Summary:

- NIO’s 2Q24 deliveries surged 91% QoQ and 144% YoY, driven by a refreshed EV line-up and strong Chinese demand, boosting investor confidence.

- Margins improved to 12.2%, up 300 basis points QoQ and 600 basis points YoY, despite ongoing losses, indicating positive profitability trends.

- NIO’s new low-price EV brand, Onvo, aims to compete with Tesla’s Model Y, potentially accelerating sales growth and enhancing valuation.

- Despite current losses, NIO’s strong delivery growth and margin improvements support a ‘Strong Buy’ rating with a long-term intrinsic value potential of $10.

Andy Feng

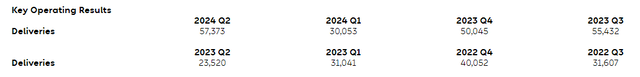

NIO Inc. (NYSE:NIO) profited from new delivery momentum in the second quarter that also catalyzed a new upswing in the stock. NIO shipped 57,373 electric vehicles in the second quarter, up 91% QoQ and up 144% YoY, amid a rebound in deliveries from a soft 1Q24.

NIO also profited from higher margins, which was a great relief for investors who have sweated over NIO’s margin trends in the last year or so.

I think that management is focusing on the right things, growing deliveries, and starting new ventures like Onvo, which should ultimately get reflected in a higher sales multiple for NIO.

My Rating History

My last stock classification on NIO was Strong Buy, which I presented in light of a strong delivery rebound throughout 2Q. The margin trend is also slowly improving, despite a high level of competition in China’s electric vehicle industry.

I think that NIO deserves a little more credit than it presently gets for its delivery growth and, in my view, the low sales multiple has a lot of room to reset higher moving forward.

Sales Growth And Margin Improvements

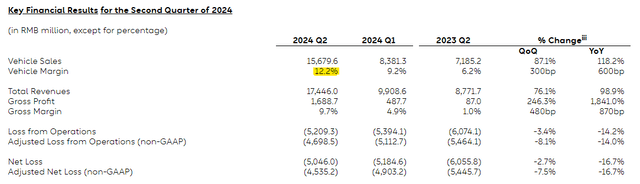

NIO is profiting from a solid upswing in deliveries, despite a more competitive market environment for EV companies. In 2Q24, NIO delivered 57,373 electric vehicles compared to 23,520 electric vehicles last year. The upswing is due to NIO refreshing its line-up of electric vehicles: 57% of the company’s deliveries were SUVs, compared to just 43% of sedans.

NIO’s YoY delivery growth amounted to 144%, reflecting robust demand from mostly Chinese customers for NIO’s EVs.

Key Operating Results (NIO Inc.)

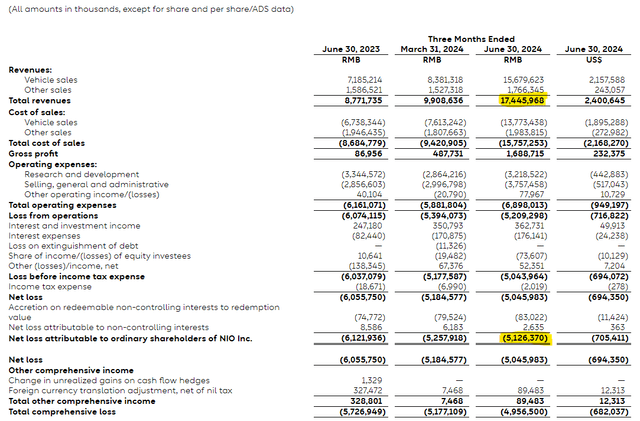

If the second quarter showed anything, it was that NIO could grow its sales line as well, though profitability remains a thorny issue. In 2Q24, NIO had total sales of RMB17,446.0 million (US$2,400.6 million), which reflected an increase of 98.9% YoY.

In terms of gross profits, NIO produced RMB1,688.7 million (US$232.4 million), reflecting a YoY increase of 1,841% which was related to NIO having a much larger number of deliveries compared to the same quarter a year ago.

With that said, though, NIO is not in the profitability zone at all. NIO lost RMB5,046.0 million (US$694.4 million) in the second quarter of 2024, and even though losses fell 17% YoY, investors need to anticipate ongoing losses for the electric vehicle company.

