Summary:

- Chinese stocks have surged due to new PBoC measures, with NIO nearly doubling in price, driven by investor optimism and high-beta stock appeal.

- NIO’s fundamentals show plateaued revenue growth, persistent losses, and the need for future cash raises, making it a risky long-term investment.

- Despite recent improvements in deliveries and margins, NIO’s profitability remains a concern, and its growth phase appears to be over.

- While NIO could benefit from the China rally, there are better Chinese stocks with stronger growth and revenues available for investors.

bunhill

Thesis Summary

After many false starts, Chinese stocks may have taken off in earnest. Chinese equities across the board are up big on Monday, and NIO, Inc. (NYSE:NIO) is one of the biggest winners.

NIO is a stock that, at the height of the market in 2021, was trading at $65 and fell as low as $4.

It has now almost doubled in price over the last month and is showing no signs of stopping.

I have covered NIO extensively in the past. In my last article, I gave the stock a buy rating as it was showing some promising trends. The stock fell quite a bit since then, but after this rally, it is trading near the same level as when I last wrote about the stock.

But Is NIO a good way to gain exposure to China? Do the company’s fundamentals support new all-time highs? And does that even matter in the face of China’s stimulus?

Let’s dig in.

Why China Is On Fire

Chinese stocks have skyrocketed in the last week, and we have a pretty good idea why.

FXI (SA)

The PBoC announced last Tuesday a slew of new measures to combat China’s flailing economy and boost liquidity. These included butting the country’s Reverse Repo rate and lowering the down payment requirement for new and existing mortgages.

In practical terms, these measures probably do not actually justify the recent rally in Chinese equities. However, investors have perceived that the PBoC is finally willing to do anything it takes to support the economy.

China’s PBoC just had its Draghi moment, so to speak.

NIO: High Risk, High Reward

With Chinese stocks back in vogue, it’s not that surprising that we have seen a stock like NIO explode higher in the last month.

