Summary:

- NIO Inc. missed its initial Q1 delivery guidance, raising significant concerns about its ability to ramp up production this year.

- Competition in China’s EV market is expected to intensify in 2024.

- Xiaomi’s entry into the EV market has worsened competitive headwinds for NIO.

- NIO’s inability to execute consistently has likely lowered investor confidence markedly.

- The pain might not be over, with the market potentially dismantling NIO’s broken growth story further.

JHVEPhoto

In my February 2024 NIO article, I reminded NIO Inc. (NYSE:NIO) investors holding on to their NIO shares that they were prolonging their pain in the battered pure-play Chinese premium EV maker. I urged investors to avoid catching NIO’s falling knife, as the lack of a hybrid strategy could lead to a moment of reckoning for unprofitable NIO.

NIO reported its fourth-quarter earnings release in early March 2024. As a reminder, NIO provided Q1 deliveries guidance of between 31K and 33K vehicles. However, the company’s update in late March downgraded NIO’s Q1 deliveries outlook to about 30K vehicles. Therefore, NIO’s overpromising and underdelivering ways of 2023 have reemerged, as NIO’s final Q1 deliveries of 30.05K vehicles missed even the low end of its initial Q1 guidance.

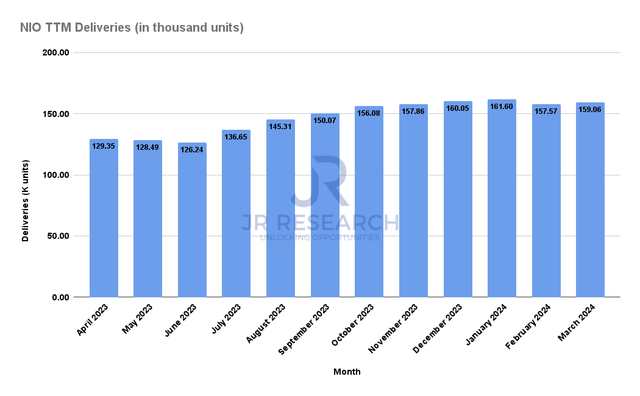

Nio TTM deliveries (Nio company filings)

As seen above, NIO delivered about 159K vehicles over the last twelve months. It remains below the highs struck in January 2024, suggesting the company continues to struggle with generating the necessary scale leading to profitable growth. As a reminder, NIO management didn’t provide a direct answer to an analyst who asked:

My first question is about 2024 volume target, in the report you target 200,000 units for full year ’24 which means 25% growth. Can you confirm what is your target? (Nio Q4 2023 earnings call)

CEO William Li responded, reminding investors that competition is anticipated to be “intense” in 2024 but didn’t communicate a full-year target. However, NIO management emphasized that NIO is “confident” in delivering “around 31,000 to 33,000 units in March as the weather gets better, and the market gets more dynamic and vibrant.” It also added that the 20K a month target (annualized 240K deliveries) is a “mid-term” target but didn’t specify when that could happen.

Therefore, NIO missed even the low end of its initial guidance despite the company’s “confidence.” Consequently, I believe the market has priced in a worsening outlook as the quarter ended, suggesting NIO could face significant challenges ramping its production this year.

China’s April deliveries outlook (based on CPCA’s estimates) suggests a 37% YoY increase in retail NEV deliveries. However, April deliveries are expected to remain flat MoM, even as NEV penetration remains robust at 45%.

However, it’s pretty clear that China’s EV growth rate has slowed markedly “due to a slowdown in consumer spending, attributed partly to a housing market crisis.” In addition, overcapacity in EV manufacturing has started to worry investors. Furthermore, even Tesla (TSLA) felt the impact of a weak Q1. Accordingly, Tesla’s free cash flow fell into negative territory as it intensified its investments in “artificial intelligence infrastructure and experiencing a rise in unsold-vehicle inventory.”

NIO investors are likely betting that Nio’s 2024 model refresh could lift the gloom over its demand challenges. In addition, they could expect NIO’s mass-market models to help the company achieve better scale economies, as automakers are leaning into lower-priced models to improve their reach. However, we will not likely get clarity on NIO’s ability to execute these strategies until late 2024.

