Summary:

- NIO Inc. is launching a lower-priced brand, Onvo, to enter the higher volume EV market in China.

- The introduction of Onvo is expected to help increase sales volumes and compete with Tesla’s Model Y.

- NIO needs to reach 20K monthly vehicle sales for the Onvo brand to significantly reduce operating losses.

Andy Feng

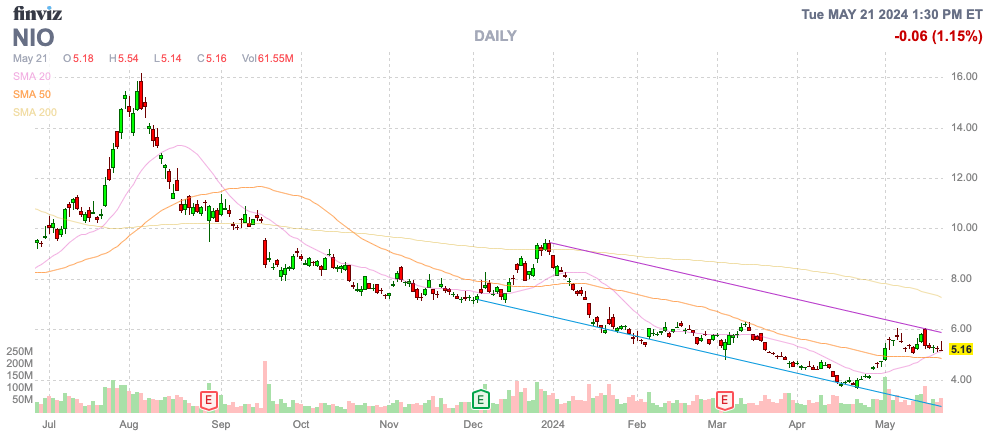

The Chinese electric vehicle (“EV”) space remains highly competitive, but NIO Inc. (NYSE:NIO) continues pushing forward with innovative technologies. It has just launched a lower-priced brand to enter the higher volume space, but the stock has fallen to only $5 with the market losing interest in the EV sector. My investment thesis remains ultra-bullish on the large opportunity ahead for the Chinese EV company, with a high-volume brand utilizing advanced technology from the NIO brand.

Source: Finviz

New Brand

Last week, NIO introduced its first product from the new Onvo brand. The Chinese EV manufacturer expects to bring premium quality EV experiences to the mainstream auto sector.

NIO released the Onvo L60 with a starting price of RMB219,900 ($30.5K) and deliveries starting in Q3. The company claims competitive advantages in areas such as supply chain, manufacturing and battery charging and swapping.