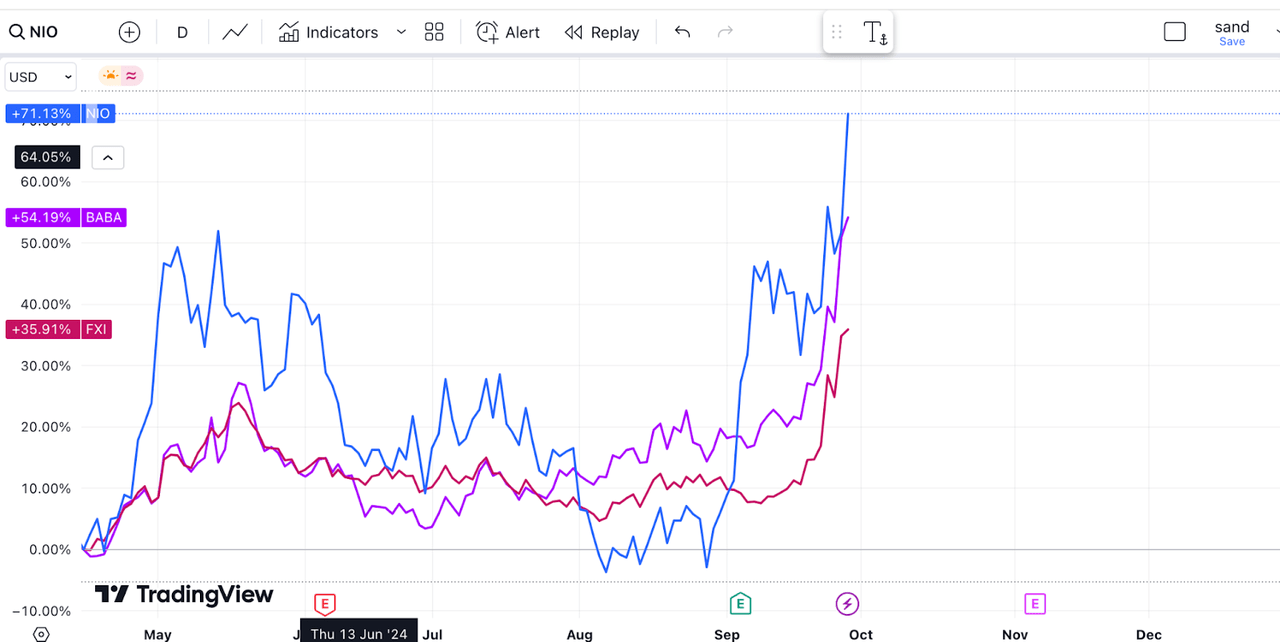

NIO, BABA, FXI (TV)

The chart above shows the returns for NIO since the stock more or less bottomed. We can also see the performance of Alibaba Group Holdings (BABA) and the China Large Cap ETF (FXI).

As we can see, NIO has bounced even higher than the general market, and even BABA, which is up 50%.

To understand why, let’s zoom out some more.

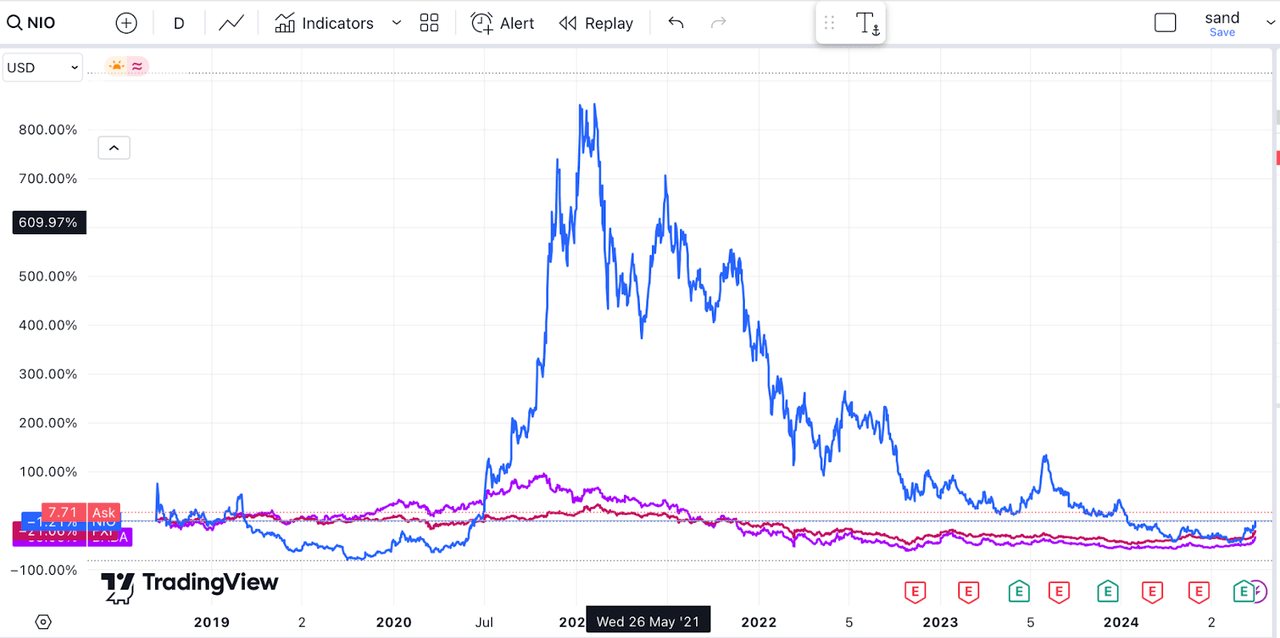

NIO, BABA, FXI (TV)

As we can see, NIO went absolutely vertical during the 2020-21 stock market rally. It returned nearly 1000% from its lows.

This was a time when small caps were outperforming, Chinese stocks were also doing very well and EV hype, led by Tesla (TSLA) was at its peak.

Understandably, I think a lot of investors are trying to catch, and amplify, the gains in Chinese stocks by buying volatile high-beta stocks like NIO.

