negative revenue, and almost zero deliveries indicate Nikola’s failure to capitalize and revitalize their situation. While new management pushed to focus on quality and deal with the recall vs. push out of more trucks, the firm has to move faster in my opinion to survive. They are burning through cash.

Meanwhile, other EV makers like Tesla (TSLA), Rivian (RIVN), and Li Auto (LI) have rapidly expanded production and deliveries to meet strong demand in 2023:

-

Rivian delivered 15,564 vehicles in Q3, which is up 2,924, sequentially, since Q2

-

Li Auto delivered over a record of 105,108 units in Q3, up 296.3% year-over-year.

-

Tesla delivered over 435,000 vehicles in Q3, which continues to target 1.8 million in volume for 2023.

Nikola’s Q3 deliveries of just 3 trucks is negligible. The company is falling further behind leading EV manufacturers in terms of scale, technology, and brand reputation. While some of these automakers do not directly compete with Nikola, their ability to scale (and learn from it) can make it easier for them to enter into the BEV Commercial Truck market later (such as Tesla).

Nikola’s recent closure of battery production facilities acquired from Romeo Power also points to persistent underlying execution issues. The company bought the company for $144 million in stock just last year, but they are now liquidating it.

Longer-Term Concerns

Beyond the underwhelming Q3 report, Nikola confronts significant structural hurdles in its journey to be recognized as a viable electric vehicle/hydrogen fuel cell truck manufacturer.

Limited Production Capacity

Nikola’s CFO confirmed its guidance on the Q2 earnings call of producing a combined 300-400 FCEV and battery-electric trucks in 2023, a tiny fraction of competitors’ volumes. This has been pared back significantly with the installment of the new CEO and dealing with the recalls. Nikola’s (non-binding) order book of just 277 trucks points to weak demand relative to the order backlogs of Tesla, which, according to an independent media source, has received 2,000 orders for its Semi truck. Tesla aims to produce and deliver 50,000 of these trucks in 2024. Positive feedback from early adopters like Pepsi and Walmart could further boost demand for Tesla, too.

Unproven & Expensive Technology

Nikola has yet to validate its battery electric and hydrogen fuel cell technologies on a large commercial scale. Its trucks remain in field testing by customers, which recently have been recalled. Competitors like Tesla have already deployed tens of thousands of vehicles utilizing proven battery technology. This technology is highly transferable to heavy trucks.

In addition, hydrogen fuel cell trucks will need to be serviced by hydrogen fuel cell refueling stations. These have infrastructure challenges (below) but also are likely more expensive to refuel. The current cost for hydrogen is about $25/kilo. Market participants estimate that the cost will need to get closer to $6-10/kilo in order to solicit more demand. Unproven, expensive tech will put a lid on demand.

In addition, the tech (due to its novelty) is likely to be less robust. Even the battery electric trucks the firm launched had to be recalled, resulting in an estimated $61.8 million (and counting) in losses/charge offs. Battery electric technology is more proven than hydrogen fuel cell batteries at scale, yet Nikola has struggled with this. I am skeptical they will be able to provide robust technology here that scales and will not malfunction as well later. After all, even their supplier (Proterra) may not even be in business going forward.