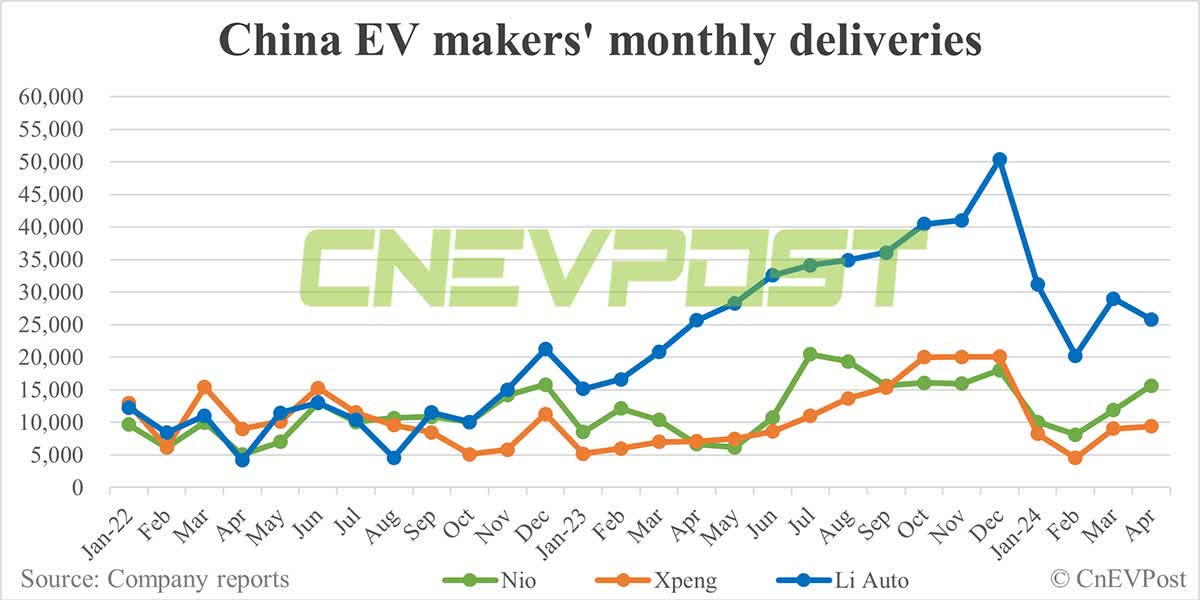

The premium Chinese EV brand has long struggled to produce consistent auto sales. NIO hit record monthly sales topping 20K in July 2023, with deliveries dipping below 10K again in February while the April sales rebounded to 15,620 vehicles, up 135% YoY.

Source: CnEVPost

The stock has become a difficult investment, with the market not very welcoming of the volatile monthly numbers, while NIO is burning tons of cash. The introduction of the Onvo brand should help unleash higher sales volumes versus the premium market, where NIO sells vehicles with full costs regularly topping $50K.

Li Auto Inc. (LI) focuses on more affordable Chinese EVs, and had pushed monthly volumes to 50K in December 2023. The company launched the Li L6 on April 18 to counter some recent weaknesses with Li Mega. The new vehicle has Pro and Max trims with starting prices of RMB 249,800 and RMB 279,800, respectively.

NIO offers customers the unique battery-swapping technology. If a customer chooses to purchase a vehicle under the Battery-as-a-Service, or BaaS, program, the purchase threshold will be lowered by at least RMB 70,000 ($9,700) due to the customer paying for the BaaS service.

The Onvo L60 model is expected to challenge the Model Y from Tesla, Inc. (TSLA) with a lower selling price.

Cutting The Large Losses

In an indication of the volumes targeted by NIO, the Onvo brand will need 20,000 monthly units to contribute a positive income. As highlighted above, NIO has struggled to even reach 20K monthly vehicle sales of premium units after years of production.

At $30K per vehicle, Onvo would generate $600 million in monthly sales and 20K units sold, or $1.8 billion in quarterly sales. In comparison, Li Auto reached $5.8 billion in quarterly sales for the seasonally strong Q4 and still produced $3.5 billion in sales for the recent March quarter.

NIO already produces $1 to $2 billion in quarterly sales, and the Onvo brand could easily help the company double sales. Of course, the question with NIO at this point is whether operating 2 different brands can help cut the ongoing massive losses, or if the additional sales are only met with higher operating costs.

