Summary:

- NIO Inc. achieved $2.2 billion in vehicle sales in Q4 2023, driven by higher delivery volumes and SUV demand.

- The company plans to launch two mass-market brands, Alps and Firefly, to compete with Tesla.

- NIO aims to establish 1,000 new battery-swap stations in 2024 to reduce charging times, incurring significant capex.

- Long-term investors can adopt a DCA strategy to average down, taking advantage of NIO’s market volatility within the $6.10 to $4.35 price range.

Drew Angerer/Getty Images News

Investment Thesis

In our prior analysis, we highlighted that the downward trend was not over yet, and NIO Inc. (NYSE:NIO) presented an opportunity for long-term investors to capitalize on market volatility by adopting a dollar-cost averaging (DCA) strategy within the price range of $6.10 to $4.35. We identified these levels as critical long-term support zones where investors could strategically position themselves for eventual market recovery.

Continuing with this approach, the rationale for maintaining a buy rating for long-term investors remains intact. The anticipation of a downward trend underscores the importance of the DCA method to lower the average cost basis before an expected rebound in NIO’s stock price.

Finally, from a technical perspective, NIO appears to be in a consolidation phase, with no significant upward or downward movement based on the candlestick patterns. Therefore, the technical indicators (such as RSI and Stochastic RSI) suggest a neutral stance, giving more time to long-term investors to digest the company’s prospects.

