Summary:

- Nikola’s stock has rallied by more than 50% over the last week, but the rally looks unsustainable to me.

- The company’s fundamentals are still extremely weak and the competition is likely to intensify.

- My valuation analysis suggests that NKLA is overvalued.

doidam10/iStock via Getty Images

Investment thesis

My previous bearish thesis about Nikola (NASDAQ:NKLA) kept up well until the stock started spiking last week with a 50% rally within just a few days. However, my NKLA stock analysis suggests that there is still a myriad of fundamental weaknesses and the last week’s rally is very unlikely to be sustainable. The company’s financial performance is still very inconsistent with notable cash burn rate and deteriorating financial position. I cannot say that the stock is attractively valued, according to my valuation analysis. All in all, I reiterate my “Strong Sell” rating for NKLA.

Nikola stock analysis

As I mentioned in my introductory paragraph, the stock surged by around 50% over the last week. The stock continues spiking in the pre-market today, with a +15% gain while I am writing this analysis. NKLA is now around 20% above $1, which is quite a milestone for the stock. The last time NKLA traded close to $1 was December 2023 and the stock price stagnated up to the last week when it started surging.

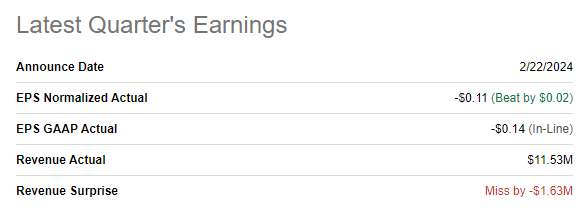

The latest big news related to NKLA was the Q4 earnings release on February 2022. NKLA missed revenue consensus estimates and was in line from the EPS perspective. The company delivered 35 hydrogen fuel cell electric trucks in Q4. For the full year 2023, Nikola produced 138 trucks, almost two times less than the company did in 2022.

Seeking Alpha

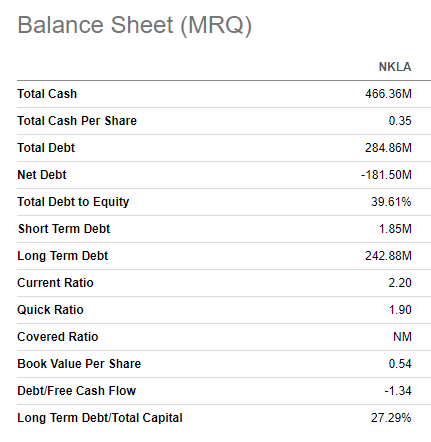

Nikola is still far from becoming profitable with a -331% gross margin in Q4 2023. The company had -$118 million operating cash flow in Q4, which does not help to improve the balance sheet. The company’s financial position might look decent out of context, however if we consider the deep minus in the operating cash flow, it looks like NKLA is likely to run out of cash within just few quarters.

Seeking Alpha

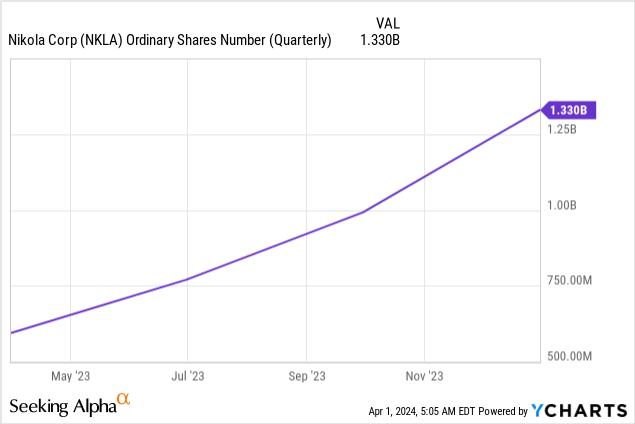

Considering the scale and deep operating losses, NKLA does not have many options to raise more finance other than diluting shareholders. The ordinary shares count has more than doubled during 2023, and I expect this trend to inevitably continue. The expected further increasing the number of outstanding shares will also highly likely be a negative catalyst for the stock price in 2024.

During the latest earnings call, the management guided for 2024 full year hydrogen fuel cell electric truck deliveries in the range of 300 to 350 trucks. The growth might look impressive compared to 138 trucks in 2023, but the growth does not look that impressive if we compare to 258 units in 2022. This represents around 16% CAGR for the last two years, which does not impress me. For example, Volvo (OTCPK:VOLAF) delivered 256% more battery electric vehicle [BEVs] trucks in 2023 compared to 2022. Another European producer, Daimler Truck (OTCPK:DTRUY) 2023 BEVs sales jumped by 277% in 2023. Compared to other producers’ ramp up pace, Nikola’s production and sales are stagnating. This means that NKLA is lagging behind substantially. January 2024 news that Tesla is expanding its Nevada Gigafactory to ramp up Tesla Semi production is another threat for Nikola meaning that competition is likely to intensify further.

To summarize, I see several strong adverse factors for NKLA in 2024 and even years beyond. The company continues ramping up slowly, the business is highly unprofitable, and the competition is already intense. The exponential growth of the outstanding shares count is also unlikely to help the stock price.

NKLA stock valuation

If we look at Nikola’s stock chart, we can see that the stock currently trades 65 times cheaper than all-time highs. NKLA spiked during the COVID-19 stock market mania and EV hype, but the decline was also rapid.

