Summary:

- NIO Inc. stock has lost almost half its value so far in 2024 with weak delivery data in Q1 2024, shrinking revenues, and the EU’s tariffs on Chinese EV manufacturers.

- However, with the company’s robust deliveries in Q2 2024 and favorable base effect, its revenues are due for a roaring comeback. And tariffs will have minimal effect on it too.

- Progress in battery swap technology and alliances with other EV manufacturers also show potential for NIO.

- However, profitability remains a challenge for it, even as peers like BYD Company and Li Auto are profit generating. The market multiples are underwhelming too.

Robert Way

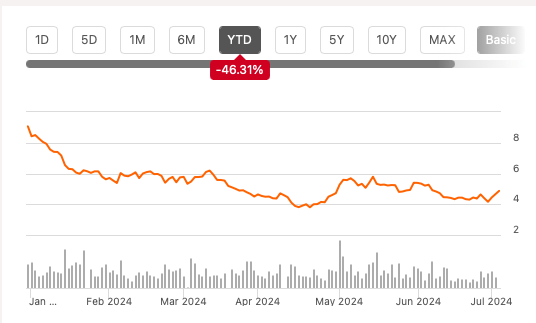

While China’s electric vehicle [EV] manufacturer NIO Inc. (NYSE:NIO) had an expectedly weak past quarter on the stock markets, with an over 10% price fall, things are looking up for the third quarter of 2024 (Q3 2024). That doesn’t mean that the beleaguered stock, which has lost almost half its value since the start of the year (see chart below), is out of the woods. Far from it. But the recent and upcoming developments detailed below do pose the question – can NIO reclaim at least some of its lost value in the second half of this year?

Price Chart (Source: Seeking Alpha)

Rising international tariffs

To assess this, let me first one concern about China’s EVs doing the rounds recently. Namely, the tariffs recently imposed by the US and the European Union (EU). NIO doesn’t have a presence in the US, where tariffs have seen a huge 100% increase, to that extent at least it won’t be impacted.

Its presence in the EU…

But it does have a presence in the EU, which has increased import duties by up to 38%, over and above the existing 10% duty. On the fact of it, there could be an impact on NIO.

Six of its nine models available in the market. It also has over a thousand employees and 43 battery swap stations in the market. The company’s focus on building customer engagement there is also notable. For example, it has mapped out Power Journeys that speak to a road trip lifestyle, with conveniently located swap stations along the route.

…is not significant enough

Even then, the significance of the market isn’t big enough to dent its financials in any meaningful. Consider the example of Germany, which is one of the limited number of EU countries it is present in, besides Norway, Netherlands, Sweden and Denmark. It sold only 1,263 vehicles there in 2023, which is less than 1% of its total sales in 2023. In fact, also, Chinese EV companies put together accounted for just 8.4% of Europe’s EV sales in 2023.

Moreover, seen in context, even its employees in Europe are just 3.6% of the total and the number of power swap stations there is less than 2% of all its stations. Also, it has 76 Power Journeys across China, compared to just one in Europe so far.

Furthermore, as it happens, while NIO is opposed to the increased tariffs by Europe, it expects its upcoming models to remain cost competitive nevertheless. The underlying point is that the real way NIO can be impacted by the tariffs right now.

Sharp turnaround in revenue expected

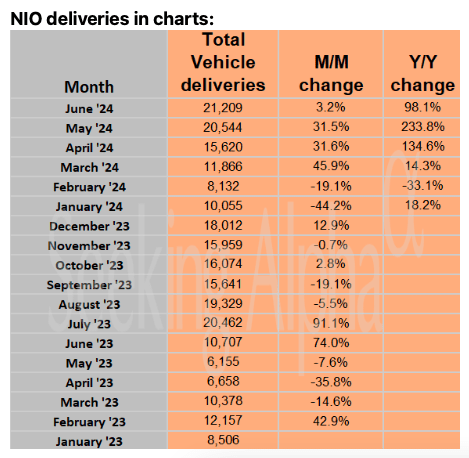

In fact, the outlook for revenues looks positive. After a disastrous Q1 2024, which saw a 3% year-on-year (YoY) decline in deliveries in Q1 2024, NIO expected its revenue to decline by 1.7% YoY. In fact, revenues dropped by a far bigger 7.2% YoY, with the decline in average selling price adding to the drag.

In sharp contrast, it’s set for roaring revenue growth in Q2 2024, which are slated for release in late August. It expects to see growth ranging between 89.1% to 95.3% YoY. There are two reasons for this:

- First, NIO has seen a robust growth in vehicle deliveries by 144% YoY during the quarter. This is even higher than its projection range of 129.6% to 138.1% YoY.

- There’s a favorable base effect at play. The company had seen a 14.8% YoY revenue decline in Q2 2023 on both a decline in vehicle delivery volumes and the average selling price as NIO cut prices across models, giving into the EV price war.

Source: Seeking Alpha

Even over the full year 2024, the company’s revenue growth is expected to improve from 2023. The average of analysts’ estimates on Seeking Alpha puts growth at 21.5% YoY in USD terms, which translates to 22.8% in RMB terms. By comparison, the figure grew by 12.9% YoY in 2023.

As I pointed out in my article on Li Auto (LI), sustained growth in China’s EV market supports manufacturers right now. In fact, data on new energy vehicles [NEVs], that has become available since, shows robust 33% YoY growth in the first half of 2024, similar to a 35% increase in the full year 2023.

Progress in battery swap

Further, NIO continues to progress on batter swaps. It now has a total of 2,482 battery swap stations in place, which is ~8% increase from the last I checked. It has also provided 47 million battery swap services, a 17.5% increase since then.

The company also continues to increase the number of its alliances with other EV manufacturers to support the battery swap model. So far, it has partnered with seven automobile companies. For context, when I first wrote about NIO in January, it had only two partners, indicating the growing momentum in favor of the technology.

While profits still elude NIO, there were also initial signs of its ability to deliver profits in Shanghai back in December. But, to be realistic, it will take time. Here’s why. The company needs to provide swapping services 60 times a day to become profitable. In June, it provided a total of 68,084 battery swap services, which amounts to just 27.4 services on average per station per month or a daily rate of less than 1.

The market multiples

As far as the market multiples are concerned, the first point to note is that unlike its bigger Chinese peers by market capitalization, BYD Company (BYDDF, OTCPK:BYDDY) and Li Auto are already profit generating, which sets them apart from NIO.

Next, even its trailing twelve months [TTM] price-to-sales (P/S) ratio isn’t competitive either. At 1.07x, it’s actually higher than BYDDY’s at 1.01x and in line with Li Auto’s 1.06x. A similar trend is visible for the forward P/S.

What next?

For the near-term, NIO’s prospects actually look good. The concerns on tariffs in the EU appear overblown, and its upcoming earnings report promises robust revenue growth. Short-term investors could even make gains from buying the stock now and holding it until the results. This answers the initial question – NIO could indeed reclaim part of its lost value.

But for medium-to-long-term investors, the NIO Inc. story is still being written. The company’s expansion in the developed Western markets is still limited and, going by the resistance of China’s EVs there, how far it will make gains remains to be seen.

NIO has quite another ace up its sleeve, though, with the battery swap technology’s adoption making notable progress so far in 2024. While it’s far from being profitable, it’s still one to watch. The progress likely isn’t enough to translate into stock returns right now. Additionally, NIO’s market multiples are also underwhelming. For these reasons, I’m retaining a Hold rating on NIO, but it’s certainly looking more interesting now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—