Summary:

- Nikola stock has seen a sharp drop-off over the last 12 months due to persistent doubts about its long-term viability, but recent Q2 earnings show signs of a turnaround.

- The company’s focus on hydrogen fuel-cell trucks in California presents a unique opportunity for growth in the zero-emissions trucking industry.

- Despite competition from Tesla and limited hydrogen infrastructure in the US, Nikola’s strategic positioning in California and potential international expansion offer significant upside potential for investors.

- With this, I think NKLA stock is now a strong buy.

David McNew/Getty Images News

Investment Thesis

Since my last piece in the fall, Nikola’s (NASDAQ:NKLA) shares have largely continued on their downward slope. The company has been struggling to shake off years of setbacks and the overhanging cloud of crimes that Nikola’s founder and convicted felon, Trevor Milton, committed. Nikola’s stock was in a consistent decline, dropping for nine consecutive sessions earlier this month and down approximately 19% at the low earlier this month.

Despite the rally following their 2Q earnings report, where Nikola exceeded delivery guidance, the market’s response has been overall negative, with shares still below where they were on July 31st. I think the main reason for the decline is the persistent broader skepticism about the company’s long-term viability, particularly as they continue to face large challenges in profitability. Investors really remain cautious, as Nikola’s efforts to restructure and focus on hydrogen fuel-cell trucks have not yet translated into a sustainable turnaround. The stock has lost over 85.5% of its value over the last 12 months.

However, with this sharp selloff in shares, Nikola’s stock has now priced in a lot more pessimism than any other point in recent history, despite what I believe to be a turning point with this last quarter. Shares may even be considered “cheap” by some metrics based on sector median valuations. With shares now trading at a fraction of their previous highs, Nikola offers an interesting, albeit high risk, potential upside for investors willing to stomach some risk. If investors are willing to bank on the possibility of a turnaround, this might be a highly fruitful play.

Nikola is currently the only original equipment manufacturer (OEM) offering a Class 8 hydrogen fuel cell vehicle, which sets their business apart in the zero-emissions trucking industry. The company has successfully produced and wholesaled a series of these vehicles in this niche market (trucking in California) which offers them the opportunity to scale their business in what would be the world’s 5th largest economy standing alone. At a time when their market is increasingly demanding sustainable transportation solutions for longer haul trucking, the company’s well-crafted plan is more timely than ever. The opportunity is real.

While the company has faced more than its fair share of challenges, including operational setbacks, the focused (and now mildly successful) approach to hydrogen gives me reasons for optimism. By narrowing their focus, Nikola has likely gained the operational efficiencies and market penetration they will need to thrive.

I believe after the last quarter, the market has begun to recognize the potential upside in Nikola’s pivot. I view the stock now as a strong buy.

Nikola Q2 Earnings Review

In their 2Q earnings call, Nikola noted they have begun seeing encouraging momentum in their hydrogen pivot. The Hydrogen truckmaker reported a whopping revenue increase of 318% QoQ to $31.3 million, marking the strongest revenue quarter in the company’s history. Overall revenue of $31.3 million beat by $5.13 million and EPS of -$2.86 missed by $0.01. This was driven by higher wholesale deliveries, stronger average sale prices, and the sale of regulatory credits. In particular, the company delivered 72 hydrogen fuel cell electric vehicles (FCEVs) in the past quarter, exceeding the high-end of their guidance range by 20% (estimates called for up to 60 vehicles). I believe this is a clear sign that Nikola’s turnaround efforts are starting to take hold.

CEO Steve Girsky emphasized the company’s commitment to their strategic goals:

The market acceptance of our FCEVs bears out with every zero emission mile driven. Therefore, not only are we getting more calls from fleets interested in deploying fuel cell trucks, but also from strategic partners like automotive OEMs, suppliers, hydrogen producers, and big energy who recognize our key role as a first mover in the hydrogen economy -Q2 Call.

This quarter’s rock solid performance, including the repeat orders from national accounts, supports Girsky’s assertion that Nikola is gaining traction in the market. The CEO also pointed out that Nikola’s profitability flywheel is beginning to gain momentum, particularly as the company expands its relationships with national accounts like Walmart Canada, which became the first major retailer in North America to introduce a Nikola Class 8 FCEV to its fleet.