But it is not 2020 anymore, the EV market has changed a lot, and so has NIO.

Is this really the best way to profit from the China rally?

NIO’s Fundamentals

NIO is a Chinese EV maker catering to the high-end market. The company also separates itself from other automakers by offering Battery-As-A-Service. Most of its sales are in China, though it has been slowly expanding internationally.

Let’s look at the company’s revenue trajectory.

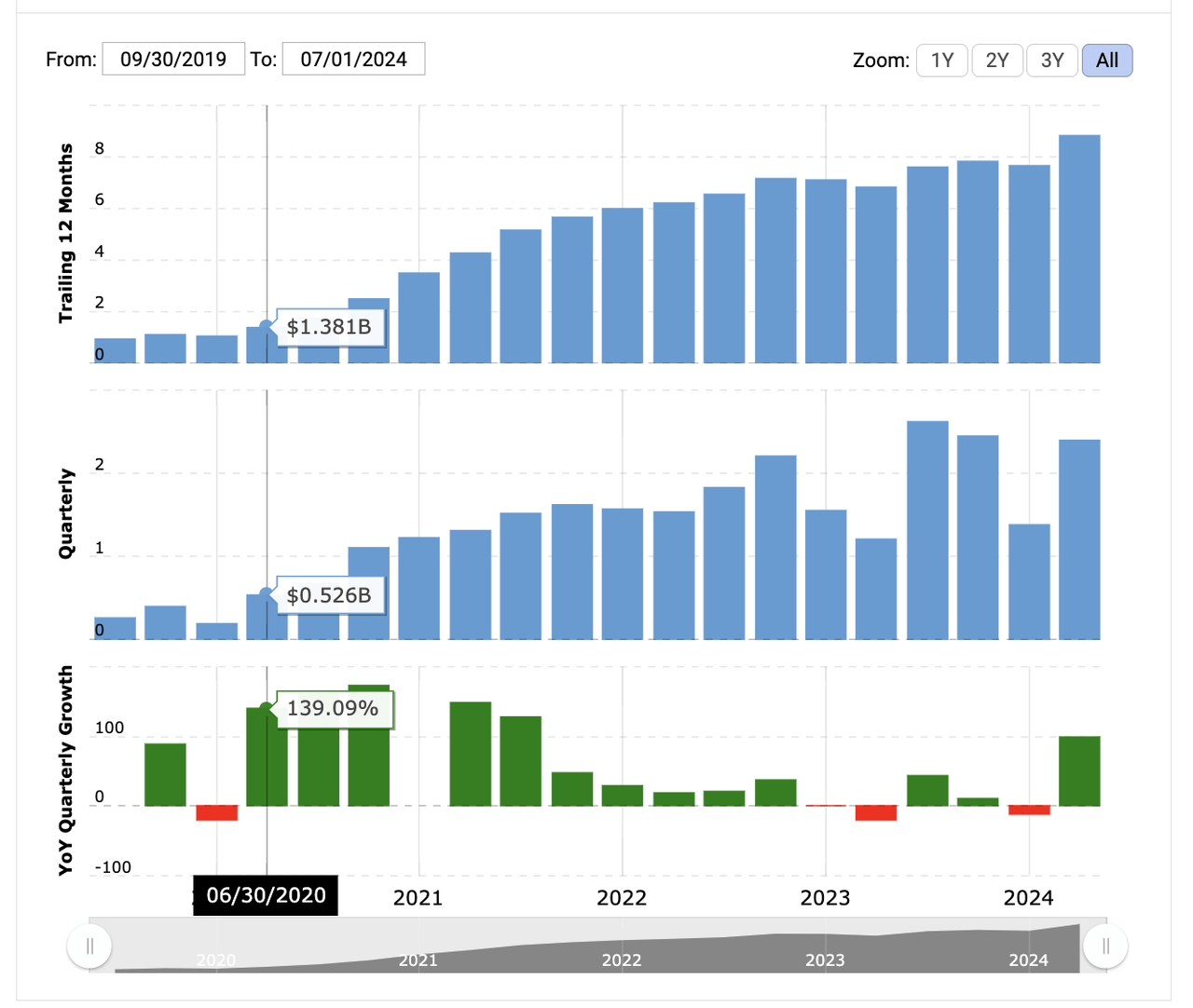

NIO revenues (Macrotrends)

As we can see, NIO’s revenues were exploding higher back in 2020, but growth has plateaued in 2023-24 with some negative quarters along the way.