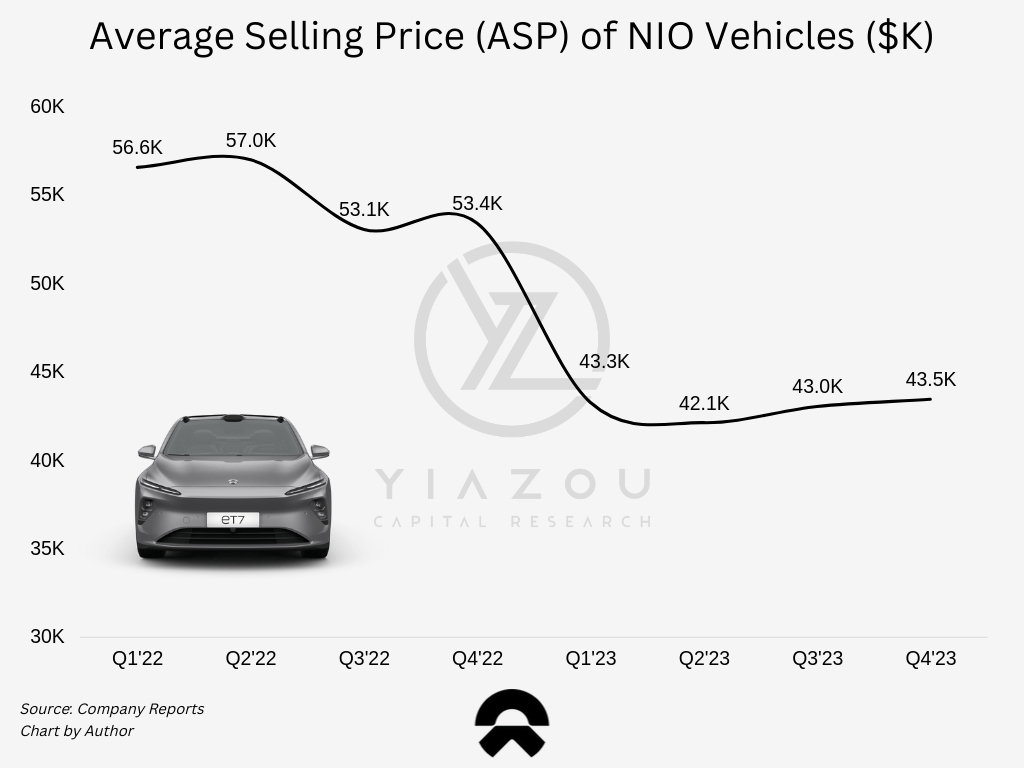

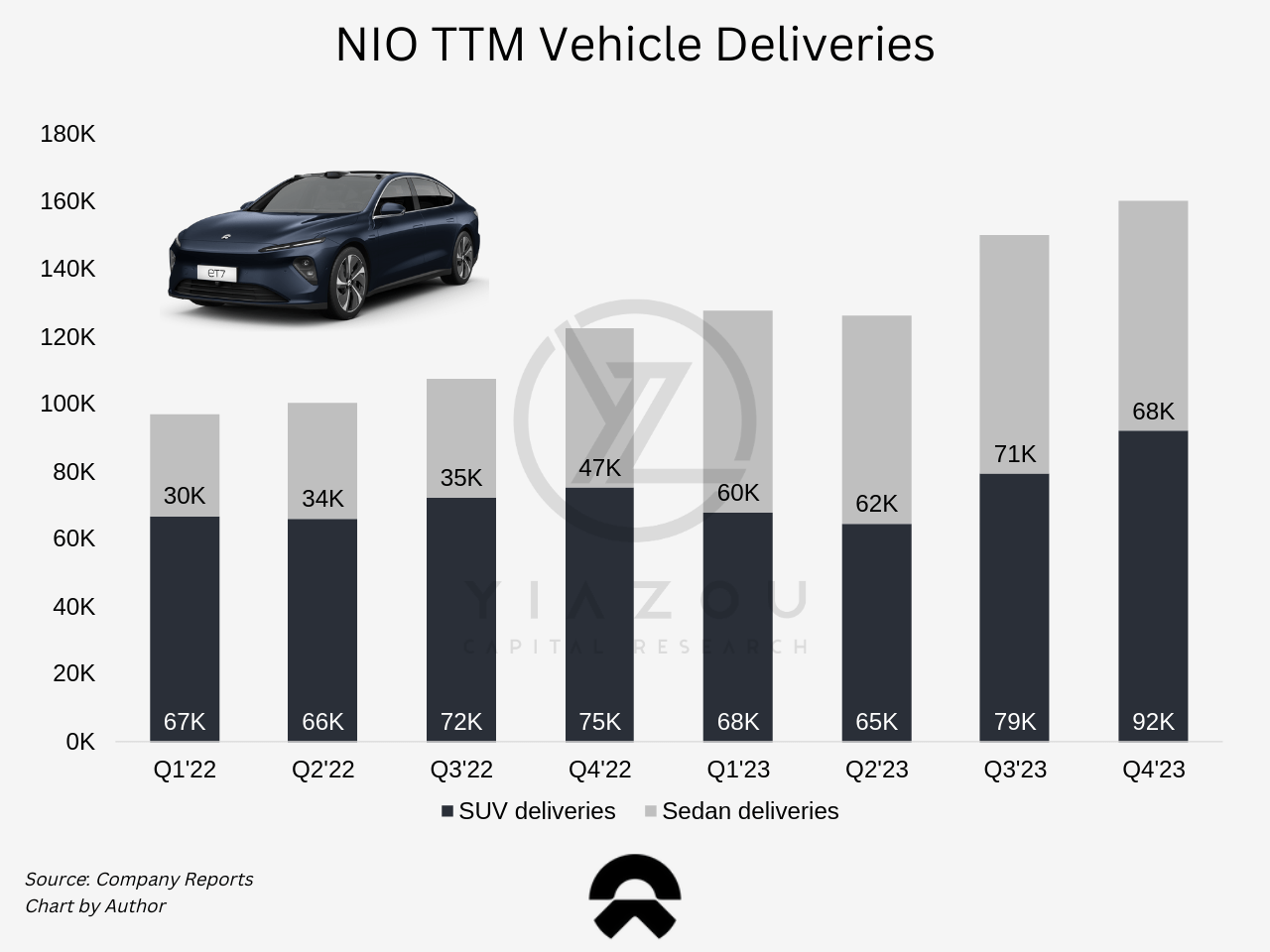

Sales Soar to $2.2B with SUV Demand Skyrocketing, Vehicle Margins Hit Record High

NIO achieved $2.2 billion in vehicle sales in Q4 2023, a 4.6% year-over-year (YoY) increase that was primarily driven by higher delivery volumes, partially offset by the lower average selling price (ASP) due to changes in product mix. ASP stood at $43.5 thousand this quarter, compared to $53.4 thousand a year ago. NIO gained significant traction in the SUV market, with 67% of vehicles sold this quarter being SUVs, compared to 52% a year ago.

