Summary:

- We are downgrading our previous Buy rating to a Hold, with the NIO stock continually charting lower highs and lower lows, implying the lack of bullish support.

- This is despite the improving manufacturing scale, growing automotive gross margins, healthy balance sheet, and new mass market launch in H2’24.

- With consumers flocking to the 200K to 300K Yuan segment and EV competition/ price war intensifying, it remains to be seen when the pessimistic sentiments may reverse.

- Based on NIO’s lower highs and lower lows over the past few quarters, it appears that the bears may have temporarily won the narrative here.

- With it remaining to be seen when the sell-off may end and bullish support may materialize, things are likely to get worse before they get better.

tiero

We previously covered NIO Inc. (NYSE:NIO) in December 2023, discussing why we finally re-rated the stock as a Buy, thanks to its increasing ASPs, growing sales, improving automotive gross profit margins, and enhanced monetization strategies, concluding that these efforts were likely to moderate its cash burn rate.

Combined with the pulled forward mass market model launches, it appeared that the worst might have already passed, with its prospects likely to lift from FQ4’23 onwards.

In this article, we shall discuss why we are downgrading our previous Buy rating to a Hold, with the NIO stock continually charting lower highs and lower lows, implying the lack of bullish support despite the notable improvements in its balance sheet and profit margins.

Combined with the ongoing price war in China, EV glut in the EU, and a potential ban of Chinese-made EVs in the US, there may be more pain in the near-term, with things likely to get worse before they get better.

The EV Investment Thesis Has Yet to Bottom – More Pain Likely Ahead

For now, NIO has delivered a disappointing FQ1’24 delivery update with 30.05K vehicles (-39.9% QoQ/ -3.1% YoY), instead of the original guidance of 32K at the midpoint (-36% QoQ/ +3% YoY).

It is apparent by now that the soft consumer demand has impacted its ability to fully utilize the installed monthly production capacity of approximately 20K vehicles, with the ongoing EV competition likely to impact its top/ bottom lines in the near-term.

As Xiaomi (OTCPK:XIACF) opts to launch its new EV at the price range of ~225K Yuan, directly competing in the increasingly crowded 200K to 300K Yuan segment (with some analysts estimating up to 240 domestic EV models), and BYD Company Limited (OTCPK:BYDDF) further intensifying the price war in China, it is unsurprising that NIO has reported impacted demand for its 300K Yuan premium range models.

While NIO has announced the debut date of its mass-market brand in Q2’24 with delivery to commence from Q4’24 onwards, we may see its delivery numbers underwhelm in the near-term.

On the other hand, NIO has adopted a just-in-time, pull-production system to control the inventory level of its components while embarking on a made-to-order manufacturing business model, to maintain a healthy inventory level while fulfilling orders within four weeks of orders.

This strategy may be more prudent indeed, since it allows the management to scale their productions according to consumer demand, instead of incurring the overly expensive inventory write-downs as reported by Tesla (TSLA) at $463M (+161.5% YoY) and growing inventories of $13.62B (+6.1% YoY) in FY2023.

Perhaps this is why NIO’s inventory levels of 5.27B Yuan in FQ4’23 (-25.3% QoQ/ -35.6% YoY), or the equivalent of $0.73B, have been declining on a QoQ/ YoY basis, albeit with elevated inventory write-downs at 65.36M Yuan in FY2023 (-56% YoY), or the equivalent of $9.03M based on the exchange rate at the time of writing.

At the same time, based on NIO’s moderating estimated ASPs of 308.49K Yuan in FQ4’23 (-1.7% QoQ/ -16.2% YoY) and 307.8K Yuan in FY2023 (-17.1% YoY), it appears that the management has achieved an improved manufacturing scale indeed.

This has also been observed in the improving automotive gross margins of 11.8% (+0.9 points QoQ/ +5 YoY) in FQ4’23 and 9.4% in FY2023 (-4.2 points YoY), further demonstrating the management’s determination to not “boost our sales volume at the cost of our product margin as this is not healthy for the longer run.”

While it is apparent that NIO remains unprofitable on an EBIT basis, based on the adj EBIT margins of -35.3% in FQ4’23 (-13.1 points QoQ/ +2.1 YoY) and -36.4% in FY2023 (-9.4 points YoY), the automaker remains well capitalized with 49.74B Yuan (+27.3% YoY), or the equivalent of $6.87B of cash/ short-term investments by the latest quarter.

If anything, the automaker is likely to have an excellent source of liquidity, based on the $2.2B investment by CYVN Investments RSC Ltd based in Abu Dhabi on December 27, 2023, resulting in 294M of newly issued Class A ordinary shares at an average price of $7.50.

