Summary:

- NIO’s operating losses deepen as deliveries increase, making it difficult to adjust pricing and compete with Tesla’s price war in China.

- NIO’s pricing advantage in high-end models is overshadowed by its lack of brand strength compared to competitors.

- Recent measures from the White House included introduction of 100% border tax on Chinese EVs, which significantly undermined NIO’s export potential.

- The valuation does not look good as there is a 34% downside potential.

Andy Feng

My thesis

NIO (NYSE:NIO) currently experiences multiple challenges. The company’s operating losses deepen as it ramps up deliveries, meaning that pricing for its vehicles should be adjusted. However, increasing prices is highly likely to be impossible as the competition is fierce and Tesla (TSLA) continues its price war in China. Nevertheless, escaping this challenging situation seems improbable and NIO is poised to continue burning cash, in my opinion. Therefore, I recommend a Strong Sell on the stock. Moreover, my DCF model indicates that the stock has 34% downside potential.

NIO stock analysis

NIO is a Chinese EV manufacturing company well-known for its battery swapping strategy to resolve the problem of scarce EV charging infrastructure in China. According to NIO’s latest 20-F SEC filing, the company positions itself as a leading company in the premium smart electric vehicle market. Therefore, when analyzing NIO’s competitive landscape in my analysis, I will compare its offerings to other premium EV manufacturers. Tesla is the name that comes to mind when we speak about premium electric vehicles. German premium legacy automakers like Mercedes-Benz (OTCPK:MBGAF), BMW (OTCPK:BMWYY), and Audi are also very popular in China’s luxury segment. Therefore, I consider these four companies to be direct competitors of NIO.

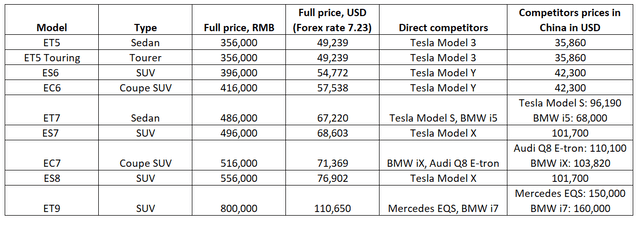

Despite being a young company, NIO already offers the market nine models, including sedans, tourers, SUVs and coupe SUVs. In the below table, I summarize information regarding prices for NIO’s models from cnevpost.com. The two last columns in the below table are added by me, based on comparisons of models between each other and competitor models’ prices in China, which I found from public sources on the internet. As we see, NIO’s models are notably cheaper than all models of German manufacturers and Tesla’s highest-end models. However, NIO’s smallest models are substantially more expensive than Tesla’s Model 3 and Model Y, which are manufactured at Giga Shanghai.

DT Invest (based on public sources)

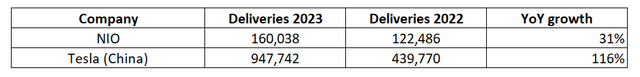

That said, NIO appears to have pricing advantage in its high-end models. On the other hand, it would be ridiculous to compare the power of NIO’s brand to German automakers, or even Tesla. The perceived relationship of price to quality, or brands, is quite subjective, and it is difficult to arrive at a highly reliable conclusion whether NIO’s pricing helps to compete or not. Therefore, I prefer to look at deliveries numbers, which likely present a fair view of NIO’s power against competition. It was impossible to find China 2023 EV deliveries of German companies. However, one source suggests that Mercedes and BMW doubled their 2023 EV sales in China. On the other hand, Volkswagen (OTCPK:VWAGY) Group’s CEO said that Audi’s EV lineup in China is not competitive. Since Tesla only sells EVs, it was not complex to compare its 2023 vs. 2022 sales dynamics in China against NIO.

DT Invest (based on public sources)

Tesla’s sales in China more than doubled in 2023 compared to 2022, while NIO demonstrated a 31% growth. Please also keep in mind that Tesla confronted much higher numbers compared to NIO, and the gap in absolute terms is more than tenfold. That said, based on NIO’s sales dynamic between 2023 and 2022 compared to Tesla, Mercedes and BMW, I can say that its price advantage does not help much to outperform competitors. Customers are likely to not consider NIO’s lower selling prices as a better value proposition compared to three out of four major competitors, in my opinion.

