Summary:

- I’m initiating NIO stock with a buy for mid- to long-term investors.

- I expect to see an upside surprise for NIO in 2025 as the company, among other Chinese players, finds a stable footing in Beijing’s stimulus plan, boosting consumer spend.

- I think NIO’s Battery-as-a-Service (BaaS) position, which supports battery-swapping tech, gives customers incentives to choose NIO.

- I believe the company’s historically close ties with the Chinese government help balance its international expansion in Europe and, more recently, MENA.

- I hereon share my positive sentiment on NIO and why I expect more upside in 2025.

Henrik Sorensen/DigitalVision via Getty Images

Investment thesis

I’m initiating NIO Inc. (NYSE:NIO) stock with a buy for mid- to long-term investors. I expect to see an upside surprise for NIO in 2025 as the company, among other Chinese players, finds a stable footing in Beijing’s stimulus plan, which should boost consumer spending and confidence. NIO can be considered a premium EV brand with a focus on battery tech, and that can be seen in the company’s focus on the premium segment of the market, as well as heightening the user experience through NIO Houses and NIO Power. NIO has two main selling points, in my opinion. The first is the leeway it gives customers through innovations such as its Battery-as-a-Service (BaaS) offering, which supports battery-swapping technology. The second is the company’s historically close ties with the Chinese government (which further establish NIO’s roots domestically) balanced with its international expansion in Europe and, more recently, MENA. NIO currently has around 43 battery swap stations in Europe and 2,420 in China, not to mention a more comfortable variety of models for consumers, with eight 2024 models under the theme “lead the change.”

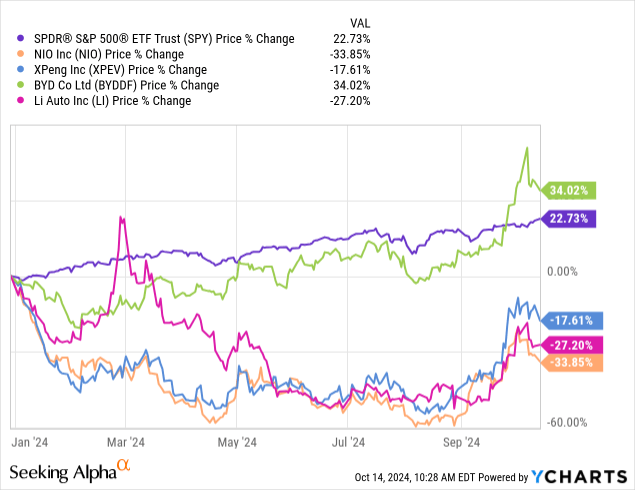

YCharts

Probably the third thing you need to know about NIO after understanding its innovative position in EV and BaaS and its background with the Chinese government is the fact that NIO isn’t one for the faint-hearted. The stock is underperforming the S&P500 year to date, down 33.8% against the S&P500, up 22.7%. This means the stock is underperforming the S&P500 by 56.5%. NIO is also underperforming its domestic peer group, with Li Auto (LI) down 27.2%, XPeng (XPEV) down 17.6%, and BYD (OTCPK:BYDDF) up 34% over the same period. I think there’s more upside ahead for the stock into 2025 as the pace of outperformance picks up.

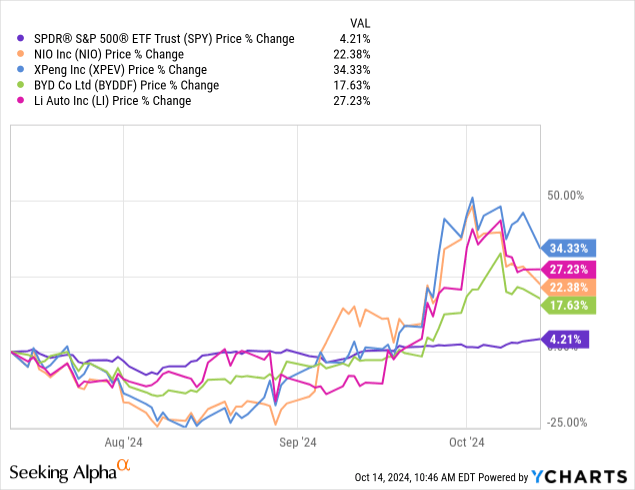

If you look at the three-month chart, NIO is showing signs of recovery. As seen below, at the three-month mark, NIO is up 22.3%, above the S&P500 at 4.2%, and its biggest domestic competitor, BYD, is up 17.6%. I’m a buy on both stocks as each company caters to different parts of the EV market, NIO the high end while BYD handles more of the mid and low end.