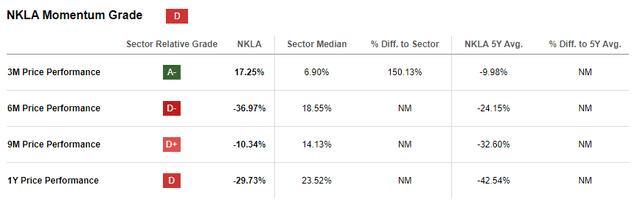

The momentum across various timeframes is mostly weak, which we can see from the low “D” momentum grade from Seeking Alpha Quant. The stock is very volatile which I see from a wide last 52-weeks share price range spanning from $0.52 to $3.71.

Nikola looks very expensive from the valuation ratios perspective, especially if we speak about the ones with sales in denominator. EV/Sales and Price/Sales ratios look extremely high because consensus estimates project that revenue will increase by more than eight times between FY 2024 and 2026. I have doubts that such a growth is doable for NKLA given all the risks and uncertainties I have described.

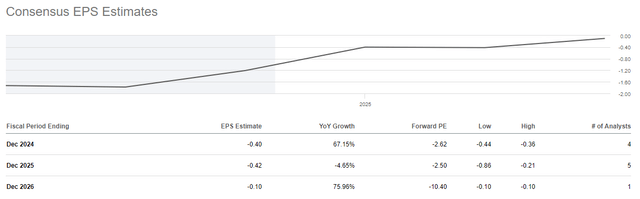

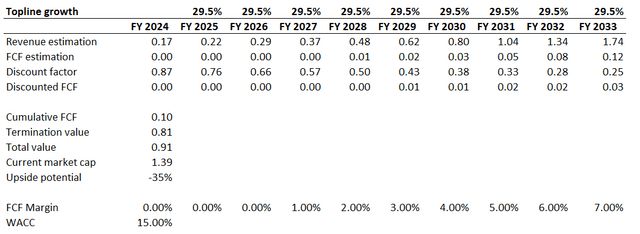

Therefore, for my discounted cash flow [DCF] valuation analysis I am incorporating a more realistic revenue growth. For example, Precedence Research forecast that zero-emission trucks industry will compound by 29.5% CAGR during the next decade. This looks fair enough to incorporate into my DCF valuation. Nikola is still far from becoming profitable and I expect the FCF margin to start expanding by one percentage point yearly starting from FY 2027. I expect the FCF margin to start growing positive not earlier than FY 2027 because adjusted EPS consensus estimates expect that the metric will be still negative in FY 2026, albeit nearing breakeven. A one percentage point yearly FCF expansion looks fair to me given the projected 29.5% revenue CAGR.

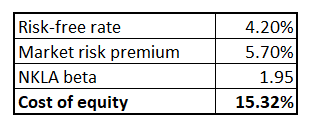

I usually rely on WACC recommendations from Gurufocus, but they estimate a 20% WACC for NKLA. This looks way too high to me, so I will figure out WACC for NKLA by calculating cost of equity. For the sake of my calculations I ignore cost of debt because I see NKLA highly unlikely to raise debt finance on market terms given the company’s weak fundamentals.

Author’s calculations

I use the current 4.2% 10-year treasuries yield as a risk-free rate, and a 5.7% U.S. stock market risk premium. The risk premium is in line with historical averages outlined by Statista. According to Yahoo Finance, NKLA’s beta is 1.95. Incorporating all these data into the cost of equity formula gives me cost of equity at 15.32%, which I round down to 15% to be more conservative in my bearish thesis.

According to my DCF simulation, the business’s fair value is close to $1 billion, which is around 35% lower than the current market cap. Therefore, I cannot conclude that NKLA is attractively valued. I do not give my Nikola stock price target or a forecast for 2024 because the level of uncertainty around the company’s revenue growth and FCF dynamics is extreme.

Risks to my bearish thesis

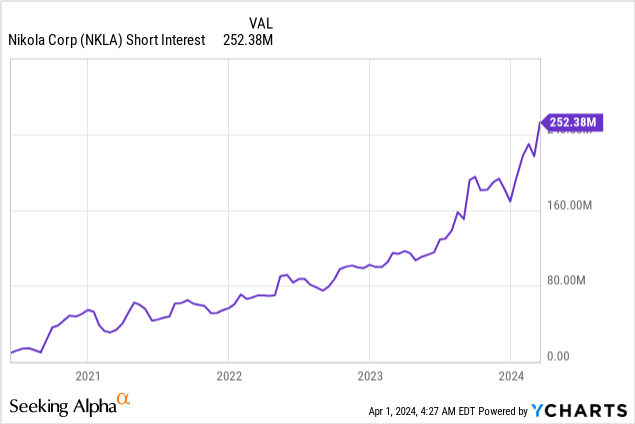

According to the below chart, 252 million NKLA shares are shorted out of total 1.34 billion outstanding shares. This represents around 19% short interest. Therefore, the last week’s rally might be explained by the short coverage as well. In the situation of a substantial short interest, there is always a risk that a short squeeze can happen. On the other hand, the 19% short interest is far lower than the GameStop (GME) stock had before its short squeeze in January 2021.

While I have highlighted multiple fundamental flaws in my analysis, it is also apparent that zero emissions trucks is a promising industry. We live in an era of a secular transition to clean energy, and this is a big tailwind for the industry. In my opinion, the probability of a turnaround under the current management is very low. However, Nikola has invested substantial amounts into R&D and has experience in producing zero-emission trucks. The current market value of the business is not sky-high which means that theoretically Nikola might be acquired by some of the legacy tuck manufacturers who are seeking to expand to zero-emission.

The probability of activist investors acquiring notable share in the business also should not be discounted. Maybe the company might have a successful turnaround under the new management that might be nominated by a potential activist investor. Developments like these are likely to work against my bearish thesis.

Is Nikola stock a buy/sell/hold now?

To me as a long-term investor who relies solely on fundamentals, NKLA is an apparent “Strong Sell”. However, risk takers might be willing to try to play the potential short squeeze, but odds look very low to me.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.