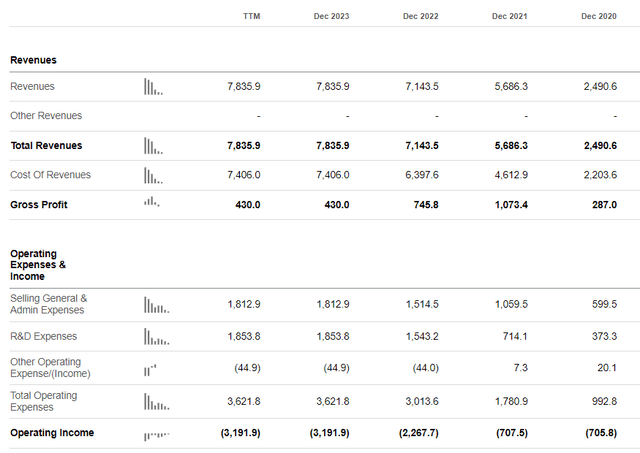

Besides not having a competitive advantage from the perspective of physical volume sales, NIO’s current pricing for its models is unsustainable from the financial performance point of view, in my opinion. Despite demonstrating impressive revenue growth in recent years, NIO’s gross and operating profits deteriorated. This means that the pricing policy works against the company’s financial success, as the more cars it sells, the deeper operating losses it gets.

As we see below, ramping up delivery volumes does not help to improve NIO’s profitability profile. Therefore, the company needs to make an upward adjustment to pricing for its models, and this in theory, will help in improving margins. However, in practice, NIO does not have such a brand strength to be able to exercise pricing power without losing customers. Moreover, increasing prices will certainly not work in the environment where Tesla continues its price war.

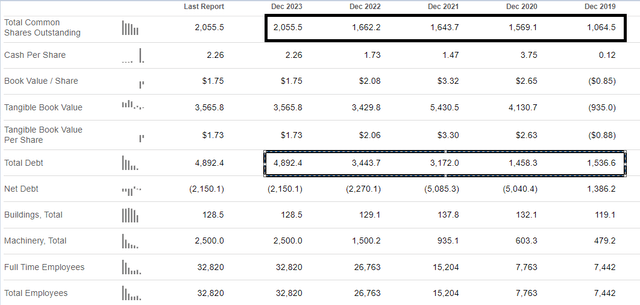

Therefore, conclusions are quite discouraging for NIO. Ramping up deliveries deepens the company’s operating losses, and the company likely does not have any power to adjust pricing higher. The company is burning cash at a massive pace, which we see in deep losses and mounting total debt, which increased more than three-fold over the last five years. Moreover, the number of total common shares outstanding has doubled over the same period.

The recent package of measures from the White House included a 100% border tax on EVs from China. This is a substantial adverse development for NIO, as it apparently means that Chinese automakers are extremely unlikely to be able to compete on pricing, with a 100% tariff added to the selling price. Recent news suggests that the European Union is considering the same move to protect local automotive companies and jobs of people occupied in the industry. Since the U.S. and EU are the largest markets for Chinese companies to export to, these moves significantly limit NIO’s export potential.

In summary, my bearish sentiment towards NIO stems from several concerning indicators. The company struggles to compete within the crowded market, profitability profile is inconsistent with revenue growth, and recent developments imply that NIO’s export potential is currently quite limited.

