Summary:

- NIO Inc.’s strong stock performance after Q2 earnings was primarily driven by a surge in retail investor activity.

- Key market players for the stock are institutions who see potential in Nio’s strategic positioning amidst a highly damaging and long-running price war in China’s auto market.

- While net income is trending to close the year lower than last year, the company’s evolving multi-brand strategy has invoked a fair amount of speculative interest.

tang90246/iStock Editorial via Getty Images

Chinese “pure play” electric vehicle carmaker NIO Inc. (NYSE:NIO) — a long-touted “Tesla Killer” — announced its second quarter (Q2) earnings for its Fiscal Year (FY) 2024 on the 5th of September. By no means was the stock a massive earner in the Year Till Date (YTD) until then. However, the stock had risen by a massive 47.35% from a month before the earnings release.

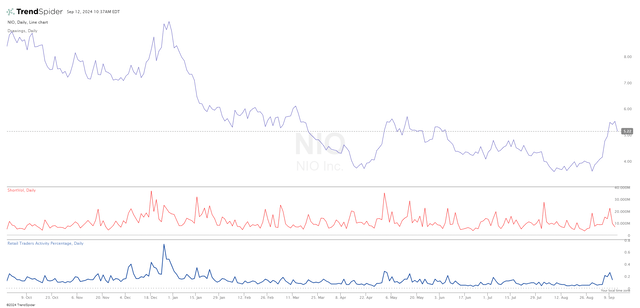

Since the release and as of the 11th, the stock has held steady. Early trends for the 12th indicate a significant downturn in the single-digit percentage range. Interestingly, the bulk of the price accrual seen in the American Depositary Share (ADS) noticeably occurred during the first week of September. The reasons for this trend in a company that noticeably doesn’t move massive volumes are quite nuanced.

Trend Drilldown

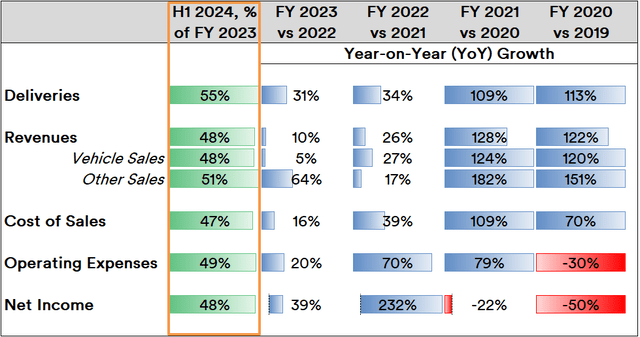

As of the first half (H1) of FY 2024, total deliveries are trending to close the year with a 10% growth.

Source: Created by Sandeep G. Rao using data from NIO’s Financial Statements

Cost of sales, which had trended in line with delivery growth, became more efficient in FY 2023 with current trends indicating that it will close out the current FY lower than in the past FY. A similar trend is evident within operating expenses.

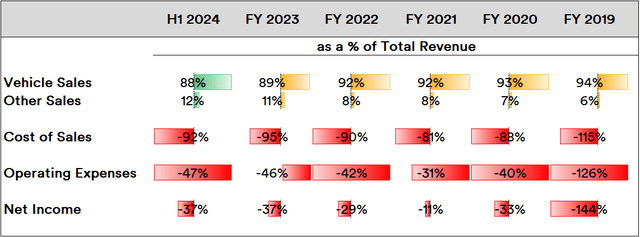

In the trend estimates, net income can be considered closing out the year about 4% to 5% lower than the previous year, which is actually a plus: the company has never drawn a positive net income for any FY since it listed. As far as key line items go, post-sales services (charging, battery swaps, spare parts, et al.) have made a substantial improvement in revenue contribution, but vehicle sales remains as important as it was in the previous FY.

Source: Created by Sandeep G. Rao using data from NIO’s Financial Statements

Cost of sales shows signs of improvement, while net income (loss) pass-through is trending to remain steady with last year. Despite an encouraging growth in deliveries, revenues are trending lower than the past FY.

So, outside a slight improvement in net losses, there is virtually no reason at first blush to buy into the company’s growth. However, market players with an eye on China are looking at the broader picture a little differently.