This built upon the previous investment worth $738.5M in June 2023, with 84.69M of issued Class A shares at an average price of $8.72.

With CYVN already owning 20.1% of the automaker’s total issued and outstanding shares, it appears that we may potentially see dilutive capital raises more commonly moving forward, along with possibly an increased reliance on expensive debt at 13.04B Yuan (+18.7% YoY) as of FQ4’23.

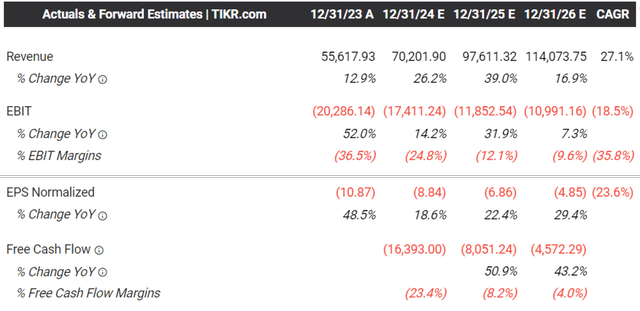

The Consensus Forward Estimates (in Yuan)

With NIO not expected to break even on an adj EBIT or adj EPS basis over the next few years, we may see the cash burn continue for a little longer.

Therefore, while the automaker may boast a double-digit growth cadence and improving manufacturing scale thus far, it remains to be seen when sentiments surrounding the stock may lift from this bottom.

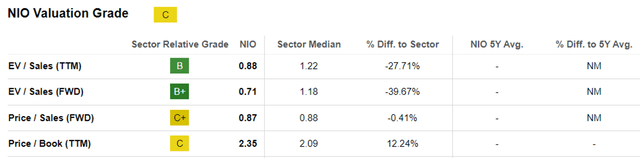

NIO Valuations

The same pessimism has also been observed in NIO’s impacted FWD Price/ Sales of 0.87x, compared to its 1Y mean of 1.39x and its Chinese-based automaker peers, such as XPeng (XPEV) at 1.02x, Li Auto (LI) at 1.07x, and BYDDF at 0.75x.

With NIO expected to generate a decelerating top line at a CAGR of +27% through 2026, compared to its peers, XPEV at +45%, LI at +36%, and BYDDF at +20%, it appears that the former may be fairly valued here.

With Tesla (TSLA) recently having to cut productions in the Chinese factory, it is apparent that EV demand and margin headwinds may persist for a little longer, especially since Hybrid vehicles are expected to grow at an accelerated pace compared to EVs through 2026.

This is likely why LI has been able to report 28.98K vehicles delivered in March 2024 (+43% MoM/ +39.2% YoY), compared to NIO at 11.86K (+45.8% MoM/ +14.3% YoY), with the former specializing in PHEVs, also known as plug-in hybrid electric passenger vehicles.

So, Is NIO Stock A Buy, Sell, or Hold?

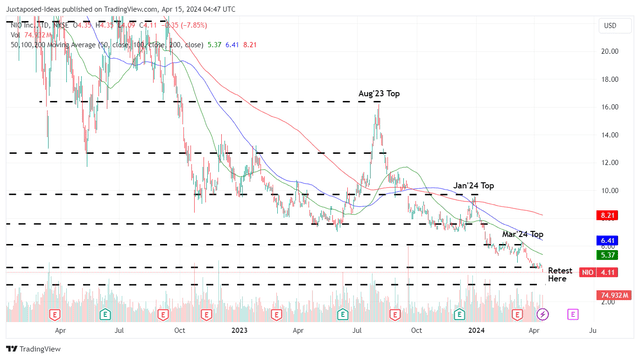

NIO 2Y Stock Price

As a result of the intermediate term headwinds, it is unsurprising that NIO has breached its previous $4.80s support levels and entered the penny stock range of below $5, while nearing its previous hyper-pandemic era support levels in the $3.20s.

Based on the stock’s lower highs and lower lows over the past few quarters, it is undeniable that the bears may have temporarily won the narrative here, attributed to weak consumer demand and intense domestic price war.

This is worsened by the EV supply glut reported in the EU, with some “Chinese EVs (supposedly) sitting in European ports for up to 18 months,” further highlighting that things may get much worse before getting better.

As a result of the potential volatility and capital losses, we prefer to downgrade our rating for the NIO stock to a Hold (Neutral) here, while waiting for a bottom to materialize.

With its remaining to be seen when the sell-off may end and bullish support may materialize, there may be more pain indeed, worsened by the elevated short interest of 11.57% at the time of writing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.