Summary:

- NIO remains unprofitable, burning cash, and facing rising geopolitical risks, making it hard to achieve a turnaround without outside financing.

- Despite rising revenues and vehicle deliveries, NIO’s profitability is unlikely before 2027.

- Geopolitical issues and industry price wars hinder NIO’s expansion in the U.S. and Europe, further complicating its path to profitability.

- NIO’s recent stock rebound is driven by external factors like China’s new stimulus package, but long-term prospects remain grim.

Victor Golmer

NIO (NYSE:NIO) continues to drain liquidity and dilute its shareholders as its business remains unprofitable and is unlikely to break even anytime soon. Despite growing its sales, the continuous burning of cash resources coupled with the rising geopolitical risks will likely make it hard for NIO to execute a proper turnaround and no longer rely on outside financing to run its operations.

The only major thing that NIO has going for it is the fact that its revenues are rising, the vehicle deliveries are going up, and Beijing looks committed to reviving its economic growth, which is why the stock was able to find a technical support level and rebounded in recent months.

That’s why NIO is a HOLD for me for now since its shares currently trade at historically low levels, which means that the downside is limited, and any positive announcement or development from China can revive momentum and result in the further appreciation of shares. As for the long-term prospects, the picture looks grim.

Disaster In The Making

My latest article on NIO was published back in March, where I noted that I’m upgrading my rating for NIO from SELL to HOLD. Back then, the previous SELL recommendation played out well, as NIO’s shares depreciated by a double-digit rate by that time, but there was also an indication that they were about to find a technical support level and rebound in part due to the developments that were happening in China. That’s why the rating was changed.

This is also exactly what has happened as NIO’s stock is now up since the latest article with a HOLD rating was published and it has also outperformed the broader market primarily thanks to the macro developments that will be discussed shortly. However, NIO currently faces major challenges that could undermine the stock’s momentum and prevent me from upgrading my rating to BUY.

If we go through NIO’s recent earnings report for Q2, which was published last month, we’ll see that while the company’s revenues increased by 98.9% Y/Y to $2.4 billion, it was below the estimates by $40 million. At the same time, the company continues to be unprofitable, its cash burn rate remains meaningful, and the rising geopolitical challenges are likely to prevent NIO from becoming an attractive long-term investment anytime soon.

Even though NIO’s revenues were up, its bottom-line performance barely improved. This is because the cost of revenues was up Y/Y and the overall net loss in Q2 was $705.4 million. If we look at the company’s balance sheet, we’ll see that during the recent quarter, the cash reserves have also decreased from $5.32 billion in Q1 to $4.99 billion in Q2.

Considering that profitability is expected only in 2027, the company will continue to lose money. However, given the weak margins and constant downward revisions, there’s a possibility that NIO will not even break even in 2027.

The only reason why NIO hasn’t gone under yet is due to the constant liquidity injections by outside investors, which results in dilution and makes the company’s stock less attractive to own for the common investors. In Q2’24, NIO had 2.05 billion shares outstanding, an increase from 1.6 billion in Q2’23.

At the same time, it’s unlikely that those investments by outsiders, which improve NIO’s liquidity, will help the company quickly scale the business and reach profitability. We should not forget that the EV industry is currently in the middle of a price war, which has already negatively affected the bottom-line performance of major EV companies even though they are experiencing a rise in overall sales and deliveries. Just recently, there was another round of price cuts for electric vehicles in China to new historical lows. This will likely lead to margin contraction for NIO and its peers and prevent the company from reaching profitability anytime soon.

On top of that, the worsening geopolitical environment also makes it harder for NIO to expand its business and diversify its markets. Earlier this year the United States implemented a 100% tariff on EV imports from China, while the Commerce Department has recently proposed to ban the use of Chinese software and hardware in cars on American roads. Considering this, it’s unlikely that NIO will be able to enter the US market and diversify its income streams in the foreseeable future.

NIO is also unlikely to increase its sales in Europe anytime soon. In Q2 and Q3, the company sold only 423 EVs and 406 EVs, respectively, in the European Union. After the European Council voted to approve the implementation of higher import tariffs on Chinese EVs, which were proposed by the European Commission earlier this year, it’s hard to see how NIO will be able to expand its presence on the old continent.

At the same time, higher tariffs are not the only issue that NIO faces in the European Union. While the company has been working on expanding its operations in Europe and even built a plant in Hungary, the decision by Beijing to stop its carmakers from exporting advanced EV technology overseas has created another major headwind for NIO. Not only will it make it much harder for NIO to expand elsewhere, but it will also make the company extremely exposed to the Chinese EV market and prevent it from reaching profitability anytime soon due to the ongoing price war within the country.

Another issue that undermines the idea of investing in NIO is its bloated valuation. The company makes less than $10 billion in annual revenues, its net loss in the trailing twelve months was nearly $3 billion, its business is not expected to become profitable in the following years, and yet its stock trades at a market cap of ~$13 billion. At this stage, it’s nearly impossible to create a traditional valuation model such as the DCF model to figure out NIO’s fair value since the business itself is on life support as it continues to burn cash each quarter and needs additional liquidity injections to keep operating. In the trailing twelve months, NIO’s unlevered FCF was -$2.14 billion, and the situation is not expected to change significantly.

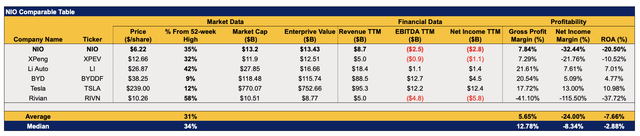

What’s worse is that when compared to its peers, NIO could also be considered one of the worst investments within the EV space. The company’s gross margin is below the industry’s median, while its net income margin and return on assets are some of the worst when compared to others. As such, NIO is an unattractive investment based on the fundamental analysis.

NIO Comparable Table (Author)

Some Upside Is Still There

Despite all the challenges that NIO currently faces, there’s still some upside left for the company and its stock. As I’ve stated earlier, NIO was trading close to the historically low levels for a while. This has created an opportunity for its shares to rebound on any positive development. That’s exactly what has happened as NIO’s shares quickly appreciated on record volume in the last month.

NIO’s Stock Performance (Seeking Alpha)

The appreciation happened primarily after Beijing announced that it’s committed to launching a new stimulus program to revive economic activity in China. This has sparked a rally for most China-related stocks.

Last week, the details of the plan have emerged. The new stimulus package will be worth $325 billion and include the issuance of special government bonds coupled with the reduction of mortgage rates for already built homes.

The potential improvement of the Chinese economy thanks to the new stimulus package along with the expected growth of the global economy should help the EV sector to thrive as well. The latest forecasts indicate that the Chinese EV sales this year will reach 12 million vehicles, above the previous estimates of 11.5 million vehicles. NIO has already achieved a new record after delivering 61,855 vehicles in Q3 after a strong performance in September. Thanks to this, the company is expected to increase its overall revenues this year, which might help the shares appreciate in the short term.

The Bottom Line

At this point, NIO is a momentum trade at best. The latest rebound of shares was caused primarily by developments that are outside of the company’s control. While the shares could retain their momentum for a while, it makes no sense to invest in NIO for the long term at this stage as the prospects look grim. The company continues to burn significant amounts of cash reserves and constantly needs additional liquidity injections, which dilutes shareholders, to stay afloat.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.