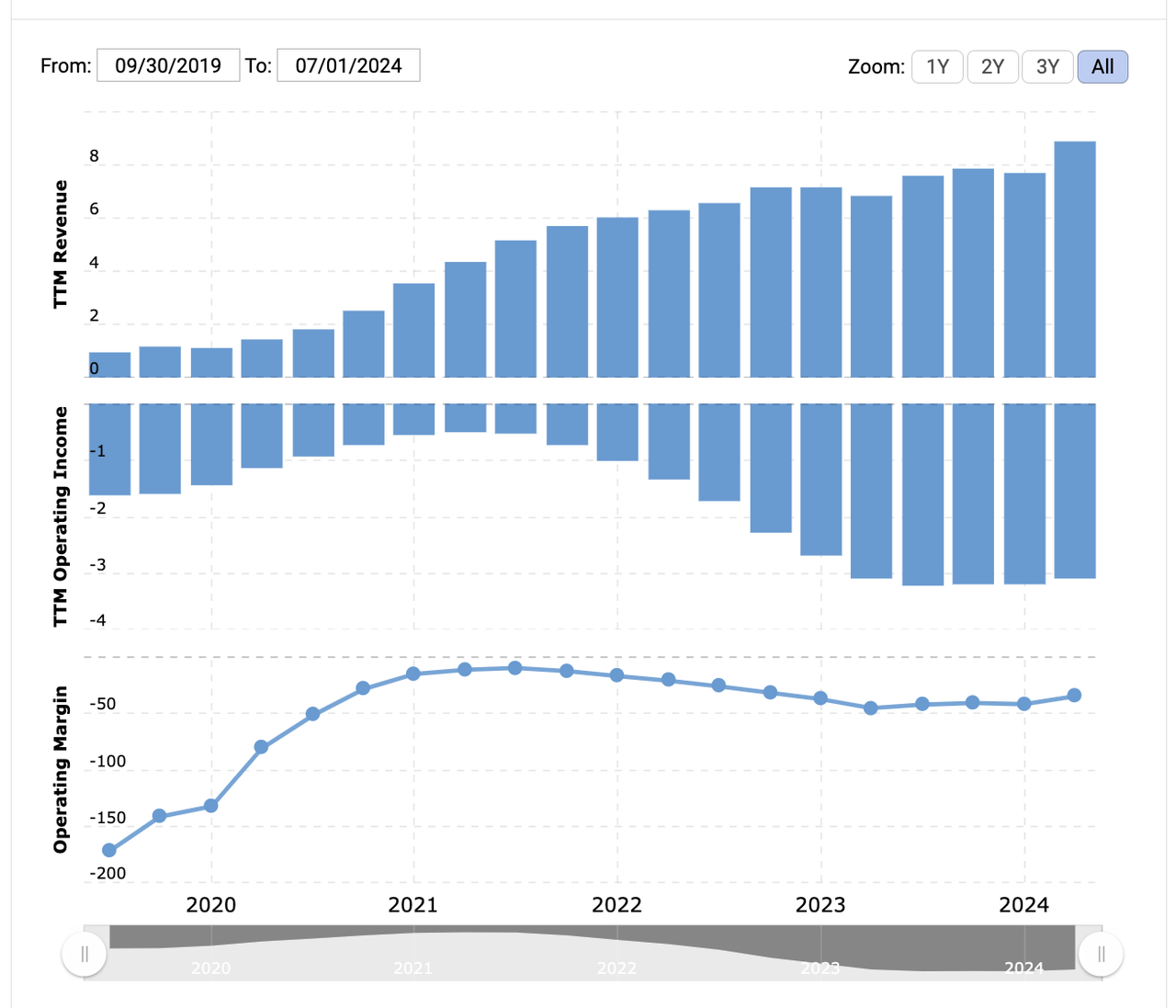

NIO margins (Macrotrends)

Meanwhile, operating margins have not actually improved much, and the company still loses a considerable amount of money every quarter.

