Summary:

- NIO’s stock has lost over 70% of its value in the last twelve months, with deteriorating fundamentals and market share.

- The company continues to burn cash and is expected to raise new funds, leading to increasing leverage and share count.

- Valuation analysis suggests NIO stock is deeply undervalued, but the discount appears justified given the numerous red flags.

Andy Feng

Investment thesis

My previous bearish thesis about NIO’s (NYSE:NIO) stock aged well, as the stock lost around 9% of its value since late April. I think that there are no reasons to be less pessimistic about NIO as the company’s fundamentals keep falling apart. The company continues to burn cash, which means more dilution to the shareholders’ value in the nearest future. The company is rapidly losing its market share and the sustainability of its business model is questionable. NIO appears to be significantly undervalued from the perspective of discounted cash flows, but the discount looks fair given all the red flags. All in all, I reiterate a “Strong Sell” rating here.

Recent developments

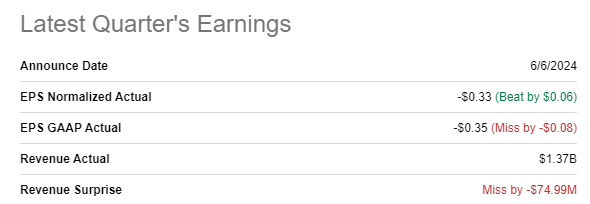

NIO released its latest quarterly earnings on June 6, when the company topped adjusted EPS consensus estimates, but the revenue surprise was negative. Revenue declined by 8.7% YoY in Q1 2024, and the adjusted EPS improved from -$0.41 to -$0.35. It was the eleventh quarter in a row when NIO missed EPS estimates.

Seeking Alpha

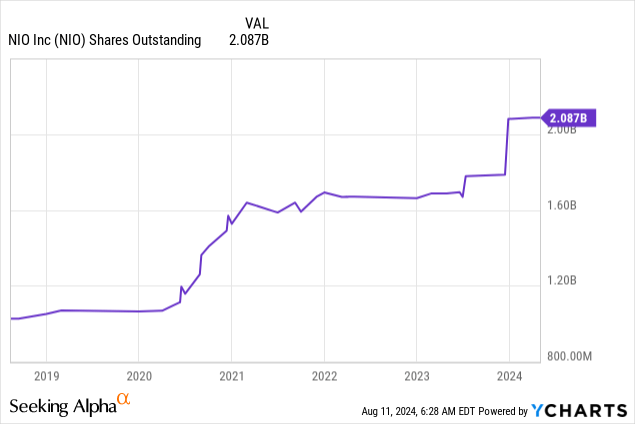

The EPS improvement shall not mislead readers, as the metric improved only due to the increased outstanding shares count. According to Seeking Alpha, the number of shares outstanding was around 2 billion as of Q1 2024, around 24% higher compared to the end of Q1 2023. In absolute terms, NIO’s net loss was $30 million deeper on a YoY basis.

NIO’s net cash position narrowed significantly in Q1, from $2.2 billion to $0.8 billion. The trend is warning as the cash burn is massive. Since the company is deeply unprofitable, it is highly likely that it is poised to continue issuing more shares. Therefore, we can expect more dilution of shareholders’ value.

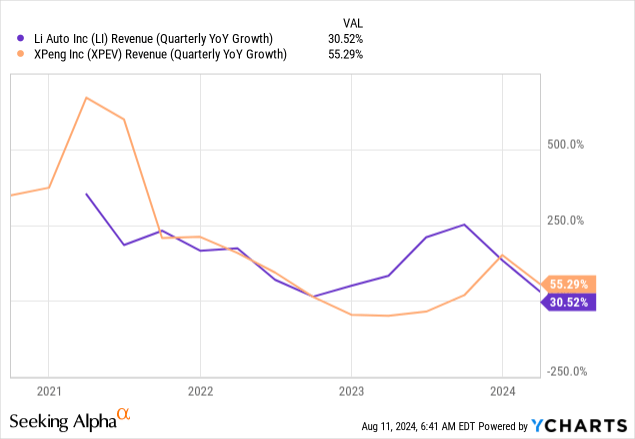

NIO’s Q1 notable revenue decline is a red flag without context. However, if compared to the overall Chinese EV market’s dynamics in Q1, the picture looks even worse. According to Forbes, China’s EV vehicles sales grew by 14.7% YoY in Q1 2024. When the company’s revenue grows slower than the broader industry with such a wide gap, it means that this company is rapidly losing its market share. NIO’s closest rivals are Li Auto (LI) and XPeng (XPEV). These companies demonstrated massive revenue growth momentum in Q1 2024.

