Summary:

- NIO’s Battery as a Service model reduces upfront EV costs, enhances convenience, and eliminates battery lifespan concerns, driving EV sales growth.

- The ONVO L60 SUV, priced competitively against Tesla’s Model Y, is expected to boost NIO’s sales with significant pre-orders and monthly delivery targets.

- NIO’s strong sales growth, driven by China’s expanding EV market and government incentives, supports a projected 35% revenue increase in the near term.

- Despite past capital raises and legal uncertainties, NIO’s cost optimization and high-margin product focus justify a ‘Buy’ rating with a $9 one-year target price.

Victor Golmer/iStock Editorial via Getty Images

NIO (NYSE:NIO) launched their Battery as a Service (BAAS) in August 2020. Since then, NIO has been expanding their charging and swapping network in China to enable their customers to swap batteries more conveniently and quickly. I view their BAAS as differentiated and believe it could drive EV sales. I am initiating with a ‘Buy’ rating with a one-year target price of $9 per share.

Battery as a Service

During the recent earnings call, NIO disclosed that they had installed over 2,561 power swap stations and 23,000 power chargers. With the growing number of swap stations, I think the Battery as a Service offers the following benefits:

- The BAAS model reduces the upfront cost of NIO’s EVs. For instance, their ONVO L60 with 60kWh battery is priced at US $30,500. However, if customers opt for BAAS model, they pay $21,000 for the car, and $90 per month for the battery swapping services, which makes NIO’s vehicles more affordable to a broad range of customers.

- Compared to traditional battery charging, the battery swapping service is more convenient for customers. A typical power swapping station, as shown in the picture below, takes only needs 3–5 minutes to complete a battery swap. After swapping the battery, customers can immediately drive away with a fully charged battery.

- With the new business model, customers no longer need to worry about the lifespan or degradation of their batteries, as they don’t own the batteries at all.

To ensure the success of BaaS, NIO needs to continue expanding the number of super swapping stations and increase coverage across more cities. Their management plans to cover their swapping stations in more than 2,300 cities in China by the end of 2025.

ONVO L60

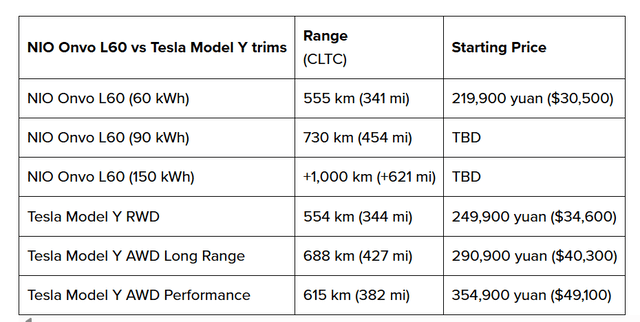

NIO started their mass production of ONVO L60, a mid-size family SUV, in August 2024, aiming to compete against Tesla (TSLA) Model Y. During the pre-sale period, NIO attracted significant market attention and received tens of thousands of pre-orders. During the earnings call, the management indicated that the NIO still has more room for future price drops, to make their car affordable and better positioned to compete with Model Y.

I think the low-cost ONVO L60 SUV could lead to a sales surge in China. NIO targets to achieve 20,000 deliveries per month. As shown in the table below, NIO’s L60 is more than 10% cheaper than Tesla’s Model Y. If customers choose BAAS model, the purchase price will be even lower, as discussed earlier.

Recent Result and Outlook

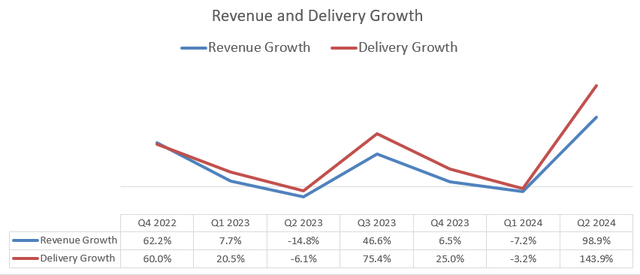

NIO released their Q2 FY24 result on September 5th, reporting 99% year-over-year growth in total sales and 143.9% growth in total deliveries, as shown in the chart below.