YCharts

BYD, for example, is more focused on being cost-friendly. NIO has a similar approach in terms of affordability, which is an approach most EVs gravitated towards after the price wars began. NIO’s edge, however, comes from what it provides with that more premium stamp, which includes BaaS and battery-swapping innovations and, lately, the more cost-friendly Onvo sub-brand. The company gives the customer more flexibility in terms of finances and the amount they’re paying upfront. I believe this approach gives NIO a broader customer base and positions it to compete with both ends of the market: XPeng, for example, caters to the lower end of the market, and Tesla is more focused on high-end customers looking for luxury.

NIO and the Chinese EV market

China EVs growth: NEV penetration

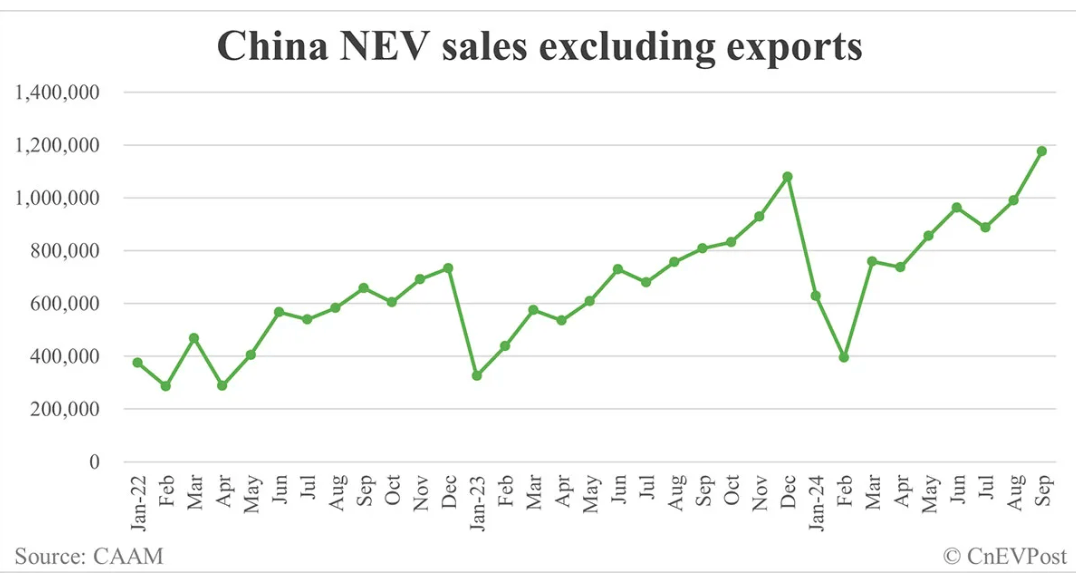

According to the China Association of Automobile Manufacturers, NEV sales were at a record high of 1,287,000 units in September, up from last December’s record of 1,191,000, marking a 42.3% year-over-year increase and a 17% increase from August. The sales include both those in China and exports; NEVs include battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell vehicles. Excluding exports, domestic NEV sales were 1,176,000 units in September, exceeding the record of 1,080,000 units in December last year and by 45.5% year over year and 18.8% from August, as seen in the graph below. There is momentum within China for NEVs, even before economic recovery. Part of my optimism about NIO is attributed to the soon-to-improve consumer spending power in China, which should allow for the momentum of July through September to extend into next year.

CAAM

NIO in China:

I don’t think we’re strangers to the fact that NIO is the Chinese government’s best buddy (or one of them, let’s say), but at a price. Back in 2020, when the company was going under due to the COVID-19 pandemic sinking car sales in China, NIO went into an agreement with the municipal government of Hefei, the capital of China’s Anhui province, and got a bailout of over 1.4 billion injection into a subsidiary in China created by NIO and called “NIO China.” In return, the company established a new headquarters in the city and decided to expand its operations and “deepen its relationship with local ecosystem partners in Hefei.” The deal, finalized in April, also took a bite out of NIO’s own pocket, with the company pumping $600 million into NIO China. Other strings attached included NIO’s commitment to its core businesses in China, such as NIO power, vehicle R&D, etc.