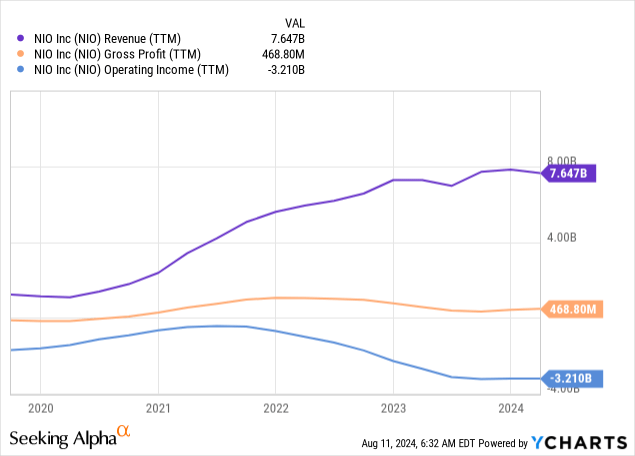

What is most crucial, I have doubts about the sustainability of NIO’s business model. As shown above, revenue demonstrated impressive growth since 2020, but the gross profit has been stagnating and the operating income even declined sharply. In a healthy and sound business model, profitability should follow the revenue growth. Otherwise, there is no point in driving revenue growth, especially considering that NIO still generates operating losses.

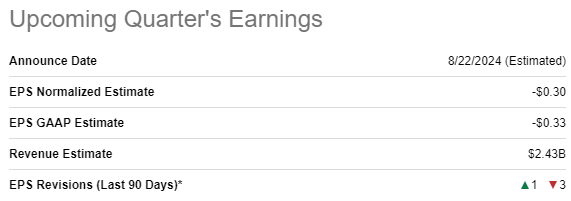

The company is expected to share its Q2 earnings on August 22. Consensus estimates project Q2 revenue to double on a YoY basis, but it is a one-off spike. There was a deep revenue pullback in Q2, 2023, explaining the expected surge. Moreover, according to quarterly consensus estimates, Q3 revenue is expected to slip again, by 3% YoY.

Seeking Alpha

To wrap up, there are numerous red flags. The business model’s sustainability is questionable, the market share is deteriorating, and the balance sheet is poised to suffer for many quarters ahead.

Valuation analysis

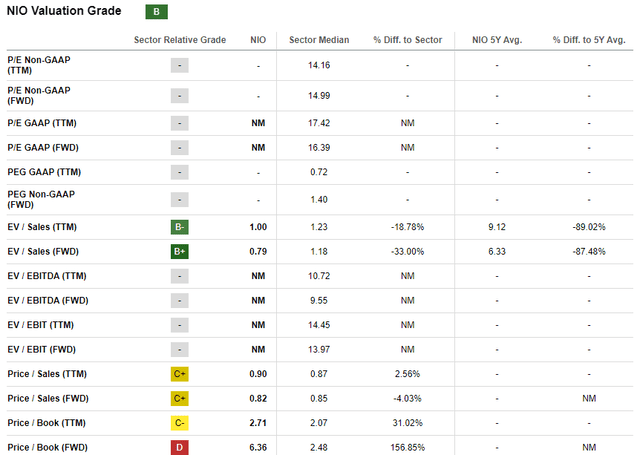

NIO declined by 72% over the last twelve months and its YTD dynamic is also quite poor with a 58% decline in 2024. NIO’s valuation ratios now look moderate, with price-to-sales ratios moving below one. Since NIO is still deeply unprofitable, most of the ratios are not applicable.

