Summary:

- NIO has a potential inflection point with record vehicle deliveries, launching a new sub-brand, and introducing new technology.

- The Chinese EV company aims to turn profitable by increasing monthly deliveries and improving gross margins with the launch of the ONVO brand.

- The stock has seen the market valuation dip to only $8 billion, a fraction of 2025 sales targets.

Michael Vi/iStock Editorial via Getty Images

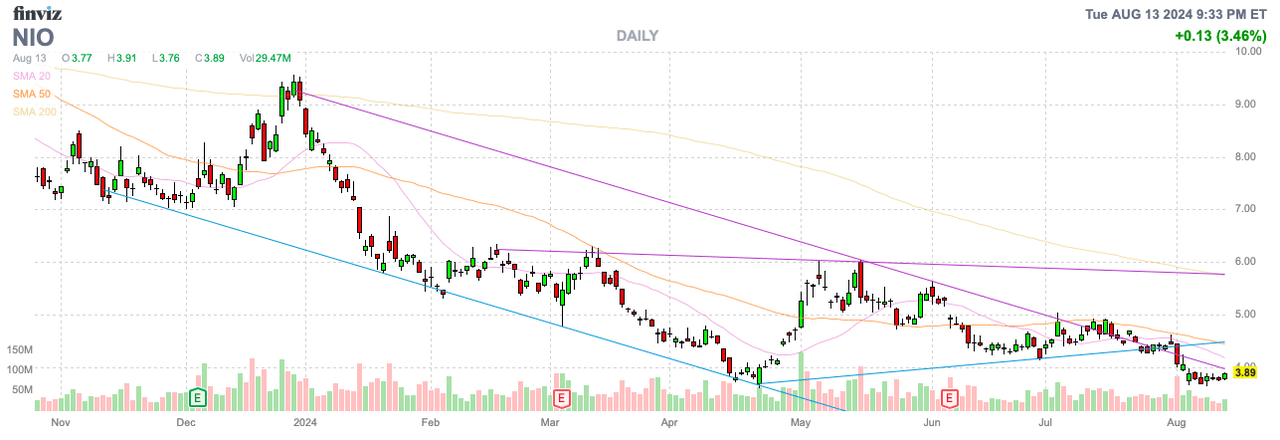

The EV space has faced a tough year or so, causing investors to forget the difficulties of building a new brand. NIO, Inc. (NYSE:NIO) is a prime example of a Chinese EV company beaten down, yet the company is coming off their most successful delivery period. My investment thesis remains Bullish on the stock, with the lower valuation and signs of a bottoming process coming to an end soon.

Big Quarter Ahead

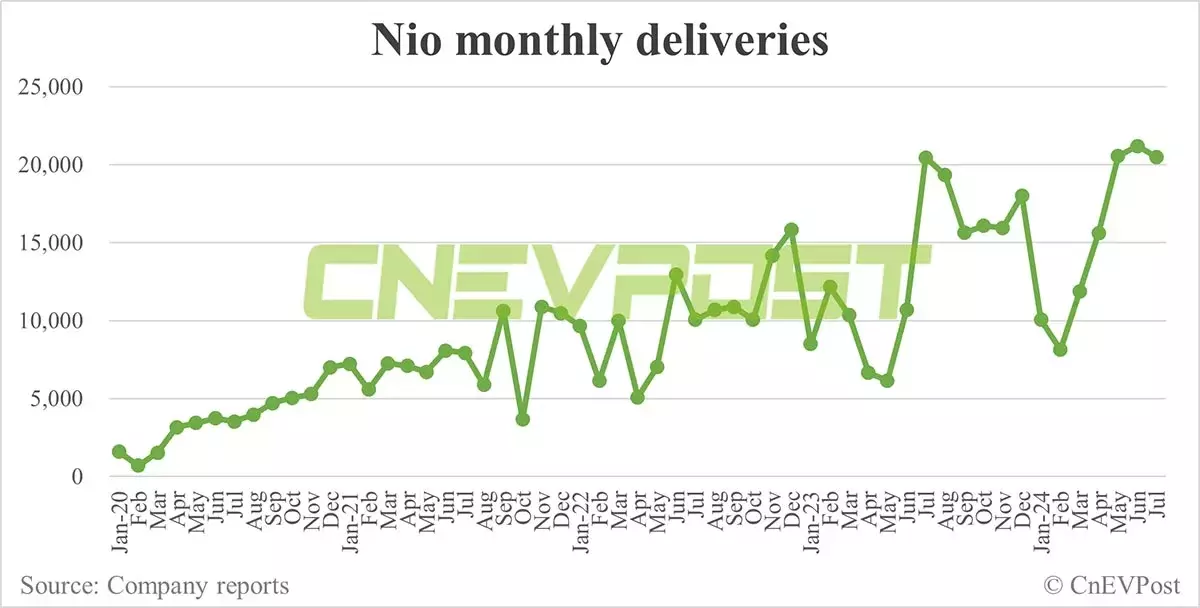

NIO recently reported July vehicle deliveries of 20,498 for the 3rd consecutive month, topping 20K. Prior to the last 3 months, the Chinese EV company only topped 20K vehicles back last July.