Last month, the company announced that its NIO China received a new investment and got into definitive agreements with Hefei Jianheng New Energy Automobile Investment Fund Partnership, Anhui Provincial Emerging Industry Investment Co Ltd, and CS Capital Co Ltd. According to a statement, these investors are expected to invest $470 million in cash. This goes to say that NIO’s chumminess with the government is open-ended in terms of the benefits it can provide.

NIO in history:

Now, for a trip down memory lane, the company was founded in 2014 and is based in Shanghai, China. The company’s mission was to “shape a joyful lifestyle by offering high-performance smart electric vehicles and being the best user enterprise.” The company then started delivering vehicles in mid-2018 and became publicly traded in the US in 2018 and announced that its “cash balance is not adequate to provide the required working capital and liquidity for continuous operation in the next 12 months,” triggering the 2020 bailout. It’s no secret that NIO benefits from the Chinese government subsidies and tax incentives for EV manufacturers, but it is one among many others, such as BYD, Li Auto, and XPeng.

I think some might argue that “government handouts” won’t be sustainable in the long term. However, I think the Chinese government is on a mission, and it is implementing strategic government policies, financial incentives and subsidies, and infrastructure development to reach its goals. After the COVID-19 slowdown, NIO started diversifying its legs of growth and opted for the battery swapping stations in Europe to offset the former. I think this diversification strategy works in its favor as it has several eggs in different baskets.

NIO’s sales:

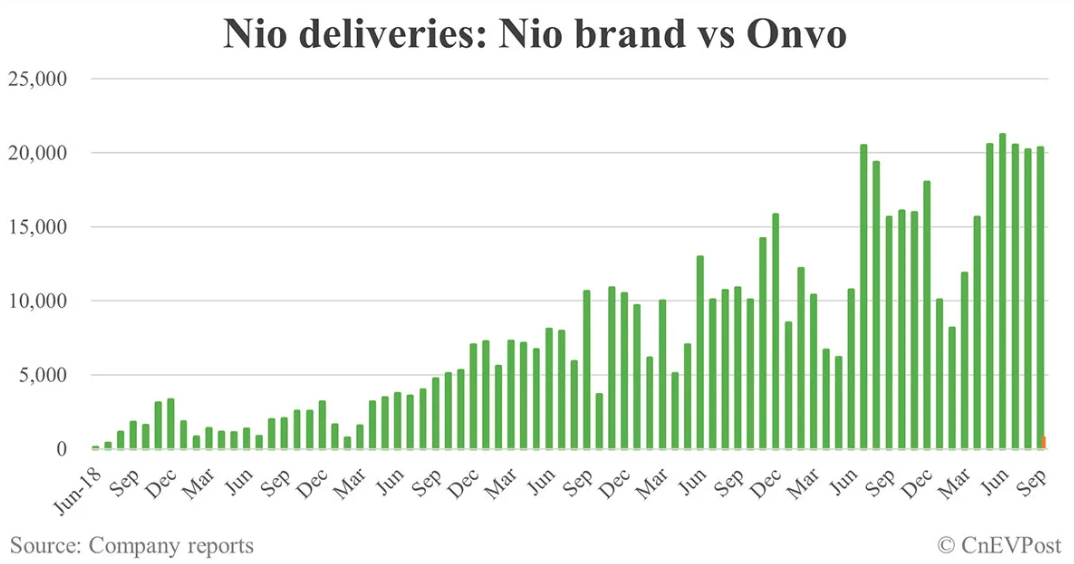

NIO’s leading brand currently has eight models, of which five are SUVs and three are sedans. The company also unveiled its ET9 last December and will start delivering the vehicles in the first quarter of 2025. I expect the latter to boost sales with the recent China Stimulus plan. As for NIO’s deliveries, the company had another impressive month, September, and deliveries during the month marked the fifth consecutive month where NIO delivered over 20,000 units. According to a news release on October 1, the company said the following:

-

NIO delivered 21,181 vehicles in September, 20,349 of which were under the main NIO brand and 832 under the Onvo sub-brand (Onvo is a lower-cost brand that NIO launched in mid-May this year.) This means deliveries increased by over 35% year over year, as seen below.

-

ES6 and ET5T delivered 13,491 vehicles during the month, making up 63.69% of NIO’s deliveries and 66.3% of the NIO brand. The ES6 delivered 55,614 vehicles, making up 37.2% of NIO deliveries, and the ET5T delivered 36,641 vehicles, making up 24.5% of deliveries.

