Summary:

- NIO’s Q1 earnings showed improved vehicle margins and a strong forecast for Q2 deliveries, leading to a positive outlook for the firm’s shares.

- The launch of NIO’s new low-cost EV brand, ONVO, represents an opportunity for the company to attack Tesla in China, but also poses risks to the company’s margin trend.

- NIO has the second-highest vehicle margins, after Li Auto.

- The Company has a low price-to-revenue ratio and upside catalysts (profit improvement, ONVO launch, growing vehicle margins).

Robert Way/iStock Editorial via Getty Images

Electric vehicle start-up NIO (NYSE:NIO) submitted a mixed earnings sheet for the first fiscal quarter on Thursday that thankfully showed a continual trend of vehicle margin improvements. NIO’s share price nonetheless dropped 7% after the Q1’24 earnings report, largely due to persistently high losses. NIO also announced the launch of a new, low-cost electric vehicle brand recently in a bid to attack the low-cost EV market segment and challenge Tesla’s (TSLA) Model Y. I believe NIO still deserves the benefit of the doubt and since deliveries are roaring back in the second-quarter, the risk profile remains skewed to the upside, especially with the kind of valuation that NIO now offers EV investors.

Previous rating

My last rating (March 2024) on shares of NIO was strong buy because I saw a positive risk profile related to the company’s valuation. Since then, shares have declined approximately 13%, largely because investors appear too bearish. NIO’s deliveries expectedly dipped in the first-quarter due to seasonal effects (and so do the deliveries of other China-focused EV start-ups) which sometimes can take a toll on investor sentiment. However, NIO’s electric vehicle margins continued to improve in the first-quarter and the company’s deliveries are set for a bounce-back quarter in Q2’24. Additionally, NIO just announced the kick-off of a new EV brand, ONVO, which is meant to create a challenge for Tesla’s widely popular Model Y.

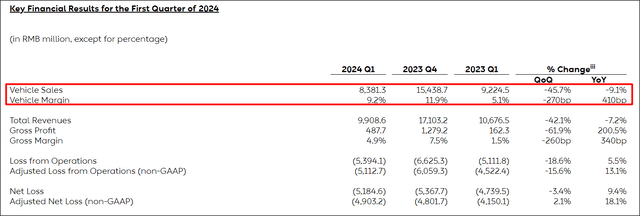

Improving vehicle margin trend for NIO

The biggest take-away from NIO’s first fiscal quarter earnings report card was that the electric vehicle start-up successfully managed to improve its margin picture. NIO’s vehicle margins improved to 9.2% in Q1’24, showing 4.1 PP expansion on a year-over-year basis. NIO’s vehicle margins dropped Q/Q due to increased promotional events.

XPeng (XPEV), as an example, improved its vehicle margins 8.0 PP to 5.5% in Q1’24. So while XPeng’s margin improvement was bigger than NIO’s in percentage terms, NIO still has higher vehicle margins than XPeng (due to the EV company posting negative margins in the last year). Li Auto (LI) is still stealing the show here and had vehicle margins of 19.8% in Q1’24, although the EV firm reported a 0.5 PP Y/Y decline in margins. Li Auto’s vehicle margins were therefore more than double NIO’s margins, and it is the main reason why I believe Li Auto remains the most attractive Chinese EV start-up for investors to invest in right now.

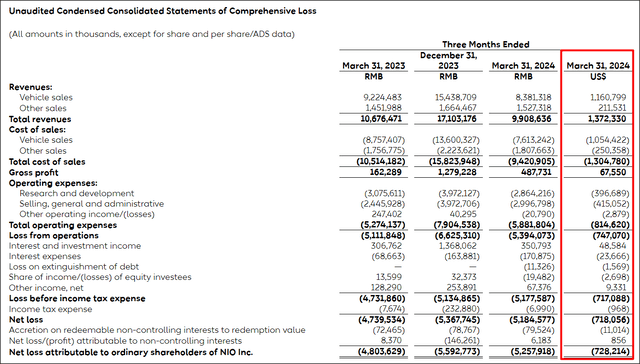

With delivery growth broadly slowing last year, investors have become more focused on profitability, and margins tend to be a great way to judge improvements in this regard. From this point of view, NIO did quite well in Q1’24, although the company’s large net loss of 5.2B Chinese Yuan ($718.1M) which increased 10% to the year-earlier period. Because investors are more focused on costs now than a year ago and NIO continues to post large net losses, shares of NIO slumped 7% after earnings… which I consider to be a buying opportunity, largely because the delivery picture is improving.

NIO delivered 30,053 electric vehicles in the first-quarter, but the company is seeing very encouraging momentum so far in Q2’24. First-quarter delivery volumes in China tend to decline drastically due to the inclusion of Chinese New Year holidays. However, second-quarter delivery volumes typically bounce back quick and hard: in the first two months of the second fiscal quarter, as an example, NIO already delivered 36,164 electric vehicles which is already 20% more than in the entire first-quarter. The company’s delivery guidance for Q2’24 calls for 54-56k deliveries, implying up to 138% year-over-year growth.

Launch of EV spin-off brand ONVO

NIO announced the launch of a new electric vehicle brand named ONVO last month, which is meant to consolidate the company’s attempts to challenge the position of the Tesla Model Y in China. The brand’s first model, the ONVO L60, is a mid-size sport utility vehicle that is meant to target families and have mass market appeal. Deliveries for the ONVO L60 are set to start in Q3’24 and any disclosures of reservation numbers for this EV model could be a positive catalyst for NIO’s shares.