In addition, NIO released their Q3 deliveries on October 1st, reporting 21,181 vehicles deliveries in September 2024, a 35.4% year-over-year increase. I am encouraged by the strong growth in deliveries. With the ramp up of L60 production, I anticipate the total deliveries will grow rapidly in the near future.

For their near-term growth, several factors have been considered:

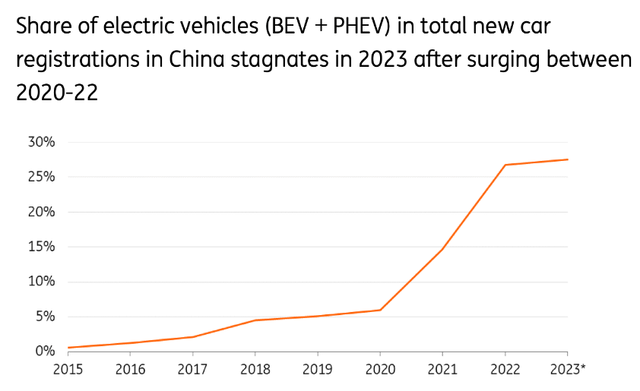

- As depicted in the chart below, China’s EV market penetration has grown rapidly in recent years, reaching more than 25% of total registration shares in 2023. The strong growth was primarily driven by government incentives, government supports for charging stations, and the launch of new EV models.

- Historically, the overall automotive market has grown at around 12%, driven by urbanization and rising middle class. Assuming EV penetration will grow by 5% annually, I calculate the EV market will grow by approximately 30% in the near future.

- I like NIO’s dual brand approach, which targets both luxury and mass markets. Their ONVO L60 is poised for rapid growth, in my view, as the price point and BAAS model make it accessible to middle-class families.

As such, I project NIO’s revenue will grow by 35% in the near term, driven by 30% market growth and 5% share gains. To be conservative, I model NIO’s revenue growth gradually moderating to 10% by FY33, reflecting the eventual maturity of the EV market.

NIO’s operating margin was -40.7% in FY23 due to excessive investments in charging stations, swapping stations, new model R&D and marketing promotions. I anticipate NIO will deliver 500bps annual margin expansion driven by 200bps from gross profits, 200bps from SG&A optimization and 100bps from R&D reductions. During the earnings call, the management indicated that the company would focus on cost optimization and expand their gross margin. In addition, NIO plans to allocate more marketing resources to high margin products, such as their high-end NIO brand models.

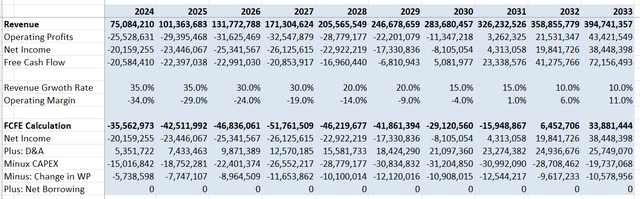

With these assumptions, I calculate the free cash flow from equity (FCFE) in the table below. Please note that the net change in working capital incorporates the changes in account receivables, inventory, account payables, and accrued expenses.

The cost of equity is calculated to be 13% assuming: risk-free rate 3.6%; beta 1.34; equity risk premium 7%. Discounting all the future FCFE, the one-year target price is estimated to be $9 per share, according to my model.

Key Risks

- NIO has actively raised capital through the equity market in the past. Specifically, they raised RMB $12 billion in FY21 and $21 billion in FY23. I understand they need capital to invest in their infrastructure buildup as well as new car productions. However, any future equity raises could place near-term pressure on NIO’s stock price.

- In December 2023, NIO received a $2.2 billion investment from Abu Dhabi’s government. NIO plans to open stores and start local production in the UAE market. It is uncertain how NIO will perform in the UAE market at this moment. After all, NIO lacks experience in international operations.

- According to NIO’s annual report, in 2022, two complaints were filed against NIO’s CEO and CFO in the federal district court for the Southern District of New York, alleging their false public disclosure between August 2020 and July 2022. The outcome of the lawsuits remains unclear.

End Note

I think NIO is one of the best players to capitalize on the rapid growth of EV market in China. I favor NIO’s BAAS model, which can potentially expand their customer base with more affordable solutions. I am initiating with a ‘Buy’ rating with a one-year target price of $9 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.