Summary:

- Nio’s Q3 revenues beat estimates, with improved gross margins, and management is targeting positive net income for 2026.

- The Onvo launch has started to boost delivery volumes, but the production ramp and Q4 guidance disappointed analysts.

- Nio’s balance sheet showed a sequential working capital decline, though it was free cash flow positive in Q3.

Image Source

On Wednesday, we received third quarter results from Nio (NYSE:NIO). The Chinese electric vehicle maker has seen some solid growth in recent quarters, and it recently launched a lower priced brand to tap more of the market. While the company’s financials did look a little better in the short term, management’s strategy shift has resulted in another disappointment for those who were looking for more delivery growth.

Previous coverage on the name:

I last covered the name back in early September, at which time the company had recently reported its Q2 results. While the company missed Q2 revenue estimates, it did make some progress on the gross margin front, and guidance for Q3 was decent. The new Onvo brand was getting ready to launch, which was slated to send the company’s delivery volumes to new heights.

I upgraded Nio shares to a hold at that time on the improving financials, but I mentioned how I wasn’t ready to fully buy in yet. I wanted to see another capital raise take place to get Nio through its major expansion, and I wanted management to prove itself on the execution side after previous production ramp struggles. Since my previous article, Nio shares have declined by almost 5%, while the S&P 500 is up almost 9%.

The Q3 report:

For the quarter, Nio reported revenues of $2.66 billion. While this number was about 2% lower than the prior year period, it did beat street estimates by a little bit. The company delivered 11.6% more vehicles than Q3 2023, but did have some lower selling prices, due to changes in product mix plus the Onvo launch. Nio saw a more than two percentage point increase in gross margins over the prior year period. On the conference call, management pointed to more margin improvement in the coming quarters thanks to the Onvo ramp as well as a reduction in Nio main brand vehicle promotions.

Unfortunately, some of those reduced promotions means that delivery volumes in the current quarter will be a little light. Guidance is for between 72,000 and 75,000 units, representing an increase of approximately 44% to 50% from the same quarter of 2023. This would also be a quarterly record for the company, but its revenue forecast for between $2.80 billion and $2.90 billion was quite a bit below the $3.18 billion analysts were expecting.

Management hopes to get the Onvo ramp up to 10,000 units a month in December and 20,000 in March of 2025. That’s a little slower than analysts were expecting, part of the reason why Q4 guidance was soft. In 2025, Nio will also launch its third brand, Firefly, which will be at an even lower price point than the Onvo brand. While the may be a little cannibalization from the main brand, analysts went into Wednesday’s report expecting almost 39% revenue growth for Nio in 2025.

A look at the financial situation:

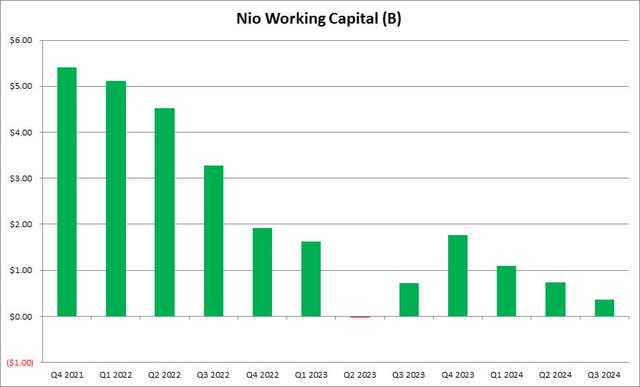

Like many electric vehicle companies, Nio’s large losses over time have lead to significant cash burn. We’ve seen multiple capital raises from the company as a result, but management did say that it was free cash flow positive in Q3. Unfortunately, as the chart below shows, the company’s working capital balance did decline by about $370 million in the period.

Nio Working Capital (Company Earnings Reports)

Nio finished September with about $6 billion in cash and investments, roughly double the amount of debt it has on the balance sheet. While there are no definite plans to raise any more capital at the moment, it is possible that Nio could raise funds if it finds an opportunistic time to do so. I’d personally like to see a bit more of a cash balance here with two new brands ramping up through 2025, but Nio shares are well off their multi-year highs, making an equity raise a bit dilutive if need be.

The current valuation picture:

Since Nio, along with most of its Chinese competitors, are losing money at the moment, the best valuation metric is price to sales. With 2024 being mostly over at this point, and Nio looking for another leg of growth next year thanks to Onvo, I looked at price to currently expected sales for each name in 2025. The chart below shows Nio against BYD (OTCPK:BYDDF), XPeng (XPEV), Li Auto (LI), and Zeekr (ZK).

Chinese Auto Valuations (Seeking Alpha)

Outside of Zeekr, Nio looks quite a bit undervalued against the other three who average 0.97 times their expected 2025 sales. If we include that low value, however, Nio’s price to 2025 expected sales figure of 0.72 times is a bit less of a discount to the 0.82 average of the other four. In terms of 2025 revenue growth, if you just use a straight average, the group of four is projected for about 39.2%, which is about what Nio is expected to show next year. The average price target on the street is $6.66, which currently implies significant upside for Nio shares. However, that average has been halved in the past year, and was in the low $60s less than three years ago.

Final thoughts and recommendation:

Wednesday’s report from Nio was a bit mixed. The company did beat street revenue estimates for Q3, showing a smaller decline than the street was looking for. Gross margins also improved, and management is going to focus on the profitability angle more in the coming quarters. Unfortunately, the quest to reduce losses means lower delivery volumes, primarily for the main Nio brand, so Q4 revenue guidance was well below street expectations.

With the valuation mostly fair at the moment, I’m going to keep a hold rating on Nio shares today. The company is making progress on its long term plan, but dramatic delivery growth seems to be lacking in the short term. We’ll get more details on the Firefly launch in late December, and perhaps if we see management give a better forecast for 2025 at the next report we can look at the rating again then.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.