Summary:

- NIO has impressed recently as it outperformed the S&P 500. Is it time to buy?

- Nio seeks to enter the more competitively priced EV segments. However, it’s also intensely competitive.

- Its unprofitability significantly limits its ability to compete effectively against leaders like BYD and Tesla.

- I assess Nio’s entry into the lower-priced segments is filled with higher execution risks, even as it struggles to achieve sustainable profitability.

- With that in mind, I explain why investors shouldn’t be fooled into celebrating too early and consider avoiding the stock.

Getty Images

NIO Surprised With Recent Outperformance

NIO Inc. (NYSE:NIO) investors likely welcomed the recent respite as the stock climbed out of its malaise and significantly outperformed the S&P 500 (SPX) (SPY). As a result, it has also surged above the lows since my last update on NIO in early July 2024. Nio’s relative outperformance has aligned with a much more robust earnings scorecard in early September, underscoring its potential recovery through 2025.

In my previous article, I highlighted that the Chinese EV maker still faces significant hurdles in its profitability growth inflection. In addition, the execution risks have also risen, even as it seeks to scale with lower-priced sub-brands. In Nio’s Q2 earnings commentary, management assured investors that its premium strategy has started to show sustained improvement, given its solid deliveries of more than 57K units in Q2. As a result, it has likely assured investors that Nio’s previous history of overpromising and underdelivering could be a thing of the past. Accordingly, Nio highlighted a solid Q3 deliveries guidance of between 61K and 63K units. Therefore, the EV maker has moved closer to an annualized deliveries cadence of nearly 250K units, underscoring its ability to ramp toward profitability.

Nio is Scaling Up. But Is It Enough?

Notably, Nio’s stellar performance in August (it delivered more than 20K units in the month) coincided with impressive performances from its EV peers, underscoring the marked improvement in market conditions. Notwithstanding the underlying macroeconomic struggles facing Chinese consumers, its EV makers have continued to make constructive progress. In addition, Nio has started to demonstrate its ability to scale while taking on immense competitive pressure from EV leaders such as Tesla (TSLA) and BYD Company (OTCPK:BYDDF) (OTCPK:BYDDY).

Consequently, I assess that the market is likely more confident of Nio’s decision to launch its lower-priced Onvo brand. Nio has demonstrated that it’s making solid progress with the volume ramp cadence of its main premium brand before executing the go-to-market strategies for its more competitively priced Onvo vehicles. Accordingly, management has indicated a monthly deliveries outlook of 10K for the L60 line-up by the end of the year (with deliveries starting in September).

Nio assured investors that as it continues to lift its volume, it should bolster its capabilities to move closer to its long-term vehicle margin target of 25%. In addition, the company aims to continue scaling its effort in meeting its long-term deliveries outlook of 40K units monthly.

Nio Is Still Far From Its Long-Term Goals

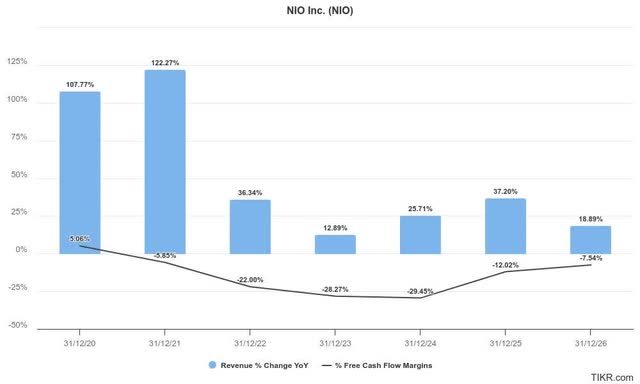

Nio estimates (TIKR)

Notwithstanding management’s optimism, investors must acknowledge that Nio remains far from its long-term goals. Management anticipates its vehicle margin improving to 15% by the end of 2024. While it indicates a solid improvement from Q2’s metric of 12%, the company must demonstrate more consistent deliveries growth to justify a further valuation re-rating.

Moreover, Nio’s relatively inconsistent revenue growth has hampered efforts to bolster investor confidence about its ability to reach free cash flow profitability. Accordingly, analysts don’t expect Nio to attain positive FCF through the FY2026 forecast period.

Moreover, geopolitical uncertainties affecting Nio’s European adventure have likely affected its international growth ambitions. While it has made constructive progress in the UAE (given its partnership with the Abu Dhabi government), the developments are still nascent. Hence, it’s still too early for investors to gain sufficient confidence in Nio’s ability to diversify from the Chinese EV market dominated by BYD and Tesla.

Nio claims to have captured “over 40% of the market share in the battery electric vehicle segment priced above RMB300K” in China. Despite that, it still has not managed to deliver consistent deliveries performance and is not profitable. Its aggressive investments in its unprofitable battery swap network have also affected the company’s ability to project more robust margins accretion.

Is NIO Stock A Buy, Sell, Or Hold?

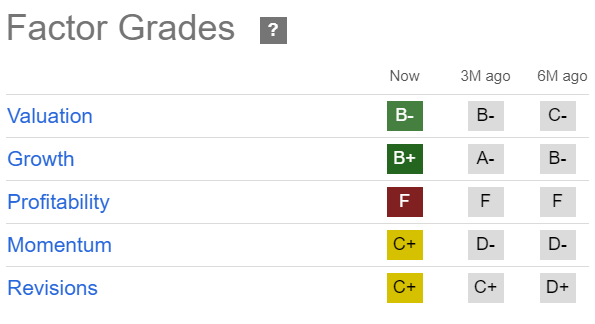

NIO Quant Grades (Seeking Alpha)

Consequently, I still find it challenging to justify a bullish thesis on the unprofitable EV maker. Although recent market sentiments have improved, leading to NIO’s relative outperformance, its “C+” momentum grade suggests caution is still warranted.

Nio’s ability to navigate the intensely competitive challenges in China is not totally within its control. BYD’s ability to scale more effectively across local and international markets is a testament to its execution prowess and production capabilities. Furthermore, Nio’s optimism in a potentially more competitive lower-priced category will likely be more challenging than anticipated.

Given its already sizeable market share in the premium segment, a more robust volume ramp in the lower-priced segment will be necessary to meet its long-term margin targets. Given its current unprofitability in its premium segment and battery swap network, I’m not convinced that Nio can scale effectively while contending with more intense competition in the mass market segments.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!