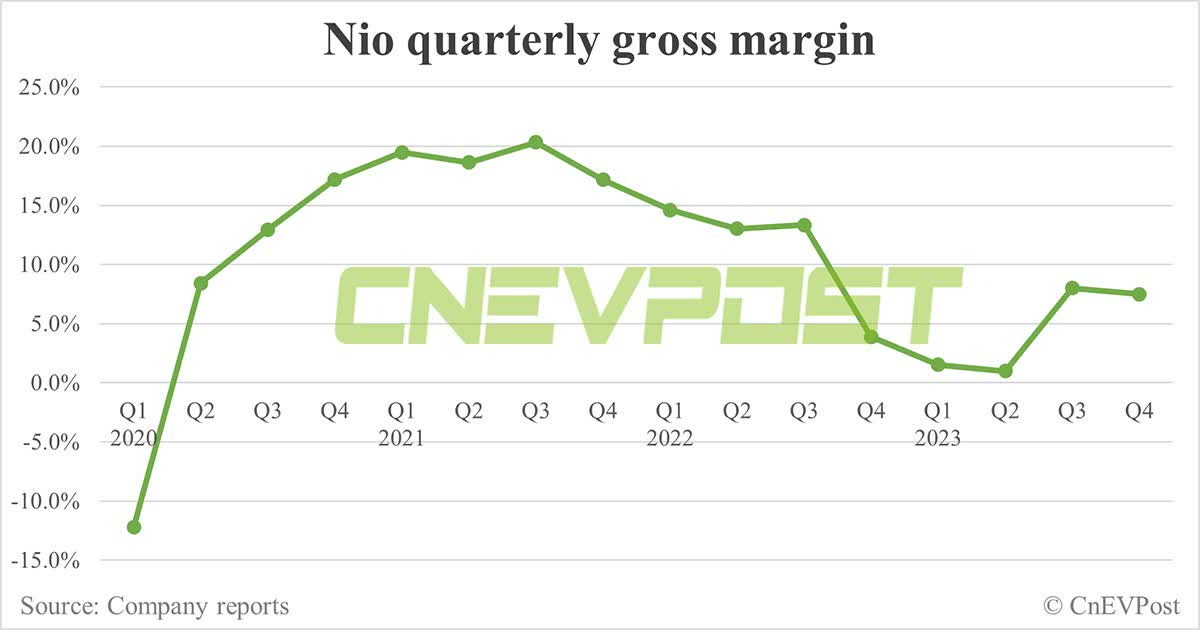

NIO has watched the gross margins slump the last couple of years while operating costs, such as research and development, have grown to support development of a 2nd brand. The Chinese EV sector has faced inflation and competitive pricing pressures in the sector.

Source: CnEVPost

Deutsche Bank forecasts the addition of sub-brand sales in 2025 will help NIO top 20K monthly unit sales, with an ultimate target of hitting 300K units next year. Per analyst Wang Bin:

Onvo L60 SUV will officially start delivery in Sep. 2024, and the company is targeting Onvo L60 monthly delivery volume of ~10,000 units

Onvo launching the last few months of 2024 with 10K monthly units would be a solid start, but NIO needs far more than 20K combined units from 2 brands to reach profits. Consensus analyst estimates have quarterly revenues reaching $3 billion in 2024 and the company had Q1 ’24 operating expenses of over $1 billion.

In theory, NIO would generate $600 million in gross profits on $3 billion in quarterly sales, with a return to 20% gross margins. The Chinese EV company would need vastly more gross profits from higher sales to cover current costs, even after some pullback in spending last year.

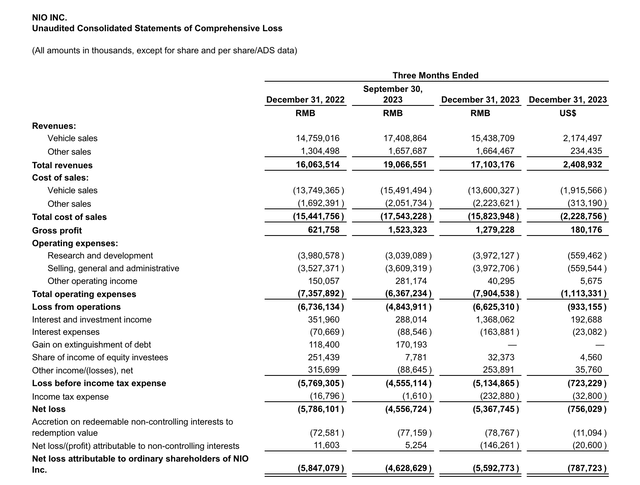

Source: NIO Q4’23 earnings release

NIO spent ~$560 million in quarterly expenses on both R&D and SG&A during Q4 alone. The company spent ~$80 million on stock-based compensation to reduce the cash costs of operations.

With a Q4 ’23 gross profit of only $180 million, NIO can easily push past the gross profit levels in 2023 to cut the operating losses. The Chinese EV company clearly needs to reach the 20K monthly vehicle sales level for the Onvo brand sooner rather than later in order for the company to dramatically wipe out the large ongoing losses.

NIO needs quarterly sales much closer to $4+ billion to reduce the operating losses to tolerable levels. The company still has a cash balance of $8 billion at year-end, allowing for a wide leash on continuing to build both brands through most of 2025.

The stock valuation has fallen to only $10 billion, while the sales opportunity in the mass market vehicle space is excellent. NIO is now valued based on a company with limited growth ahead, while the business could easily soar from current levels.

Chinese EV makers suddenly face tariffs to enter the U.S. and European markets, though the NIO investment story is only really based on the impact of European tariffs. The company already has EVs for sale in parts of Europe with plans for expanding the Onvo brand to Europe, and any tariffs could impact those plans, though the investment story has never been highly based on Western buyers aggressively buying Chinese EVs. Any major sales levels there would just be a bonus to the NIO investment story.

Takeaway

The key investor takeaway is that NIO Inc. is no longer priced for the opportunity ahead, with the market too focused on volatile quarterly sales. The company has a huge opportunity ahead with the Onvo brand, and the current analyst estimates appear very low.

Investors should use the ongoing Chinese EV sector weakness as an opportunity to own NIO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market in May, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.