Girsky’s remarks during the call also emphasized the qualitative improvements in Nikola’s operations:

We are attracting prospective partners such as large logo and fleets, big energy, hydrogen producers, and automotive OEMs who recognize the need for a zero-emission world. Seeing is believing. The more fuel cells we deliver, the more like-minded partners want to work with us -Q2 Call.

Nikola has also positioned themselves within California’s lucrative transportation corridors, particularly between Los Angeles and San Francisco, which are among the most heavily trafficked routes in the state. This region presents a huge opportunity for the company because of the high volume of goods movement and the state’s aggressive push towards zero-emission vehicles (ZEV).

Nikola’s HYLA refueling network, which includes recently inaugurated stations in Southern California, are strategically located along key freight corridors such as those near the Port of Long Beach, Ontario, and other high-traffic areas. Nikola’s focus on building robust hydrogen infrastructure will help in capturing a large share of the growing demand for sustainable transport solutions in California. The market is looking for more than just EV long haul transport. Nikola is answering the call.

The transportation route between Los Angeles and San Francisco is particularly lucrative because it is a critical link for freight distribution throughout the state. With the company establishing a network of hydrogen refueling stations along this route, Nikola is ensuring that their FCEVs can operate efficiently over long distances, helping to enhance their unique hydrogen appeal. This also enables them to tap the growing interest in hydrogen as a cleaner alternative to diesel, potentially securing a dominant market share in this emerging sector.

With this, Nikola’s forward revenue estimates are beginning to show a promising upward trend, suggesting that the company may have reached its bottom. Starting earlier this month, analysts have started revising their revenue estimate upwards for the first time in a long time, reflecting this growing confidence in Nikola’s future. The company is expected to generate $128.85 million in revenue for the fiscal year ending December ‘24, marking a 259.52% year-over-year growth. Analysts expect this parabolic trajectory to continue going forward, with estimates predicting revenue to grow another 242.35% to $441.11 million in 2025, and a promising $1.11 billion in 2026, another 152.23% growth.

Earnings estimates for Nikola also suggest very high growth (or, for this matter, minimization of losses) over the same three-year period. Although the company is still projected to post a loss, the gap is narrowing, with EPS estimates improving from -$9.42 in 2024 to -$7.99 in 2025 and -$5.13 by 2026, indicating a significant year-over-year improvement in financial performance. I don’t think the company has to be profitable to be more long-run viable. They just have to show enough progress to convince investors to invest more money in the company.

Where Do Nikola’s Financials Stand?

While Nikola is making good progress, the balance sheet does have to be discussed because they are still losing money.

As of the last quarter, they had $258.8 million in cash + short-term investments on the balance sheet, along with $65 million in receivables. On the other side, the company has $238.9 million in long-term debt and a book value of $10.80/share.

The company over the last 12 months lost $860.8 million. So current cash would only provide for about 1 quarter of liquidity. Obviously bearish, but I think when we dig deeper the picture is still high risk, but slightly better.

Over the last quarter, losses totaled $133.7 million, so a much lower burn rate. Of this, $11.1 million are non-cash depreciation and amortization expenses. Another $8 million is stock compensation (non-cash). So this really means that cash burned on operations is closer to $115 million last quarter vs. $133.7 million. If we dive into the balance sheet from here, we can see the company now has about 2.5 quarters of runway with revenue ramping. Still super high risk, but now somewhat better.

The company also completed an ATM (at the market) stock offering of $52.2 million last quarter to help extend their runway. I’ll dive into the California piece below, but I think developments like these may be enough to help give investors the confidence to keep investing, so the company can keep going.

Why California Is The Key

As part of my previous research, I noted why it was important that Nikola pivoted to the California market, particularly in light of the state’s incredible hydrogen infrastructure incentives. Now, 9 months later, California’s incentives remain an important component of the company’s strategy, providing financial support for the adoption of hydrogen FCEVs. California’s aggressive push towards zero-emission vehicles, backed by these incentives, allows for some really big discounts in order to help push companies to purchase Nikola’s long-haul trucks—up to $696,000 per vehicle.

On this note, California’s hydrogen charging network is considered as the most developed in the country. As of mid, this year, the state boasts over 100 public hydrogen refueling stations, a figure that is far ahead of any other state in the U.S. This extensive network is supported by investments from the California Energy Commission to make hydrogen refueling as accessible as traditional fueling options for zero-emission vehicles.