The trend over the last year has not been great, though the last quarter did show some improvement.

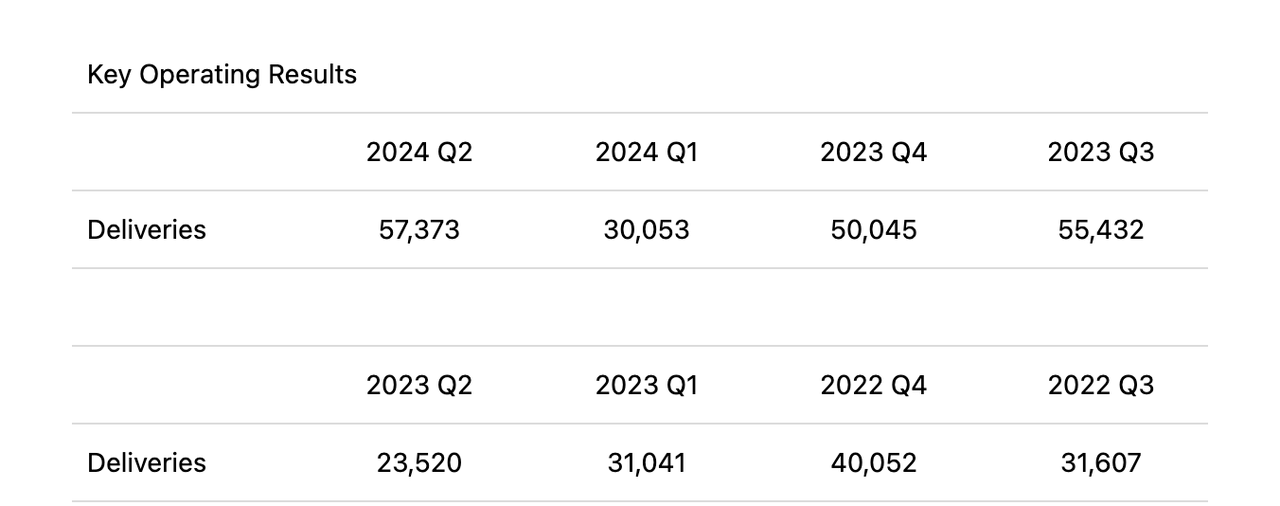

NIO Quarterly Update (SA Press Release)

Deliveries were up over 50% QoQ, and what’s more, margins improved notably.

Vehicle margin was 12.2% in the second quarter of 2024, compared with 6.2% in the second quarter of 2023 and 9.2% in the first quarter of 2024.

