Summary:

- Nio missed Q2 revenue estimates but showed an improvement in gross margins, with more progress expected later this year.

- Despite a 144% YoY increase in vehicle deliveries, lower average selling prices impacted total revenues, marking the second top line miss in three quarters.

- Nio’s Q3 guidance included record deliveries and revenue expectations slightly above Street estimates, with ambitious long-term operational targets for both the Nio and Onvo brands.

Jacobs Stock Photography Ltd/DigitalVision via Getty Images

Last week, Chinese electric vehicle maker NIO (NYSE:NIO) reported its second quarter results. While the company missed Q2 revenue estimates, it did make some progress on the gross margin front, and guidance for the current quarter was decent. Things are starting to finally look up for the company after a couple of tough years, which has me raising my rating on the stock, but I’m not quite ready to fully buy in just yet.

Previous coverage on the name:

My last report on Nio came back at the company’s Q1 earnings report in June. At that time, I mentioned how it was finally time for Nio to start delivering on some of the lofty growth goals management had laid out in previous years. I mentioned how the company was still losing a lot of money, and I thought the balance sheet could use a little help as the company prepared to launch its Onvo mass market brand.

Investors certainly cheered last week’s report from Nio. Between Thursday and Friday, shares rallied more than 18%, and they might have done even better to finish the week if it wasn’t for a big US market decline. Even with that solid jump, however, the stock has still lost almost 7% since I went to a sell rating earlier this year, while the S&P 500 is up almost 6% over that time.

The Q2 report:

Nio had already detailed a nearly 144% year over year increase in vehicle deliveries for Q2, so we knew that total revenues were going to more than double. However, total revenues of $2.40 billion were a little below street estimates, as they were hurt by lower average selling prices as a result of changes in vehicle product mix and user rights adjustments made since June 2023. This was the second revenue miss in the past three quarters, and the fifth in the last eight periods.

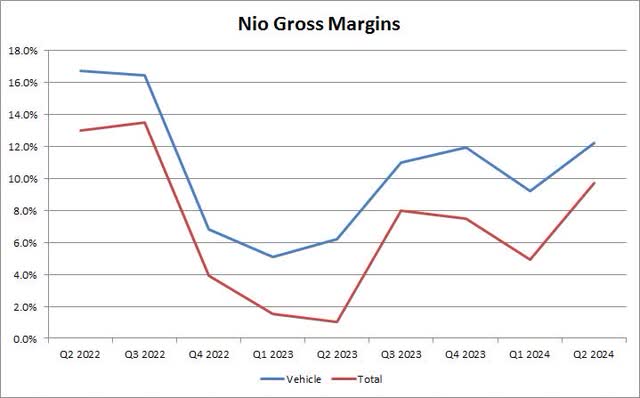

As Nio has finally started to ramp up its production and delivery numbers, the company’s gross margins are improving. In the chart below, you can see how both vehicle and total company gross margins were at their highest point in more than a year and a half. Management expects further improvement into the mid-teens for its main Nio brand later this year as it continues to reduce overall product costs.

Nio Gross Margins (Company Earnings Reports)

The main problem for Nio at the moment though is its tremendous amount of operating expenses. Despite a more than 76% rise in revenues sequentially, the loss from operations only came down by about 3%. Building out its sales infrastructure has been quite expensive, along with the research and development needed not only for the new Onvo brand but for model refreshes of the current lineup. These large losses are one reason why I can’t suggest buying the stock just yet.

Looking ahead:

For the third quarter, Nio management guided to a new quarterly record of 61,000 to 63,000 deliveries. This will include a small amount from the Onvo launch later this month. Total revenues are expected to be in a range of $2.630 billion and $2.707 billion, which was a little ahead of the street’s average estimate for about $2.60 billion. During the conference call, management laid out the following longer term operational targets:

- Nio brand – monthly volume of 40,000 units and a vehicle margin of 25%.

- Onvo L60 – monthly volume of 20,000 units and a vehicle margin of 15%.

- Onvo brand – monthly volume higher than Nio brand and vehicle margin of 15% or greater than 15%.

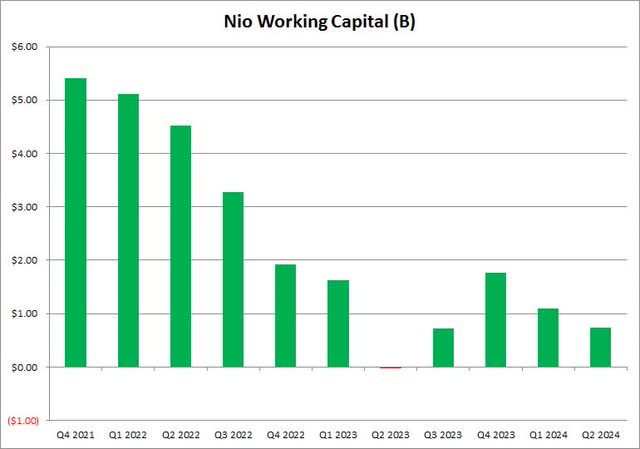

Building out the Onvo brand will be fascinating to watch, as the Chinese electric vehicle market is getting more competitive by the month, which gets me to another reason I can’t buy in just yet. I’d like to see the company improve its balance sheet a little bit moving forward. As the chart below shows, working capital decreased by over a billion dollars in the first half of 2024. With shares rallying nicely after the Q2 report, raising some equity capital here wouldn’t be as painful as it would have been in recent weeks.

Nio Working Capital (Company Earnings Reports)

The company finished June with about $5.7 billion in cash and investments against about $2.9 billion in debt. The balance sheet is not a problem at the moment, but launching a new brand and building a third factory will be expensive, all while you are reporting large losses. With Nio also expected to launch its third brand, Firefly, in 2025, more capital on hand would likely improve sentiment a bit.

The valuation picture:

If I had written this article a week ago, the valuation argument for buying Nio would have looked a lot better. Since Nio, along with most of its Chinese competitors, are losing money at the moment, the best valuation metric is price to sales. With 2024 being mostly over at this point, and Nio looking for another leg of growth next year thanks to Onvo, I looked at price to currently expected sales for each name in 2025. The chart below shows Nio against BYD (OTCPK:BYDDF), XPeng (XPEV), Li Auto (LI), and Zeekr (ZK).

Price to Expected Sales (Seeking Alpha)

Outside of Zeekr, Nio looks pretty fairly valued against the other three. If we include that low value, however, Nio’s price to 2025 expected sales figure of 0.77 times is a bit of a premium to the 0.64 average of the other four. In terms of revenue growth, if you just use a straight average, the group of four is projected for about 37%, which is basically what Nio is estimated to show right now, making a buy recommendation hard to argue for today.

Final thoughts and recommendation:

In the end, Nio delivered a mostly decent set of results last week. While Q2 revenues were a little light, margins did improve, and the company gave solid guidance for the current quarter. The company is still losing a good deal of money, however, and working capital dipped a bit sequentially. Now, all eyes turn to this month’s launch of the Onvo brand, which is the company’s introduction to the mass market.

With a bit of progress being made, I am upgrading Nio shares to a hold today. I might have gone even further if not for last week’s rally, which pushed the valuation up a little too much for my liking. I’d like to see the company raise some more capital as it launches this new brand and builds out another factory, so perhaps if that happens soon we can look at the rating again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.