By securing a strong foothold in California, Nikola has gained access to a well-established hydrogen network and positioned themselves in a market that, on its own, would be the world’s fifth-largest economy if it were a separate country. I believe dominating in the California market is akin to securing significant market-share in a large European nation. I believe that the state’s leadership in clean energy adoption and its economic size make it a pivotal market. It makes me optimistic.

NKLA Stock Valuation

I believe Nikola’s story is better today than it has been in a while. What’s incredible about this is that the company is also now trading at a compelling valuation, particularly when considering their forward price-to-sales (P/S) ratio for 2025, which is projected to be under 1. Specifically, the forward P/S ratio for 2025 is estimated at 0.87, which is far below the median forward P/S ratio of the industry as a whole (1.42). While the industry P/S ratio is for the next 12 months vs. 2025, I assume the industry P/S ratio is more stable over the long run. Nikola’s ratio is well below the sector median, which suggests that the market is pricing in lower than expected sales growth. I think this makes the market’s current sentiment overly pessimistic, driven by what have been chronic operational struggles.

I disagree with this assessment, and I think Nikola really has a unique opportunity here. The company’s strategic shifts and focus on niche growth in California, suggest that their growth may be better than the market expects. If Nikola manages to outperform these low expectations, I think the stock could see significant upside.

I think that the company should trade at a 50% premium to the sector median price-to-book ratio. Given the current price-to-book (P/B) ratio of 0.88, this actually happens to be well below the sector median of 2.71, Nikola should be trading at a premium to reflect the potential for a successful turnaround. A 50% premium to the sector median P/B ratio would place Nikola’s P/B ratio at approximately 4.06, translating into a potential upside of around 361% from the current levels for shares. Shares right now offer a high risk, but asymmetric opportunity. I like it.

Risks

Competition is the biggest Elephant in the room. Specifically, the rise of Tesla (TSLA)’s Semi poses a significant risk to Nikola expansion efforts outside California. Tesla, already a dominant force in the electric vehicle market, has started to roll out their long-anticipated Semi.

For Nikola, which has focused heavily on the California market due to favorable hydrogen infrastructure and state incentives, the real challenge will be expanding their market share as Tesla ramps up Semi production. While Nikola has outperformed Tesla in the semi-truck space within California, the broader national and international market will be more difficult to penetrate because of the restrictions on hydrogen charging. Tesla’s established brand, higher production capacity, and extensive network give them an edge that could overshadow Nikola’s efforts as they attempt to grow beyond their stronghold in California.

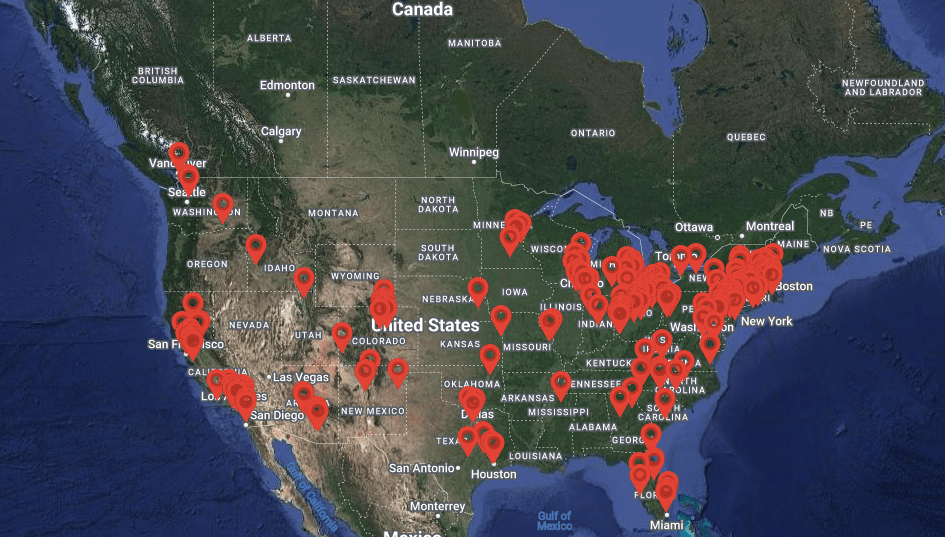

The risk here is the limited hydrogen infrastructure across the United States. Nikola is selling a vehicle that is designed for long-haul travel. Yet, in the middle of the US, there are really not that many hydrogen charging stations.