Seeking Alpha

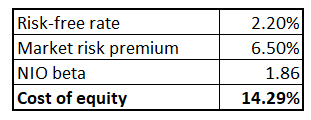

Looking at ratios is likely insufficient to draw conclusions. Therefore, I must proceed with the discounted cash flow [DCF] simulation. I consider a 15% WACC to be fair considering political and geopolitical risks inherent to all Chinese stocks together with company-specific several fundamental weaknesses, which I have highlighted in the section above. My WACC assumption is also backed by the cost of equity calculations below using the CAPM approach.

Author’s calculations

NIO’s market beta is 1.86, according to Yahoo Finance. China’s 10-year governmental bonds yield is currently at 2.2%, which I use as a risk-free rate. A 6.5% equity risk premium for Chinese stocks is my personal judgment, which is approximately in line with the levels recommended by Aswath Damodaran [5.63% equity risk premium + 1.03% country risk premium]. The CAPM formula gives me 14.29%, which is approximately in line with my WACC.

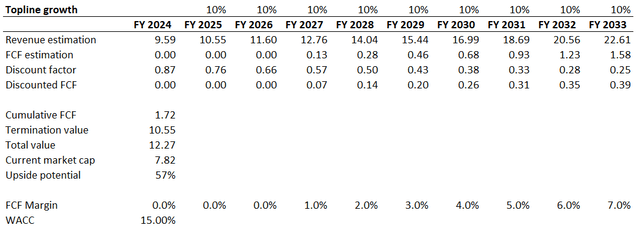

Due to the fierce competition, which is poised to intensify further, I expect NIO to underperform compared to the overall Chinese EV market and project a 10% revenue growth. Consensus EPS estimates project the bottom line to become positive, not earlier than FY 2027. Therefore, I project that NIO will deliver a 1% FCF margin in FY 2027 and will proceed further with a one percentage point yearly expansion, which correlates with the revenue growth projection.

Author’s calculations

According to my DCF valuation, the stock is around 57% undervalued. However, I consider such a deep discount to be fair given all the fundamental weaknesses the company demonstrates. A 57% upside potential is insufficient to me because all the risks I have highlighted in “Recent developments” suggest that there are risks that NIO might potentially be out of business within the next couple of years, if the company does not find its path toward profitability. Should this occur, investors could potentially lose up to 100% of their investment in NIO, which does not appear to offer a fair risk-to-reward relationship.

Risks to my bearish thesis

NIO is still backed by an investment vehicle controlled by the government of oil-rich Abu Dhabi. The company received another $2.2 billion in late 2023, which indicates firm confidence of NIO’s major investor in the business’s prospects. With such a support from a wealthy investor, NIO might eventually come up with a new jaw-dropping technology or a new best-selling model. Even if NIO continues stagnating, every new piece of information regarding a new tranche from the Abu Dhabi fund might lead to share price spikes.

NIO’s stock does not exist in a vacuum, and its movements also depend on the sentiment around the whole EV industry, or even the health of biggest names like Tesla and BYD (OTCPK:BYDDF). The company’s fundamentals might not improve, but a potential rally in Tesla’s stock might be beneficial for the NIO’s share price. The same with other news which does not directly improve NIO’s fundamentals, like the accelerated growth in the Chinese economy or improved geopolitical situation between China and the U.S., which will highly likely lead to a rally in all most popular Chinese stocks.

The largest EV maker in the world, BYD, is not currently presented in the luxury segment. I believe there is a possibility that BYD might wish to expand its reach to high-end consumers, potentially making NIO a target for acquisition. Should this happen, NIO’s shares might be bought out by BYD at a premium. Even if this potential deal never materializes, the stock could surge on rumors of such a possibility, which would work against my thesis.

Bottom line

To conclude, NIO is a “Strong Sell”. The Chinese EV market is steadily maturing, and growth rates are poised to cool down. At the same time, the competition is intensifying, and NIO does not look like a powerful enough player to compete in such a tough environment. The stock’s deep undervaluation should not fool readers, since all the red flags outweigh potential benefits.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.