Source: CnEVPost

The company doesn’t report Q2 results until likely the end of August, but deliveries hit a quarterly record at 57,373. NIO previously had a record 55,432 vehicles delivered last Q3, so the Chinese EV company topped the prior record, yet the market has mostly ignored the delivery totals.

The numbers are already big and NIO is set to launch the ONVO sub-brand in September, which translates to “Path to Happiness”. This new brand sees the price point fall down to the $30K range to open up the market to additional customers.

As a premium brand, NIO hasn’t had the opportunity to explore volume production to cover massive costs. The company just had an AI-themed event to release new technology, including a 5nm AD chip and SkyOS software as an operating system to connect vehicle applications with intelligent driving and smartphone applications.

NIO is a technology leader with 2,400+ battery stations leading the Nio Power brand, which raised $207 million at a nearly $2 billion valuation. In addition, the Chinese EV company recently reported 120 million kilometers of mileage with smart driving in July, including 87.5 million kilometers with pilot assistance.

The ONVO brand introduced the first product as a family-oriented smart electric mid-size SUV called the L60. The vehicles are expected to roll-off the line in mid-August, with initial sales in late September.

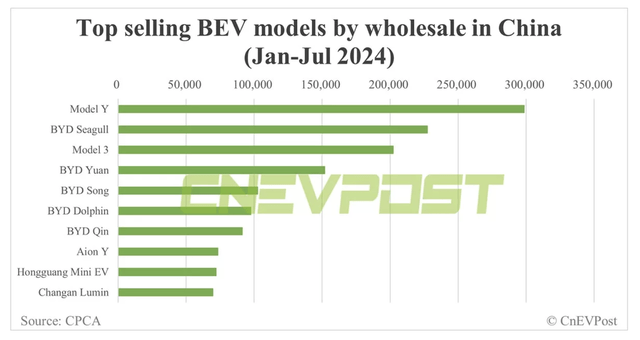

The L60 is expected to compete with the premium technology features of the Tesla (TSLA) Model Y while undercutting the price. The Model Y was the top-selling BEV in China with 300K units sold this year through July with a starting price of nearly $35K, topping the L60 by over 10%.

NIO has the technology prowess to build a valuable brand. Now, the company just needs to take the next step, though the Chinese EV sector has seen a recent shift towards the cheaper BYD (OTCPK:BYDDF) versions like the Seagull. The upcoming FireFly brand from NIO is expected to compete with these lower cost EVs.

Path To Profits

The biggest story with EV startups in China and even the U.S. is whether these companies will finally eliminate massive losses. Auto manufacturers have massive startup costs to build manufacturing facilities and new technologies, while these facilities take time to ramp up to scale.

NIO has struggled the last few years to produce consistently growing gross margins due in part to the volatile quarterly delivery numbers while building new brands, ONVO and Firefly, and technologies for the future. The company saw the auto gross margin dip to only 9.2% in Q1’24, down from 11.9% in the prior quarter.

The management team set the following vehicle delivery targets for turning profitable:

- NIO – 30K monthly deliveries @ 20% gross margin

- ONVO – 20K to 30K monthly deliveries @ 15% gross margin

As an example, the ONVO L60 vehicle has a $30K pre-order price for an ~$4.5K gross profit. At 30K vehicles per month, NIO would generate an $405 million gross profit from the ONVO brand alone per quarter.

The L60 vehicle apparently hit 60K in cancellable pre-orders, providing a good indication of strong demand. Ultimately, the goal would be for the mass market brand to produce far higher sales than just 30K per month, which is the target of the premium brand.

Nio reported a Q1 loss of ~$700 million. The company needs the combination of both brands producing strong vehicle margins in order to eliminate the large losses.

The Chinese EV company ended the March quarter with a cash balance of $6.3 billion. NIO is at the point where cutting losses is crucial to success going forward, considering the EV manufacturer will already have 2 brands launched and the need to raise additional capital will come at a high dilutive cost.

The stock only has a market cap of $8 billion now, despite reaching record vehicle deliveries and vehicles for a mass market brand rolling off the assembly line. All signs point to NIO reporting a banner year in 2025 with sales targets at $13.5 billion for 40% growth.

Takeaway

The key investor takeaway is that NIO has slipped below $4 despite some promising developments leading to a potential inflection point in the business with total volumes taking the next step higher. The next quarterly results will provide a good indication on whether NIO can really boost gross margins, leading the company on a path to eliminating large losses.

Investors should use the current weakness in the stock to continue building a position, with NIO retesting the April low and indicating the market is in the process of becoming more bullish on the Chinese EV company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NIO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.