Market Players’ Outlook

From the beginning of the year till August 8, i.e., one month before the earnings release, net retail investor activity in the ADS had declined from over 28% to around 9%.

In the week of the earnings release — starting from the 5th — retail activity spiked to 21% and even further to 26% as of the day of the earnings release. Since then, retail activity has dropped with a corresponding decline in price in early trends today.

However, institutional interest, i.e., the likes of long-term growth funds, hedge funds, et al., continued to be the key drivers of volumes and price trajectories in the ADS. Nio continues to curry favor among these prominent market movers for various reasons.

Firstly, the overall lack of substantial revenue gains despite solid double-digit percentage growth since FY 2020 has been due to a cut-throat price war in China’s auto market which briefly involved even the likes of BMW and Mercedes-Benz. The price war has been damaging for virtually every carmaker. Foreign players are inching towards backing out as their margins get more and more frayed. This could be considered as a definitive battle to establish clear leaders in China’s heavily fragmented market, which has hundreds of brands.

There have been no substantial outsized volumes in complaints in performance when it comes to the company’s products. The company’s products are by no means cheap: the recently launched ET9 retails for around $112,000 while the ET7 retails for a little under $60,000. In China, this is a mid- to high-end brand (with an inclination towards the latter) and the company has traditionally stayed well away from the budget- to mid-price range where the bulk of the price war has been raging. However, even in its niche, the price war continues. The company’s rising footprint in this segment is a matter of interest to institutions looking at the long term.

Second, the company is consciously decoupling from the mid-price range by introducing a new marque — Onvo — to access the mid-range “family car” market. The first model in this range is the Onvo L60.

Starting at a little over $30,000, this model directly competes with Tesla’s (TSLA) Model Y by being 10% cheaper, has a more spacious interior, and eligible to access most of the parent brand’s established battery swap and charging stations. While there may or may not be some issues with battery swapping, this mode of operation does tend to optimize the downtime necessary to recharge an EV. Making this accessible to the mid-range market might be transformative in buyer preferences, and this is likely another point of interest for institutions.

The company is also preparing to enter the stiffly competitive budget/small car market via a second marque named “Firefly.” Chairman and CEO William Li described Firefly as being to Nio what Mini is to BMW in a short video on Douyin (a short-form video app similar to TikTok). Mr. Li further stated that these cars will be built on European “five-star” safety standards and will have battery swapping made available for a monthly fee through upcoming company-operated stations not used by Nio or Onvo brand vehicles. The first model under the “Firefly” brand is expected to debut by the end of the year, with Europe being a tentative market.

It is no secret that China’s small car market is immensely cost-competitive. A well-designed budget small car is expected to do well if introduced in Europe. This point of speculative interest is the third likely reason behind institutional interest.

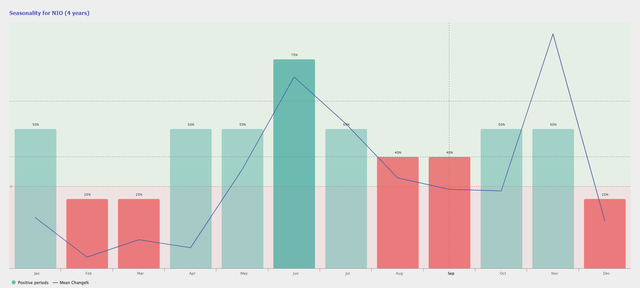

The ADS’ performance typically aligns well with quarter-wise delivery trends. For more tactically inclined institutions, September has tended to be a very attractive price point to buy into as the next two months generally tend to trend higher, as data over the past four years indicates.

In Conclusion

While the net average of retail investor attention has been decidedly through most of the year, institutional activity remains fairly firm and unchanging in that the company is worthy of attention. Given that the company has never been profitable, it likely might be an uninteresting stock for many.

With three brands based on high-quality engineering serving three key niches of the car market in China (and possibly beyond) as well as the odds favoring Nio to be a likely survivor of China’s long-running price war, net income can tentatively be expected to trend towards zero or a weak positive by the end of FY 2025.

For investors looking at the long term, this might be an interesting point of time to buy in once NIO Inc. price corrections are done. But this won’t be the only period of price volatility; significant amounts of turbulence can be expected over the course of the next one year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.