Hydrogen Infrastructure Challenges

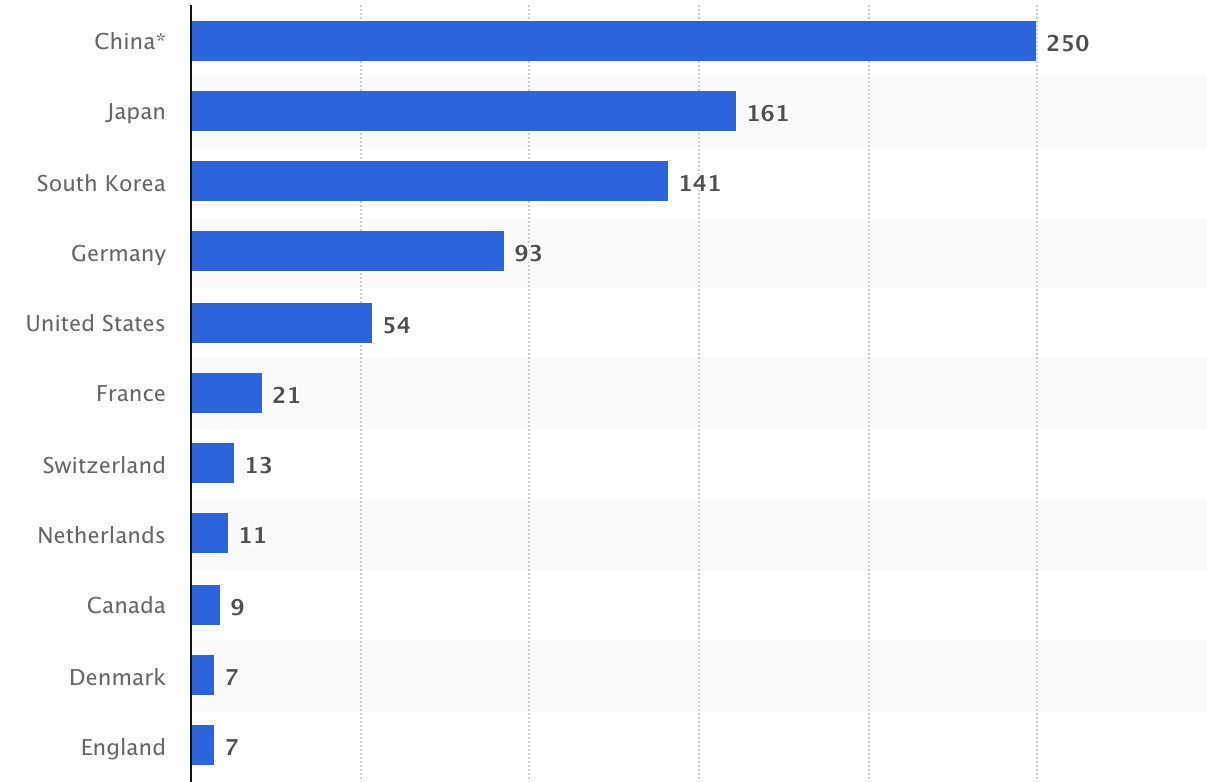

Nikola’s hydrogen fuel cell ambitions face immense infrastructure requirements, with limited hydrogen refueling stations available globally, which is depicted in the graph below that illustrates the number of hydrogen fueling stations for road vehicles worldwide as of 2022, by country.

Global Hydrogen Refueling Stations (Statista)

Additionally, major competitors are focused on scaling battery-electric vehicles that leverage existing electric grids for charging. Moreover, building out a competitive hydrogen refueling network could take decades and major capital. The firm has leaned on 9 mobile refueling stations for the hydrogen fuel trucks (Q3 Call).

I question how scalable this will be when their trucks will be driving all over California (their new focus market). Nikola is trying to reinvent both the propulsion type of commercial trucks and the refueling station (usually fueling stations are stationary). Doing one is hard, doing both at once is really hard.

To counter this, the company has announced they have leaned into the California market in order to find a place that supports the development and commercialization of hydrogen electric trucks. The incentives in California allow for BEV/Hydrogen trucks to up to over $696,000 per truck off their purchase price. Management on the earnings call Thursday noted there are “30,000 trucks servicing the ports in California” and that all new trucks for these ports servicing California starting in 2024 will need to comply with California’s new zero emissions standards. Granted, this is a powerful government carrot and stick setup, but the TAM (total addressable market) annually for this might be lower than it appears (see below).

Financial Risks & NASDAQ Inclusion

Nikola had just $362.9 million in cash remaining as of Q3 2023, very little for an auto manufacturer ramping production. Tesla, for reference, raised billions of dollars to fund their expansion to reach profitability. The company simply does not generate meaningful revenue to fund growth initiatives. As I mentioned before, management already stated they need an additional $600 million to get to “EBITDA positive” by 2025. This does not even mean net income profitability. As this $600 million is issued, some of this can come in the form of debt but much will have to be stock issuance due to high interest rates. The company’s current market cap is at $1.06 billion, meaning anything close to a fraction of this $600 million being issued in stock will significantly increase share count.

If Nikola shares fall below $1/share they also risk delisting from Nasdaq, so they would have to do a reverse stock split. This (combined with the stock issuance to fund operations) sets us a vicious dilution cycle that could destroy the remaining shareholder value.

TAM of the California Market

Finally, while I admire management’s focus on a target market of California and striving to do well in it, I question the true size of this market. With the estimated price of $750,000 per truck, and a total of 30,000 Commercial trucks in California implying a TAM of $22.5 billion, this feels big on the surface. But keep in mind that not all 30,000 of these trucks will be replaced immediately. In fact, California has given truck operators till 2035 to replace many of these trucks.

Switching costs to a new fuel are high and the cost to refuel with hydrogen is expensive. Given this, it is highly unlikely that they will capture a large part of this market immediately. And with the firm losing over $1 billion over the last 12 months, they would have to capture a massive part of this market up front in order to reach a profitable scale. Even at $22.5 billion this market appears to be too small for Nikola to reach scale. Their order book of 277 trucks compared to 2,000 for Tesla’s Semi truck indicates lukewarm demand as well.

Why I am a hold (and not a short)

To be clear, I think there is a very real chance this stock could go to zero. Being short here is hard, however. Short interest is at 21.2%, so any sudden spike or breath of good news could cascade into short covering. Being short here is risky, I think it’s best to avoid the stock and get out.

Conclusion

Nikola’s Q3 earnings were disappointing, to say the least. The road to profitability, or “EBITDA positive by the end of 2025” – I am skeptical of this language – will likely be an uphill battle to win. When combined with Nikola’s tough battery technology supply chain, unproven business model, and sizable competitive risks, the Q3 earnings reinforce that NKLA remains a highly speculative investment even after the stock’s deep pullback from all-time highs.

Significant milestones must still be achieved in terms of manufacturing scale-up, hydrogen infrastructure buildout, and technological validation before Nikola warrants consideration as a viable long-term investment. In the meantime, I believe investors should avoid Nikola Corporation shares given the underwhelming execution, financial risks, and uncertain outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox is the Co-Managing partner of Noahs' Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.