With NIO’s disappointing execution over the past year that continued in Q1, I believe the market has downgraded NIO management’s ability to deliver effective results for 2024. To make matters worse for NIO, Xiaomi’s (OTCPK:XIACF) recent entry into the EV scene has intensified competitive headwinds for NIO. It’s important to consider that Xiaomi is a free cash flow profitable company, bolstering Xiaomi’s EV market expansion. Analysts expect Xiaomi’s EV efforts to incur losses but don’t expect Xiaomi’s FCF to turn negative, with Xiaomi’s FCF margins for 2024 and 2025 to reach 4.5% and 5%, respectively.

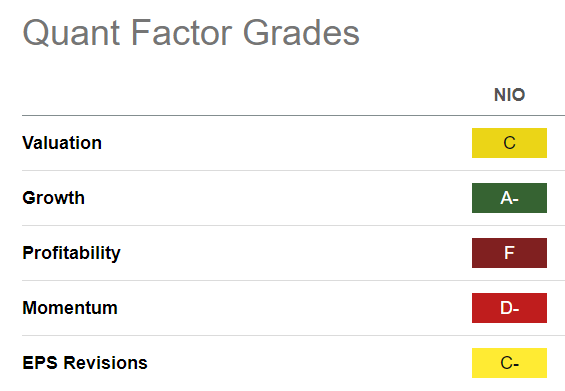

NIO Quant Grades (Seeking Alpha)

Notwithstanding the valuation de-rating, NIO is still not valued at a discount with a “C” valuation grade. However, with an unenviable “F” profitability grade, I believe NIO’s ability to scale profitably could prove highly detrimental. In addition, competitive headwinds are expected to intensify as automakers realize they may have been too optimistic in their near-term projections.

With NIO primarily dependent on its domestic market to drive scale, NIO also faces concentration risks. Geopolitical headwinds in the EU and US will likely discourage NIO from expanding its penetration more aggressively outside China beyond its current European cadence. Therefore, NIO’s problems are expected to worsen and not improve in 2024 as Tesla looks to regain its competitive edge by potentially launching lower-priced Tesla models as early as the end of 2024.

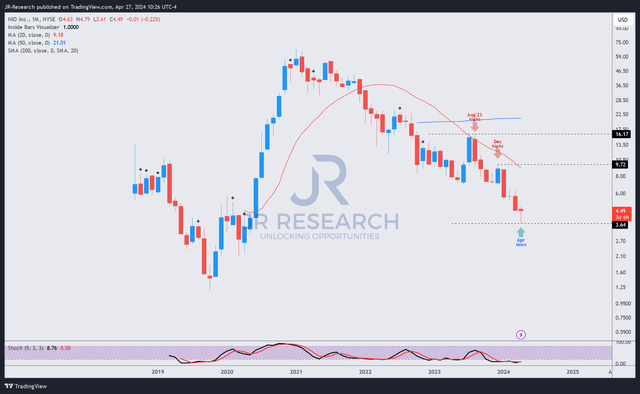

NIO price chart (long-term, monthly) (TradingView)

NIO stock’s price action demonstrates the market’s discontent with its execution. NIO has continued taking out lower and lower highs, as investors were left baffled by NIO’s inability to chart a clear path toward profitable scale.

I assessed some selling respite in April, showing a possibility that buyers could have returned to stem further downside. However, it could also be a temporary response attributed to short-covering after NIO’s short interest surged to significant highs recently.

While I assessed that a near-term bullish mean reversion setup could provide opportunities for short-term traders, I believe investors should continue to avoid NIO.

NIO management needs to regain the trust of NIO investors to buy into its growth thesis. Its inability to deliver its guidance consistently over the past year has unveiled the failings of its execution. Unless NIO can demonstrate a clear path toward 20K monthly deliveries with its main brand, I believe NIO’s valuation hasn’t fully discounted a worse outcome.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!