In Q4 2023, NIO’s vehicle margin reached 11.9%, a 510 basis point (bps) improvement compared to Q4 2022 (which stood at 6.8%). This positive trend was mainly attributable to reduced material costs per unit and addressing inventory provisions, accelerated depreciation on production facilities, and losses related to purchase commitments for the previous generation of ES8, ES6, and EC6 recorded in Q4 2022.

Overall, revenue grew a modest 12.9% YoY to $7.8 billion, mainly driven by 43.6% growth YoY in sedan vehicle deliveries. Vehicle margin fell 420 bps YoY to 9.5% in FY 2023 as the company faced increased battery cost per unit from Q1 2023, coupled with changes in product mix. With subsequent decreasing marginal cost per unit, vehicle margin recovered from Q3 onwards and reached 11.9% by Q4 2023.

Author

NIO Targets Q1 Rebound: Eyes Modest Growth Amid Seasonal Challenges

The management anticipates first-quarter 2024 vehicle deliveries as 31,000-33,000, or growing YoY in a 0.1-6.3% range approximation. NIO delivered 18,187 cars in the first two months of Q4 2024 versus 20,663 in Q4 2023, down about 12% YoY. With NIO already delivering at least 12,854 vehicles in March 2024, matching the delivery number from the same month in 2023, this provides confidence that the company remains on track to meet the target.

NIO faced a slowdown in deliveries in January and February due to the Lunar New Year, which starts mid-January and finishes at the end of the month. During January, millions of Chinese leave their cities and return to their homes to spend time with their families, meaning both EV production and sales take a seasonal hit. Hence, the Lunar New Year and the shorter February month underestimate NIO’s actual production and delivery performance. Typically, the effect of the Chinese New Year lasts into February, so investors will likely see a return to fully normalized production levels only in March.

Finally, management also forecasts revenue to fall between $1.479 and $1.562 million in the first quarter of 2024, representing approximately 1.7% to 3.8% growth YoY. They also maintain vehicle GPM guidance of 15-18% for 2024.

Author

NIO Sets Sights on Mass Market: Unveils Alps and Firefly Brands to Compete with Tesla

NIO aims to harness all its technologies to launch two mass-market brands, with project codes Alps and Firefly, to break into a much larger pool of potential customers. The Alps (NIO’s second brand) is targeted at the RMB 200,000 to 300,000 (about S$37,000 to S$55,500, similar pricing range as Tesla, Inc. (TSLA) in China) market, while Firefly will aim for another complementary sector.

Being the first vehicle released on the NT 3.0 platform, Alps will incorporate thinner battery packs and next-gen internally developed electric motors. NIO plans to unveil the Alps in the second quarter of this year to refresh its existing product portfolio. Contrary to the NIO brand, a premium segment brand, Alps would be the brand for the mass market. Thus, NIO aims to launch the first product of this new brand in Q3 this year, with mass market release likely to start from Q4 this year.

Lastly, the Alps brand will strategically determine its store locations and network development based on distinct user groups with varying price segments and product ranges. The brand will select its stores and locations and deploy the network according to demand. Therefore, the Alps’ sales network will also be more efficient, as the Alps can have a variety of sales stores like NIO House. Therefore, its point of sale will be more efficiency-oriented, similar to Tesla’s sales stores.

NIO Plans 1,000 New Battery-Swap Stations to Slash Charging Times

Among other breakthroughs, NIO developed a battery-swapping system to solve a critical challenge of selling electric cars: the time it takes to charge the battery. Most vehicles have to charge for hours to get their batteries fully charged. With NIO’s battery-swapping system, one only needs five minutes to get a fully charged battery pack.

In November 2023, the company showed its commitment to the technology by securing deals with two top car manufacturers in China, Changan Auto and Geely, to build and share the battery-swapping network in China. The companies will develop two battery-swapping standards for private and commercial vehicles, promote battery-swapping technology, and expand the operational scale. They will also establish a battery asset management mechanism, build a unified battery-swap operation, and develop vehicles compatible with each other’s battery-swap systems.

Following these deals, the company announced on its NIO Day in December that it intends to open 1,000 new swapping stations in 2024, including the 4th generation station that can perform 480 battery services per day. The next generation of battery swap stations will feature 4 Nvidia Orin X chips with six ultra-wide angle LiDARs, boasting an overall computing power of 1,016 Tops. The new stations will feature 23 battery bays, up from 21 in the current generation stations, given that NIO’s vehicles come with a 75 KWh or 100 KWh battery.

