Summary:

- Last September, I warned investors of betting on Nikola Corporation, as I thought the company was disadvantaged compared to pure-play BEV truck manufacturers.

- Despite some progress in restructuring, Nikola’s profitability remains a concern due to high production costs and limited market potential for fuel cell electric vehicles.

- Nikola is losing money on each truck sold. The average production cost of a Nikola truck was $679,000 in Q4 2023 while the ASP was just $351,000.

- Under normal circumstances, I would not be alarmed by a young company selling a product at a loss to gain market share. However, when it comes to Nikola, this is a bigger problem than it seems.

Tramino

Nikola Corporation (NASDAQ:NKLA) has wiped millions of dollars’ worth of investor money since its market debut in June 2020. The company has lost more than 95% of its market value since the IPO (adjusted for the reverse split), and even more concerning, remains uninvestable today even at beaten-down stock prices.

Last September, when Nikola stock was trading for a split-adjusted price of around $43, I claimed investors would be burned. I am not surprised about how things have turned out since then, with Nikola continuing to demonstrate its inability to inch closer to profitability. Below are some of the main reasons I highlighted in my bear report on Nikola last year.

- The continued self-inflicted reputational damage arising from Nikola’s failure to meet vehicle delivery milestones.

- The high cash-burn ratio of the company, which was pointing to more ownership dilution.

- The low energy efficiency of fuel cell electric vehicles (“FCEVs”) compared to battery-powered electric vehicles (“EVs” and “BEVs”).

- Lack of infrastructure to support increased adoption of FCEVs.

Fast-forward to today, Nikola seems to have made some progress in its commercialization plans with the company delivering 72 Class 8 hydrogen fuel trucks in Q2, beating the guidance for sales of 60 trucks. After years of production delays and missed guidance, this may come off as music to the ears of Nikola bulls, but a deeper dive into the company’s fundamentals reveals Nikola will likely continue to hurt investors over the long run.

There May Not Be Light At The End Of The Tunnel

We all love turnaround companies. In fact, identifying troubled companies that would eventually see better days in the future is a lucrative investment strategy. Nikola, unfortunately, is not one.

Nikola restructured the business since 2023 by reducing its workforce, liquidating its interest in troubled battery pack maker Romeo Power, and divesting its interest in Nikola Iveco Europe GmbH, a European joint venture, to focus on the domestic market. The company has also come up with a strategy centered on expanding its scale to turn profitable.

Exhibit 1: Nikola’s profitability flywheel

Q1 presentation

Nikola’s challenges stem from the high production costs of fuel cell trucks. The company is making losses from every truck it sells, which is not where you want to be, given that the demand for FCEVs may never reach the highs associated with BEVs. According to Hydrogen Insight, in Q4 2023, the average production cost of a Nikola truck was $679,000 while they were sold for an average price of just $351,000.

Under normal circumstances, I would not be alarmed by a young company selling a product at a loss to gain market share. However, when it comes to Nikola, this is a bigger problem than it seems.

Nikola’s target market is not as big as we initially thought. This is a direct result of the cost disadvantages associated with FCEVs. According to IDTechEx, only 4% of zero-emission vehicles will be powered by hydrogen by 2044. The outlook for fuel cell trucks is much better, as expected, given that BEVs are perceived to have a disadvantage in this segment due to the weight of lithium batteries required to enable long-distance journeys for trucks. IDTechEx expects fuel cell trucks to account for approximately 20% of all zero-emission trucks by 2044.

Although this segment offers an opportunity for Nikola, the unit economics picture remains disappointing. Nikola CFO Thomas Okray, who joined the company in March, acknowledged this problem during the Q1 earnings call and said:

As noted previously, absent meaningful volume, profitability will be below our expectations.