Source: Press Release

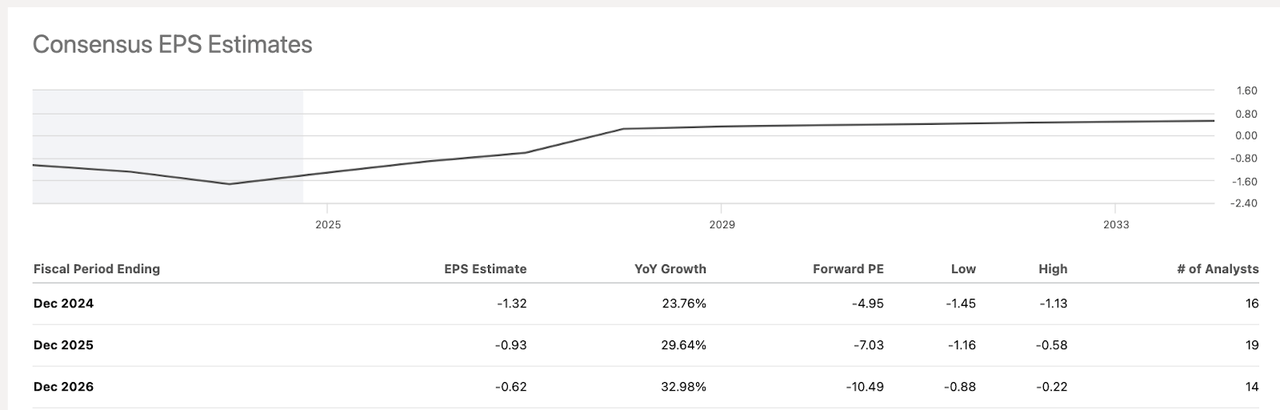

In terms of the company’s future outlook, EPS is expected to turn positive by 2027.

EPS estimates (SA)

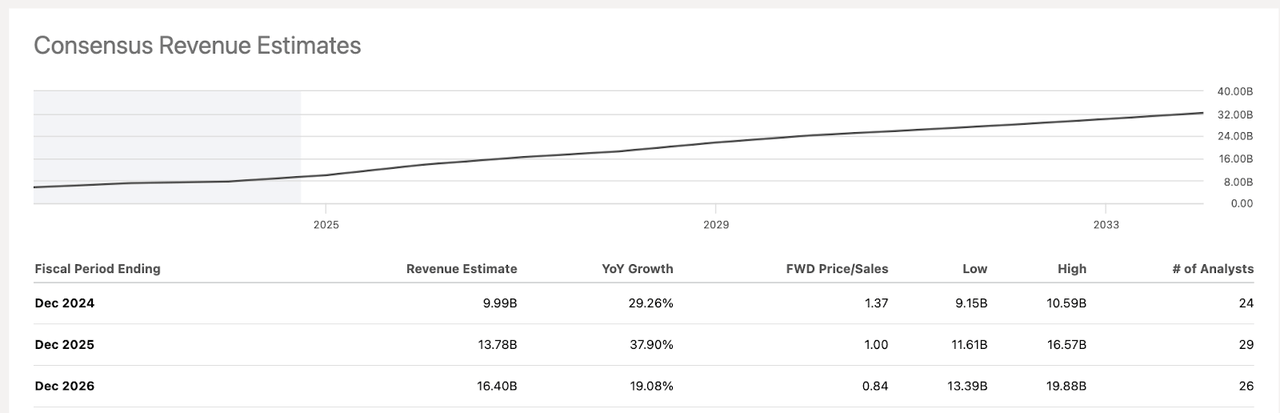

Meanwhile, analysts forecast revenues to reach around $16 billion by 2026, growing at a CAGR of over 25% over the next three years.

Revenue estimates (SA)

In terms of the fundamental outlook, NIO is clearly past its growth phase. What concerns me, at the time, is the company’s inability to make a profit and the fact that it will likely need to raise cash again. NIO isn’t the best investment from a fundamental point of view, but it has other appeals.

NIO Technicals

NIO is a highly volatile stock and one that lends itself well to trading.