Intrinsic value calculation

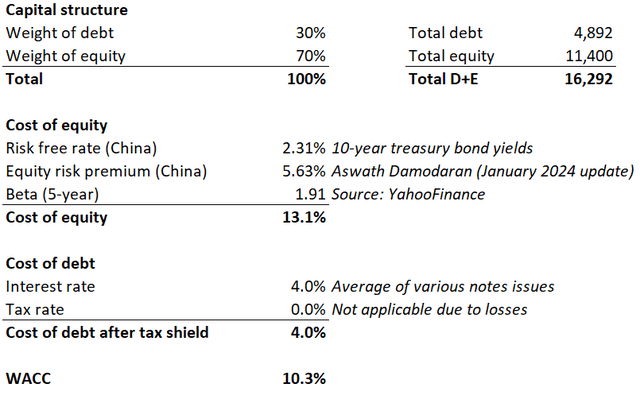

As I mentioned earlier, NIO is deeply unprofitable, which makes analyzing valuation ratios based on earnings irrelevant. For a growth unprofitable company like NIO, the discounted cash flow (DCF) approach is likely the only one to calculate intrinsic value. Under DCF, future cash flows must be discounted, and I must figure out the discount rate. In the below working, I have outlined my WACC calculation and have explained the sources of all my assumptions.

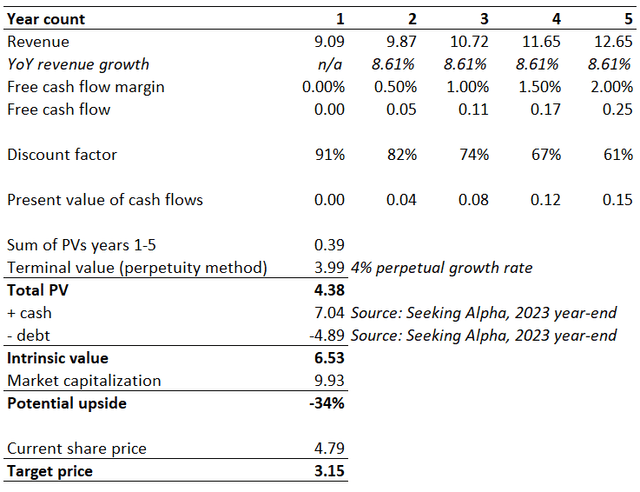

With WACC figured out, I can proceed with other assumptions. Since NIO’s recent revenue growth history has been notably volatile, and is still incurring losses, the level of uncertainty around my assumptions will be extremely high, also because consensus estimates are extremely volatile. I am using Wall Street expectations only for the base year revenue assumption, and the rest will be based on other sources. Therefore, base year revenue is $9.09 billion and revenue CAGR for years beyond is 8.61%. Due to the weaknesses described in the stock analysis, it is extremely difficult to forecast NIO’s free cash flow (FCF) dynamic. Therefore, some rule of thumb should apply here, and I will project a 50 basis points FCF margin expansion each year. I incorporate a 4% perpetual growth rate due to solid secular trends in EV industry. I also add up NIO’s cash position and deduct total debt, these amounts were recorded in the company’s balance sheet as of December 31, 2023.

NIO’s intrinsic value is 34% lower than the market capitalization, and that is the evidence that the stock is overvalued. My target price for NIO is $3.15.

What can go wrong with my thesis?

Despite all weaknesses and strong competition, NIO continues investing in developing its business because it has a wealthy investor among its shareholders, Abu Dhabi’s CYVN Holdings fund. I did not find much information about this fund on the Internet in terms of its assets under management (AUM) to assess its investing potential. However, the fund has already invested billions of dollars into NIO, and it is not a secret that Abu Dhabi is an oil-rich state, which means that CYVN’s pockets are likely deep enough to continue supporting NIO’s operations and innovations. For example, on May 15, NIO unveiled its lower-priced brand Onvo, which might help improve NIO’s revenue mix and help in expanding into new segments.

Recent news also suggests that NIO is working under launching two new mass-market models for the European market, and in case one of these models becomes a best-seller, it might be an inflection point for NIO, which will be absorbed by the market with big optimism and will work against my bearish thesis. However, if the EU implements increased tax barriers for Chinese EVs, this potential positive catalyst will remain unrealized.

Summary

NIO is in a very difficult situation when adjusting prices appears to be the only option to reduce losses and cash burn. However, such a scenario will likely lead to a significant market share loss because of fierce competition, especially from Tesla. The valuation also does not look good, in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.