-

Onvo launched the L60 model on September 19, and just under ten days later, on September 28, it started deliveries, which made up around 4% of NIO’s deliveries in September.

NIO reports

Three days ago, the company announced it had reached the 600,000th production vehicle milestone, only four months after delivering its 500,000. I think these wins should be taken for what they are: the company’s efforts in innovation.

Valuation

NIO currently has a market cap of $12.17 billion and an enterprise value of $12.38 billion. Its beta is 1.86, higher than the market average. NIO is down 31.64% in the last 52 weeks. And I’m going to be honest: NIO is cheap, but it isn’t a stock for investors looking to make money on the spot and cash out, and it is definitely not for the faint-hearted. The best we can do is give an educated guess based on the company’s future prospects of growth, and in NIO’s case, these are plenty.

The company is currently investing in R&D and focused on market expansions, which explains its low profitability. According to the company’s 2Q24 earnings report, R&D was up 12% quarter over quarter, and gross profit was up 1,841% year over year and 246.3% from 1Q24. Gross margin also increased significantly, going up to 9.7% from 1% in a year ago and 4.9% from 1Q24. Loss from operations was down 14.2% year over year and 3.4% quarter over quarter, and net loss was down 16.7% year over year and 2.7% quarter over quarter. According to the company’s CFO, Stanley Yu Qu, the vehicle gross margin was up 12.2% in 2Q24 due to the ongoing cost optimizations, noting: “We will continue to focus on efficient R&D and infrastructure investment, leverage the growth potential in the mass market, adopt flexible market strategies, and continuously optimize our product portfolio. We are confident that these efforts will result in steady improvements in gross profit and cost efficiency in the future.”

The market sentiment on the stock is positive. Over 17% of Street Analysts, according to data from Refinitiv, are a strong buy on the stock, and over 35% are a buy. Around 43% of Street Analysts are a hold, and only 3.6% are a sell, with 0% strong sells. I think the market is on the fence about NIO’s growth potential and when it’ll materialize.

The median PT and mean PT have had a downward trend since July, and this is to be expected with a stock with such high price volatility. The former was at $7.7 in mid-July and went down to $7.3 in August. It continued going down to $6.1 in September but has recently rebounded slightly to $7. As for the mean PT, it was at $8.45 in July, $8.2 in August, $7.5 in September and $7.43 currently.

In comparison to its domestic peers, NIO seems to be relatively cheap at current levels. With EV/Sales ratio (TTM) at 1.42 and EV/Sales at 1.24, NIO trades slightly higher than Li Auto with EV/Sales (TTM) t 0.91 and EV/Sales at 0.81 and BYD with EV/Sales (TTM) at 1.31 and EV/Sales 1.12. Also, NIO is cheaper than XPeng with EV/Sales (TTM) at 2 and EV/Sales at 1.71, and Tesla with EV/Sales (TTM) at 7.1 and EV/Sales at 6.8.

What’s next: Globalization efforts

I believe that through its continued technological advancements and the cutting-edge technology that its vehicles incorporate, NIO is positioned to snatch more than “40% of the market share in the battery electric vehicle segment, which is priced above RMB 300,000 in China.” On that note, earlier this month, NIO collaborated with CYVN Holdings based in Abu Dhabi, an investor in smart & advanced technology, to enter the MENA and launch NIO MENA (Middle East and North Africa). The agreement was signed on October 4th with the presidents of the UAE and Egypt present. According to NIO’s founder, chairman, and CEO, William Li, this is a vital step towards the company’s globalization process.

“Our collaboration with CYVN Holdings is a cornerstone in our strategy to enhance global accessibility to smart electric vehicles and push the boundaries of technological innovation.”

The UAE will be the initial market for this collaboration as a key player in deploying both 1. advanced autonomous driving systems and 2. battery-swapping technologies. This partnership, as previously mentioned, isn’t just for globalization purposes. Both NIO and CYVN are planning to establish a “state-of-the-art” research and development centre in the UAE’s capital, Abu Dhabi, to focus on autonomous driving and AI advancements. Egypt will have a hand in this, too, and NIO MENA will work with local partners in Egypt. I see a lot more opportunities for NIO to boost its sales and, alongside it, its market share in China and abroad.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.