Hydrogen Fuel-Cell Charging Network (HFCnexus.com)

However, with Nikola, their particular California corridor offers a silver lining. The LA-San Francisco route is one of the most heavily trafficked and economically vital stretches in the nation. The volume of goods transported along this route is truly immense, providing Nikola with a substantial market even with a limited geography. Nikola is focused, and can capitalize on this dense traffic with the existing hydrogen infrastructure, and I think this means they’ll establish a unique presence even without immediate nationwide expansion.

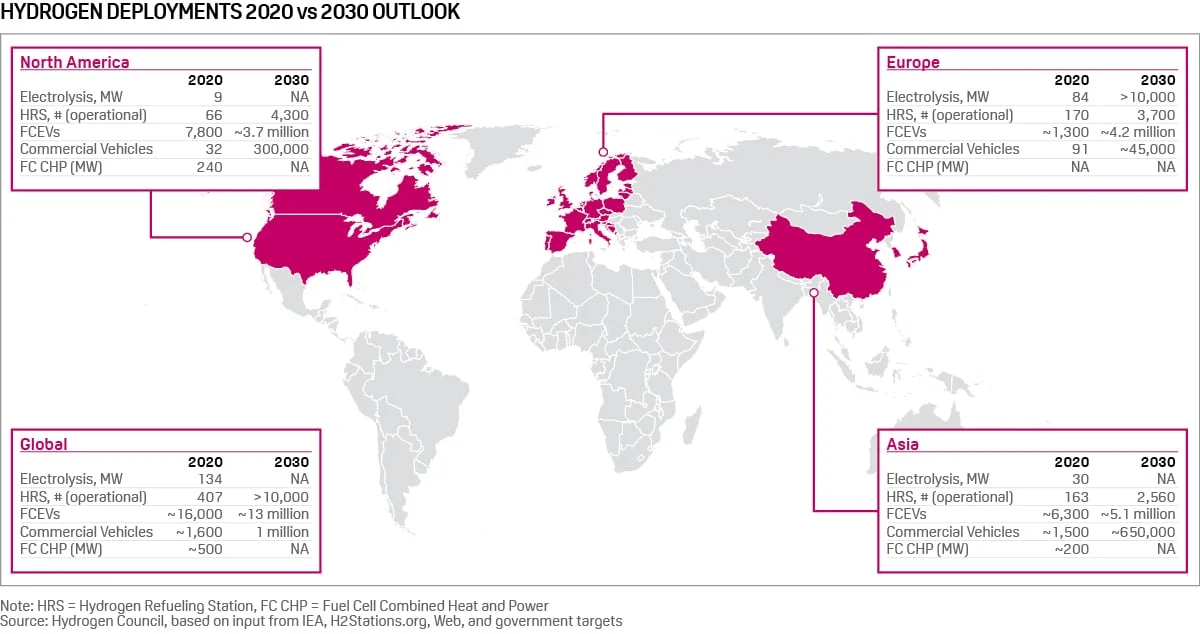

Looking beyond the US, other nations have made more significant steps in developing hydrogen fueling networks. Germany, France and the Netherlands have the most HRS’ in Europe, while China remains a global leader in the number of HRS and boasts a hydrogen energy industry output set to be valued at $14 billion by next year. Globally, these mature networks present Nikola with opportunities to leverage existing infrastructures, meaning they can more easily enter into international markets where their hydrogen trucks could operate unencumbered by many of the limitations faced domestically.

Global Hydrogen Development Map (Hydrogen Council )

Bottom Line

Nikola’s focus on the LA-San Francisco corridor leverages one of the most heavily trafficked routes in the U.S. mitigating the risk posed by the limited hydrogen infrastructure across the country. While hydrogen power remains controversial, Nikola’s unique positioning and potential access to more developed hydrogen networks internationally could be advantageous. Their most recent quarter shows they’re executing on this, and that makes me excited.

Despite the controversy surrounding hydrogen as a green energy source, Nikola’s current valuation offers a compelling entry point. The company’s shares are trading at levels that more than reflect the risks, and with that offer significant upside potential if their execution in California succeeds. This is still a high contrarian play, given the uncertainties around hydrogen, but the current stock price and the company’s strong focus make it one of the most interesting opportunities out there.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.