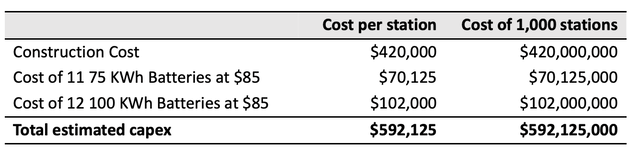

Additionally, NIO would incur a significant CapEx this year to establish these battery-swapping stations. Since setting up a battery swap station is estimated to cost around $420 thousand, NIO would incur $420 million for the 1,000 stations. Chinese domestic battery cells, which NIO predominantly uses in its vehicles, are priced between $80 – $90 per kWh for NMC (Nickel Manganese Cobalt) chemistry. Hence, assuming each station will have 12 100 KWh batteries and 11 75 KWh batteries, equipping a single station with batteries would cost NIO over $172 thousand at $85 per KWh, and equipping the 1000 stations would cost NIO more than $172 million. Hence, we expect NIO to report more than $592 million in CapEx related to this project.

NIO’s Strategy Amid EV Price Wars

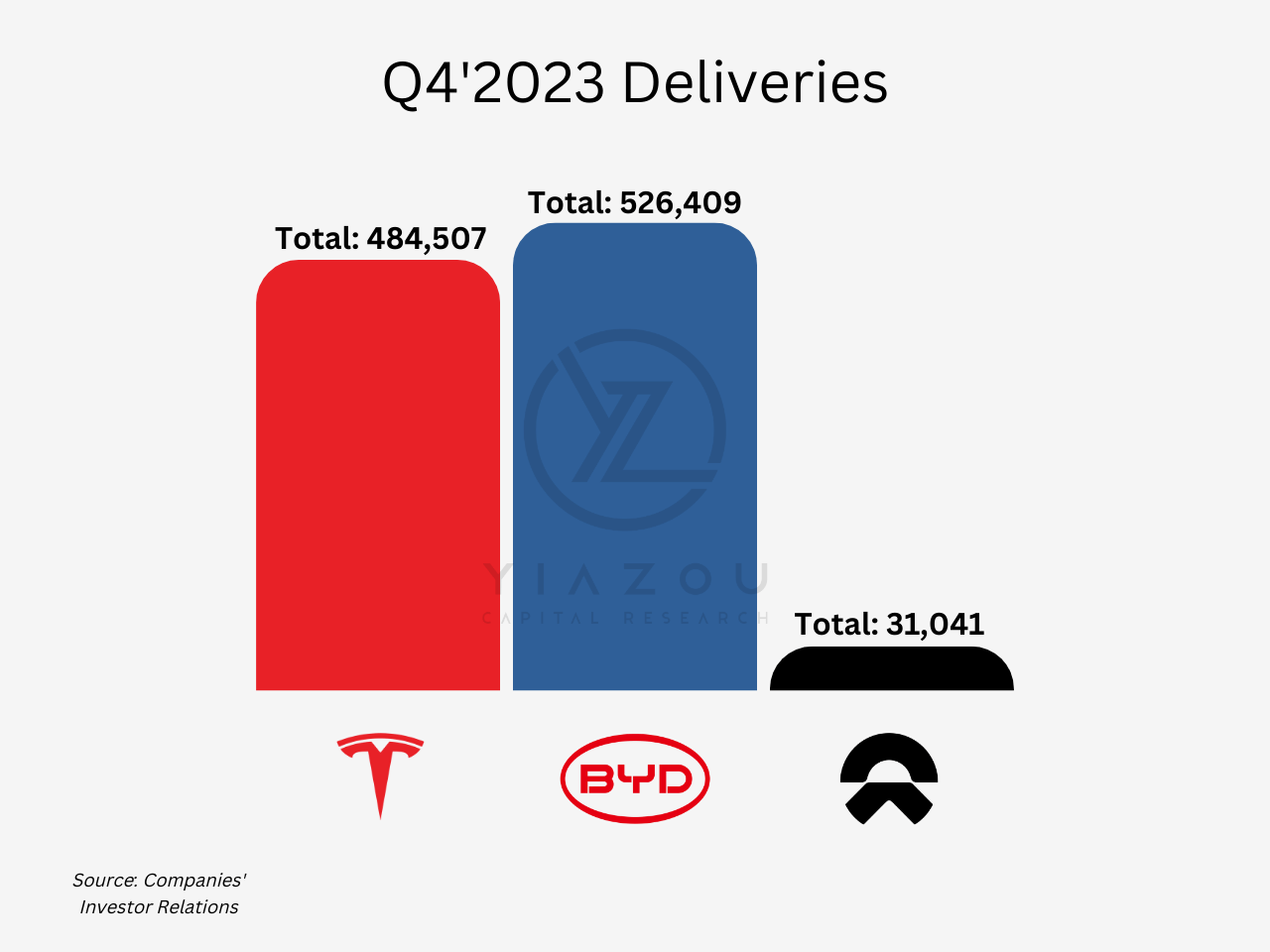

NIO has continued its momentum into January and has delivery potential but faces short-term headwinds due to growing pricing pressure in the EV industry. Competition in the mass market may only intensify, especially considering the number of new launches from peers such as XPeng, BYD Company Limited (OTCPK:BYDDF), Geely (Galaxy and Zeekr brands), and Great Wall. Xiaomi’s entry will eventually make it another significant competitor in the mass market, although its volume may not be noteworthy this year.

BYD announced several 2024 upgraded model lineups with starting prices meaningfully lower than last year, which has inadvertently caused a new wave of price cuts for many OEMs. This year, we can expect BYD to stick with its low-price strategy and multi-brand approach as it strives to achieve 3.5mn to 4mn annual vehicle deliveries.

The massive price cuts announced by Tesla and BYD are hurting all EV companies. Management in both companies is focusing on margins. One primary reason is the overcapacity accumulated in anticipation of future demand. However, macro headwinds in China and higher interest rates have decreased demand, forcing EV companies to slash their prices.

The recent price war in the EV industry stems from several factors, including overcapacity, low demand, higher interest rates, and industry maturity. However, both Tesla and BYD will eventually have to limit their price cuts as they harm their operating margins. The legacy automakers like Ford, GM, Mercedes, Volkswagen, Renault, and others have already pushed back their EV plans, which should help balance supply-demand in this segment.