The ONVO L60 is set to debut with a price tag of $30k which would make it about $10k cheaper than the Tesla Model Y. I believe the launch of the spin-off brand is a positive development for NIO although the ONVO brand also poses a significant risk for the EV start-up: with vehicle margins just rebounding, it is a big risk for NIO to launch a low-cost EV brand to consolidate its efforts to target the mass market as it could have negative consequences for the company’s vehicle margin trend. Therefore, the vehicle margin trend for NIO will remain the most important KPI going forward, in my opinion.

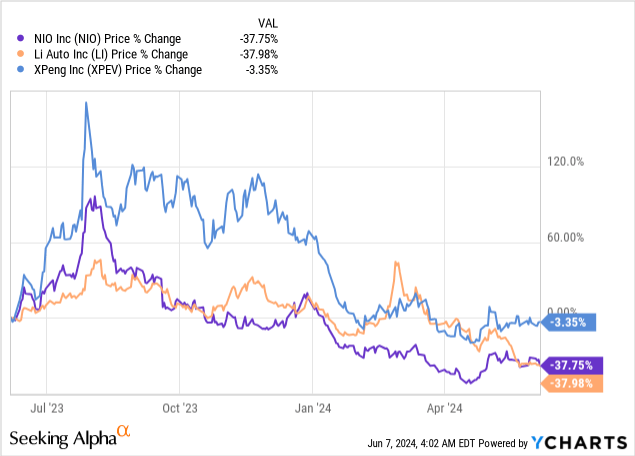

NIO’s valuation reflects deep investor pessimism

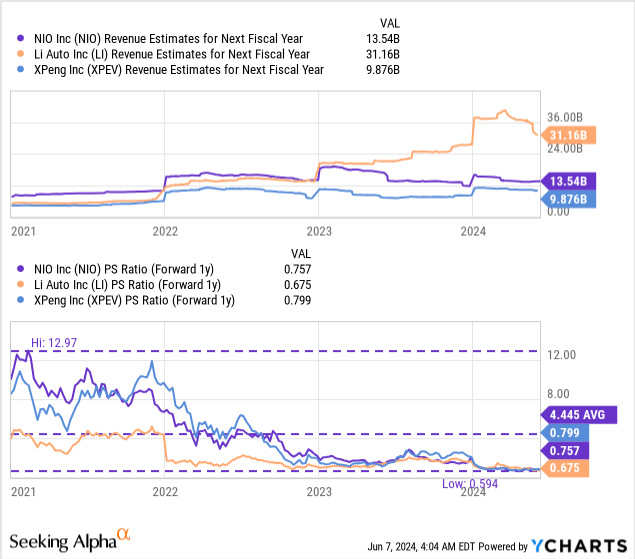

I believe NIO and Li Auto are the two EV start-up companies that are the most attractive for investors. This is because Li Auto is growing the fastest and is posting vehicle margins around the 20% mark, which is more than double what NIO achieved in the first-quarter and almost four times of what XPeng achieved in Q1’24.

Li Auto is not only growing the fastest, but is also already profitable and has the lowest price-to-revenue ratio… which I believe is completely undeserved. NIO is currently trading at a price-to-revenues ratio — which I have to use for comparison purposes since only Li Auto is currently already profitable on a net income basis — of 0.76X, which is way below the longer term (3-year) average P/S ratio of 4.45X.

In my last work on NIO, I said that the EV maker could have a fair value of $10.80 per-share if shares revalued only to their 1-year P/S ratio… which has since further risen to 1.40X. In my opinion, the reason for this is that investors have soured on the EV sector more broadly due to reports about waning electric vehicle demand, and especially on those EV firms that are not yet profitable.

However, NIO is seeing strong growth in margins and deliveries, so I believe NIO does have a lot of revaluation potential. If NIO executes well, defends its vehicle margins and continues to grow its deliveries in FY 2024 (first-half FY 2024 actuals + Q2’24 forecast imply an annual 170k+ delivery volume on a full-year basis), I believe NIO could revalue to its 1-year average P/S ratio of 1.4X which implies a fair value in the neighborhood of $9.30 per-share.

Risks with NIO

I see certain risks with NIO continuing to post high net losses, especially now that investors are more focused on profitability than mere growth. There are also risks regarding the launch of a new, lost-cost EV brand, which could add new margin pressures for NIO going forward. This launch also comes at a time at which the electric vehicle start-up is not yet achieving a baseline of profitability. What would change my mind about NIO is if the company were to see a decline in its vehicle margins specifically or suffered slowing delivery growth.

Final thoughts

NIO did a great job in growing its vehicle margins in the first fiscal quarter, which has been a point of contention for investors for a long time. Compared to rivals in the start-up industry, NIO has now the second-highest vehicle margins after Li Auto. XPeng is still hanging a bit behind, but has also recently seen some upside momentum in vehicle margins. I have mixed feelings about NIO’s launch of its low-cost, mass market EV brand ONVO which appears set to increase margin pressures just at a time when they are recovering. The outlook for the second-quarter, in terms of deliveries, confirmed my earlier suspicions that NIO was set for a strong Q2 delivery rebound. What sustains my strong buy rating here is that NIO is trading at a very attractive valuation, from a price-to-revenue point of view, and I believe that investors are too bearish. Overall, I believe the positives outweighed the negatives with regard to NIO’s earnings report for Q1’24, and I especially like the change in the vehicle margin trajectory!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO, LI, XPEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.