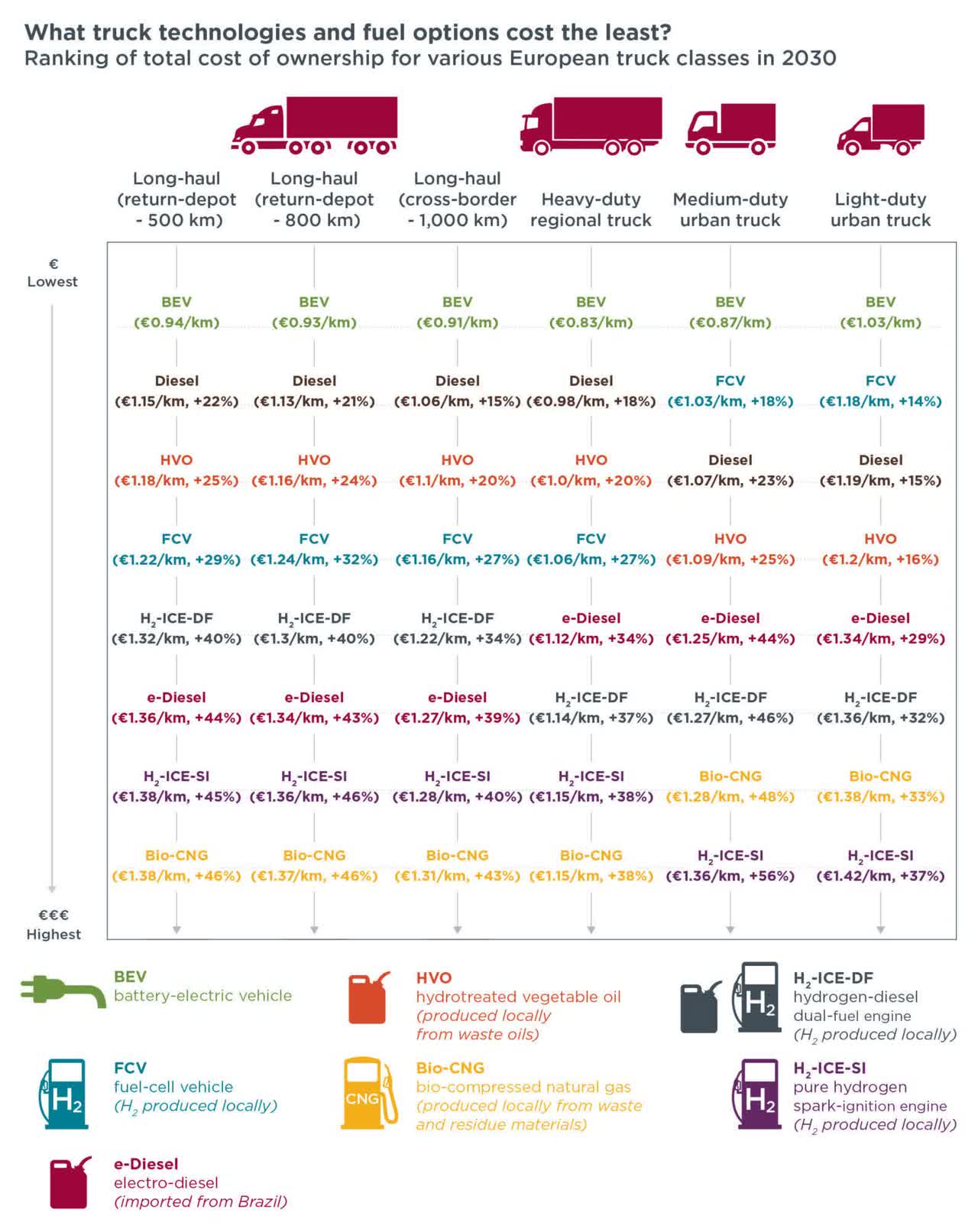

The company also revealed that average selling prices increased to $381,000 in Q1, a $30K increase from the previous quarter. This may improve the profitability profile in the short term, but I believe rising prices for FCEVs will dampen the demand eventually when advancements in BEV technology and infrastructure put FCEVs at a disadvantage. According to the International Council on Clean Transportation, fuel cell trucks powered by hydrogen will not be cost-competitive with diesel trucks until 2035. The below illustration shows that battery electric trucks cost the least to operate among all alternative energy types.

Exhibit 2: Comparison of fuel options for different types of trucks in Europe

The International Council on Clean Transportation

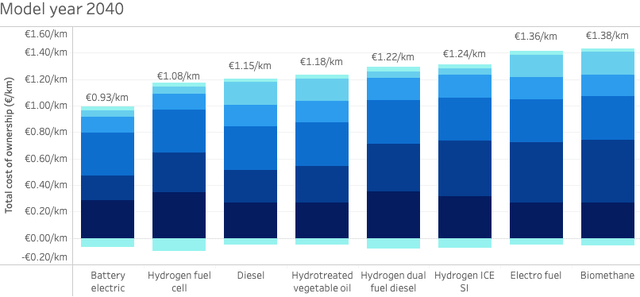

With fuel cell technology advancing, the total cost of ownership of a fuel cell truck is expected to decline sharply in the next decade. This is a good sign. However, even by 2040, hydrogen fuel cell-powered trucks are projected to cost more to operate compared with battery electric trucks.

Exhibit 3: Total cost of ownership comparison for model year 2040 long-haul trucks

The International Council on Clean Transportation

Then comes the infrastructure challenges. Charging infrastructure for BEVs has seen major improvements in the last decade, with leading automakers including Tesla, Inc. (TSLA) investing billions of dollars to expand charging networks. Fuel cell charging infrastructure, on the other hand, is still at an infant stage. Nikola’s attempts to approach national trucking carriers with large vehicle fleets will not be successful as long as infrastructure is lacking. Nikola has already understood this challenge, which is why the company is aggressively investing in its Hyla refueling network. CFO Thomas Okray said:

Going to these big national accounts, you’ve got to have the fuel in place, or else that discussion doesn’t go as smoothly as you would want to.

Despite aggressive investments, it will take many years for hydrogen refueling networks to be as expansive as EV charging networks, which leaves ample room for technological advancements in the BEV space to drive the demand away from FCEVs. The increasing energy density of lithium-ion batteries used in BEVs, faster charging times compared to a few years ago, and the continued reduction in battery pack costs paint a promising picture for BEVs.

Nikola’s BEV division, which is already struggling to satisfy customers, will also face stiff competition in the future with leading automakers drawing plans to aggressively invest in long-haul vehicles. For instance, Mercedes is investing in the eActros LongHaul truck, which was launched last October, while MAN is developing the MAN eTruck which is scheduled for launch this year. EV leader Tesla has already captured the interest of commercial customers with its Semi truck.

Takeaway

Nikola’s business is in better shape compared to a few years ago, with the company focusing on its strengths in the U.S. market. However, the going will get difficult in the future. Its BEV division is expected to face stiff competition, while the inherent disadvantages of fuel cell technology will continue to be a barrier to mass adoption of fuel cell trucks. This is needed for the company to reach a breakeven point. Selling 400-500 trucks, which is what the company is hoping for this year, will not make any meaningful improvement to Nikola’s financial performance. Based on the challenging outlook for mass adoption of FCEV trucks, I believe investors should steer clear of Nikola Corporation stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.