Moreover, the Chinese government is increasing spending to support the economy and improve growth. The macro headwinds will likely reduce by the end of 2024, supporting NIO to regain the lost margins of the past few quarters. At its peak, NIO’s gross margin was nearly 20% in 2021, dropping to 7.5% in the latest earnings.

There will be no further announcement of new NIO-branded models this year, and management has already communicated its stance on not taking part in the raging price war. In that context, the key will be the sales force revamp that brought in >3,000 headcounts to augment/deepen the brand reach.

Investor concerns regarding the price competition’s toll on smaller, less financially robust companies have been notable. However, NIO stands out with its substantial cash reserves exceeding $4.6 billion despite a $750 million loss in Q4 2023. This financial cushion ensures NIO can sustain its operations without liquidity issues until at least Q3 2025 at the current expenditure rate.

Finally, a notable improvement in NIO’s vehicle margin, a 90 basis point increase quarter-over-quarter to 11.9% in Q4 2023, signals positive momentum. Hence, this trend of margin enhancement is expected to continue into Q1 2024, further solidifying NIO’s financial health and operational efficiency.

Author

Concluding Thoughts

Despite the lack of a specific P/E ratio, as the company is yet to reach profitability, other metrics paint an encouraging picture. NIO’s EV/Sales ratio aligns with the sector median, indicating a fair valuation. Additionally, the Price/Sales ratio of 1.21 suggests a slight premium over the sector average, reflecting optimism.

While NIO doesn’t offer dividends, its growth potential and market positioning contribute to a bullish sentiment. Considering that NIO’s shares now trade at less than 1.0x forward revenues, the risk profile is much more attractive, making a growth stock like NIO a bargain.

Finally, NIO’s low valuation based on revenues limits the downside, as most EV companies, including those in the U.S. with much lower production and delivery volumes, trade at significantly higher revenue-based valuation factors. Hence, if NIO can show margin improvement in the next few quarters, we could see a big jump in the stock price, making it a good bet at the current price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.