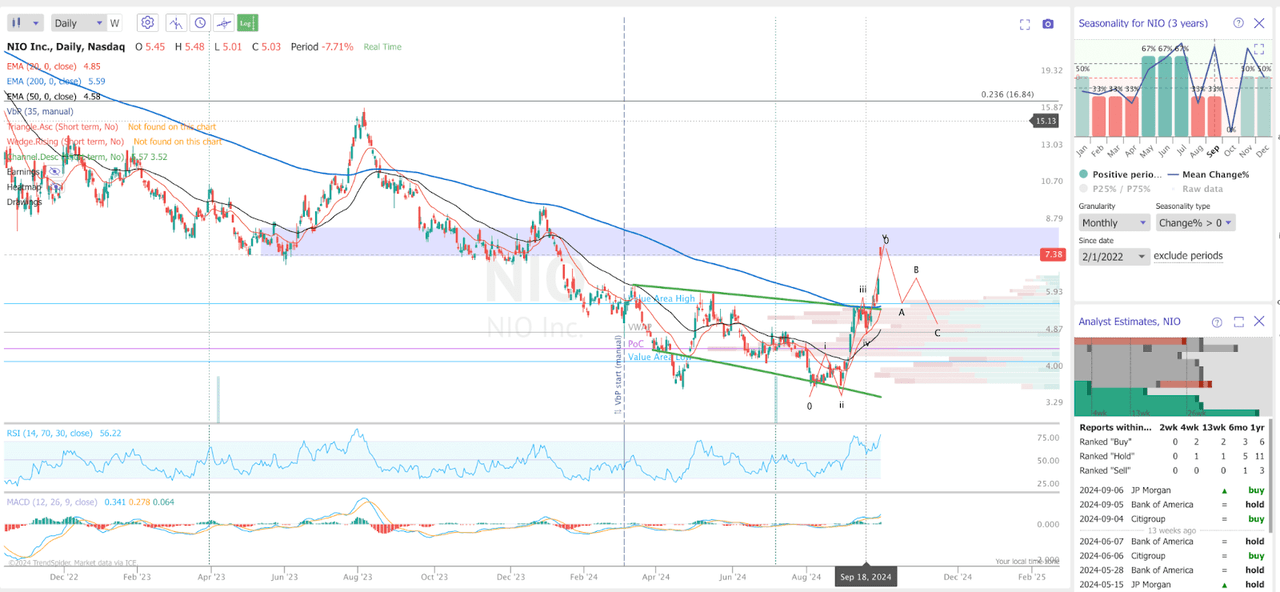

NIO TA (TrendSpider)

NIO has seen a meaningful breakout in the last month. After bottoming out around $4, the stock has almost doubled. We can actually see that NIO is forming an impulsive five-wave structure here, and we also have a bullish crossover of the key EMAs.

However, the stock looks overbought on the daily, and we are now running into an important area of resistance around the $8 level.

This seems like a squeeze that will likely fade out, and I’d expect NIO to test support back at the 200 EMA in the coming weeks.

But is NIO worth a buy for the long term?

Is NIO Stock A Buy?

NIO has skyrocketed in the last week, but is it worth buying into the stock now?

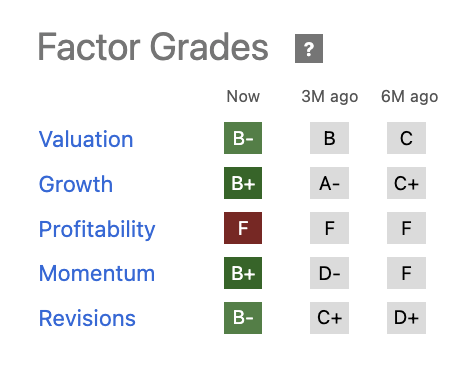

Factor Grades (SA)

While NIO’s factor grades look reasonable, we must realize firstly that it’s hard to value the company as it has negative earnings.

While growth is decent, it is nowhere near where it used to be, and likely will never be.

And, profitability is still a big issue with this stock, and the company will likely need to raise more cash in the future.

While I have been bullish before on this stock, the last few months have made me change my mind. Fundamentally, speaking, NIO is not a great company. It is losing money in a very competitive industry which isn’t even growing that much.

Having said this, I am certainly bullish on the China trade, and NIO will no doubt benefit from this. I don’t think NIO will be left out of this rally, and the stock could rally strongly even without the fundamentals supporting it. After all, NIO stock has a meme quality about it.

But, if you ask me, there are better Chinese stocks out there that one could buy. Companies that actually have strong growth and revenues, but are trading at steep discounts.

Final Thoughts

I believe we will likely see this rally fade in the next few weeks, though NIO might be a good technical buy back around the $6 level. However, I do think there are many better options for investors to gain exposure to China.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video