In addition to a substantial jump in gross profits catalyzed by higher deliveries, NIO’s margins improved and this is a positive development for NIO, despite the overall profitability situation still being a bit disappointing. Margins, on a per-vehicle basis, rose to 12.2% in the second quarter, up 300 basis points QoQ and up 600 basis points YoY.

Margins also rose in the first quarter and the trend is certainly encouraging, particularly now that NIO produces higher per-vehicle margins on a higher comparative delivery level.

I think that this trend fundamentally supports my previous thoughts about the electric vehicle company and why I come to a stock classification of ‘Strong Buy.’

NIO Still Has A High Margin Of Safety

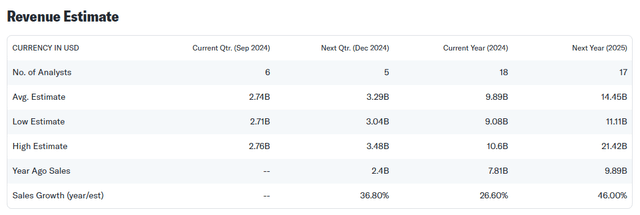

The market models $14.45 billion in sales for NIO next year, which reflects back to us an anticipated sales growth rate of 46%. In the present year, NIO is anticipated to collect $9.89 billion in sales, reflecting a 26.6% sales growth rate YoY.

NIO is starting another brand, Onvo, which could turbocharge the company’s sales growth and render present estimates a bit conservative.

NIO is launching Onvo as a low-price EV brand that has ambitions to compete against Tesla’s Model Y. The Onvo-branded L60, the first SUV of the brand, is expected to cost as little as 149,900 Chinese Yuan ($21,210). Onvo-related growth could possibly add to present consensus estimates and lead to higher total sales and delivery growth next year.

Revenue Estimate (Yahoo Finance)

Based on a market value of NIO’s equity of $10.2 billion, the electric vehicle company is selling for 1.0x this year’s sales. A main peer in the EV market is XPeng Inc. (XPEV) which is selling for 1.3x sales.

However, NIO has sold for multitudes of this sales multiple in the past. While I think with the benefit of hindsight that NIO has been evaluated a bit too positively in the past, I now think that investors are leaning too heavily on the negative side. The reason being that NIO is substantially scaling production upward and doing so while growing its margins. This is not an easy thing to do, particularly not in the present market environment where companies are forced to cut prices to stay competitive.

With NIO proving that it can rebound from 1Q24 deliveries, I think the delivery trajectory is a positive one heading into 2025, particularly with NIO’s Onvo catalyst possibly contributing here positively. Thus, I think that NIO could potentially expand its valuation multiple in the next year or so: A 2.0x sales ratio is a sensible long-term valuation target, in my view, especially because NIO sold for more than 10x leading sales in 2021 when the company had substantially lower deliveries.

Presently, NIO is on a 2Q24 annual run-rate delivery of 230K electric vehicles, compared to just 91K in 2021. The delivery volume thus is poised to increase by 150% whereas the sales multiple contracted by 90%. Thus, I see a considerable opportunity here.

In our particular case, with a 2x sales multiple, NIO’s stock has an implied intrinsic value of $10. I don’t anticipate this valuation target to be realized imminently, however. Rather, I think NIO can grow into this valuation if it grows its deliveries while also gradually lowering its losses.

Why The Investment Thesis Might Disappoint

NIO is not yet in the profit zone, after years of scaling production, and this is what could continue to hold the stock back a little bit moving forward. The margin trend, however, is showing promise, as is the gross profit trajectory.

With that said, though, the overall weakness in net income is an issue for the company and its investors. NIO’s margins will remain key to NIO’s success: If the margin curve turns south again, NIO will have a harder time convincing investors to buy the stock.

From a delivery angle, however, I think risks have decreased as of late as the electric vehicle company has seen a nice jump in deliveries QoQ.

My Conclusion

NIO is a promising EV investment, particularly after the company’s 2Q24 earnings made it clear that the company is capable of growing its margins, even with competition among EV companies heating up. NIO’s margins surged to more than 12% which marks a positive change compared to last year when price cuts took a bite out of EV maker’s margins.

I think that NIO continues to have a lot of potential for growth, and the delivery upsurge in 2Q was definitely soothing for the souls of abused NIO investors. Though the stock has been boosted by NIO’s 2Q24 results, I think the electric vehicle company has a lot of gas in the tank long term.

If NIO started to post lower losses (which may take a while), the valuation situation for NIO could change and improve drastically. Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.